xijian/E+ via Getty Images

iSun’s 2021 Had Highlights And Lowlights

iSun (NASDAQ:ISUN) has a history that began as a commercial electrical company, Peck Electric, who began developing large-scale solar projects over the past decade or so. In 2019, the company SPAC listed on the NASDAQ, and then finally merged with iSun. Now under the iSun banner, the company has begun adopting a strict focus on renewable infrastructure projects. In April 2021, iSun was able to acquire the assets of Adani Solar USA, whether IP, clients, project data, etc., which has allowed for the incredible revenue growth over the past year. At the same time, it may seem strange that the company share price continues to fall to below a 1.0x price per share, even as revenues grow well over 100%. Issues with losses, however, are doing their part in driving the stock price down in this rising interest rate environment.

Growth is not an issue, as the company has plans to establish a “Renewable Energy as a Service” business strategy, which is also a way to increase the typically low margins in the engineering, procurement, and design (EPC) industry. A major growth driver for iSun is designing off-grid and on-grid solar canopies for EV applications, with the company already earning a contract for almost 1,800 units. Additionally, their expertise and former history with commercial and industrial electric projects will drive sustainable background growth. The client base established thanks to the Adani Solar IP has already borne fruit, and will increase company visibility. Although, it will be important to realize margins may remain low, especially as this is the case for most of the industry. Let’s dive in.

Solar Production and EV Landscape

Applications such as commercial solar and EV charging infrastructure are important paths towards a wide scale renewable landscape. Solar arrays have yet to penetrate a significant portion of our energy matrix, especially in northern states, and so there is still plenty of growth available for EPC companies. While EV vehicles are becoming optimized for consumer, fleet, and industrial use, issues with lacking infrastructure limits the full potential of the technologies. Therefore, there is currently a significant wave of both EPC, EV, and EV infrastructure companies who are attempting to address this risk point. Then, as EV infrastructure becomes more common than gas stations, EVs will be able to thrive in a completely positive growth environment. And iSun stands ready to leverage growth in the EPC and EV infrastructure segments into the future.

According to the Solar Energy Industries Association, solar applications remain less than 5% of the total energy consumption share in most states, and total GW produced are low compared to the Southern US. Innovation in design and effectiveness of solar is making the tech more economically viable, even in dark, cold, and cloudy regions of the US (alternate source). As such, I foresee significant growth possibilities for solar in iSun’s New England territories. The table below truly shows how little solar there is in the region, or most of the US in fact.

