AsiaVision/E+ via Getty Images

Investment thesis: Overstock.com (NASDAQ:OSTK) is a classic internet growth story. However, the stock has recently sold off, probably in anticipation of the Fed raising rates. Take a pass for now.

Overstock.com is an internet retailer:

Overstock.com, Inc. operates as an online retailer in the United States. It operates through Retail, tZERO, and Medici Ventures segments. The company offers furniture; and home decor, including area rugs, bedding and bath, home improvement, kitchen and dining items, and other related products. It also operates Supplier Oasis, a single integration point for partners to manage their products, inventory, and sales channels, as well as obtain multi-channel fulfillment services through its distribution network. In addition, the company offers businesses advertising products or services on its website. It provides its products and services through its internet websites, which include overstock.com, o.co, overstock.ca, and overstockgovernment.com.

It is the 19th largest company by market cap out of 53.

My standard analysis for individual companies is to look at the macroeconomic backdrop, followed by a look at the company’s financials, and, finally, its chart.

The macroeconomic backdrop is mostly positive:

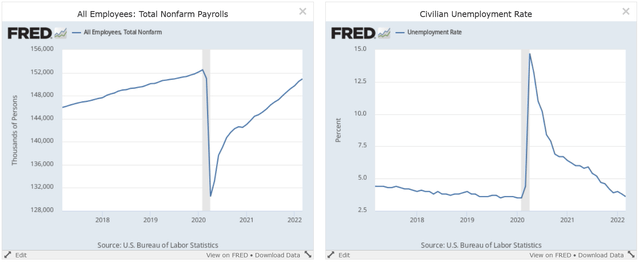

Total payrolls and the unemployment rate (FRED)

Total payroll employment continues to rise (left) which is lowering the unemployment rate (right).

The strong jobs market is supporting wage gains.

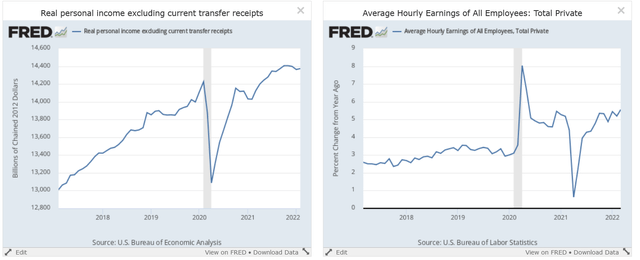

Personal income less transfer payments and the percentage change in wages (FRED)

Personal income less transfer payments (left) is just shy of a 5-year high while the average hourly earnings of all employees is rising (right).

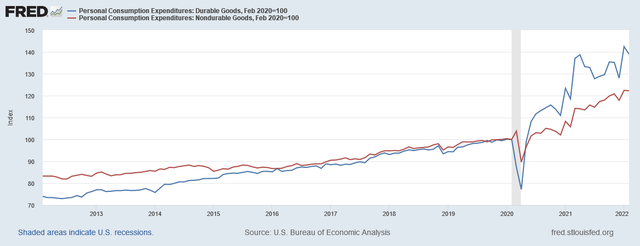

Strong wage gains are supporting spending:

Durable and non-durable spending (base 100 format; the beginning of the last recession is 100) (FRED)

Spending on durables and non-durables is rising at a strong clip.

Finally:

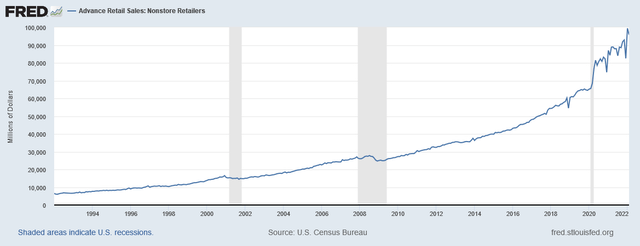

Nonstore (internet) sales (FRED)

Internet sales continue to increase at a strong clip.

Now let’s turn to the company’s finances, starting with gross revenue:

Gross revenue has risen in most of the last 10 years.

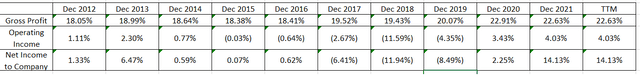

Gross, operating, and net margins (Seeking Alpha)

Gross margin has increased over the last 10 years — a sign the company is gaining purchasing leverage. Operating income has also risen. Net income has bounced around but has been generally positive.

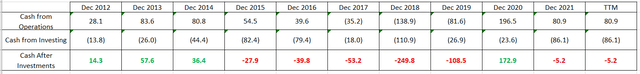

Overstock, cash after investing (Seeking Alpha)

The cash flow situation is a little concerning. In six of the last 10 periods, the amount of money remaining after paying for investments was negative. In three of the four years, the amount of cash generated was relatively small.

This isn’t a fatal development. Retail is a notoriously thin margin business. But it does mean the company has little room for financial error.

I would classify Overstock as a classic growth company. Its top-line revenue has grown in all but one of the last 10 years. Margins are fair and cash flow is tight.

Finally, let’s look at the charts:

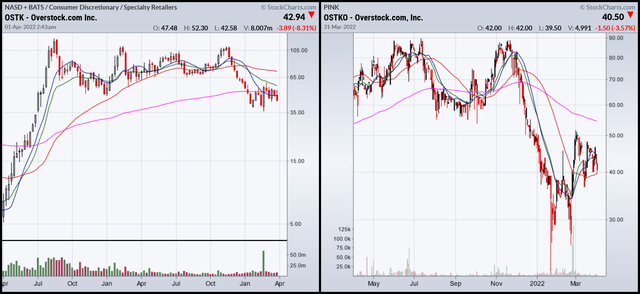

Overstock weekly and daily charts (Stockcharts)

The stock sold off sharply at the end of last year (left). The right chart shows that prices are now below the 200-day EMA – a bearish sign.

This is not the time for growth stocks. The Fed has embarked on a period of rate hikes and there are additional signs of a potential recession. Finally, the charts definitely say no.

Take a pass for now.

Be the first to comment