Lacheev

Thesis

VICI Properties Inc. (NYSE:VICI) delivered a solid Q2 card that demonstrated the robustness of its casino-assets focused business model. Its triple-net lease model generates strong visibility into its earnings and cash flow, giving investors the confidence to invest in a high-quality REIT.

VICI has also significantly outperformed the market in 2022, as investors celebrated its inclusion in the S&P 500 in Q2. But we think the surge has been too fast and likely unsustainable. We posited in our previous article that VICI’s price action was looking increasingly ominous even as it continued to move higher. Our current analysis suggests that a deep pullback looks to be in the making, and therefore, investors should bide their time before adding more positions.

VICI’s valuation is also no longer attractive, as it traded at a P/AFFO of 17.49x, well above its historical mean of 14.31x. Therefore, we think adding at the current levels requires a high conviction of its growth cadence, which could be increasingly challenging as it moves to add non-gaming assets.

Therefore, we reiterate our Hold rating on VICI and urge investors to wait patiently for a deeper pullback first.

VICI’s Solid Q2 Assures The Market

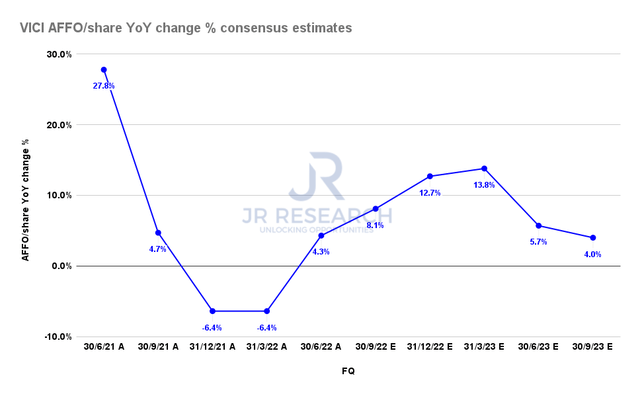

VICI AFFO/Share change % consensus estimates (S&P Cap IQ)

VICI posted revenue growth of 76% YoY, reaching $662.5M, with AFFO rising 67.9% to $430.1M. Both metrics came ahead of the Street’s consensus (very bullish). However, its AFFO/share increased by just 4.3% (in line with consensus) due to the expansion of its share count used to finance its MGP acquisition.

Notwithstanding, we can understand why the market remains confident in VICI’s forward performance. VICI is still projected to deliver robust AFFO/share growth through Q1’23, highlighting the resilience of its business model. Coupled with its inclusion in the S&P 500 and investment-grade credit status, management is confident of its enhanced financing capability against its peers. CEO Edward Pitoniak accentuated:

As we have discussed in the past, the gaming customer has proven to be more resilient through both garden-variety recessions and full-blown crises than just about any other discretionary consumer out there. Point number two, gaming operator resiliency. A couple of you on the sell side have produced well-reasoned analyses that show the gaming operators generally and many of our partners specifically will be in very solid shapes in terms of both free cash flow and balance sheet strength, even under fairly draconian recession scenarios in the year or so ahead. Both gaming consumer and gaming operator resiliency give VICI confidence in our belief that a possible recession will not harm the credit quality of our operators. (VICI FQ2’22 earnings call)

Therefore, we believe the market has rewarded VICI for its underlying strength, which pretty much comes across as recession-resilient. Moreover, given the worsening macroeconomic environment, VICI has undoubtedly outperformed its peers and the market, validating the market’s confidence.

However, we also need to highlight to investors that they need to consider VICI’s growth opportunities in the future, as it adds on non-gaming assets, which could impact its earnings quality. Adding more assets away is helpful to diversify its reliance on Caesars and MGM, as both accounted for 78% of its revenue. Management highlighted:

I think we’ve been clear that the magnitude of gaming assets and the magnitude of EBITDA that they generate are significantly higher than what we’ve seen in the non-gaming space. So we may end up doing more non-gaming transactions, but they may not add up to the quantity of rent, so to speak, of just 1 or 2 gaming assets. So we’re continuing to work on this. (VICI earnings)

VICI’s Price Action Warrants Significant Caution

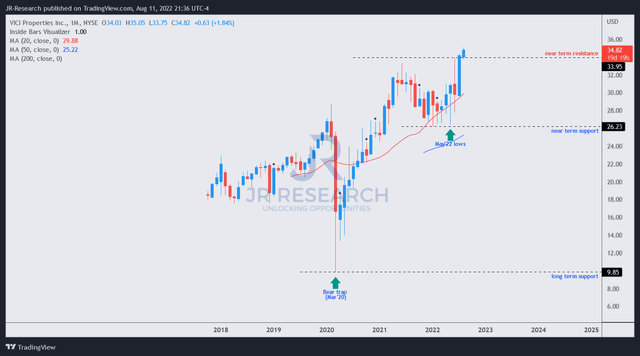

VICI price chart (monthly) (TradingView)

As seen in VICI’s long-term chart, it surged rapidly from its May lows and is testing its near-term resistance. However, such price action is often unsustainable and could portend a deep pullback as the market starts to digest its gains.

Therefore, we urge investors to wait patiently for the re-test of its near-term support at its next pullback before adding further.

Accordingly, we reiterate our Hold rating on VICI.

Be the first to comment