BlackJack3D/iStock via Getty Images

A Hidden Gem Revealed

I found a hidden gem in the swimming pool, and that’s the shares of Pool Corporation (NASDAQ:POOL).

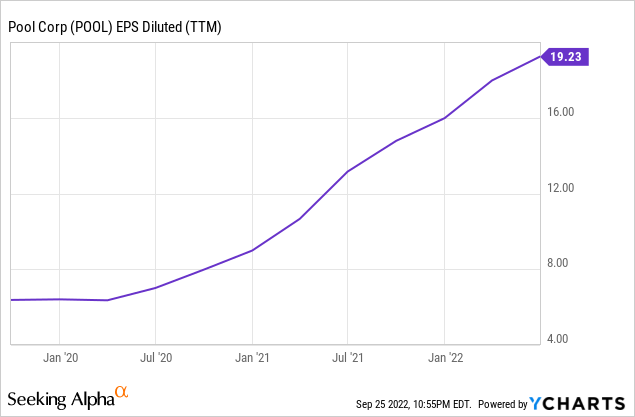

The company has a 190% return over a five-year period, outperforming the S&P 500 index by over 140%, and had an incredible return of 35,000% since being listed in 1995. Behind its stellar return, POOL has robust financials and growth. Revenue grew 35.8%, and EPS surged 78.04% in the previous financial year (2021).

The market was overhyped about its magnificent results as everyone stayed home during the pandemic, and new homeowners in the suburbs sought properties with a pool. POOL benefited from this sudden shift, and its shares almost quadrupled from the pandemic bottom.

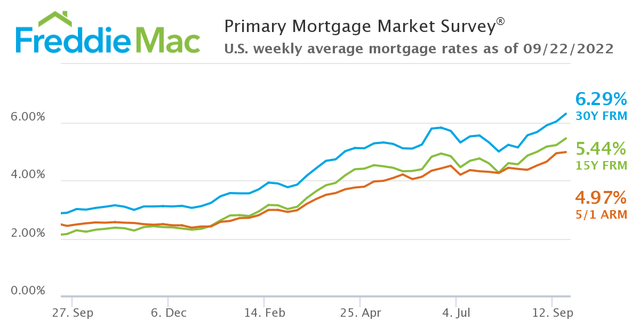

But now, the market was overwhelmingly panicked with the poor housing data, surging mortgage rates and negative consumer sentiment. While the financials and fundamentals of POOL remain robust, shares of POOL have been cut in half from an all-time high ($582.27) in less than a year. It is a no-brainer buy with such an attractive valuation.

Market Trend

The overall market trend is mixed. On one hand, supply chain constraints improved so that the company could bring down the inventory levels. On the other hand, the market has a gloomy sentiment outlook, and demand for pool construction or refurbishment slowed down due to the fading effects of the pandemic.

New Pool Construction

Indeed, the housing market is getting vulnerable right now. 30-year mortgage rates are over 6%, which contributes to the elevating cost of home purchasing. Housing has never been less affordable in over three decades. And new home sales dropped to 511k in July.

The weakening housing market will potentially moderate consumer demand for new pool construction as the major market share of the company is in the residential area. However, the company found the demand for new pools is still strong. Backlog cases triggered by the pandemic are still piled up but returning to a normal level. As Mr. Peter Arvan said:

I think what people sometimes don’t understand is because backlogs are smaller, it doesn’t translate into less work being done. So the builders that we talk to on, obviously, on a daily basis are still very busy. There’s still plenty of work out there for new pool construction.

Pool Refurbishment and Remodelling

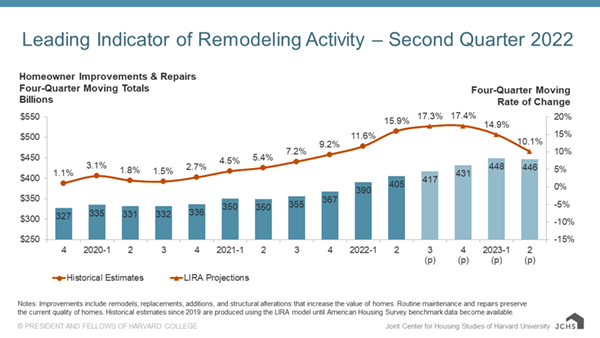

The demand for refurbishment and remodelling of existing homes is also softening. Existing home sales declined for six consecutive months to 4.80million in August 2022. Leading Indicator of Remodeling Activity (LIRA) also shows that the growth of expenditure on home improvement works is likely to slow down and peak in early 2023. However, growth is still well above the historical average of 5%.

