Torsten Asmus/iStock via Getty Images

Main Thesis/Background

The purpose of this article is to discuss the ProShares Ultra Bloomberg Crude Oil ETF (NYSEARCA:UCO) as an investment option at its current market price. UCO is a double long instrument, designed to return two times the daily performance of the Bloomberg Commodity Balanced WTI Crude Oil Index. This is a futures market product, so it may not directly follow the current price of crude. However, it should bear a pretty strong correlation, and is a fund I regularly follow when I want to take an aggressive long position.

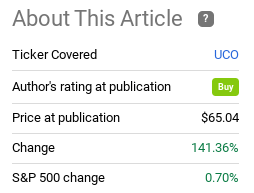

On this point, oil was an asset I suggested investors get bullish on during the sell-off late last year. To me, this represented a great buying opportunity – to the point where I was willing to recommended a riskier, leveraged product to play a potential rebound. In hindsight, this was a smart move, as UCO has simply soared over the past four months, far outpacing equity gains:

Fund Performance (Seeking Alpha)

Given this short-term gain, I think now is a reasonable time to start taking profits / reducing exposure. For me personally, remaining long leveraged products is not the best strategy. I like to use funds like UCO and other leveraged equity ETFs on a short-term basis. When I see over-sized gains, like what UCO has recently delivered, I tend to fade my outlook a bit. For this reason, I see less upside to UCO than I did heading into 2022, and believe a more modest or neutral rating for the fund is appropriate. Simply, I see a few risks to the continuous climb in oil prices, and I will explain them below.

Political Pressure Has Some Leaders Caving

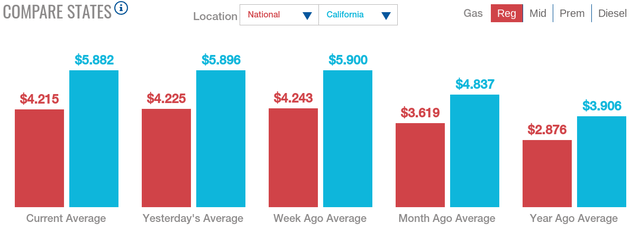

For me, one of the biggest headwinds facing oil in the upcoming months is simply that politicians and other global leaders are finally reacting to the public’s pressure on rising fuel costs. As oil goes up, so does the cost to fill your car, heat your home, travel by airplane, etc. While the current U.S. administration was content to call the rise in prices “transitory” for the majority of their first year in office, that message is no longer reasoning with the public as prices continue to climb. Not only that, but retail prices have moved well beyond recent norms, highlighting the pinch many households are facing today:

Retail Gas Prices (American Automobile Association)

Again, this reality has been a boon for energy and oil investors, helping spur the amazing gains UCO has registered in the last four months. Yet, this reality has sunk into the controlling party in Washington, to the point where they are starting to get concerned about the impact on the November mid-term elections. For this reason, we are starting to see more concrete steps to bring down the price of oil, and therefore bring down costs to U.S. retail consumers.

The most recent of which was the announcement this week by President Biden that the U.S. will be releasing 180 million barrels of oil from the Strategic Petroleum Reserve (SPR), as reported by Reuters. Specifically, this will be a 1 million barrel a day release, intending to help contain the price of oil. It was also accompanied by calls for energy companies to increase their domestic production, as well as hopes that U.S.-allies will similarly release reserves.

In fairness, this is not a massive supply-shock to the market, which is why oil is still trending near $100/barrel (at time of writing). But to me, the significance of the event is bigger than the event itself. It signals that U.S. leadership is finally reacting to the demands of the American public, and marks a strategy shift that we have not really seen in twelve months (prior releases from the SPR have been much smaller). Therefore, I believe the administration’s efforts to combat rising oil prices are not finished, and view this development as a reason to temper my outlook on oil for the short-term.

OPEC+ Continues To Add To Global Supply

Another factor is that OPEC+ has also continued to increase production. Granted, this remains at a very measured pace, and is largely priced into the market. In fact, market participants may even view this past week’s increase announcement pessimistically because they were hoping OPEC+ would be more generous. While there is merit to this, I still see the overall story that more oil will be hitting global supplies as a reason for some caution on oil. Yes, the demand story will probably counteract most of this production increase. As a result, I can see very much see a bull case for crude oil. Yet, more supply is bound to have at least some impact on price, which is part of the reason why I am less bullish than I have been.

What If There Is Positive Progress In Ukraine?

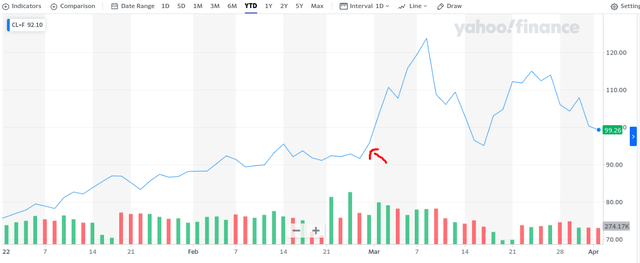

Another headwind facing crude prices right now is one that would be a positive for humanity at large. Specifically, this would be a peaceful resolution to the current conflict in Ukraine. This is important, both on a humanitarian level and also for the global crude market because Russia’s invasion of Ukraine has been responsibility for a good part of the bull run oil has had in the last few months.

Now, I am not saying that oil has not been rising prior to this conflict. Of course it has, and that was mainly expected as global demand was expected to rise in 2022 (which was why I suggested buying UCO back in December, well before the geo-political crisis in eastern Europe). But we have to recognize that crude took a big jump when hostilities started back in early March:

Price of Crude Oil (Yahoo Finance)

My point here is this highlights some of the risk facing investors today. On the one hand, if the conflict drags on, escalates, or extends beyond Ukraine’s borders, then watch out for prices to skyrocket higher. There is the potential for that, so I wouldn’t suggest shorting crude now by any means. But, on the other hand, that jump could self-correct if conditions in Europe improve. This is not a far-fetched idea, and has actually been the case over the past week or so, which is why oil had already been dropping a bit prior to the developments from Biden and OPEC+ this week.

In short, there is downside risk to crude oil if geo-political risks wane. Whether or not they will is anyone’s guess at this point. To be clear, I am not suggesting the conflict in Ukraine is going away overnight. But what I am suggesting is that if peace talks emerge or the aggression is consolidated in eastern Ukraine, then there is plenty of downside risk for crude. This is a key reason why I wouldn’t get overly aggressive at this juncture, and no longer have a position in a leveraged play on the sector through UCO.

Covid Still Plays On Market

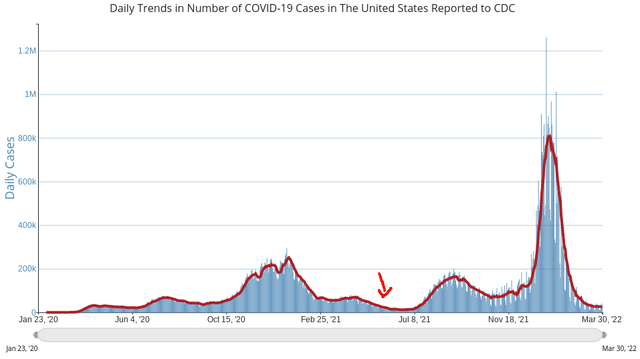

My last point touches on the news story we don’t hear much about anymore – Covid-19. This pandemic is not over yet, although the market has essentially ignored the risks of it for months now. Personally, I do not see a major flare-up in new cases or deaths ahead, as we approach the spring and summer months. Last year, the U.S. saw a dramatic decrease in cases during this time period, and I would expect something similar this year as well:

I say this because I want to make my position clear. I am not a bear on oil, and I do believe oil prices will probably trend higher throughout 2022. However, I do not expect these gains to be consistent week in and week out. There are headwinds that are going to effect this market, and I don’t think now is a great time for a leveraged bull play. I see some real catalysts for short-term downward moves in the price of crude oil, and I would use those opportunities to buy a fund like UCO. Simply, I would wait for big down day, of a few down days in a row, to start that type of position again.

For support, let us consider oil prices throughout March. While prices had soared on the Ukraine invasion, the month ended up being quite volatile because of other developments. Namely, there was a Covid-variant surge in China, which prompted new lockdowns. This had the effect of forcing down demand expectations for crude, sending the price lower as a result:

This chart really emphasizes how volatile crude has gotten. While the first two months of the year showed a consistent, but more stable, rise higher, March was a seesaw month. That is the type of action I expect to see in April as well, emphasizing I will wait for those volatile days to re-consider buying UCO.

Bottom-line

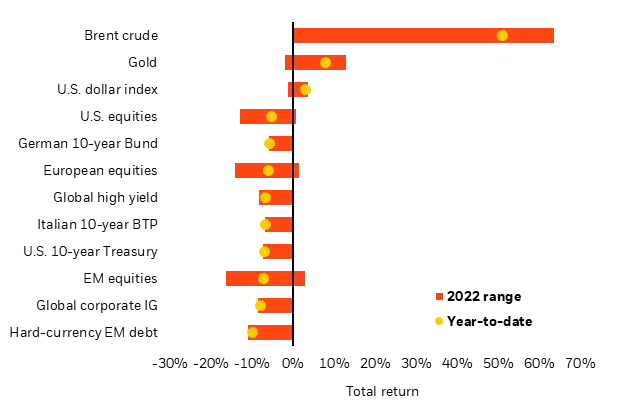

Oil and Energy investors have been handsomely rewarded so far this year. This is probably not going to suddenly reverse, so I would advocate keeping plenty of long exposure to this sector, whether through direct oil plays or Energy funds like the Vanguard Energy ETF (VDE). Importantly, crude has smashed the returns of other major asset classes this year, and we are only through Q1:

Sector Returns (BlackRock)

However, I wrote this review because I want to manage expectations here. Buying UCO going into the new year was a very rewarded play, but one should not approach leveraged funds lightly. This is especially true with a leveraged option of an asset, crude oil, which is already quite volatile to begin with. This reality means being extra selective on timing is critical, otherwise you can wind up with big losses in a short time-frame.

As a result, I think now is a good time to take some chips off the table with UCO, after such a nice gain. Or, for one who doesn’t already have a position, wait and see if a better entry point presents itself. With U.S. adding millions of barrels to the global supply-chain, OPEC+ continuing to hike production, and the potential for price easing if Russia and Ukraine reach a diplomatic solution, I see enough headwinds to crude to suggest a patient investor could be well rewarded. Therefore, I am downgrading my rating on UCO from “buy” to “hold” and suggest readers approach positions very selectively at this time.

Be the first to comment