NoSystem images/E+ via Getty Images

Ambev SA (NYSE:ABEV) is the largest brewer in Latin America with diversified operations that include non-alcoholic beverages. The company based in Brazil, technically a unit of Anheuser-Busch InBev (BUD), recently reported its latest results highlighted by solid growth moving past the pandemic disruptions of the last two years. Indeed, the stock has been a winner, up around 5% and bucking the trend of global market volatility.

We last covered ABEV back in January, and our update today reaffirms a bullish call while recapping the latest developments. In line with strong, solid operating trends, we note that macro conditions in Brazil are improving and represent a new tailwind for the next leg higher in the stock. We can also start looking ahead to this year’s “FIFA World Cup” which should provide a boost in beer sales as another strong point in the outlook. Ambev is a high-quality leader and a good option to gain exposure to consumer trends in the Latam region.

ABEV Key Metrics

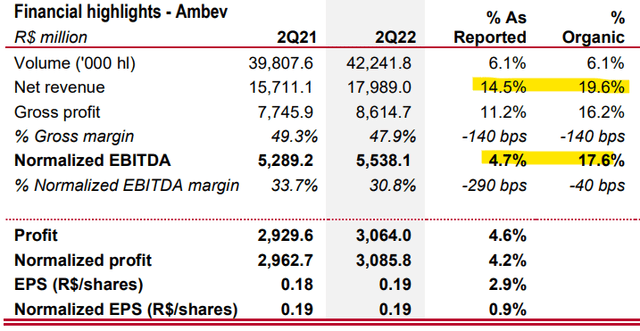

ABEV Q2 earnings at BRL 0.19 per share climbed 1% year-over-year. More impressive was the net revenue at BRL 18.0 billion, up 15% from Q2 2021 and even 19.6% on an organic basis. Volumes climbed 6.1% compared to the period last year, with the company noting that 42.2 million hectoliters sold in the quarter were a Q2 record.

A positive sales mix and pricing initiatives contributed to the top-line momentum, balancing inflationary cost pressures which hit the gross margin by 140 basis points. Still, the normalized EBITDA at BRL at 5.5 billion, or approximately $1.1 at an exchange rate of 5.25 BRL per dollar, was up a reported 4.7% and 17.6% y/y on an organic basis. The spread here considers an adjustment for some tax credit accounting. The message from management is that the results were better than expected, despite some macro challenges.

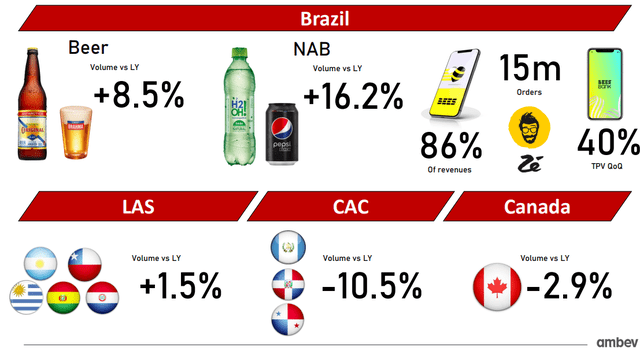

The Brazilian market, which represents approximately 52% of total revenue and 55% of operating income, stood out as a strong point in this report. Brazil beer volumes were up 8.5% y/y while non-alcoholic beverages gained 16.2%. This balanced a 2% volume growth in the “Latam South” region, which includes countries like Argentina and Chile. On the other hand, the smaller Central America and the Caribbean segment faced an -11% volume decline, with management citing some supply chain disruptions being limited availability of glass bottles. In other words, a literal “bottleneck”, although comments in the conference call suggest some improvement already into Q3.

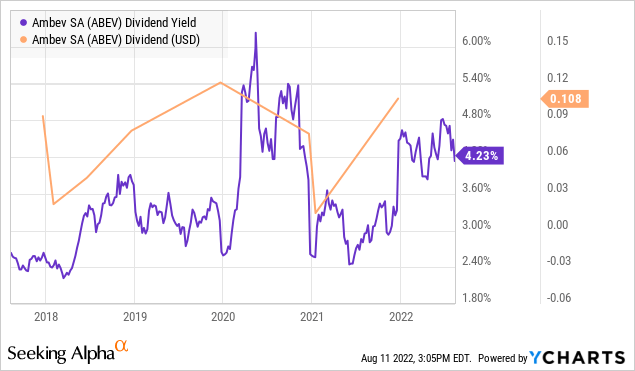

Finally, when we talk about the company’s quality, keep in mind that Ambev maintains a net cash position on the balance sheet at BRL 12 billion, or around $2.3 billion, representing a strong point in its investment outlook. Ambev also pays a dividend, although the timing has historically been irregular, at the discretion of the Board of Directors. According to the company’s Dividend Policy, the intention is to distribute at least 40% of net income to shareholders. A yield of around 4% can be expected on a forward basis, keeping in mind that the distribution for ADR holders will depend on the FX rate fluctuations.

ABEV Benefiting From Improving Brazil Macro

A bullish call on Ambev, in large part, comes down to the macro environment and sentiment towards emerging market equities. The good news is that we have some positive signals out of Brazil, Ambev’s largest market.

We’ll note that the economic outlook for Brazil has improved, with The Finance Ministry raising its 2023 GDP forecast to 2% from a prior 1.5% target. A recently passed legislative tax cut package has been credited with supporting activity levels and the improving outlook. The unemployment rate in the country has been dropping and actually hit a seven-year low at 9.3% in June.

While high inflation remains an issue in the region and much of the world, even pressuring Ambev margins in Q2, the latest July consumer price index for Brazil surprised to the downside. The -0.7% decline compared to June was the largest monthly drop on record since the series began in 1980. This echoes headlines we saw from the U.S. CPI, with Brazil’s inflation trends cooling off based on the pullback in gas prices and the effects of recent Central Bank rate hikes.

For anyone following Brazil, the country always has its problems, but the setup here has been amid low expectations. As it relates to Ambev, economic data coming in stronger should be a positive backdrop to operating and financial trends.

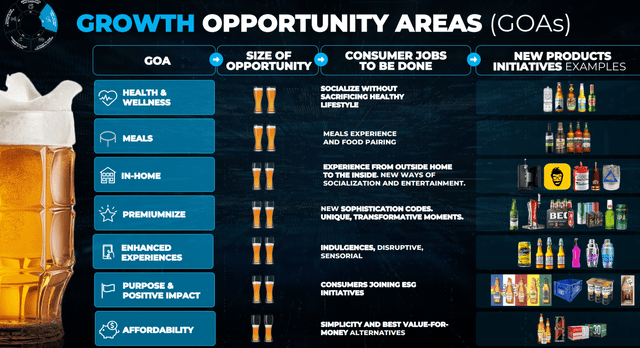

From a high level, the attraction of a Latam brewer and beverages leader is a recognition that the market offers higher growth opportunities compared to more developed regions. Ambev has made an effort to capture market share through initiatives like introducing “light beers” along with some premium imports in an effort to drive margins. The point here is to say that its long-term outlook is looking up.

ABEV Can Win The World Cup

When analyzing stocks, a good catalyst always helps make the case. The 2022 FIFA World Cup is set to kick off in November in Qatar. Several countries in Ambev’s operating regions are playing, including Brazil and Argentina as among tournament favorites. We bring this up because the quarter during which the World Cup takes place has historically been strong for Ambev going back to 2018, 2014, and 2010 editions of the event.

It’s fair to assume that beer volumes should see a boost in Q4 amid the fan excitement and large gatherings, which could help Ambev outperform expectations. Management touched on this topic during the earnings conference call:

So it will be a very important moment. We are very intuitive. We are prepared on the logistics side. We are prepared on the marketing side. We believe that we will — it’s the first time that we have World Cup in the summer in this context after one year of pandemic. And for sure, we will help us this year… We are very excited about the World Cup.

ABEV Stock Price Forecast

Shares of ABEV have traded in a relatively tight range over the last few months, failing to break out above $3.00 while $2.60 to the downside has worked as support. If we’re correct that the macro conditions strengthen going forward, including an operational boost into Q4 during the World Cup, everything is in place for the next leg higher in the stock.

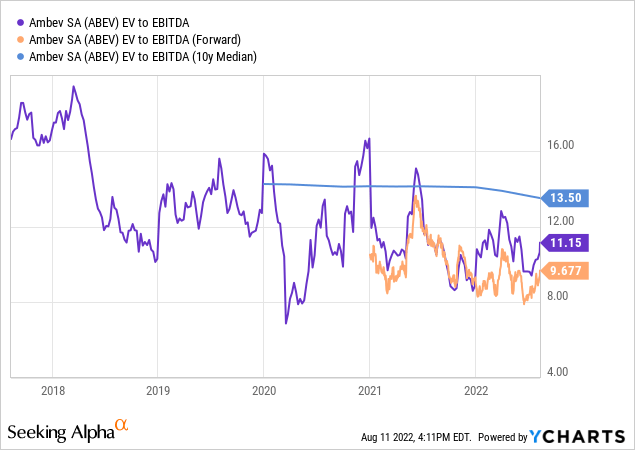

In terms of valuation, ABEV is trading at an EV to forward EBITDA multiple of 9.7x, which we note represents a discount to the stock’s 10-year average for the multiple at 13.5x. In our view, ABEV is undervalued and the latest financial trends warrant some multiples expansion.

Is ABEV a Buy, Sell, or Hold?

We rate ABEV as a buy with a price target for the year ahead at $4.00 per share, representing a 13.5x multiple on the current consensus EBITDA for the year and the implied enterprise value at that level. The potential 40% upside in the stock considers a combination of continued operating and financial momentum, which should support a higher premium for the stock.

In terms of risks, keep in mind that as an international stock, ABEV remains exposed to FX trends related to the Dollar. The 2022 Presidential election in Brazil could also add some volatility to Brazilian stocks. On the other hand, the election results could also remove a layer of uncertainty in regard to the political picture as a positive development for region assets. The operating margin and volume sales levels will be key monitoring points over the next few quarters.

Be the first to comment