vchal/iStock via Getty Images

Investment Thesis

Uranium Energy (NYSE:UEC) is America’s leading uranium mining company. On the one hand, this business is very difficult to assert a fair value to as the business is still burning substantial amounts of cash.

Indeed, at the present run rate, it will burn more than $50 million in cash flows from operations in fiscal 2022.

But on the other hand, if you believe that as more countries seek alternatives to fossil fuels as their primary energy sources, they’ll turn to nuclear energy, then this investment makes a lot of sense.

Right now, the single aspect to focus on is the price of uranium on the spot market. With the price of uranium at an 11-year high and supply being heavily restricted, this puts Uranium Energy in a very attractive position, at a valuation that’s not stretched.

In fact, roughly 10% of its market cap is made up of cash. I believe this is an attractive investment.

Why Uranium Energy? Why Now?

Here’s the backdrop, Uranium Energy is a well-positioned uranium player that’s going to benefit from the change in sentiment in Europe when it comes to nuclear energy.

Trading Economics, uranium on the spot market

However, before going further, I wish to highlight an aspect that not many investors have put much consideration on.

Uranium prices on the spot market had been rising before the Russian sanctions. So while the talk of Russian sanctions put accelerant in this dynamic, it’s important to realize that this had already started beforehand.

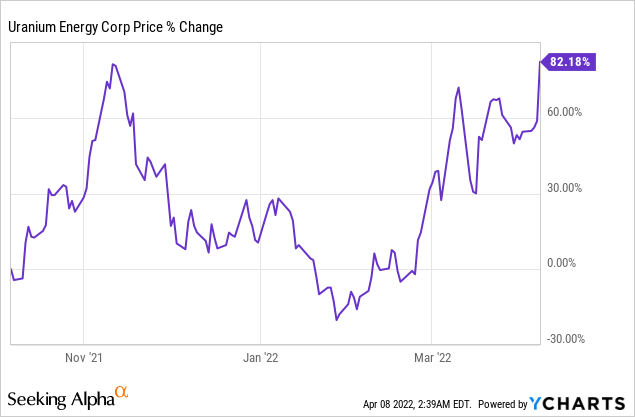

The reason why I highlight this is to drive home the point that even if it appears that Uranium’s share price has moved up a lot recently, that’s only if you are price anchoring to where the share price was in January and February.

But these dynamics were already underway before the talk of Russian sanctions put the spotlight on this space.

As more and more countries have been willing to embrace the green agenda, as a means of weaning off their dependency on fossil fuels, nuclear energy has increasingly been viewed as a viable green alternative.

Meanwhile, the other consideration to keep in mind is that Sprott Physical Uranium Trust (OTCPK:SRUUF) has been active in buying up as much uranium as it can, as a means of taking supply offline, called sequestering.

And then, the final piece of the puzzle came into the fray yesterday. The UK announced its intention to triple nuclear power generation capacity by 2050. This shows that the European Union has increasingly been willing to embrace nuclear energy as a means of getting away from carbon-intense coal as a primary use of energy.

Maven Newsletter

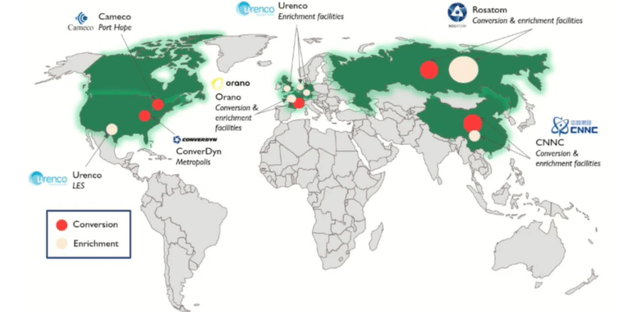

As you can see from Maven’s substack, there’s a limited number of places in the world that can convert and enrich uranium.

And by taking access to Russia’s inventory offline to Western countries, which in practice you have done so since it would be difficult to insure for Russian uranium supply at this time, you have rapidly limited the amount of uranium available for energy production.

Now, let’s drill into Uranium Energy specifically.

Financial Position Discussed

Uranium Energy holds approximately $127M of cash and equivalents and no debt. For investors, this puts Uranium Energy in a very strong position as it has plenty of margin of safety to continue its mining operations.

Think about this, approximately 10% of Uranium Energy’s market is made up of cash. For a business that’s about to embrace a once-in-a-lifetime supercycle in demand for its product, this is a great position to be in.

UEC Stock Valuation – Nicely Priced

Uranium Energy’s physical uranium portfolio of 4.6M lbs. is warehoused at $36.05/lb average cost. With the price on the spot market at above $60/lb, it doesn’t take a genius to figure that there’s a lot of upside between what’s inventoried on its balance sheet and the going price in the spot market.

Investors are asked to pay approximately $1.6 billion market cap for a business that’s the largest resource base of fully permitted In-Situ Recovery projects of any US-based produce. This isn’t a stretched price by any means.

The Bottom Line

There are many moving parts here. Ultimately, there are many qualitative aspects, which make it difficult to envision what is intrinsic value.

The fact is there’s no getting around that the business is not generating any cash flows. Accordingly, by my estimates, for fiscal 2022 Uranium Energy is likely to burn through $50 million of cash flows from operations.

But to look at it from the other side, you are looking at an unhedged, low-cost uranium mining facility, with a lot of operating leverage.

Thus, to sum it up in one line, the thesis is contingent on the price of Uranium remaining elevated going forward. Whatever you decide, good luck and happy investing.

Be the first to comment