Drazen_

Chase Corporation (NYSE:CCF) is a company that sells what ultimately are chemical products like sealants, adhesives and coating products, but also tapes, for the electronics and construction industries among others. While construction is being challenged by higher interest rates that are making large outlays and developments less profitable, threatening infrastructure build to which Chase’s most profitable segment is exposed, CCF is mainly struggling in the electronics end-markets driven by difficulties in the Chinese wallet. We think these markets have more permanent struggles than construction, especially with the US CPI situation, and with peers in Europe trading at a fraction of the multiple, CCF seems a poor choice to us.

FY Results

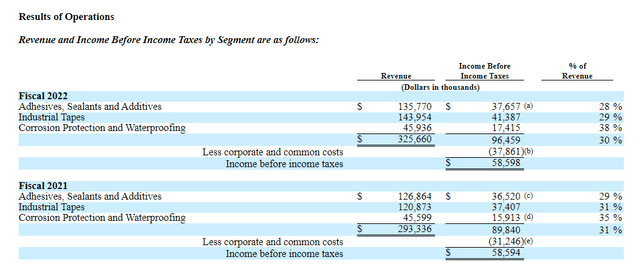

The FY results were by no means bad. Overheads rose and that was much of the reason why overall operating profit didn’t rise. Otherwise, gross profits did rise although gross margins unsurprisingly fell as the company and rest of industry in general dealt with higher logistics and other chemical input costs.

The principal problems within the segment were coming from weakness in electronics end-markets, driven by general recession in China which is quite self-inflicted due to incredibly draconian COVID-zero policy measures. It’s a more sustained problem for the entire electronics industry which has a lot of China wallet share.

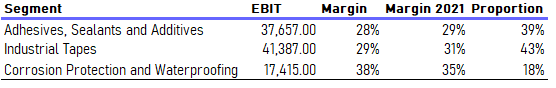

Summary Stats , VTS

Adhesives and Sealants which has a decent amount of electronics exposure saw margins pressure due to worsening mix as a consequence of demand shortfalls from electronics. The same goes for the Tapes business, which being more commodified saw even worse declines in marginality on account of loss of scale. Corrosion protection and waterproofing apparently saw mix pressure from a fall in demand from the construction world, in particular from pipeline work that apparently got delayed. But pricing initiatives here and a more powerful margin profile to begin with saw this segment being the most resilient of them. Pricing initiatives overall drove pretty good revenue growth for the FY, including for Q4, and the overall growth in operating income excluding corporate costs was about 11%. Corporate costs saw inflation though and the overall operating income growth was therefore nullified.

Bottom Line

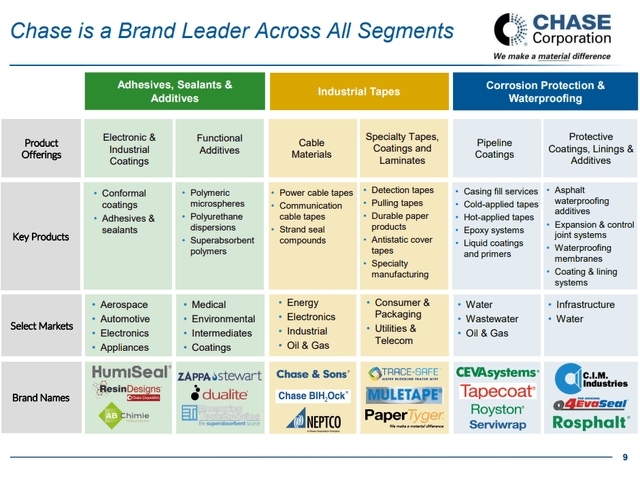

Chase is not very construction exposed. Really the only end-market where we might worry about some construction exposure is in the corrosion and waterproofing segment, where they sell waterproofing membranes which could be used in infrastructure. The company doesn’t sell to residential home markets for example. Interest rate risk is most pronounced in the demand side of these markets, but also automotive which is one of the markets for the adhesive and sealant businesses too.

End-markets (CCF Investor Pres)

Otherwise exposures are pretty solid, and we think that at any rate construction and other interest rate exposed businesses are not in too much peril as the Fed breaks the back of inflation. The issue is that the electronic exposures will fall out from under the segments that rely on them, and politics in China is the reason for this, not really normal market cycles. Volumes have been impacted meaningfully by this to the extent that almost all growth we’re seeing is inorganic or driven by pricing initiatives.

The company is resilient but we question the value. It trades at a 24x PE, meanwhile companies with which Chase has overlap but who operate in Europe have far more attractive multiples. Gobain (OTCPK:CODGF) trades at single digit multiples and has some similar style chemical exposures. More pointedly, Nordic Waterproofing trades at a 10x PE, and they are exposed to some of the best markets that Chase is exposed to but as more of a pureplay, namely waterproofing. Their exposure there is mostly commercial and to infrastructure, so not too far off in terms of market dynamics by being residentially focused (only 20% of their business is residential). If you really want a US company, you could trade in some cyclicality for a much smaller multiple with Owens Corning (OC). While not perfect comps, why not consider these instead, especially Nordic Waterproofing which has more recurring revenue and is less discretionary. We’d never buy CCF with these alternatives on the market.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment