Eloi_Omella/E+ via Getty Images

Introducing Veris Residential

Veris Residential (NYSE:VRE) is formerly Mac-Cali REIT. Mac-Cali was a diversified REIT owning multifamily, office and hotel properties. VRE’s properties are all concentrated in the Northeast, with heavy presence in the NYC metro area. Currently, VRE is in the process of a strategic transition into a multifamily REIT, disposing of all their non multifamily properties. The below interactive map provides a deeper look into the locations of VRE’s multifamily portfolio.

Figure 1. Map of VRE MultiFamily Properties as of June 2022. Data Provided by REIT Data Market and Veris Residential

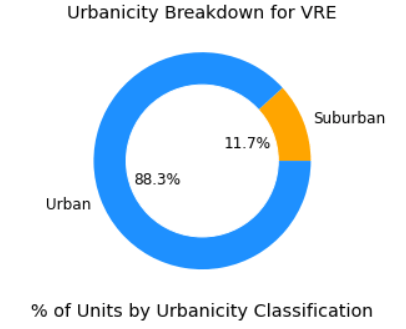

Given the locations of VRE’s apartments, it is no surprise VRE’s properties are located in high-density urban environments. Figure 2 breaks down the urbanicity of VRE’s multifamily portfolio. Our analysis shows that over 88% of VRE’s apartment units are located in urban census tracts. In total, VRE is the largest pure Northeastern urban play in the multifamily REIT space. A complimentary coupling of characteristics that during the Covid era have been attributes REIT investors devalued, but are becoming more attractive as workers return to the office and rents rise due to inflation and lack of new supply.

Veris Residential (VRE) Urbanicity Breakdown (REIT Data Market)

Figure 2. Urbanicity of VRE Portfolio as of June 2022. Data from REIT Data Market and U.S. Census

Property Portfolio Profile

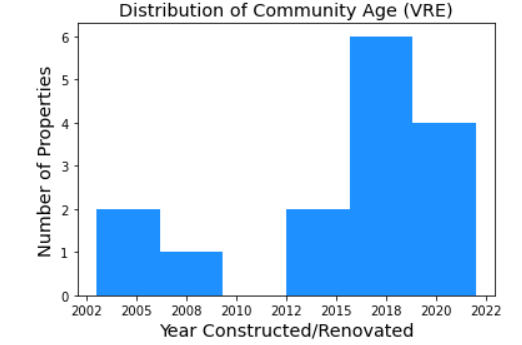

VRE owns class A properties built within the last 20 years. Figure 3 shows that most VRE properties have been constructed in the last 4 years, with the mean age of VRE’s multifamily portfolio at 6 years old. In addition, VRE is reporting a occupancy rate of 97.1% across its multifamily portfolio as of Q2 2022.

Veris Residential (VRE) Multifamily Portfolio Age (REIT Data Market)

Figure 3. Age of VRE Portfolio of June 2022. Data from REIT Data Market and Veris Residential

Newer apartment construction allows VRE to push environmental, social, and corporate governance (‘ESG’) principles across its portfolio. In its most recent earnings call, VRE stated that it is committed to “to reducing our Scope 1 and 2 emissions by 50% by 2030, a target we have validated by the Science-Based Targets Initiative and that we are well on the way to achieving”. During the same earnings call, Mahbod Nia, CEO of VRE stated, “approximately 40% of our wholly-owned multifamily portfolio is Green certified, LEED or equivalent”. The percentage of assets with Green certification almost double the nearest multifamily peer.

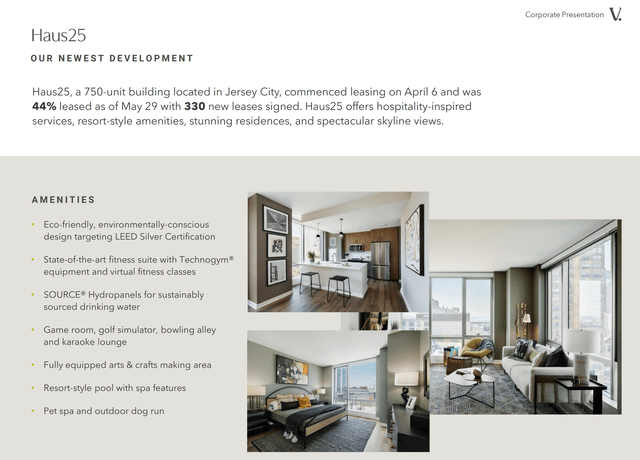

Figure 4 is from VRE’s most recent corporate presentation. Their newest development, Haus25, is an exemplar VRE property.

Haus25 (Veris Residential (VRE))

Figure 4. Slide 8. From Veris Residential Corporate Presentation (June 2022)

Of course, Class A luxury LEED certified apartments with golf simulators are targeting a specific type of demographic. Given VRE’s multifamily assets are predominantly in northeastern urban areas, the location of VRE properties must be situated in zip codes where the tenants can afford their amenity-rich offerings.

| Demographic (unit weighted) | VRE |

| Renters as % of zip code Population | 72% |

| % of Renters in zip code Age 25-34 | 29% |

| % Renters in zip code w/ >= Bachelor’s | 64% |

| % Renters in zip code Paying Above $2000 | 51% |

| % Renters in zip code Income > $100,000 | 47% |

| Median zip code HH Income | $102,289 |

| % Renters in zip code Non-Married | 52% |

Figure 5. Property Data from REIT Data Market, Demographics from American Community Survey (ACS 2016-2020) accessed via CensusData.

We see from the demographic analysis of the zip codes where VRE owns properties that the population mix is higher educated, younger and renter dominated (for reference, it is worth comparing this demographic profile and the urbanicity breakdown above to the same analysis we did for Independence Realty Trust (IRT). The differences in the two REITs could not be more stark). The population mix in the locations where VRE owns property appear well suited for the amenity rich and class A apartments that dominate its portfolio. However, it is not a sure thing that a focus on ESG, green construction and golf simulators generate a rent premium for VRE relative to the market. Moreover, rent premiums may not always be desirable during times of recession as there is a risk of pricing out communities offering rents way above market means/medians. We compared average rent of a VRE property to the zip code average (data provided by Realty Mole) to understand where VRE’s multifamily assets stood vs other listings in the same zip code. Our analysis showed a median percent difference of +7%, meaning VRE properties are offering a slight premium to zip code peers. Even with a slight premium to zip code peers, VRE properties remain less expensive than median rents in Manhattan, which hit another record, since a majority of VRE properties are located in New Jersey across the Hudson. VRE leadership sees its proximity of its New Jersey properties to New York as a key strength, both in taking advantage of rising New York rents, while also providing potential strength in a recession since rents for VRE New Jersey properties are “approximately half of those in Manhattan” according to data VRE provided in their most recent earnings call. However, it is worth noting, one survey from rent.com identified Jersey City, NJ as the city with the highest rent in the country with a YoY rent increase of 66.25%. VRE has a concentration of properties there. This survey is an outlier, but does provide data that undermines VRE’s thesis of more recession proof properties.