|

State |

MW Installed |

% of State Electricity from Solar |

|

Vermont |

397.6 |

16.2 |

|

Massachusetts |

3,607 |

19.9 |

|

Maine |

440.5 |

2.89 |

|

New Hampshire |

164.8 |

1.18 |

|

New York |

3,380 |

3.14 |

|

Illinois |

1,107 |

0.81 |

|

Florida |

8,205 |

4.35 |

|

Texas |

13,840 |

3.37 |

|

California |

34,950 |

25.6 |

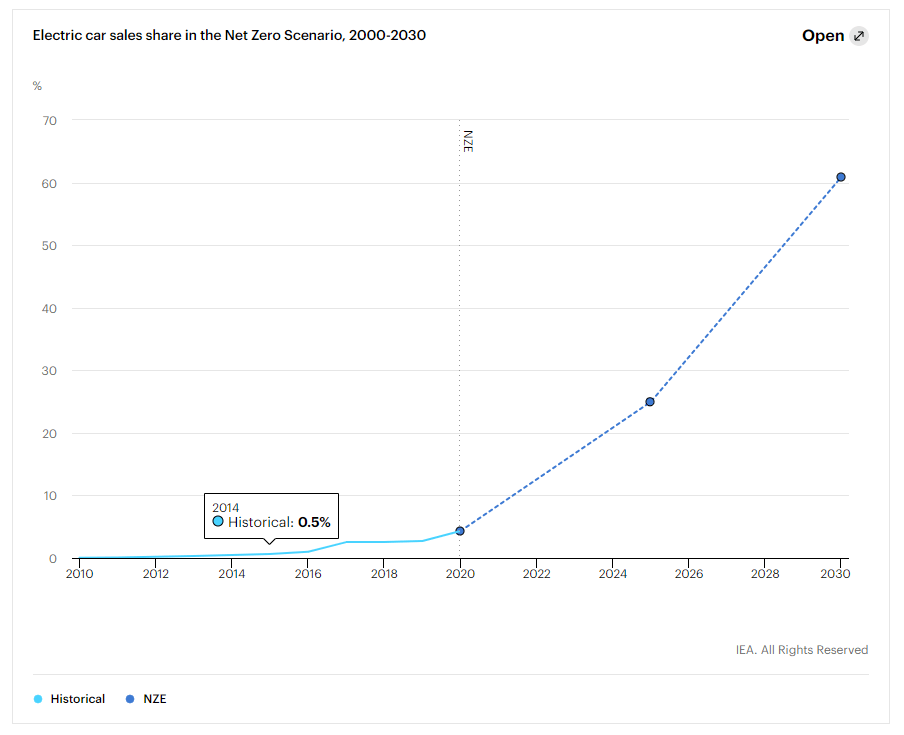

Moving on to EVs, iSun is timing their advances in EV charging perfectly with expansive growth of EVs on the roads. According to IEA, EVs only held 4.3% of the world’s total car sales for 2020. The organization forecasts that we must have at least 25% of all new car sales being electric by 2025. These strict and necessary guidelines allow us to take a dent out of vehicular carbon emissions. However, as units on the road increase at a rapid clip, increases in infrastructure such as charging is necessary. With rising electricity consumption comes the need for increased solar applications, allowing for a positive feedback loop for iSun. Below, I provide current EV vehicle growth rates from a few manufacturers that highlight the strong growth.

IEA

There are hundreds of sources I could provide with evidence in favor of the need for increased renewables, whether EV, Solar, or more. For this reason, there are few market growth environment headwinds to consider when looking out more than a few years, although, I bring up some risks later in the article. As such, outlook for iSun should be focused on their own financial and managerial success. To do so, I will now break down the FY 2021 results that just came out.

