Beautifulblossom

Fun couple of months, huh? I suppose if you’re short Bitcoin (BTC-USD) then it’s likely true that you’ve done very well in recent weeks and months. In fact, even I have been calling for lower prices in Bitcoin since May. Yes, it’s true. My last Bitcoin article for Seeking Alpha laid out some pretty straight-forward levels to keep an eye on in Bitcoin’s price. This is what I said in Picking Your Spots in the Carnage:

The immediate price level that I see as a potential support line is $26.2k. Bitcoin was very close to kissing that line in overnight trading but buyers stepped in a little earlier. Underneath that level, I view $23.8k as the next downside target bulls may try to defend. If that level fails to hold, I think the full capitulation event below $20k is coming and probably fairly quickly. At that point, if you’re a long term believer in Bitcoin, that’s probably a level to make larger buys.

At the time, Bitcoin was a little under $29k. While Bitcoin is hanging on to $20k as I type this, there was a very large selloff that took the coin below $18k a few weeks ago. Since then, the top crypto coin has been ranging between $19k and $21k. A break of that range seems inevitable, and I’m going to now make the argument that since everyone seems to be expecting lower prices, we may get the opposite.

Asset Runs and Contagion

Aside from the macro setup, which I covered in my last Bitcoin piece, one of the biggest reasons why the crypto market has sold off to the degree that it has is because of Terra (LUNC-USD) contagion and CeFi (Centralized Finance) crypto custodians like Celsius Network (CEL-USD) and Voyager Digital (VGX-USD) (OTCQX:VYGVF) blowing up. BlockFi, which has been a yield-paying competitor to both Celsius and Voyager, has also faced serious solvency issues and was recently bailed out by FTX at a much smaller valuation. What has driven some of these CeFi insolvencies is the run on assets.

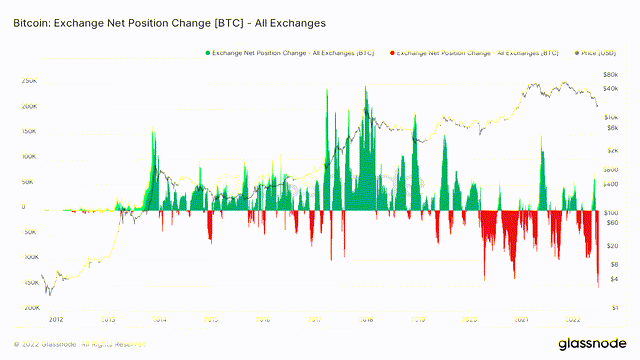

This Glassnode chart shows the price of Bitcoin (black line) with the net position flow of centralized exchanges represented by the green and red bars. Green is inflow. Red is outflow. What those historically low outflow bars indicate is a move to self-custody. Outflows of this magnitude are rare, and they generally happen before a price runup as bullish speculators choose to hold assets on-chain rather than trade through an exchange. What’s different about the exchange outflow this time is that it is seemingly a reaction to industry-wide solvency concerns. This Lehman-style asset run causing problems for other businesses was corroborated by BlockFi in a recent statement:

Crypto market volatility, particularly market events related to Celsius and 3AC, had a negative impact on BlockFi. The Celsius news on June 12th started an uptick in client withdrawals from BlockFi’s platform despite us having no exposure to them.

This is why custodians and funds have been blowing up. The companies and protocols that have exercised better risk management are going to survive this while the ones that have not adopted strong risk management measures are facing margin calls and forced liquidations. Those liquidations have helped exacerbate this crypto selloff that we’ve experienced in recent weeks. This has led to the worst sentiment the crypto market has experienced in quite some time.

Sentiment Check

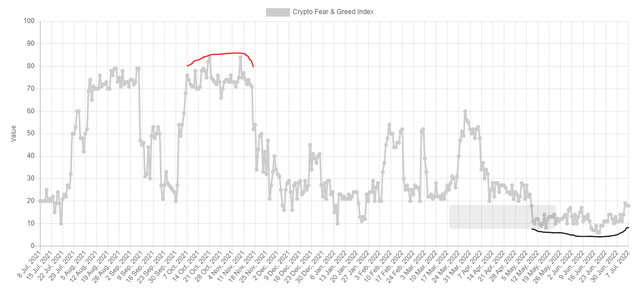

Sentiment in the crypto market is awful. The crypto fear and greed index is currently at an 18 out of 100. That’s categorized as “extreme fear.” Unbelievably, 18 is actually higher than it has generally been over the last month. There were times in June when the index was sub-10.

Crypto Fear and Greed Index (alternative.me)

When we look at the index with a full year of history, it’s a pretty interesting potential counter-trade opportunity in my view. We saw from October through mid-November last year a sustained index above 70. That would have been “extreme greed.” That extreme greed was evident and lasted weeks. Now we have the opposite. Two straight months of extreme fear. So who has been selling during that time? Turns out, it’s been the miners.

Miner Capitulation & HODLers HODLing

While I’ve covered some of the mining companies for Seeking Alpha, I do think that many of them have problematic business models long term. Some of them are better positioned for crypto winter than others. Marathon Digital (MARA) is one of the other large publicly traded Bitcoin mining companies. That company, along with Hut 8 Mining (HUT), did not sell from its BTC holdings in June. I’ve been talking about Hut 8 with BlockChain Reaction subscribers for the last couple of weeks. Marathon’s CEO Fred Thiel recently detailed why they haven’t had to sell any of the company’s BTC position:

So our model means that in times like this, we can literally just sit on our miners and, if we have to, operate at a very low cost because we’re not having to prefund these big CapEx investments. So it gives us an advantage in this current market situation.

Not all of the miners have been able to avoid selling though. What we’ve seen over the last month is miners selling Bitcoin to sustain operations. In June, at least two publicly traded miners sold significant portions of their Bitcoin stack:

| Company | BTC Mined | BTC Sold | Current BTC Stack |

|---|---|---|---|

| Riot Blockchain (RIOT) | 421 | 300 | 6,654 |

| Core Scientific (CORZ) | 1,106 | 7,202 | 1,959 |

| Bitfarms (BITF) | 420 | 3,352 | 3,144 |

| CleanSpark (CLSK) | 339 | 328 | 561 |

Sources: company June announcements

The two miners that jump out as having clearly capitulated in June are Core Scientific and Bitfarms. Core Scientific sold 78% of its Bitcoin position in the month. For Bitfarms, it’s a particularly unfortunate story because that company bought 1,000 Bitcoin for $43.2 million in early January in an attempt to bolster its Bitcoin holdings with the anticipation of a big price rebound. Not only did the price move against them considerably, but to repay a portion of an outstanding loan owed to Galaxy Digital (OTCPK:BRPHF), Bitfarms just had to sell those 1,000 Bitcoins (with an additional 2,000 Bitcoins previously mined) to raise the $62 million needed to cover the loan. Just a brutal situation for Bitfarms.

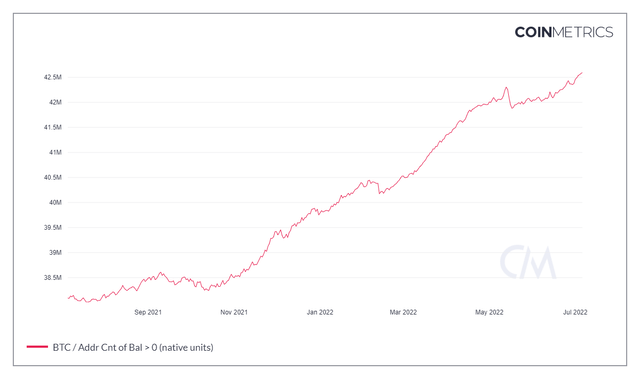

Despite the wreckage in some of these miner positions, the individual Bitcoin wallet growth on-chain has actually been pretty impressive so far this year. There are now 42.6 million wallets on-chain that have a non-zero balance.

Wallet addresses with non zero balance (Coin Metrics)

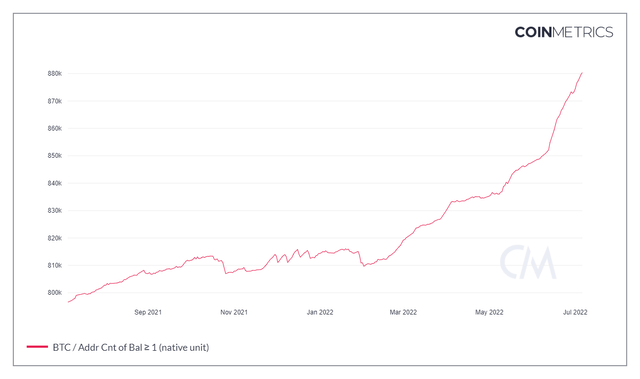

Non-zero balances are just one part of it though. To get a sense of real commitment to Bitcoin holding, we can look at wallet addresses by certain stack levels. Those who hold a full Bitcoin refer to themselves as “full coiners.” The number of full coiners just eclipsed 880k and is up about 8% year to date.

Wallet addresses with at least 1 BTC (Coin Metrics)

Summary

Miners have been selling. Exchanges are seeing outflows. All of this is happening while non-zero balance on-chain wallets have actually increased year to date. Not only that but there are now more wallets on-chain holding at least 1 BTC than during the 2021 top. Bitcoiners aren’t selling. They’re just cutting out the custodians.

As I’ve been telling my subscribers over in BlockChain Reaction, I suspect that crypto is now in a consolidation phase that will likely last through the end of the year. I actually don’t think Bitcoin has necessarily made its “crypto winter” cycle bottom yet. That may come later. But I do think that sentiment is so bearish that it is almost bullish and taking the other side of the trade might not be a bad idea. Bitcoin bulls haven’t had a real bear market rally yet. Everyone is bearish. Everyone expects lower prices. I think it’s possible we see Bitcoin do the exact opposite first.

Be the first to comment