Peer Analysis

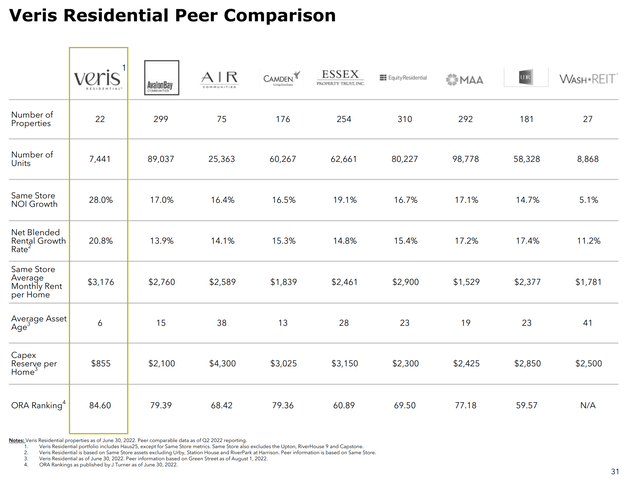

it is important to point out, SeekingAlpha does not classify VRE as a MultiFamily REIT. SeekingAlpha continues to group VRE with “Office REITs”. However, this is NOT how VRE sees itself or how it seeks to communicate company performance. Of course, they have a regulatory requirement and duty to report all business segments. But VRE will soon be out of all non multifamily real estate sectors. Indeed, VRE, as stated in the Q2 2022 earnings call, has [signed] definitive agreements for the sale of the Hyatt Hotel and 23 Main Street, [their] last remaining suburban office assets. So it is very important to understand what VRE means by “peers”. VRE does not consider other office REITs its peers. Investors need to adjust their analysis as well. VRE provides a list of its peers in Figure 6.

Veris Residential (VRE) vs MultiFamily Peers (Veris Residential (VRE))

Figure 6. Slide 31. Q2 2022 Supplemental Operating and Financial Data from VRE. Note: ORA is Online Reputation Assessment.

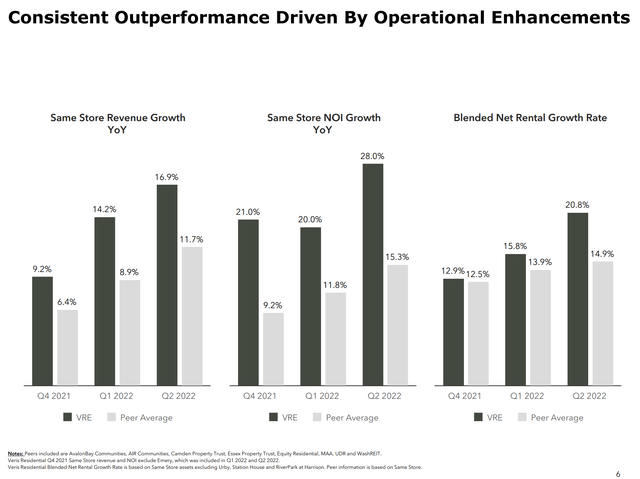

Now compared against proper peers, recent Q2 2022 results show some bullish signals for VRE. VRE is reporting accelerated NOI growth relative to its peers. It also beat street expectations on revenue and FFO for Q2 2022, posting sector-leading rental and NOI growth.

Veris Residential (VRE) Multifamily Performance vs Peers (Veris Residential (VRE))

Figure 7. Slide 6. Q2 2022 Supplemental Operating and Financial Data from VRE.

Inflation, Recession and Rising Rates Oh My!

There are several market factors discussed that could impact the progress VRE is making towards its goal of transitioning from a diversified to pure multifamily REIT. First, rising rates could impact the transaction market by slowing down financing for deals. Obviously, this can impact the ability of VRE to dispose of non multifamily properties. Moreover, a possible recession can effect occupancy and therefore impact the attractiveness of non multifamily portfolio to investors and be another factor slowing the transaction market. All these potential factors in summary could slow down and delay the transition; weighing the REIT down and impacting performance. So despite the progress made over the last 18 months or so to transition to a pure multifamily play, the final stages could get disrupted and delayed if economic conditions worsen and VRE is not able to exit out of non multifamily asset classes that are likely more vulnerable to macro economic pressures.

Looking to the Future

Analysis of VRE as a multifamily REIT opens new doors for consideration. As a multifamily REIT, VRE is unique play relative to peers from geographic, demographic and portfolio perspectives. The REIT is highly geographically concentrated, almost exclusively urban, “young in age”, places an emphasis on ESG and LEED certification, situated in zip codes with the right population mix for its profile and is currently buoyed by positive market fundamentals. VRE’s transition has been proceeding at a brisk pace from 39% of NOI from multifamily in Q1 2021 to 83% of REIT NOI derived from its multifamily properties in Q2 2022. However, it is undergoing a major transition during a time when market conditions could face major headwinds. Inflation, rising rates and recession are all threats to completing the transition over the next few quarters. It is also important to note, VRE does not offer a dividend. A fact that some investors may find disqualifying. Nonetheless, long term investors may see a coherent investment thesis here based on focused and driven management, well placed properties and strong underlying multifamily market fundamentals.

Be the first to comment