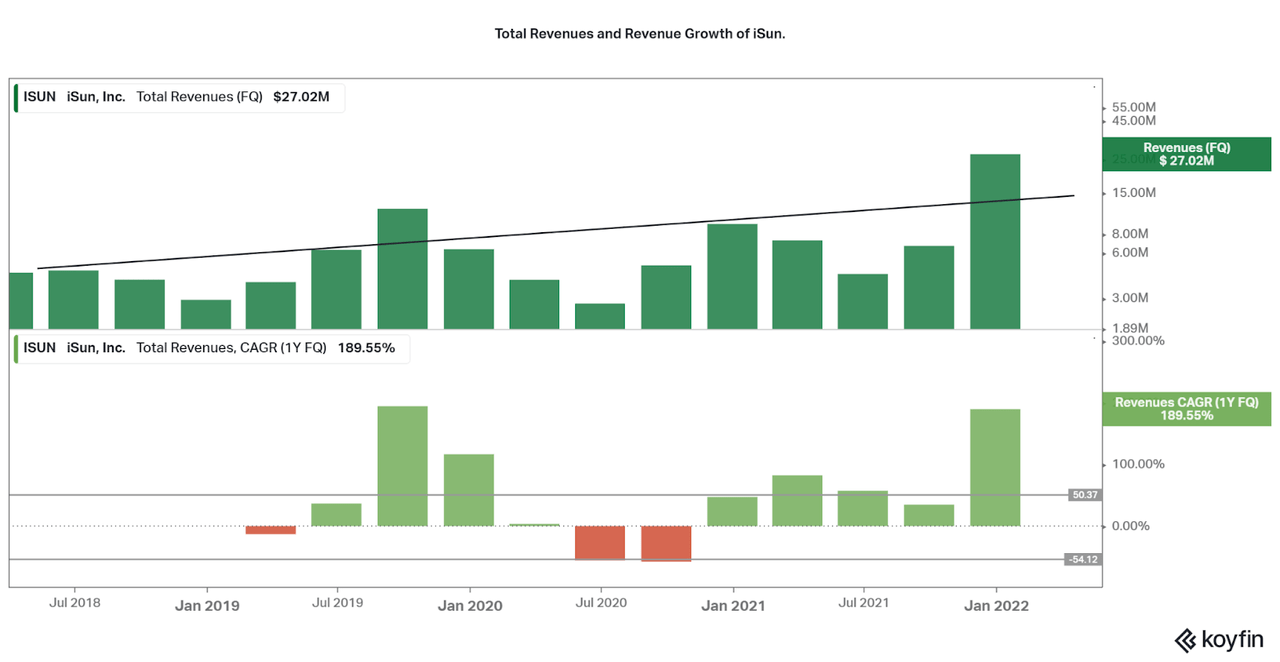

Revenues

2021 was a record year for iSun, Q4 in particular. Revenues reached $27 million in the quarter with a total of $45.3 in 2021. This contrasts with the $21.1 million in revenues for 2020, but the high growth is thanks to picking up Adani’s projects (for about $2 million). This is a 190% increase YoY for the fourth quarter, and 115% for the full year. Of these revenues, approximately 53% was organic growth, while 62% was a result of acquisitions. Therefore, I do not expect growth to remain over 100% for 2022, but should be close to the 50% organic growth level.

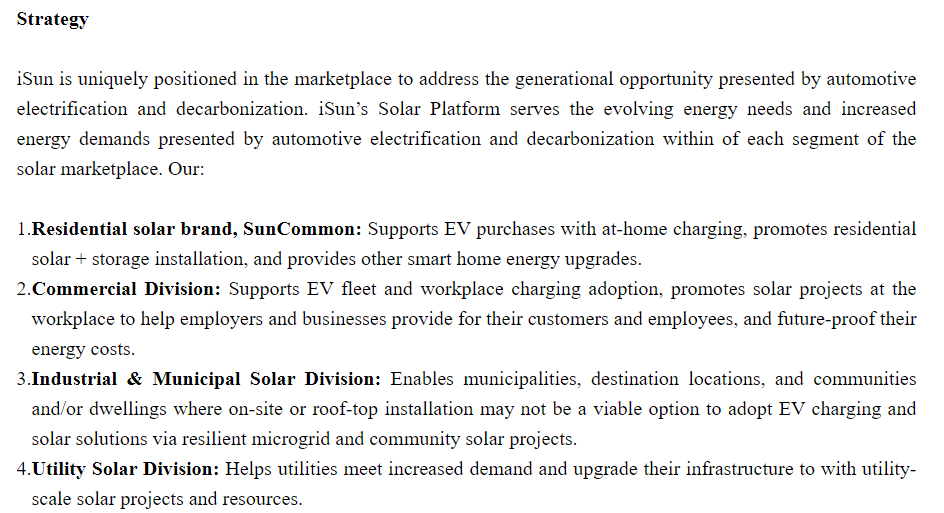

The current revenue breakdown is 88% from EPC projects (61% commercial or industrial and 28% residential), 11% from the legacy electrical and data projects, and 1% from solar asset recurring revenues. For the future, the company aims to increase solar recurring revenues and expand organic/inorganic growth across the US for their EPC segment (10-k). EPC services include residential, commercial, industrial, and utility level applications, highlighting the company’s broad capabilities and licensing for all customer needs. The image below shows the four subsidiaries and their particular strategies.

