aluxum

Investment Thesis

In my last article on the VanEck Vectors Emerging Markets High Yield Bond ETF (NYSEARCA:HYEM), I highlighted the risks associated with investing in Emerging Market (“EM”) bonds during US hiking cycles. The Fed is today committed more than ever to fighting inflation, which has transformed the dollar into a wrecking ball for the rest of the world. Dollar scarcity remains the main risk factor for HYEM going forward, and I see further weakness as long as US monetary policy remains unchanged. Higher rates for longer also raise the odds of a widespread credit event happening in the future, which isn’t yet fully reflected in EM spreads, indicating that the HYEM selloff isn’t over.

What Has Happened Since My Last Article

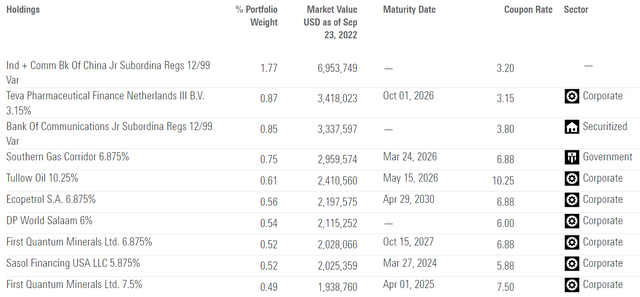

As a reminder, HYEM provides exposure to USD-denominated emerging markets bonds that are rated below investment grade. You will find below a recent breakdown of the top 10 holdings.

I concluded my previous article with the following statement:

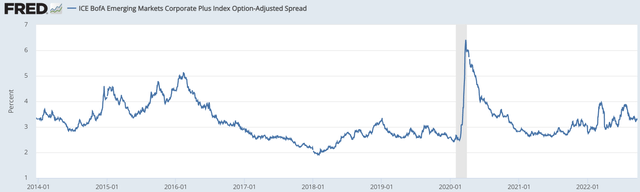

I believe concerns surrounding a potential EM debt crisis are real and should be seriously considered by investors before purchasing HYEM. Despite the attractive yield, there are several risks such as unexpected higher inflation or a global recession that could impair the long-term performance of HY EM bonds. The option-adjusted spreads indicate the market is starting to price in some of the risks, but we are still far from the 2020 peak, suggesting a bottom in HY EM bonds prices might not be in yet.

High-yield emerging markets bonds continued their sell-off as predicted. Their decline was more pronounced when compared to a diversified benchmark of bonds from around the world. HYEM underperformed the Vanguard Total World Bond ETF (BNDW) by over 2 percentage points since my previous article and the negative performance spread between the two strategies even reached a maximum of 10 percentage points in mid-July 2022.

Year-to-date returns are also disappointing and portray a tough macro environment for bonds in general, fueled by untamed inflation and a record pace of monetary policy hiking. HYEM is down nearly 20% since early January 2022, without a clear bottom in sight.

At the same time, the dollar acts like a wrecking ball around the globe, reaching multi-decade highs against both developed and emerging market currencies. A rising dollar puts emerging markets in a precarious condition, because it is similar to a margin call when they need it the most, and adds fuel to the inflation issue. Here you will find an interesting article in Barron’s on the risk of contagion stemming from coordinated rate hikes, and the increasing odds of a large credit event that comes with it.

Refinitiv Eikon

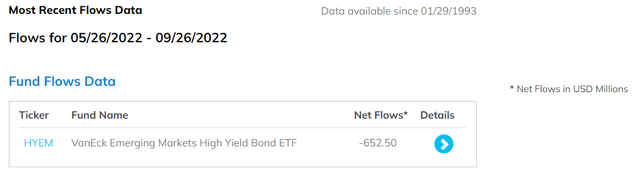

HYEM registered ~$652 million in outflows since early June 2022, which is more than 50% of the total assets of the fund. With US 1-yr Treasuries now yielding over 4% and amidst geopolitical tensions, it’s no surprise to see capital flowing from various regions of the world back to the US. I expect this trend to continue in the near future (at least 6 months) and to add further downward pressure on EM bonds.

What’s Next For HYEM?

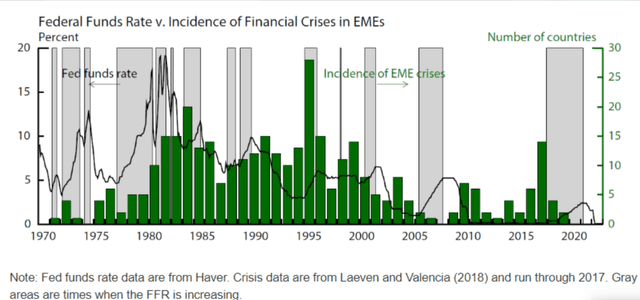

To answer this question, we need to have a good understanding of the Fed, which is the key to this puzzle. As mentioned in my last article, “the Fed plays a particularly powerful role on this topic”, because US rate hikes are a destabilizing factor for EM. The correlation between Federal Fund Rate (“FFR”) hikes and the incidence of financial crises in EM economies is very positive, and a clear risk factor for HYEM at the moment.

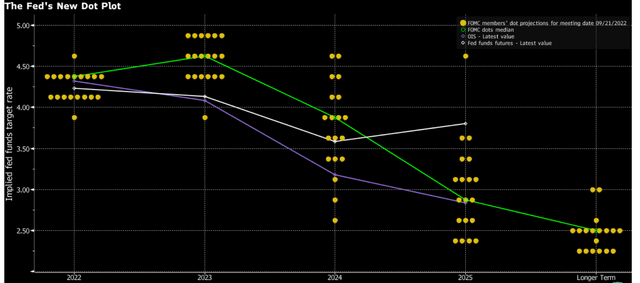

During the last FOMC meeting, Chairman Powell was very specific when he mentioned that he wants financial conditions to tighten further. The Fed believes this goal will be achieved through higher rates for a longer period of time, as illustrated by the Fed’s new dot plots. The ramifications of this revised guidance are critical for emerging markets since they are now facing dollar collateral shortages for a longer period of time. A Fed pivot would be a good indication of an inflection point for HYEM, but we’re still far from this moment.

Until then, pressure is slowing building in the EM credit space. While option-adjusted spreads (“OAS”) are below this year’s high, they have stayed above average. I believe they should be at least 75 to 100 basis points higher today given the current macro context, and I strongly suspect we haven’t seen the post-March 2020 highs yet. All in all, I see risk slowly building up in the EM credit space, and the unfolding event will probably be sudden. As a result, HYEM remains too risky for now to be a buy, and I see more pain ahead for EM bonds.

Key Takeaways

In my last piece on HYEM, I outlined the dangers of investing in EM bonds during US interest rate hike cycles. The Fed is now more determined than ever to combat inflation, which has turned the dollar into a wrecking ball for the rest of the world. Dollar scarcity will continue to be the key risk factor for HYEM in the future, and I expect prolonged weakness in the sector as long as US monetary policy stays restrictive.

Be the first to comment