ThomasVogel

Investment Thesis

AbbVie (NYSE:ABBV) stock has done little except appreciate in value since the company was spun out of Abbott Laboratories (ABT) in 2012, in order to allow the market to value its pharmaceutical product portfolio separately to its diagnostics, nutrition and medical device divisions.

The shining star underpinning the ~350% rise in AbbVie’s share price since 2013 has been Humira, the auto-immune, anti-inflammatory drug whose sales in 2019 – 2021 were $19.2bn, $19.83bn, and $20.7bn respectively.

It’s unclear if Abbott knew at the time of the spinout what a success Humira – a tumor necrosis factor (“TNF”) inhibitor with a challenging safety profile – would turn out to be, but it is impossible to overstate its importance to AbbVie over the past decade.

Now that the drug’s patent exclusivity is finally coming to an end – Humira faces generic competition in Europe already, and will do so from 2023 in the US – the company faces a new challenge. How to reduce reliance on a drug that accounted for 37% of company revenues in FY21, and keep growing the company’s top line revenues despite Humira sales falling by perhaps as much as 20% per annum?

AbbVie management successfully fought to have Humira patents extended or new ones approved for many years, and have used price hikes to cancel out falling sales in Europe and the US, but that tactic is not going to last for the company much longer, and it is therefore time for a change of tack at the company.

In fairness to AbbVie’s management team, led by CEO Rick Gonzalez, it has acted fast and early in response to its first major challenge as a <10 year old company.

First, the Pharma successfully bought out Allergan, the medical aesthetics giant, for $63bn in May 2020. Allergan assets – including Botox and Juvederm, atypical antipsychotic Vraylar, Duodopa, used to treat Parkinson’s Disease, and migraine therapy Ubrelvy – generated ~$12.3bn of revenue for AbbVie in 2021.

Secondly, the company has also brought 2 drugs to market in Skyrizi and Rinvoq that management expects to generate $15bn in peak sales by 2026, across broadly the same autoimmune indications as those that Humira is approved for. These 2 assets generated $4.59bn of revenues in 2021, up from $1.16bn in FY20.

Finally, apart from the Loss of Exclusivity (“LoE”) that arrives for Humira in the US next year, AbbVie has no other major drug losing patent protection this decade, meaning that blockbusters like blood cancer drugs Imbruvica and Venclexta, Botox, Vraylar and Eye Care therapy Restasis – which generated combined sales in FY21 of $14.9bn – are more likely to grow sales volumes than see them fall.

AbbVie management’s stated ambition – first articulated before FY20 earnings were announced – was for the company to maintain strong top line growth until the Humira LOE in 2023, then experience an annual decline in sales, followed by a return to growth in 2024, and continued “high single-digit” growth from 2025 until the end of the decade.

The fact that AbbVie’s share price has risen in value by 30% across the past 12 months, which represents the strongest growth of any major US Pharma except for Eli Lilly (LLY) (and AbbVie’s investment proposition is built on much more solid ground than Lilly’s) – implies that the market believes AbbVie can achieve this growth goal, even whilst paying down most of the Allergan acquisition debt – which Q1’22 10Q reporting suggests at $63.5bn long-term debt, and ~$10bn near term.

The question for investors to consider is whether AbbVie can stick to its plans – which my own discounted cash flow analysis suggests supports a share price target of ~$170, if targets are met – or whether the level of risk involved i.e. executing perfectly in every year when there are unknown and unexpected tailwinds in play – is too high to support an investment in AbbVie stock at this time.

AbbVie stock took a slight hit around the time management announced slightly underwhelming performance in Q1’22 back at the end of April (my discussion of results can be found here), so with Q2’22 earnings set to be announced on July 29th, this seems a good time to check on company progress, and consider where the company’s market cap valuation – currently $269bn, is likely to dip or rise in both the short and long terms.

Expectations Downgrade For Q2’22 Hints At Another Tricky Quarter

In Q1’22, revenues came in a little lower than Street expectations, at $13.54bn, and FY22 EPS was downgraded from $14.00 – $14.20 to $13.92 – $14.12.

It is only a small correction, but any uncertainty, or a failure to hit Street expectations, can be heavily punished by investors, who have little other information to go on.

Before we consider the fact that AbbVie management has already downgraded expectations for Q2’22, let’s briefly highlight some revenue trends within AbbVie’s current commercialized portfolio.

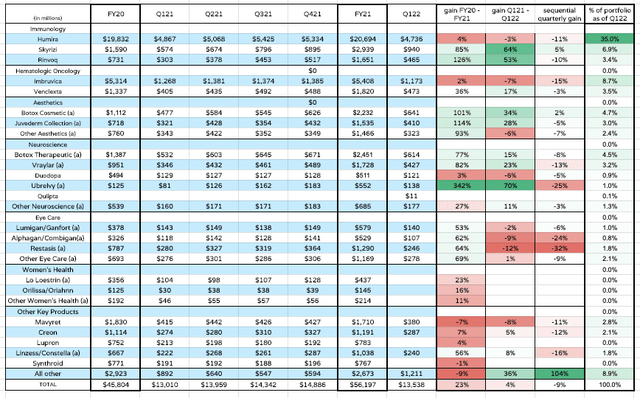

AbbVie product revenues by quarter since FY20 (my table)

I have included 3 separate analyses of revenue growth or shrinkage – annual, i.e. FY20 – FY21, quarter-on-quarter i.e. Q1’22 versus Q1’21, and sequential i.e. Q4’21 versus Q1’22. I have also included the % of total revenues that each product generates.

Probably the first point to note is that in Q1’22, Humira still represented 35% of total revenue, and also that, although the drug generated more revenue in FY21 than FY21, in Q1’22 revenues were down year-on-year, and down 11% sequentially, which suggests the slide has begun.

In truth, much of Humira’s revenue shrinkage is likely down to Skyrizi and Rinviq, which as we can see made stellar progress in terms of revenue growth between FY20 and FY21, and between Q1’21 and Q1’22. So far so good, Skyrizi and Rinvoq’s gains outweigh Humira’s losses, but let’s not forget that the real challenge begins from 2023, when Humira revenues ought to start falling by at least 20% per annum.

That may make the sequential comparison – Humira revenues down 11%, Skyrizi up just 5% and Rinvoq down 10% – a little troubling. Are Skyrizi and Rinvoq revenues beginning to plateau ahead of time, putting the $15bn – $20bn peak revenue target in doubt? Has the competition in Humira’s markets already intensified to the extent physicians are turning their backs on the mega-blockbuster?

In all honesty this could most likely be attributed to a traditionally unfavorable comparison between quarters 4 and 1, and I would not be too worried as an AbbVie shareholder, although it does serve to highlight a couple of important points.

Firstly, Humira sales have not been growing due to higher sales volumes, but higher price points – a 41% increase in its price to Medicare between 2016 and 2020 according to some sources, and an increase of 9.6% in 2020 alone. This is important since it means that when generics do arrive – and there are at least expected to launch next year, from the likes of Viatris (VTRS), Organon (OGN), Pfizer (PFE) and Amgen (AMGN), Humira will lose out on both volume and price.

The effect on AbbVie’s bottom line could be more substantial than investors, used to seeing Humira sales go up even having lost exclusivity in Europe already, expect, and that could lead to panic selling of AbbVie shares.

The second thing to note – that Rinvoq and Skyrizi growth shrank between Q4’21 and Q1’22 – could be related to the intense competition within the autoimmune markets. AbbVie is not the only large pharma hoping to take the market share left behind by Humira in 2023. But in order to prevent the generics taking all of the spoils, pharmas need to show that their drugs are an improvement on anti-TNF drugs like Humira and its generics.

In a previous note I listed Skyrizi and Rinvoq’s competitors as follows:

Eli Lilly’s (LLY) Mirikizumab, Novartis’ (NVS) Cosentyx, Johnson & Johnson’s (JNJ) Tremfya, Amgen’s Otezla, Bristol-Myers Squibb’s (BMY) deucravacitinib (not yet approved, but posting strong data), and Zeposia, Pfizer’s Etrasimod – to name a few.

Since it is highly unusual for a drug to dominate markets in the way that Humira has for a decade or more, AbbVie will be tested to the limit as its 2 new drugs go head-to-head against all the above, and others besides.

AbbVie has the sales and marketing infrastructure already in place, giving the company a competitive advantage, but as an AbbVie investor, I would urge paying very close attention to the data readouts coming from other Pharma’s drugs in markets such as Psoriasis, Rheumatoid Arthritis, Ulcerative Colitis, Crohn’s Disease etc. If a drug establishes itself as best in class, that is not Skyrizi or Rinvoq, then these 2 drugs will be powerless to reverse the slide in revenues within AbbVie’s flagship autoimmune division, which will be very negative for the share price.

I would also urge investors to consider the downturn in Imbruvica revenues – another drug that is growing revenues using price hikes rather than by growing sales, and also look at the sequential Botox figures. These may represent a more accurate reflection of Botox’ sales – trending flat or downward – the 2020/2021 and Q1’22 vs Q1’21 look impressive, but it should be noted that since the Allergan acquisition was only completed in mid 2020 the drug’s sales likely underperformed significantly early in 2021.

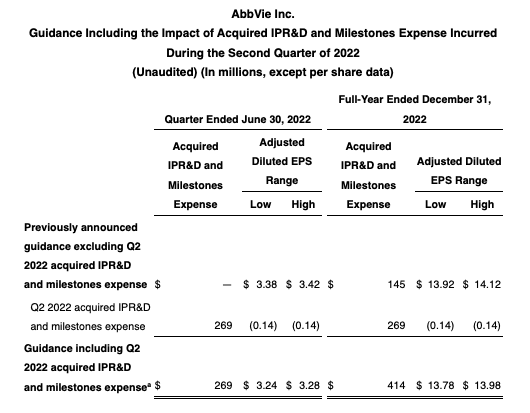

Q2’22 Earnings Downgraded

If Q1’21 threw up a few question marks, it seems as though Q2’22 may do similarly, given that AbbVie management have revised forecasts downwards in an SEC filing.

AbbVie revises Q222 earnings forecast. (SEC filing)

Thanks to acquired IPR&D and milestones expense expected adjusted EPS has fallen from the $3.38 – $3.42 range, to $3.24 – $3.28, whilst FY22 guidance has slipped from adjusted EPS of $13.92 – $14.12, to $13.78 – $13.98.

That still represents a forward price to earnings (“P/E”) ratio of ~11x, which is attractively low, and there is also AbbVie’s dividend, not quite as generous as it once was, yielding ~3.7% today as opposed to >5% before the past 12 months share price gains – to take into account.

AbbVie says it will realize ~$2bn of expense synergies in FY22, up from $1.8bn in the prior year, and the company will also pay off debt – having paid off ~$17bn in FY21, the target is a net leverage ratio of 2x earnings by the end of this year. Given the high profit margin generated in Q1’22 of ~33%, the cash flow generation in FY22 I would estimate to exceed $13bn, compared to $11.5bn in FY21.

High levels of profitability coupled with falling debt are a recipe for share price upside in the long term, but in the short-term management’s clipping guidance will upset a few shareholders and perhaps contribute to a post earnings sell-off, which would not surprise me. But does that make AbbVie a selling opportunity, or a buying opportunity?

Looking Ahead – Path To Profitability Demands Excellent Stewardship

AbbVie has never been a prolific developer of drugs – having inherited Humira, and had Imbruvica approved very early in its life as a new company, protecting these 2 assets has arguably been more important to the company than replacing them.

Although Imbruvica has its issues, fighting off competition from AstraZeneca’s Calquence, for example, the emergence of Venclexta keeps the oncology division growing, whilst Vraylar and Ubrelvy do similar for the neuroscience division. The Eye Care and Women’s Health divisions do seem to be struggling, however – AbbVie didn’t break down performance in Women’s Health by product last quarter, instead presumably shifting it into the “all other” category. Rumors that the division is up for sale are probably correct.

Products such as Creon and Lupron cannot be expected to keep growing sales exponentially ad infinitum, so I expect AbbVie will have to bring some new products through.

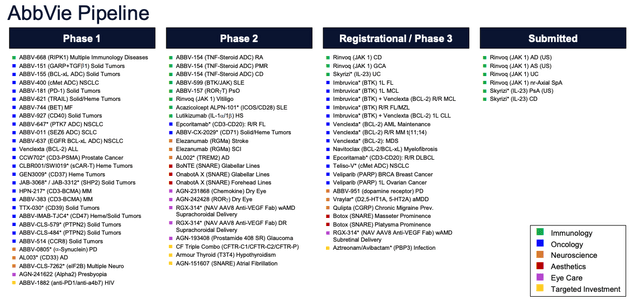

AbbVie pipeline as of beginning 2022. (investor presentation)

If we consider the assets set for regulatory review and pivotal trial data readouts this year, however, we can see that it is dominated by Rinvoq and Skyrizi, Imbruvica and Venclexta, Vraylar and new migraine therapy Qulipta, Botox etc. – brand new assets are thin on the ground.

Oncology appears to be the major new product approval space, with Navitoclax – in blood cancers – Epcoritamab – in DLBCL and Follicular Lymphoma – ABBV-383 – in multiple myeloma – and Teliso-V in 2nd line NSCLC the approvals-in-waiting, with blockbuster sales potential.

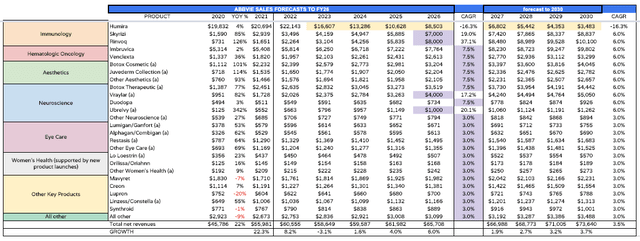

In a prior note I suggested that AbbVie’s management’s long-term forecasts implied a peak revenue opportunity of ~$70bn by 2026, and ~$80bn by 2030, but in my most recent model I am slightly downgrading those expectations, as we can see in the table below.

AbbVie product sales forecasts to 2030. (my table)

These figures are intended for ballpark guidance only, and do not include contributions from e.g. the new oncology assets, but in the interests of making a quick forecast we can, for example, argue that an overestimation of future sales in Eye Care and Women’s Health can be offset by these likely new launches.

I still have AbbVie generating $65.7bn of sales by 2026, and $73.6bn by 2030, and when I plug this into my discounted cash flow analysis model, using a weighted average cost of capital of 8.3%, my target price emerges as $193, and that is closely supported by parallel EBITDA multiple analysis. That offers investors a ~25% upside opportunity (whilst collecting a dividend) and that would be more or less where I see AbbVie stock valued in 12 months’ time.

Conclusion – Still An Attractive Long-Term Buy & Hold But Mind The Near-Term Headwinds!

To summarize my thesis, AbbVie has been in existence for a comparatively short time and the Humira LOE is its biggest challenge to date. Management has prepared well with the Allergan acquisition and the development of Skyrizi and Rinvoq, but these assets and this strategy will be put to the ultimate test over the next 3-5 quarters as investors and analysts scrutinize sales figures – I would not be surprised to see some investors discouraged with these figures and looking to sell.

AbbVie does not have a great track record as a drug developer, and its Women’s Health division and eye care division seem vulnerable, although this may be compensated for by new oncology launches.

Long term, AbbVie can drag its share price towards $200 simply by hitting targets that are not excessive – high single digit growth in immunology, oncology, aesthetics and neuroscience supported by either new products of low-single digit growth in eye care and other key products.

The real tests will come in 2023 when generics arrive to challenge Humira, but don’t be surprised if the old drug fares better than expected – until physicians are confident in the alternatives. Meanwhile, AbbVie must win in its traditional autoimmune markets if management’s plans are not to be severely blown off course.

That is probably the biggest risk to consider, although luckily for AbbVie, the auto-immune markets in play are so large, management ought to be able to achieve its goals. I see the AbbVie growth spurt continuing in the long run, although I would not expect to see the share price break $250 this decade, and there may be better opportunities to realize value within the Pharma industry.

Be the first to comment