syahrir maulana

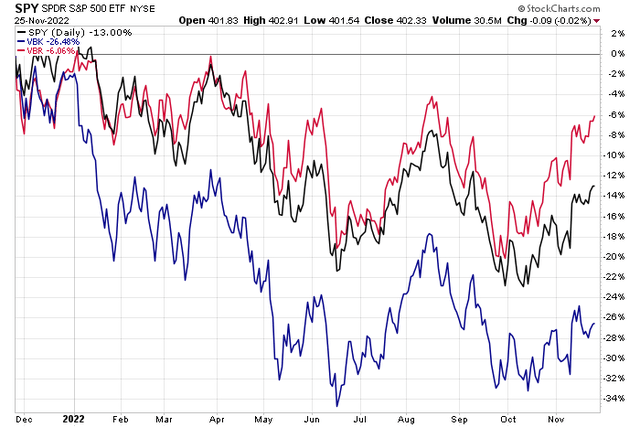

Small-cap stocks have been a mixed bag in the last year against the S&P 500. Small-cap growth is down more than 26%, including dividends, while small-cap value is lower by just 6%. Let’s dig into the former to see if it could turn things around in the coming months and through next year.

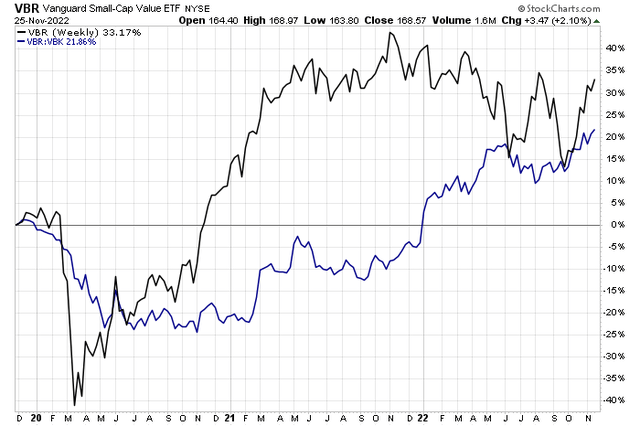

A Tale Of Two Styles: Small-Cap Value Crushing Small-Cap Growth YoY

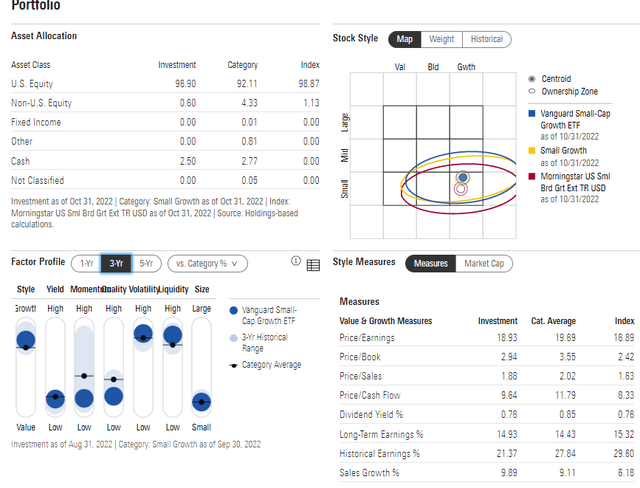

The Vanguard Small Cap Growth ETF (NYSEARCA:VBK) offers investors a way to match the performance of a diversified group of small growth companies, according to Vanguard. VBK uses a passively managed, full-replication approach that tracks an index that follows the CRSP US Small Cap Growth Index, which measures the investment return of domestic small-capitalization growth stocks.

With an expense ratio of just 0.07% per year and a 30-day median bid/ask spread of only eight basis points, it’s an effective way to get exposure to the lower-right part of the style box. The fund pays a small 0.53% 30-day SEC yield, so this ETF is probably one that investors should place in a taxable account and leave higher-payout funds in tax-advantaged accounts for asset location purposes.

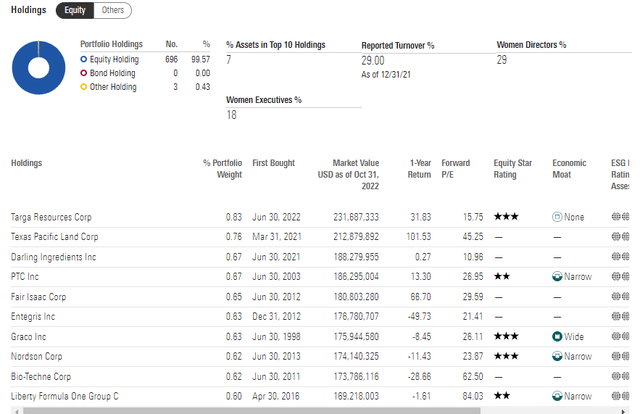

VBK holds 696 stocks, according to Vanguard as of October 31, 2022, and the weighted-average earnings growth rate is high at 19.1, but so too is the group’s price-to-earnings ratio at 20.9. In net, the PEG ratio is about 1.1, which is reasonable, but not as cheap as the Vanguard Small-Cap Value ETF’s (VBR) 0.8 PEG ratio. So, on valuation, I favor small-cap value over small-cap growth.

