Valerie Loiseleux

In the past, video streaming companies hiking subscription fees were a bullish sign. Walt Disney Company (NYSE:DIS) hiking ESPN+ fees by 43% is now probably an indication of the business needing to cover higher sports rights fees in a scenario of every escalating costs. My investment thesis still isn’t Bullish on the stock despite Disney hitting 52-week lows recently.

Bidding Wars

With signs that Apple (AAPL) is ready to outbid Amazon (AMZN) for the NFL Sunday Ticket, the sports rights market has gone bonkers and is even more competitive now with the tech giants aggressively entering the space. Apple is apparently willing to spend $3 billion annually for only out-of-market NFL games on Sundays while Disney apparently stopped bidding below $2 billion.

Disney is already paying $2.7 billion per year for Monday Night Football games plus the company has rights to NBA and NHL games. According to Axios, the sports streaming app covers over 22,000 live sports events. Last year alone, ESPN inked deals for La Liga soccer and the NHL with combined costs of ~$600 million per year in rights fees.

The cost of ESPN+ is apparently jumping to $9.99 a month, up from $6.99 per month. The company has already hiked the monthly fee from the original price of $4.99 per month to the current $6.99 price.

The service had 22.3 million subs at the end of May, but the news appears to suggest the Disney Bundle price isn’t being hiked. The price hike will likely push more viewers into the bundle which includes Disney+ and Hulu along with ESPN+ for only $12.99 per month. Remember though, an ESPN+ subscriber doesn’t even get access to the MNF games and others aired on either ESPN or ESPN2.

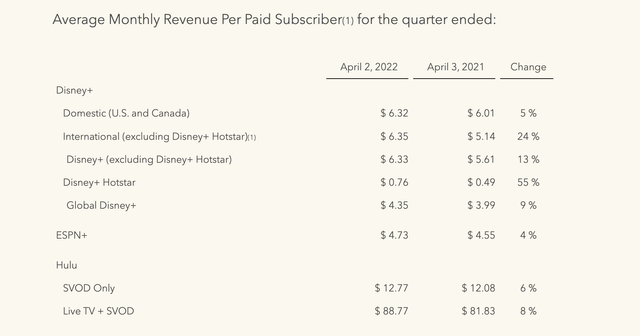

The average monthly revenue per paid subscriber is nowhere close to the current $6.99 figure. ESPN+ only generates $4.73 per sub, up a meager 4% from last year. Disney is only collecting roughly 50% of the prescribed new monthly fee for ESPN+.

Source: Disney FQ2’22 earnings release

Of course, the fallacy in the video streaming sector is that additional subs don’t come with higher costs. If Disney can push someone paying $6.99 for ESPN+ alone into a bundle at $12.99 per month, the media company would generate $6 in additional monthly revenues, or $72 per year.

The problem here is that the potential customer base is ultimately finite. Disney is only obtaining $4.73 per ESPN+ sub due to the bundle. Any attempt by the streaming service to hike the bundle cost by $3 per month could end up with current subs paying $12.99 per month dropping the bundle for either Disney+ or ESPN+ as a standalone service and the company collecting less fees.

Back in FQ2’22, Disney generated $4.9 billion in Direct-to-Consumer revenues, yet the company had an operating loss of $0.9 billion. The higher operating loss was partially blamed on higher sports programming costs.

An example of the problem facing Disney is that ESPN+ spent $400 million annually on the NHL rights deal alone. At $5 per sub, the streaming service only generates around $110 million in monthly subscription fees. The service hardly covers the cost of the NHL rights fees alone during the hockey season.

The company collects advertising revenues on most events, but the sports rights fees don’t even cover production costs, along with the high costs of talent to announce games and such.

Deep Pocketed Competitors

The problem facing Disney is that tech giants like Apple and Alphabet (GOOG, GOOGL), owner of YouTube TV+, have vastly larger balance sheets. Both Apple and Alphabet have roughly $100 billion in cash plus billions in annual free cash flows to throw at media content and sports rights.

Amazon won the Thursday Night Football game for the NFL at a cost of $1.5 billion, while broadcast networks passed on the game this time due to the games failing to deliver necessary ratings. The e-commerce giant uses games on Amazon Prime to funnel viewers into buying goods from the platform.

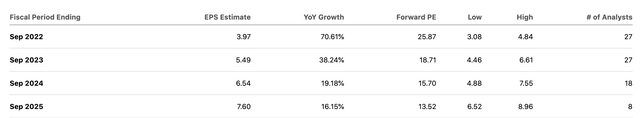

The tech giants can use sports rights as a loss leader to feed other services, while Disney is trying to make a profit off events hosted by ESPN. For this reason, the media company has seen annual profit estimates fall to just below $4 for FY23, while Disney earned nearly $6 back in FY19.

The stock is insanely expensive at 26x these EPS estimates. A shareholder needs Disney to hit the FY23 and beyond growth targets in order to make the stock appealing, even down at $100. The ever increasing competition from the tech giants in the space make these profit targets difficult to reach.

Takeaway

The key investor takeaway is that Disney no longer has an attractive business model with ever increasing content spend forcing subscription fee hikes to cover higher costs, not increase profits. Investors should not assume the ESPN+ price hike leads to higher profits due to escalating sports rights fees. Until the content spending equation changes, the stock should be avoided.

Be the first to comment