Company 10-K

Koyfin

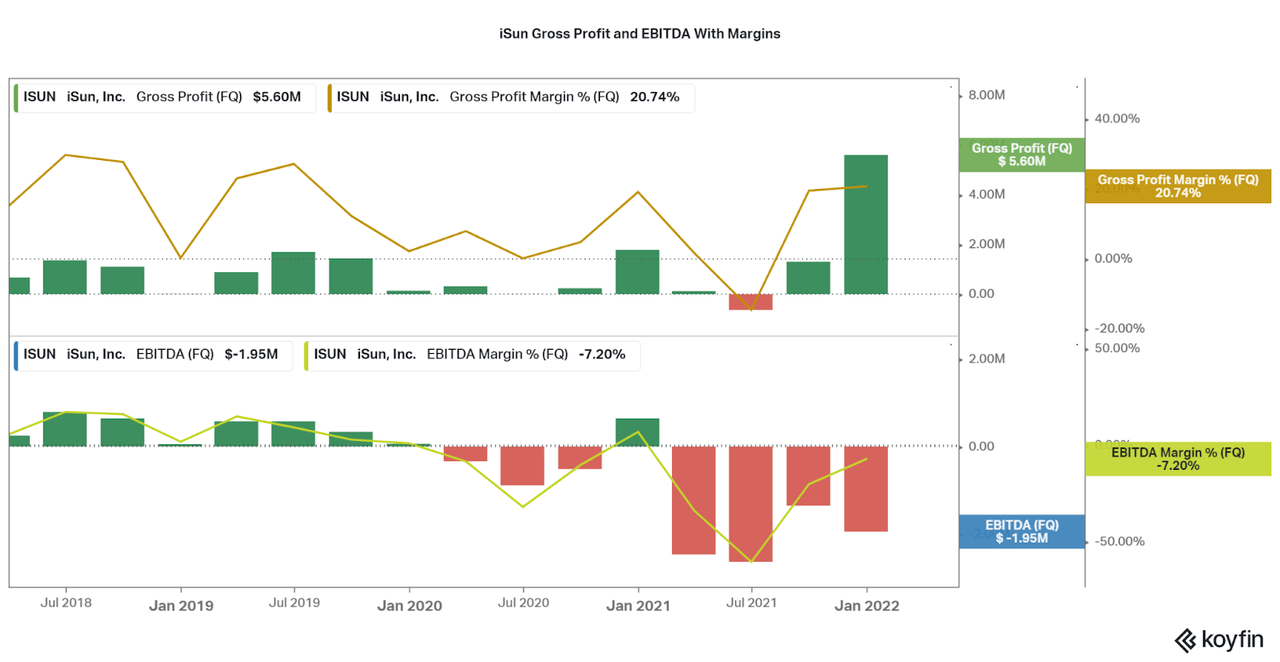

Earnings and Expenses

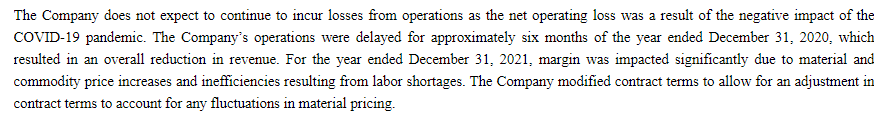

It will be important to consider iSun as a majority EPC company, rather than a manufacturer or distributor. As such, gross margins will remain low, but hopefully remaining over 20%. While gross profit hit a high of $5.6 million in Q4, 2021 saw multiple quarters with very low and even negative gross margins. Net income remained negative for 2021, reaching a loss of $6.2 million due to acquisition costs, warehouse expansions, and increased G&A. One point to consider in regards to future profitability is that the residential subsidiary, SunCommon, is a certified B corporation and so profits are not the only desired outcome. Is this a reason for the low valuation?

Gross profit margins were low in the first half of 2021 due to industry material and commodity prices and labor shortages. However, the second half saw a return to over 20% gross income margins. This helped EBITDA return to positive for Q4, along with not having to pay back their PPP loans. As an EPC, 20% gross margins are favorable because the company must purchase and hire all necessary equipment and labor for their customers. As a result, EPC’s income is based on whatever premium they can receive from customers on top of the total project expenses. Due to the competition in the industry, especially when vying to be the lowest bidder, net income is often extremely low compared to the rest of the market and can often be negative.

As iSun remains small, margins will be volatile depending on project timelines, costs of goods and labor, and customer payment plans. However, with size positive earnings will normalize. It is hard to predict what net income margin the company should aim for, but 2.5-5.0% is a great initial target. The company has relationships with local unions across the Northeast to contract labor, and this should prevent risk associated with labor shortages. The potential for stable earnings growth from solar asset recurring income also becomes relevant over the horizon. However, profitability will always remain an issue for the business which is why it is important to be realistic about the future valuation of the company. I will discuss valuation issues later in the article.

Company 10-K Koyfin

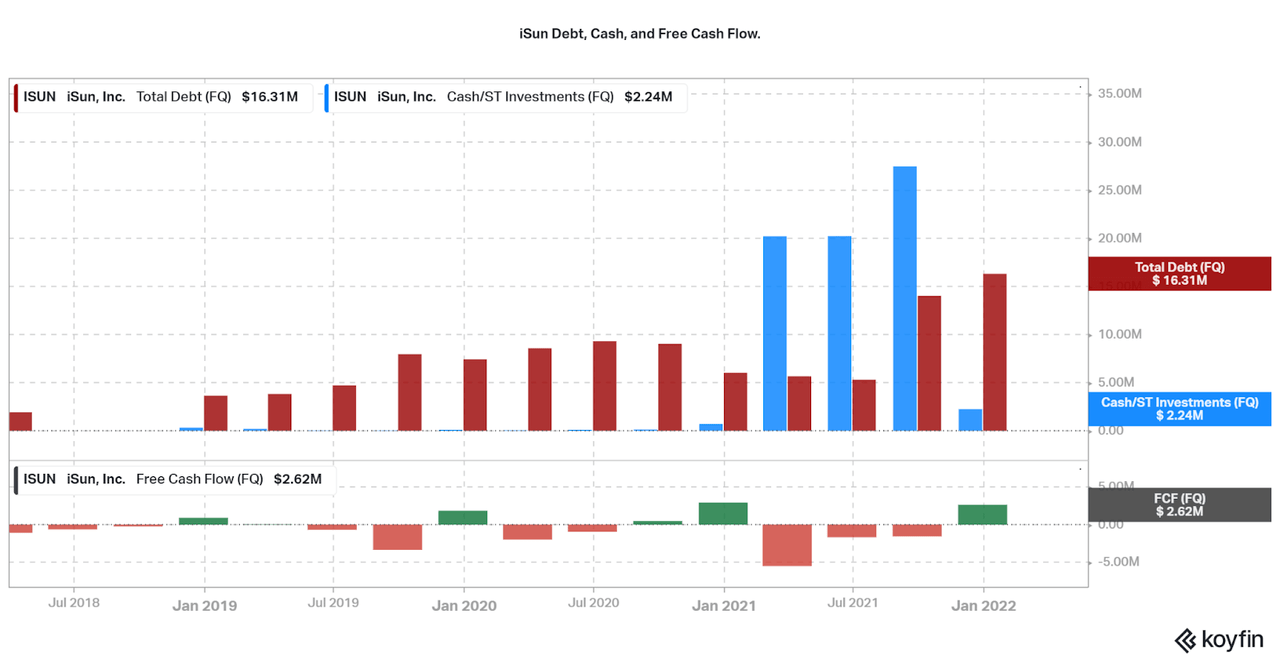

Balance Sheet

While 2021 saw an increase in available cash due to listing on a major stock exchange, this has fallen to $2.2 million for the year end. The company acquired and merged with multiple assets, supported operations, and invested in growth using this cash supply. At the same time, total debt increased from around five million to over $12.2 million. This is the amount provided via the annual 10-K, and contrasts with data provided by Koyfin, Seeking Alpha, and other data providers ($16 million). Either way, one can take solace in the fact that $8 million was in the form of investments into Gemini Electric Mobility, NAD Grid Corp, and Encore Renewables. As such, future return is possible from these segments. However, the gist is that debt has increased and cash has decreased.

The debt to cash ratio is one reason why the valuation remains low, as investors look for financial safety. However, I will break down the major totals. The largest loan is a new short-term cash raise with B. Riley for $6.0 million at an 8.0% rate, payable in full in Fall 2022. The second largest item is PPP loans totalling $2.5 million, which is due to be forgiven as of the next report (it is included in the income segment). After that, the only other large loan is a $640,000 business loan at a 4.25% rate due September 2026 and $1.15 million in vehicle loans with rates less than 10% with terms lasting through 2027. Debt of this amount will be easy to pay off with the expected cash flows from operations for 2022 and beyond.

Koyfin

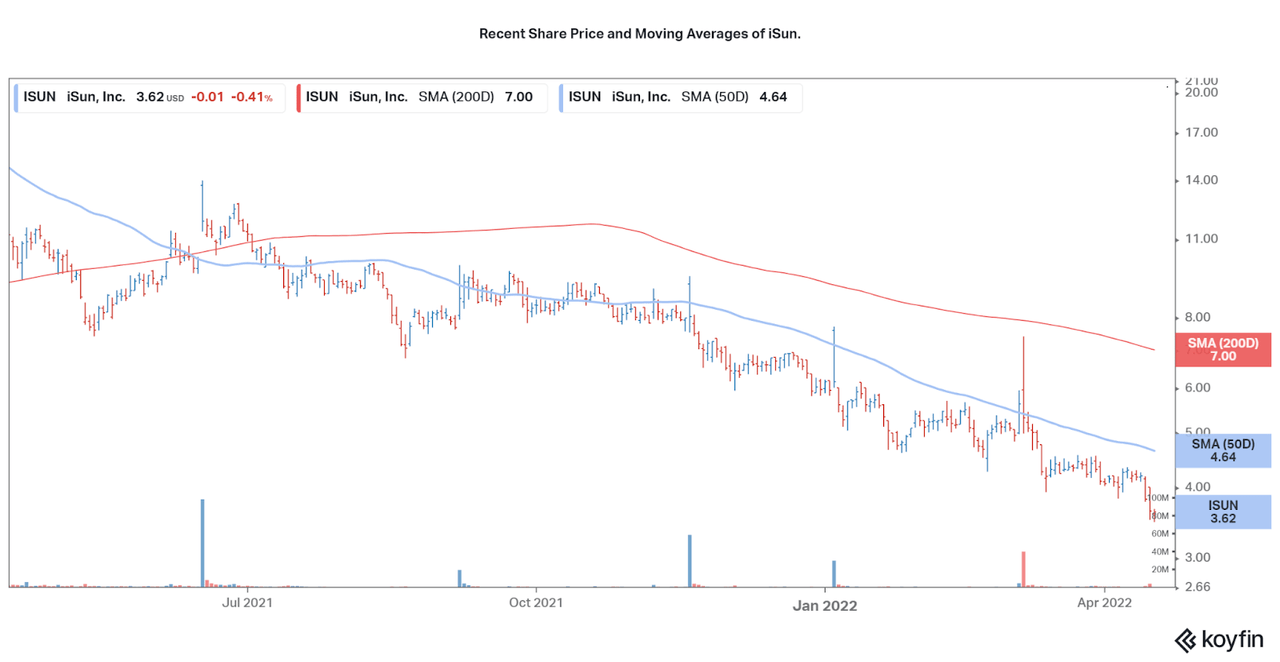

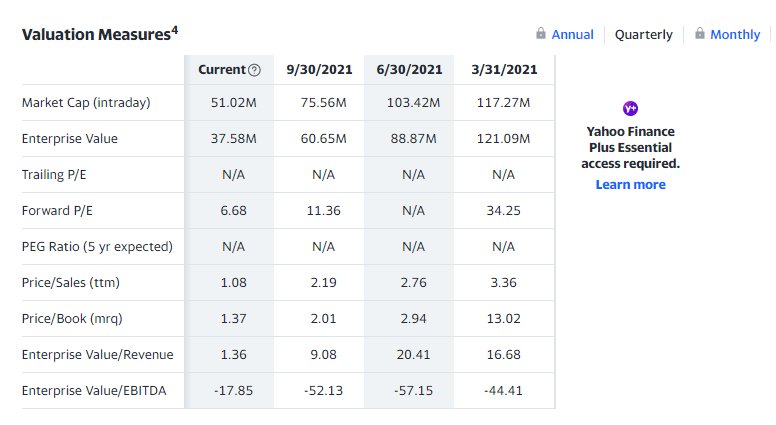

Share Price And Valuation

ISUN has fallen significantly since the first half of 2021, and is down 67% over 1 year. The current market cap is now $50 million, and so the price to share ratio is now approaching less than 1.0x. At the same time, the price to book ratio has already fallen below 1.5x to 1.37x, according to Yahoo Finance. While in any normal market and for any other company this would be a low valuation, it is important to be considerate of what this value represents.

Koyfin Yahoo Finance

To understand how the entire sector is underperforming from a share price standpoint, I collected data from some peers in the table below. As you can see, valuation is favoring profitability at the moment. It does not seem to make sense, but as each company is small, there are dozens of reasons for the lack of correlation between assets. However, the point is clear that all of these names hold low valuations even when growth is extremely high. In my conclusion, I will discuss a few key points to consider if you believe the price must rise.

|

Company |

Price to Sales |

TTM Revenue Growth (%) |

Average 2021 Net Income Margin (%) |

|

iSun |

1.1x |

115 |

-22 |

|

Renesola (SOL) |

5.4x |

-12.4 |

12 |

|

Sunworks (SUNW) |

0.6x |

168 |

-35 |

|

IEA (IEA) |

0.3x |

18.5 |

-4.1 |

Conclusion

