AdrianHancu

Investment thesis

Societe Generale (OTCPK:SCGLF) has absorbed the Rosbank sale loss and its tangible book is actually up on the year. The LeasePlan purchase should help bridge the profitability gap with largest peer BNP Paribas (OTCQX:BNPQF) but will erode SocGen’s superior capital position. Nevertheless, the tangible book differential relative to BNP remains attractive and should close to an extent over the coming years. Furthermore, BNP Paribas will likely execute a large buyback (around 6% of market cap) to compensate its sale of the Bank of the West, in the process boosting French bank valuations across the board.

In this article, I will go over SocGen’s performance and update on its buyback progress, finishing off with a comparison with BNP Paribas.

Company overview

Societe Generale reports results in four main divisions, namely French Retail Banking at about 31.9% of Q3 2022 net banking income, International Retail Banking & Financial Services at 32.6% of Q3 2022 net banking income, Global Banking & Investor Solutions at 33.9% of Q3 2022 net banking income and the Corporate Centre at 1.7% of Q3 2022 net banking income.

Operational overview and buyback update

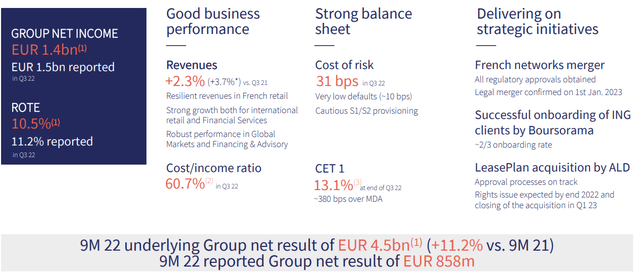

Underlying return on tangible equity (RoTE) came in at 10.5% for the quarter, in line with the 10.4% achieved for the first 9 months of 2022. Net tangible asset value per share grew 2.1 EUR/Share to 61.5 EUR/share Q/Q. Apart from organic earnings, a sequential reduction in share count to 817.8 million (down 1.6% from 831 million in H1 2022) thanks to the 915M EUR buyback helped push the tangible book up.

SocGen Q3 2022 Results Presentation

The buyback helped offset the 12.7 million in new shares created during the quarter due to a capital increase reserved for employees. And while the latest announcement states that the repurchase plan is now 94% complete, SocGen was still buying shares early in October (i.e. after period end for Q3 2022) and I expect the tangible book to rise further. Looking at the latest company disclosures, it seems SocGen repurchased a further 13.32 million shares after September 30 2022, and the share count as of the time of writing stands around 804.5 million shares, boosting the net tangible asset value per share by a further 1 EUR to 62.5 EUR/share.

All in all, thanks to strong underlying earnings, a weak euro and favorable market conditions to execute the buyback, tangible book value per share is now up compared to year-end 2021, albeit only marginally by 0.4 EUR/share (or 1.4 EUR/share if you take into account October stock repurchases), fully absorbing the RosBank sale loss.

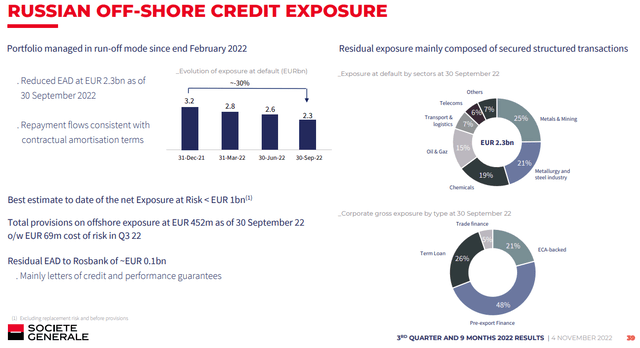

The company’s Q3 2022 “best estimate to date of net Exposure at Risk” to Russia is at less than 1bn EUR:

SocGen Q3 2022 Results Presentation

Capital Position and Cost of Risk

CET 1 capital came in at 13.1%, up 0.14% sequentially, and is 3.83% above the bank’s Maximum distributable amount (MDA) threshold of 9.27%. However SocGen has to absorb a 0.4% hit to CET 1 capital once the LeasePlan purchase is finalized in Q1 2023, with the ALD rights issue expected in Q4 2022. As a reminder, SocGen will subscribe shares in its 79.8%-owned vehicle leasing subsidiary ALD to help it purchase LeasePlan. You can read more in my article here.