On the other side, consumer spending remains robust. Bank of America (BAC) credit card and debit card spending rose 11% in August on a YoY basis, which represents a 2.7% increase in the real term. Discretionary spending from middle and higher income groups improved, while the lower income group tended to deposit their money in bank accounts.

Besides, given the average age of a swimming pool in the U.S. is around 25 years, many of them need or will require modernization and update soon. Also, it is appealing to the owners to install technologically advanced products like automation control and robotic cleaners in their pools.

Thus, I see the overall spending on refurbishment and remodelling of pools staying strong in 2022 but may be overturned in mid-2023.

Havard University

Pool Repair and Maintenance

The above two sectors combined for 40% of POOL’s net sales. Let’s not forget that 60% of the company’s revenue and 69% of the operating income is from the repair and maintenance segment. They made their clients lifetime customers (at least during the lifetime of a swimming pool). Every owner of a newly installed pool will become POOL’s future customer.

Maintenance of a swimming pool is considered non-discretionary and thus less affected by the turbulent economic backdrop. For instance, the demand for chemicals is robust in the first half of 2022, where net sales rose 35% year over year.

Acquisition of Porpoise Pool & Patio, including Pinch A Penny, provided POOL with substantial opportunities for integration and expansion in this sector. The integration allows POOL to create synergies and enjoy better margins. The management is very confident in the potential of this acquisition.

The company added a new Pinch A Penny franchise store in the previous quarter and aims to open ten new stores this year.

Overall speaking, the market condition is looking good in 2022 despite the cooling housing market. Backlog cases still provide strong demand for new pool construction and refurbishment. And the demand for repair and maintenance products is recurrent and less disturbed by the macroeconomic atmosphere.

Valuation

Subsequent to two consecutive years of phenomenal results, the growth of POOL’s earning is expected to slow down. Still, the excellent earning result of POOL is likely to carry on in 2022. In the previous quarter (FY2022 Q2), the company recorded the first ever quarter with $2 billion in sales.

Also, in the previous earnings conference call, the management raised the full-year EPS guidance from $18.38 to $19.13 per share, representing a 20% growth over an incredible 2021 (77.8% growth).

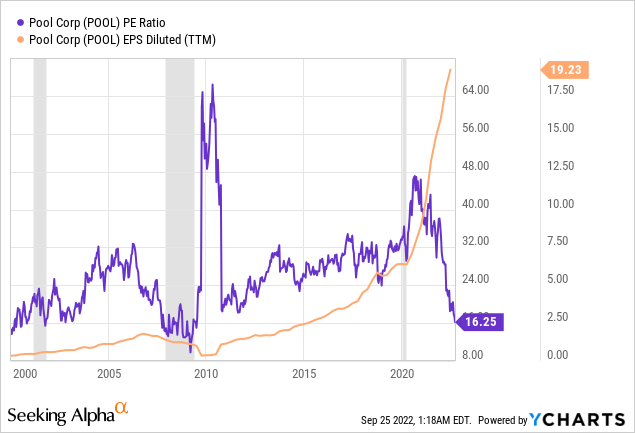

The current PE ratio of POOL is 16.23, which is way lower than the 5-year average (33.07). Below tabled my bullish case and bearish case of valuation, assuming the stock returns to a 5-year average at the end of 2023:

| Bullish Case | Bearish Case | |

| 2022 (EPS Growth %) | 20% | 15% |

| 2023 (EPS Growth %) | 0% | -25% |

| Fair Value ($) | 632.63 | 436.6 |

| Implied Growth (%) | 102.43 | 39.7 |

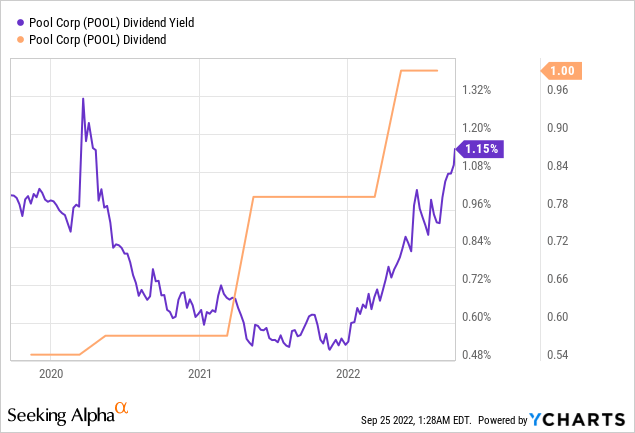

POOL’s dividend is also approaching the pandemic level, indicating its valuation is returning to an attractive level.

With its current attractive valuation, the company also actively bought back its shares. It completed $216 million in share repurchases during the quarter (Q2 2022), acquiring 547,000 shares.

POOL is inflation proof but is it recession proof?

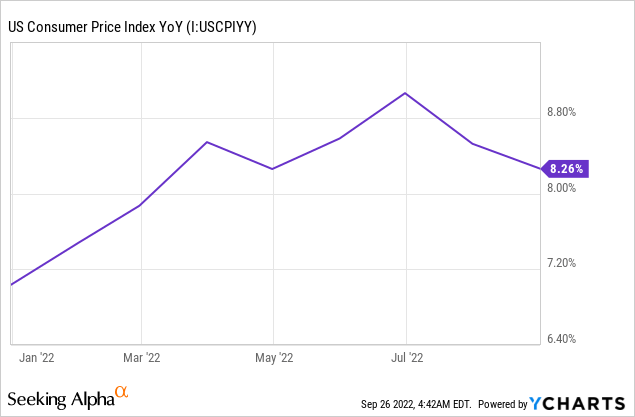

Headline CPI data is still hovering at a high level (8.26% in August). Many companies delivered disappointing results and struggled to maintain their margins and keep operating expenses low. However, POOL is an exception.

The company performed excellently during the inflationary environment as it is well positioned to shift the extra cost to its customers. Net sales benefited approximately 10% to 11% from elevated price inflation.

Also, despite the elevating cost in salaries, fuels, leases and transportation, its operating expenses only increased by 20 basis points. At the same time, its gross margin improved by an impressive 150 basis points.

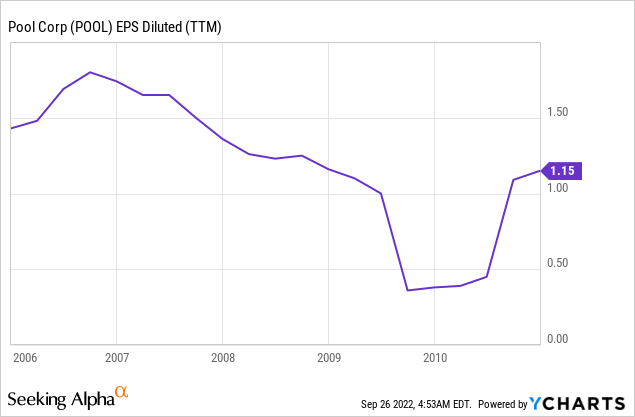

The fundamentals of POOL remain intact during the inflationary time. But the odds of a recession are increasing. It makes me wonder how POOL performed during previous recessionary periods (e.g. the Great Recession). As shown below, EPS of the stock were cut more than half during the Great Recession, while its stock price dropped a whopping 77%.

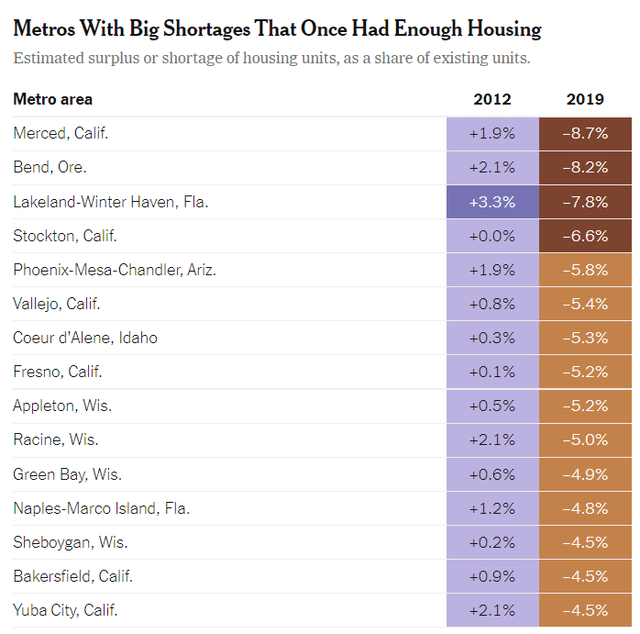

So, although inflation is not a problem for POOL, a “Great Recession-like” economic downturn will hurt the company badly. However, unlike during the Great Recession, when the housing market collapsed and homeownership rates declined, we face a net housing shortage right now. Freddie Mac has estimated that the U.S. is short 3.8 million housing units to keep up with the household formation. The figure below shows the transformation of housing shortages from the recovery phase of the Great Recession in 2012 to the pre-pandemic era in 2019.

We all have no idea when the recession will arrive. But the fundamentals and financials of POOL still look great to me now. In particular, the repair and maintenance sector is likely to perform during an economic downturn.

And the amazing thing is that even if POOL’s earnings are cut in half in 2023, the PE ratio will still be lower than the 5-year average at the current price level. Thus, I believe it is a rare opportunity to buy some shares of this excellent company considering the underlying risk and reward.

Be the first to comment