While the financial performance seems strong on the surface, we can see clear issues with both profitability and net debt. While I believe these issues can be improved quickly, as shown by iSun’s quarterly progress, I cannot see into the future. Additionally, investors must be prepared for valuations to remain low until those two issues are resolved. The comparison to peers showed that positive net income is valued higher than growth. Lastly, I will address some other issues.

-

The solar industry is influenced by macroeconomic factors such as plentiful supply and demand of services and components, having enough labor, and ample investment capital.

-

Tying into that is the reliance on numerous subsidies, anti-competitive tariffs, and other incentivisation programs. Many of these are set to end within a few years, and most are already tapering down (10-K).

-

Competitive advances in alternative energy production, continued reliance on fossil fuels, and low demand across various populations all hinder future growth, and solar seems to be in a pessimistic state at the moment.

Are these issues at play in regards to iSun’s valuation? Or is it the financial difficulties due to their recent shift to high growth? While I believe iSun has the capability to continue growing, and innovate novel solar applications for customers, it will be important to take it quarter by quarter. Especially since other investors fail to value the company at a high level. Therefore, I will continue to be bullish on the company due to the fact that growth remains elevated. Even if the valuation falls by another 50%, growth for 2022 should be able to outpace this decline. Further, if margins return to the positive side, and the $6 million loan is paid off, I believe meaningful margin expansion will occur.

Since the company remains in a risk state, it is important to consider your tolerance to the downside. There are many, many renewable or sustainable growth companies out there for you to consider, and plenty of time to make a decision if you are looking for a solid long-term investment. Since I have the fortune of being young, I favor this riskier choice. I also cover many profitable or hedge-like bets in the market to diversify my basket. Due to the current state of the market, I am going through and covering many of the most sustainable companies out there, so stay tuned for more.

Thanks for reading.

Be the first to comment