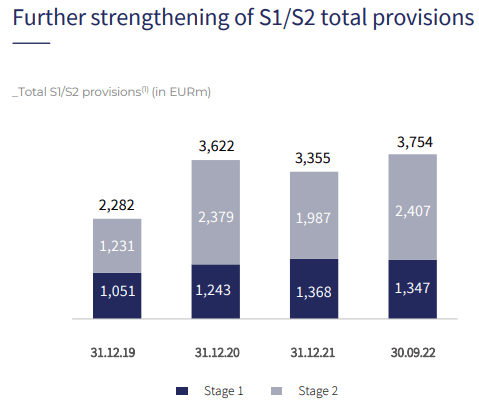

Turning to the cost of risk, SocGen reaffirmed its 30-35 bps guidance for 2022, with the Q3 figure at 31 bps. It is worth noting that despite a dropping Non-performing loans ratio of 2.7% (down from 3.2% in September 2019), the bank is sitting on a substantial provision for credit losses:

SocGen Q3 2022 Results Presentation

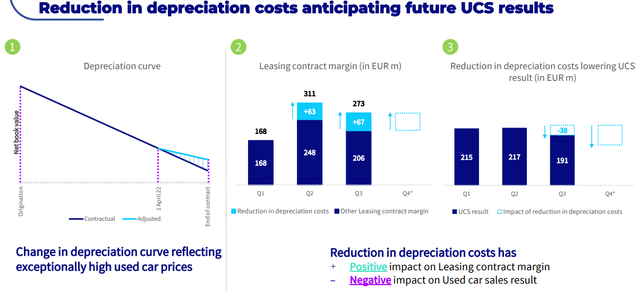

ALD Update

The vehicle-leasing subsidiary reported a 20.9% rise in net income to 0.31B EUR driven by a further improvement in the used car result and a change in depreciation method to account for consistently higher used car prices. In essence, in the future ALD will depreciate cars less, boosting its core leasing margins, but decreasing the used car result, since the difference between the sale price and the cost of the asset in the books will be smaller:

ALD Q3 2022 Results Presentation

ALD had a market cap of circa 4.4B EUR at the time of writing, which coupled with the 0.73B EUR of intangibles and 0.31B EUR in net income generated during the quarter should take the tangible shareholders’ equity to 4.7B EUR as of September 30, hence the price/tangible book is around 0.94 prior to the rights issue.

Compared with SocGen’s price/tangible book of around 0.39 it remains the most tangible asset of the group. All in all, since the LeasePlan transaction was announced the core business of SocGen has improved and while ALD is still performing strongly, I continue to think the LeasePlan purchase was a poor decision in terms of shareholder value creation, at least from Societe Generale’s point of view. Nevertheless, it will create a valuable asset for the bank which will give visibility to its earnings potential.

Comparison with BNP Paribas

On the surface, SocGen compares very favorably with BNP Paribas:

| SocGen | BNP | |

| RoTE | 10.5% | 11.4% |

| P/Tangible book | 0.39 | 0.64 |

| CET 1 Capital | 13.1% | 12.1% |

| MDA Requirement | 9.27% | 9.4% |

| MDA Buffer | 3.83% | 2.7% |

Source: Author’s calculations based on Q3 2022 company disclosures.

While the RoTE for SocGen is 1% less than BNP’s, this is more than compensated by the big premium BNP commands in terms of tangible book. Societe Generale also boasts a stronger capital position, both on an absolute CET 1 level (+1%) and on a relative basis – 1.13% higher MDA buffer.

However BNP is about to close on its Bank of the West sale to BMO Financial Group. The transaction is expected to boost BNP’s CET 1 ratio by 1.1% (after an offsetting buyback to compensate for the lost income) while SocGen will take a hit thanks to its LeasePlan purchase. Furthermore, BNP will book a gain after the close of the sale, taking its tangible book higher by at least 3%. Since the closing of the deal was never certain, BNP probably did not hedge the EUR/USD exchange rate, hence the gain may be bigger than the 2.9B EUR originally announced back in 2021.

All in all, Societe Generale will likely lose its appeal in terms of stronger capital position and will have to rely on a valuation differential in terms of tangible book discount to attract investor interest (the LeasePlan purchase should help close the gap in terms of RoTE).

The Bottom Line

The main risk for Societe Generale is a further escalation of the war in Ukraine, since it operates in Romania via BRD, as well as in the Czech Republic via Komercni Banka. However a de-escalation of the conflict could likewise lift the risk premium from Central and Eastern European assets, boosting SocGen’s appeal.

In the base case for a mild recession in 2023 SocGen should be able to absorb elevated credit losses due to its conservative provisioning, and eventually gradually close the valuation gap with BNP Paribas.

Personally, I will continue to roll my options positions.

Thank you for reading.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment