Ismed Syahrul

Tech stocks are having a rough time with the VanEck Semiconductor ETF (NASDAQ:SMH) falling by more than 40% since the start of 2022 while the broader market tracking S&P 500 went down by less than 25% as shown in the chart below.

Performance Comparison (www.seekingalpha.com)

Except for some short-term bounces from time to time, the downside should continue well into 2023, unless the Federal Reserve suddenly moderates its hawkish instance on interest rates. Well, this is what most of us tend to think, but, it is precisely now that one has to be contrarian by going against the market sentiment and thinking about opportunities.

For this purpose, I already wrote about how the CHIPS Act in a thesis on the iShares Semiconductor ETF (SOXX), and how chip equipment manufacturers will most likely be the short-term beneficiaries as foundry capacity is added frantically on American soil.

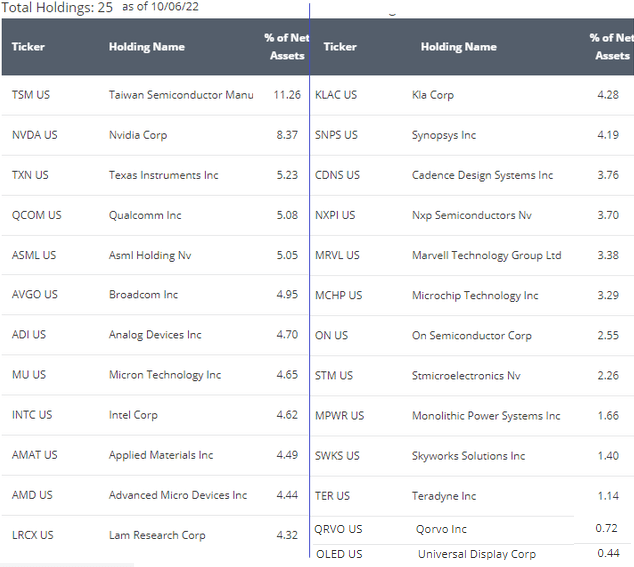

To make the case for this contrarian thesis, I show how VanEck’s holdings, when considered as a whole, operate as a private club, where a commodity, in this case, chips, is offered in limited supply. Normally, such a business model applies to exclusive golf clubs, but, makes sense for SMH’s concentrated cocktail of 25 stocks, given their industry leadership positions, and the fact that they are being supported by favorable policy measures as well as the way the semis ecosystem has evolved.

The Evolution of the Ecosystem

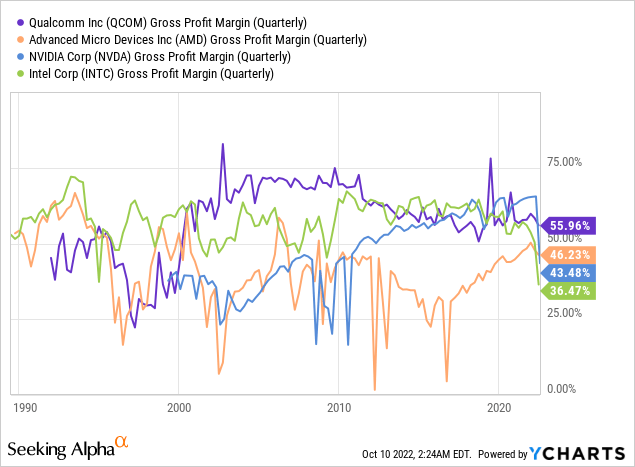

First, the CHIPS Act is trying to reverse a trend that has been going on since the 1990s, namely outsourcing less profitable and capital-intensive manufacturing to East Asia. At that time, high Capex foundry businesses were not aligned with the profitability motives of corporate America prompting companies like Qualcomm (NASDAQ:QCOM), NVIDIA (NASDAQ:NVDA), and Advanced Micro Devices (NASDAQ:AMD) to outsource manufacturing to Taiwan Semiconductor Company (TSM).

Subsequently, the financial results, namely the gross margins of the three fabless (without foundries) companies have beaten Intel’s (NASDAQ:INTC), which opted to be an integrated device manufacturer (“IDM”), or one which does everything from designing chips to producing them in foundries. The outsourcing concept was so successful that even Intel entrusted the production of its most advanced 5nm chips to TSMC and South Korea’s Samsung Electronics (OTCPK:SSNLF) which is not a member of SMH’s exclusive private club as it is a conglomerate involved in many other sectors.

