Rafael_Wiedenmeier/iStock Unreleased via Getty Images

Today, we are back to comment on Glencore’s (OTCPK:GLCNF) (OTCPK:GLNCY) performance, following the company’s latest positive and negative development. Here, at the Lab, we continue to see our long investment thesis playing out nicely. It was based on 1) the company’s diversified commodity mix, 2) its strong balance sheet, 3) the coal division – Glencore’s internal cash cow, 4) a compelling dividend and buyback yield for a total forecast of 14% for 2023, and 5) the upside due to the energy transition revolution thanks to its exposure to copper and nickel. All these advantages were positively confirmed in the latest Q3 production report.

Speaking of that, we could not fail to mention Tesla (TSLA). The interest in Glencore was spread in all the news. According to the FT, there have been several talks between the two companies in the last year, with Tesla deciding to acquire an equity stake between 10% and 20%. The deal has suffered setbacks but would still be standing, with Musk increasingly determined to make such a leap. Tesla’s CEO had already made it clear, confirming that “the company might actually have to get into the refining and mining directly at scale unless costs improve“. Indeed, lithium price has significantly increased since the beginning of 2021, and it is a cost that has a crucial impact on Tesla’s core business. Besides its production mix, Glencore is one of the greater battery recyclers in the globe, and this could be a positive upside for Tesla, which is planning to start up its own lithium hydroxide refinery. However, here at the Lab, we are definitely not speculating on potential M&A deals, and today, we are looking at the latest Q3 production report recently released by the company.

Before moving on with the analysis, last week, Glencore was fined to pay a total consideration of £275 million over bribery offenses. In detail, the company was settled to pay £189m to the SFO and an additional fine of £92m related to its oil involvement activities in West Africa. Financially speaking, Glencore had a much larger provision of $1.5 billion, and looking at the court order, the judge remarked that the company “appears to be a very different corporation than it was at the time of these offenses“. In our view, this is an important step that shows the company’s ability in the ESG matters that will positively influence Glencore’s stock price.

Q3 Production Report Analysis

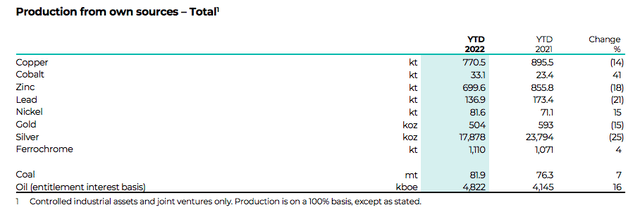

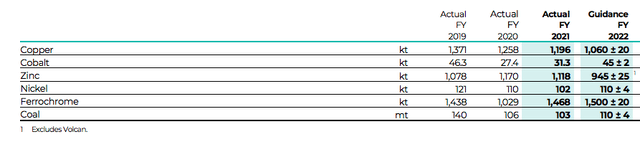

As we already performed in Q2, we are analyzing the Q3 production report. As the company stated: “performance was negatively impacted by a range of events including extreme weather in Australia, industrial action at nickel assets in Norway and Canada, and logistics issues in Kazakhstan“. Indeed, Q3 production missed Wall Street consensus estimates and led to a cut in the company’s guidance for 2022 numbers.

Glencore Production Results (Glencore Q3 Press Release)

Concerning the main commodity output, below is Mare Evidence Lab’s key takeaways:

- Coal output was a total miss and was mainly due to supply chain constraints and climate adverse conditions in South Africa and lower production from the Cerrejon facility. Coal guidance was cut by almost 10%, this was already noted in our peers’ analysis assessment.

- Copper production was again a miss. During the call, the company explained that there was a geotechnical issue in the Katanga mine. Copper guidance was left unchanged.

- Zinc production similar to coal output was impacted by logistic constraints and by COVID-19 absenteeism in Australia. Zinc outlook was cut by 6% given the ongoing issue in the CIS region.

- On the other hand, despite lower performance compared to the first half year, the marketing division continues to outperform at an above-average level. The company expects an EBIT above $1.6 billion, which is broadly in line with Wall Street estimates. So, we do not make any changes to our internal model.

Conclusion and Valuation

The company’s next key catalyst is planned to be on the 6th of December with an Investor Day event. Despite the results not being in line with expectations, Glencore’s dividend and buybacks ($3 billion) are well covered by its FCF generation, and also it has one of the juicy dividends within the sector. Its diversified commodity mix and defensiveness position in the energy transition revolution make Glencore a top pick. The ESG best practice shown with the African investigation is a positive catalyst, so we decide to increase our target price once again. Taking into account the latest company’s guidance, and using our 50%/50% blend of EV/EBITDA and NPV analysis with a multiple of 4x (as in the rest of our universe coverage that includes BHP and Rio Tinto), we derive a price of £6 per share, confirming our outperforming rating. In our internal estimates, due to higher costs, our 2023 EBITDA slightly decreased by 1%; however, these results are totally offset by the marketing NPV division, where the company has a clear comp advantage to return superior performance in the guidance upper-end. Additional risks to include in our price are further outlook cuts (as just happened in Q3 for zinc and coal outputs), lower output prices, political risks such as coal restrictions, and regulatory risks such as permission and licensing to operate in unstable countries.

Be the first to comment