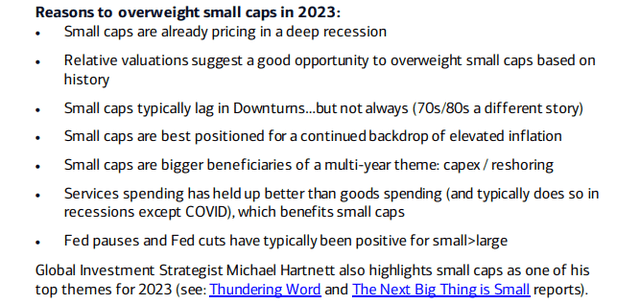

BofA continues to favor small over large in the coming years while Wells Fargo came out in favor of small-cap shares due to low valuations and better relative earnings expectations. Below are reasons why small caps should outperform large-cap stocks in 2023. I agree with the general take that small caps are attractively valued, and the late 1970’s analog is definitely intriguing.

BofA: The Case For Overweighting Smalls

So far in 2022, VBK has done well on so-called “risk on” days in which growth shares and Cathie Wood-type names perform well. Bigger picture, though, small-cap value has been beating small-cap growth for more than two years. In fact, just last week, the latter made a fresh weekly high against the former dating back to shortly after the November 2020 elections and when Covid-19 vaccine breakthroughs were made.

Small-Cap Value Beating Small-Cap Growth Last Two Years

Digging into the portfolio, VBK is diversified with just 7% of total assets in the top 10 holdings. Morningstar also notes that VBK is slightly larger on the market-cap spectrum relative to other funds when plotting the portfolio on the style box. VBK has trended on the low side of momentum in the last three years while volatility and liquidity are high using Morningstar’s factor analysis.

VBK: Top Holdings

VBK: Factor Profile & Portfolio Key Statistics

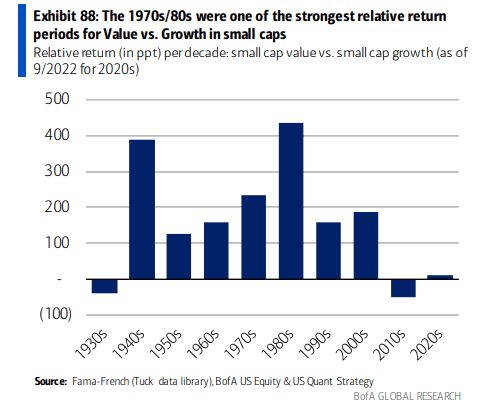

A key question so many small-cap value investors have is, “Will small-cap value alpha return?” Growth has generally beaten value since April 2006 – one of the longest stretches in history. It used to be that small-cap value routinely beat small-cap growth decade by decade. I expect value to reassert itself versus growth among small caps based on this long-term trend and amid macro conditions such as above-trend inflation and higher interest rates today.

Small-Cap Value Often Beats Small-Cap Growth

BofA Global Research

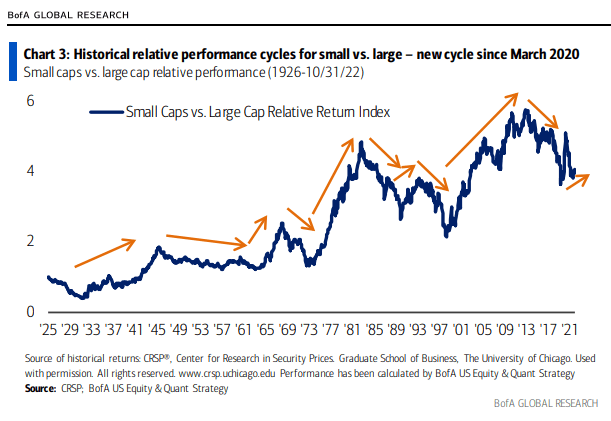

I agree with BofA’s take that small caps will outpace the performance of large caps in the coming years, resuming the longer-term trend.

Small vs. Large Long Over the Long Term

BofA Global Research

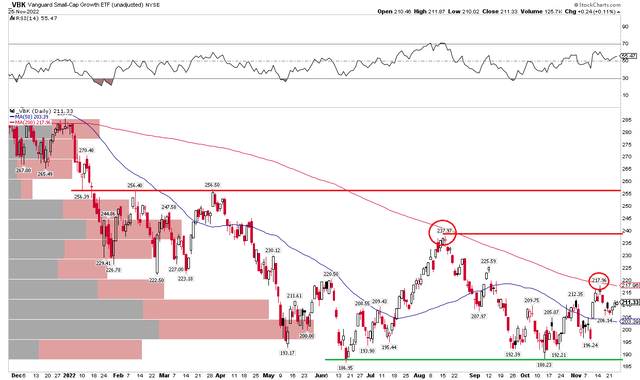

The Technical Take

With a good valuation, though expensive compared to small-cap value, how does the chart of VBK look? I see shares still below important resistance. The $186 to $189 range is solid support, though. I see the 200-day moving average as critical for the VBK bulls. Notice how shares pulled back from that long-term trend indicator in August and just recently earlier this month. A breakout above the 200-day should lead to a move toward $238 and possibly $256 after that.

VBK: Shares Consolidating Below the 200-Day

The Bottom Line

I favor small-cap value over small-cap growth right now and through 2023. VBK is more expensive when comparing price to earnings and growth while VBK’s chart is not as bullish as VBR’s. Small-cap growth remains lacking a breakout and is trending lower on a relative basis to VBR.

Be the first to comment