However, the era of cheap manufacturing abruptly came to an end in 2020-2021 as the pandemic disrupted supply chains, with the Ukrainian conflict exacerbating matters this year. As a result, costs went up with TSMC having to pass on these to its customers in turn bringing down their gross margins as of 2022. This decline is evidenced in the above charts, and, in a way, justifies the investment being made to boost home capacity as it shows that one cannot always take low-cost East Asian manufacturing for granted.

Furthermore, Covid infection rates remain persistently high in China where a lot of the components used to manufacture electronic devices come from. Drastic lockdowns aimed at containing Covid spread have negatively impacted economic growth in that country, which consumed more than 50% of the world’s chips in 2021.

Volatility due to both Demand and Supply

Chinese chip stocks are also suffering from volatility after the U.S. Department of Commerce’s recent move to further restrict Lam Research (LRCX), KLA Corp (KLAC), Applied Materials (AMAT), Nvidia, and AMD, and others from exporting AI chips together with the equipment which can produce them to China. However, investigating deeper, these measures which seem more geared at restricting the use of semiconductors for military applications include a reprieve (does not apply to) foreign firms operating in that country.

This reprieve could signify that U.S. semis will not face a sudden erosion of revenue from China and, to be frank, these restrictions have regularly been imposed since 2016 with the stocks also adversely impacted during periods of high geopolitical tensions.

Additionally, volatility has gained the upper hand since August as seen in the above chart, following a worsening of the demand outlook for some like Micron (MU), with AMD and NVIDIA also having issued warnings earlier on due to the higher inflation eating into their customers’ disposable income.

Also, a bleak report by the SIA (Semiconductor Industry Association) stipulates that global sales for August, while growing slightly by 0.1% compared to the same period last year, were down by 3.4% with respect to July. The real cause for concern though was that the Americas region which comprises the U.S. (and generally viewed as being a more resilient country) was down by 2.8% or worse than Japan’s 1.4% decline.

The bright spot in this rather gloomy picture was Europe whose August sales progressed by 1.5% with respect to July. In this respect and as shown in the table below, VanEck’s ETF includes European NXP (NXPI) and STMicroelectronics (STM) which are major designers and manufacturers of automotive and industrial chips.

SMH’s Holdings (www.vaneck.com)

In addition to slowing demand concerns impacting investors’ sentiment due to the cyclicality of the semis industry, there is also the quantitative tightening of monetary policy by the Fed.

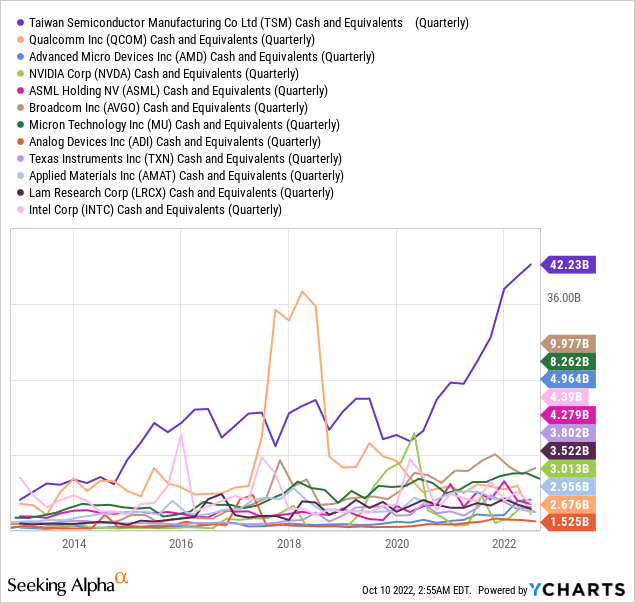

With liquidity being drained out of the monetary system and interest rates going higher, tech companies may find it harder to get their hands on the cash necessary to finance their growth. Normally, this is rhetoric put forward to justify why tech stocks are being punished by the market, but this may not apply to SMH.

Getting Better with Competitors being Sidelined

For this matter, VanEck’s Index tracks the most liquid companies based on market capitalization and trading volume. These are profitable and have high levels of cash as shown in the table below. Therefore, if liquidity does not completely evaporate from the monetary system, they could resist the forthcoming period of economic gloom being forecasted by many as the Fed desperately battles high inflation.

In addition to financial strength, there are also other reasons which make them resilient.

First, with more chips being used in cars and demand exceeding supply, they have the pricing power to pass on additional costs to customers in order to sustain their profitability and cash flows. Second, looking at the competition, the barriers to entry are high in this industry for any new entrants. For example, few have the financial capability to purchase ASML’s (ASML) advanced EUV lithography machine priced at $200 million each. To this end, even New York-based GLOBALFOUNDRIES (GFS), which, by the way, does not figure in SMH’s holdings, halted its plan to purchase them in 2018 and instead concentrate on more matured nodes.

Third, China as a competitor is being sidelined just like Huawei was ousted from the telecommunications supply chain through export restrictions. Now, even if some foreign company wants to export chip-making gear to China, it would rapidly be tracked down by the U.S. authorities. For this matter, most European, Japanese, South Korean, and Taiwanese companies producing advanced gear make use of U.S. technology or patents somewhere in their value chain, which entitles the Department of Commerce to impose hefty fines in case of violations. In fact, the CHIPS Act has China so worried that it envisaged bringing matters to the World Trade Organization, possibly on competition grounds.

Therefore, while SMH’s holdings may face short-term pains, policy actions are being taken to strangle competitors in East Asia. Continuing on a positive note, some are also getting federal support to expand U.S. operations. Normally, when companies face hurdles in their supply chains, they have to fend for themselves and even change their operating models. This is not the case for SMH’s fabless plays who are indirectly benefiting from taxpayers’ money, all in the name of national security and competitiveness, while in fact, the ETF’s holdings will benefit as well as the investors who invest in them.

Concluding with the Private Club Rationale

Along the same lines, their roles at the heart of the semiconductor ecosystem confer SMH’s strong cocktail of semis exclusive rights just as the rich and powerful members of a private club. This is not a monopolistic competition when many companies offer competing products that are relatively similar, but not good substitutes.

Instead, SMH’s ecosystem consists of only 25 companies, and with ASML being the sole supplier for the leading edge process nodes, it means more or less standard designs for its customers. Also, the usage of software enables a higher degree of product substitution compared to a decade ago when it was all hardware based.

To further make my point about the private club model, there are strong interrelationships among members. First, there is the fact Intel outsources the manufacturing of chips to Samsung and TSM and the two East Asian companies are ready to sell to their American customer despite them being competitors. This may be due to the fact that they all form part of ASML’s Customer Co-Investment Program elaborated in 2012 for lithography development. Second, NVIDIA, which makes advanced AI chips that can be used to make the most advanced supercomputers could avail itself of Intel’s Foundry Services for producing chips.

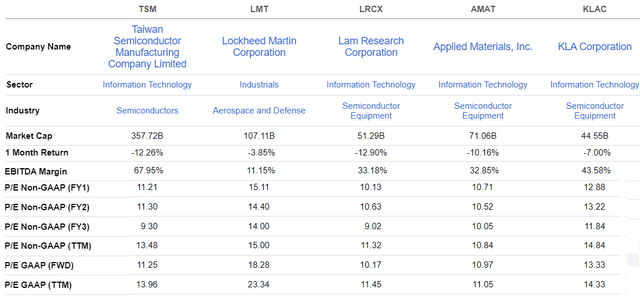

Looking at the security dimension, TSM which manufactures chips for the F-35 fighter jet made by Lockheed Martin (LMT), is undervalued even for the non-GAAP P/E (FY3) despite remaining on track to begin U.S. production in 2024 (table below). It is the same for chip equipment makers Lam Research, Applied Materials, and KLA despite their much higher EBITDA margins.

Comparison of Valuation Metrics (www.seekingalpha)

Thinking aloud, this undervaluation of semis is due to market sentiment being against them and is abnormal in view of the central roles they play to enforce U.S. defense and economic superiority. They are also crucial for industries like automobiles and smartphones and it is unlikely for the authorities in their respective countries to let them down in an acute recession. As such, SMH deserves to be part of a contrarian portfolio looking for long-term opportunities.

Finally, with the market having lost in mind, and momentum indicators showing the downwards trend to continue, it is better to wait for the dust to settle before buying, and in this respect, patience is key to benefit from a good margin of safety.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment