LeoPatrizi/E+ via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the Invesco California Value Municipal Income Trust (NYSE:VCV) as an investment option at its current market price. The trust’s investment objective is to “provide current income exempt from federal and California income taxes”. This is an area I regularly cover, although this is the first time I have written about VCV specifically.

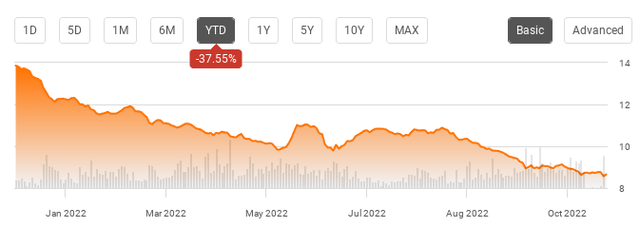

This option has come on my radar for a few reasons, the primary of which has been the chance to pick up what I see as a quality fund at a rock bottom price. To understand why, consider that while VCV holds mostly IG quality bonds, its performance in 2022 has been miserable. Even if we consider investors earned a 5% yield, the total return is a loss of more than 32% year-to-date:

Fund Performance (Seeking Alpha)

This is a scary graphic no doubt about it – but it doesn’t differ much from most of the leveraged CEFs I cover (muni or otherwise). While this poor performance could certainly turn some investors off, I would take the long view here. I see a quality fund that has sold-off sharply, offers a tax-free income stream for residents of California, and will benefit if the pace of interest rate hikes slows in 2023 – as I expect. Therefore, I see a “buy” case opening up for this fund, and will explain why in detail below.

Let’s Not Ignore Reality

As my readers know, I have long been a proponent of municipal bonds. However, as 2021 was wrapping up, I shifted to a more cautious stance. The market saw these bonds shoot up in value and many leveraged CEF options gain rapidly. I was concerned about persistent inflation, Fed rate hikes, and a rotation back to normalized values for these bonds. In sum, I expected some volatility and generated suggested trimming positions.

Well, I was right about that, but before I got patting myself on the back let me be very frank. I saw the sell-off that occurred in Q1 and Q2 as predictable, but also as a chance to buy-in. I started getting bullish again on the muni bond sector mid-2022, and boy was I flat out wrong. Leveraged funds in particular have been hit hard because when one amplifies their position and the trade goes the other way, leverage works against you! Beyond that, an inverting yield curve was putting pressure on leverage expenses while at the same time limiting opportunities to find higher yielding, longer dated bonds to make up the difference. The end result has been more losses in the second half of 2022, much to my dismay.

I bring this up because I am an open book when it comes to my positioning. I keep my portfolio list current on my profile page and I never shy away from admitting a mistake. So I see a “buy” argument for VCV, and other funds like it, but I want readers to know I have been early with this call already, and that could continue to be the case here.

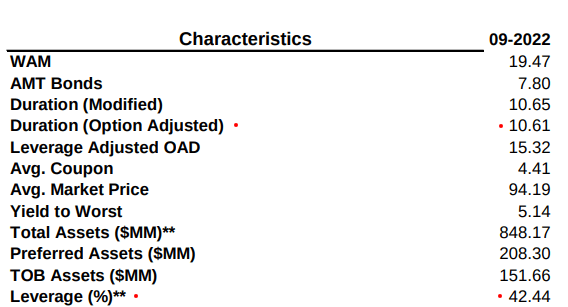

A key reason why is that VCV and the like are very interest rate sensitive. This particular CEF has a duration level above 10 years:

VCV Metrics (Invesco)

What this means is that if interest rates keep going up, VCV could have much further to fall. This is in addition to the fact the fund is highly leveraged at over 42%. So the risk of more downside is present, and I could be wrong yet again.

So – Why Am I Bullish?

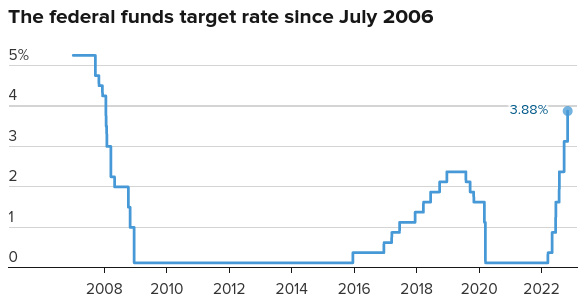

With that disclaimer out of the way I will focus now on the reasons why I do see a buy case. Starting with the primary point on interest rate risk. There are a couple reasons why I don’t see another 10% drop in the cards for VCV. One, I think the worst of Fed rate hikes has passed. We are starting to see more job cut announcements and the benchmark rate is approaching levels not seen since 2008 – suggesting that raising it much higher will pose a challenge:

Fed Rate (CNBC)

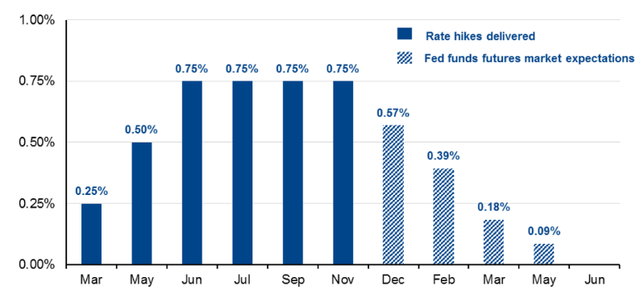

My thought here is that while VCV’s drop has been justifiable, there will be a limit to how much further it will go. Sure, rates could go up another 1%, and VCV could drop roughly 10% (as the duration indicates). But I am reluctant to predict another 1% boost to rates. And the futures market is on my side. After the November rate hike announcement, investors are expecting a more dovish Fed in 2023:

Fed Funds (Actual and Forecasts) (CME Group)

The thought is that if the Fed does ease up a bit, funds like VCV will not face nearly the same headwinds in 2023 as they have this year.

Beyond just that, there is another reason why VCV could see limited downside going forward – even if rates do keep rising. This has to do with the fund’s valuation. At a double-digit discount, VCV could see its NAV fall but the share price remain intact if investors decide the value is too cheap to pass up:

| NAV | Market Price | Discount to NAV |

| $9.95/share | $8.64/share | 13.2% |

Source: Invesco

The rationale here is the NAV could see some further declines due to rising interest rates, but a narrowing of this wide discount could be a buffer against that. Ultimately, I see enough upside from investors finding value at these levels to outweigh some of the other headwinds.

Income Cut Not a “Positive”, But Removes A Headwind

My next point is kind of an odd one, but hear me out. When it comes to an income play, VCV seems like a solid bet. It has a current yield right at 5%, which is very attractive when we consider the intended tax savings for high-income investors. However, we have seen a number of distribution cuts across the muni CEF space, and VCV is no exception. To start November off, the fund announced an income cut over 12%, as shown below:

Distribution Cut (Seeking Alpha)

While an income cut is never something investors want to see, I think it helps support a buy rating here. This isn’t mean to sound counter-intuitive. The point is that I have been expecting income cuts across the muni CEF realm. This led me to hold off on buying new positions as market realities forced fund managers to reduce payouts. This was a major headwind, but one that is getting removed across the CEF universe as similar funds have already cut. In my view, VCV’s announcement this month removes that immediate headwind. The cut is over and done, and now we can focus on how attractive the current distribution is without worrying about an impending cut.

California Muni Supply Remains Limited

I will now shift to a more macro-view on why I like California munis as a whole. I see VCV as a good way to play this space – but why should one be interested in California munis at all?

In fairness, this type of investment is probably limited in nature in that California residents would benefit the most. It could be the right move for non-Cali residents for a number of reasons, however. One could be diversification. California is one of the largest issuers of muni debt, so having some exposure here could be helpful. Two, even if one doesn’t have the benefits of avoiding California state income tax, these bonds can still be federally tax-exempt, so the yield could be competitive anyway. Three, if one simply thinks the CEFs in the space are undervalued, the capital appreciation could be a primary motivator for buying, no matter where one actually resides.

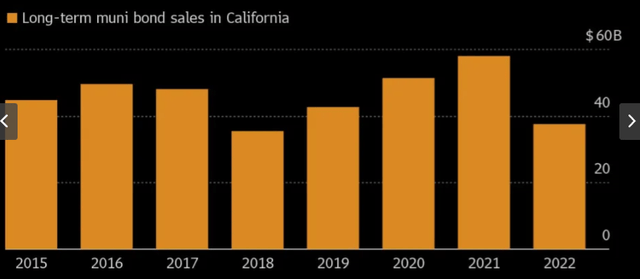

Therefore, I see the bulk of the benefit going to Cali residents, but still believe a buy case here could be applicable to a wider audience. Beyond the individual merits of VCV, I would note the state has seen a sharp drop in issuance this calendar year:

Muni Bond Sales (California) (Bloomberg)

This is a positive for two reasons. One, it speaks to the fiscal stability of the state as a whole. As interest rates have risen, the state and local governments have opted to pay for some projects with cash, rather than utilizing the muni market. This shows that rainy day funds have been put to productive use and the state is not over-leveraged. Two, as supply remains tight, the value of existing bonds benefits as long as investors demand the sector. This point has been under pressure a bit in 2022, but I expect demand to normalize in the coming months and quarters. With lower supply, current prices are supported in my view, benefiting funds like VCV by extension.

Tax Hike On The Ballot Next Week

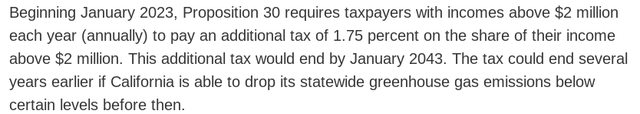

In what probably is not a surprise to readers, we should remember that voters in the Golden State will consider whether to tax its most wealthy residents even more come next week. While the state already has some of the highest tax burdens in the nation, Proposition 30 is aimed at those with incomes over $2 million/annually. Pegged as a way to fund wildfire management, electric vehicle incentives, and infrastructure, the Proposition 30 reads as follows:

Proposition 30 (Legislative Analyst’s Office (LAO))

Now, we can debate all day where this is a “good” idea or not. I certainly have my own opinion on the matter. But the issue at hand is how this may impact VCV. In that vein, I see it as a positive for two reasons.

One, if the bill does pass it will almost certainly raise tax revenues for the state. That will again improve the fiscal picture and limit any impending stress of muni bond delinquency levels. Two, the appetite for further tax increases within the state could be increased and, at the very least, this will lead to more residents considering tax-exempt munis. That could be a catalyst for demand for this sector, something that is sorely lacking at the moment.

Suffice to say I see Proposition 30 passing and having a bullish impact on VCV. This macro-event helps support my buy rating for the fund.

Muni Defaults Remain Low, Isolated In Areas VCV Doesn’t Hold

My last point on VCV has to do with the fund’s holdings. As followers of this product probably know, it is focused on IG-rated securities. This puts me at ease somewhat, especially since the high amount of leverage amplifies the inherent risk of owning it. I have some comfort in knowing it holds quality bonds with that leverage.

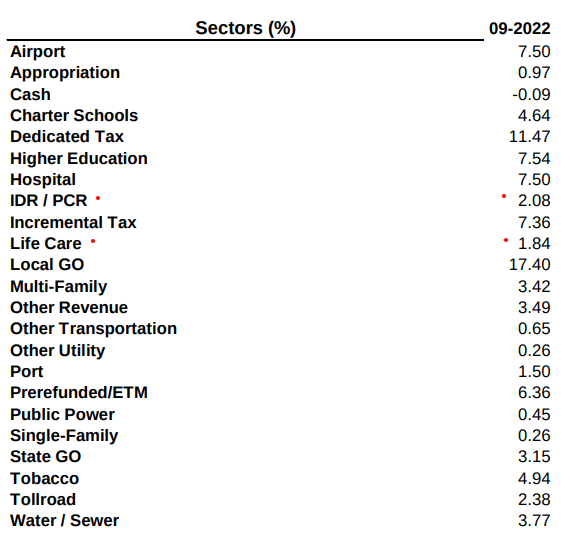

In addition, we have to remember that muni bond defaults are rare, but not impossible. Through 2022, first-time municipal bond defaults totaled over $984 million. While this may sound high, it is a small percentage of the overall $4 trillion market. Importantly, the defaults are concentrated in nursing homes and industrial development revenue bonds, according to a report from asset manager Nuveen.

The fortunate part is that these are two areas where VCV lacks much exposure. The fund is heavily exposed to GO bonds and other revenue bonds tied to specific tax receipts. The two most troubled sectors – nursing homes (long-term care facilities) and industrial development revenue – combine to make up less than 4% of total fund assets:

VCV’s Sub-Sector Breakdown (Invesco)

This convinces me VCV holds the right stuff in this environment. They are under-weight the most troubled areas and are overweight sectors that are well supported by California tax revenue. All things considered, I would feel comfortable recommending this fund.

Bottom-line

The one rock-solid muni bond sector has been disproportionately hurt this calendar year. But cooler heads will prevail. Anomalies like this do not last forever and often turn out to have been good buying opportunities. I see value in the sector, but continue to manage expectations because a continued hawkish Fed will pressure leveraged fixed-income plays of all stripes.

In this light, I see merit to VCV. I am looking for funds exposed to states with strong finances, that have double-digit discounts, and have removed the headwind for a near-term distribution cut. VCV fits the bill on all these counts. Therefore, I believe a “buy” rating makes sense here, and suggest readers give this option some consideration at this time.

Be the first to comment