imaginima

Article Thesis

With OPEC+ cutting production, domestic production of oil and gas will be even more important for North America in the future. This means that the infrastructure that allows for the transportation of oil and natural gas will likely become even more important (and valuable) as well. And yet, many midstream names have seen their shares come under pressure in recent months, which provides attractive buying opportunities. In this article, we’ll compare Kinder Morgan (NYSE:KMI) and Enbridge (NYSE:ENB), two 7%-yielding energy midstream giants, in order to see which one is the better investment at current prices.

North American Energy Infrastructure Becomes More Important And More Valuable

Recent moves by OPEC+ to reduce oil production levels have shown that the cartel is highly interested in keeping energy prices elevated. At the same time, this will likely further tighten the market for energy products around the globe. North America will likely depend even more on at-home production in such an environment. Of course, oil and natural gas that is produced in the US or Canada need to be moved to relevant end markets, which is where Kinder Morgan, Enbridge, and its peers come into play. Their pipelines, storage facilities, terminals, etc. allow for these energy commodities to be moved to where they are needed. One could argue that the growing energy scarcity around the world and the recent OPEC+ move make North American energy production, and therefore also North American energy infrastructure, more important for both the US and the world (think LNG for Asia and Europe, for example).

At the same time, building out new pipelines has become harder and harder in recent years, due to rising costs for labor, steel, and so on, but also due to more and more regulatory headwinds. In total, this has made existing pipelines more valuable, as they are needed and hard (or impossible) to replace.

High inflation numbers also mean that pipeline companies are able to demand higher fees for the transportation of oil and natural gas, as its counterparties are more profitable and since some contracts are CPI-linked anyways. All in all, the current environment is thus pretty positive for North American energy midstream names.

Kinder Morgan And Enbridge: Two Midstream Giants

KMI and ENB are two of the largest of these, with KMI being very focused on natural gas assets in the US, while Enbridge is a little more diversified across natural gas and oil in both the US and Canada, while the company owns some non-correlated renewable energy assets such as wind parks on top of that.

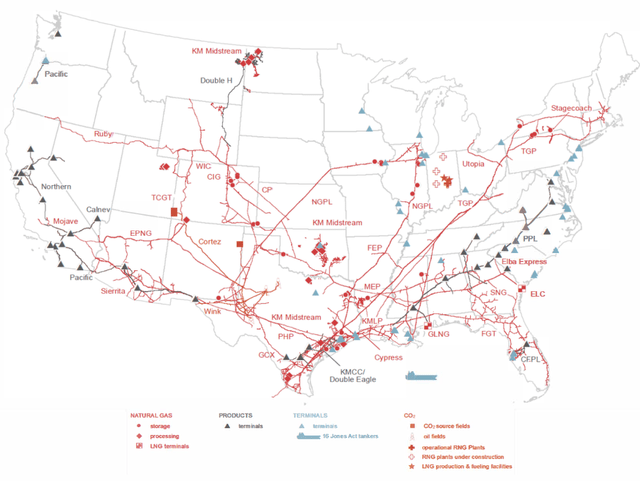

Both companies own highly important and, I would say in some cases, irreplaceable assets. In Kinder Morgan’s case, that includes the following asset footprint:

The company’s pipelines connect important production areas such as the Permian Basin to end markets on the Gulf Coast and in Florida, but also to some other regions, where natural gas is either used for the chemical industry, heating and cooking, for electricity generation, or for LNG production so it can be exported.

Enbridge arguably owns some even more important assets, such as its oil pipelines that connect production areas in Alberta to end markets in both Canada and the US. It’s also connecting production areas in the US, such as the Bakken area, to end markets, for example via DAPL and ETCOP, while its massive Gray Oak pipeline that transports almost 1 million barrels per day serves Permian Basin producers. With its even larger asset footprint, it’s not surprising to see that Enbridge is the more valuable company relative to Kinder Morgan:

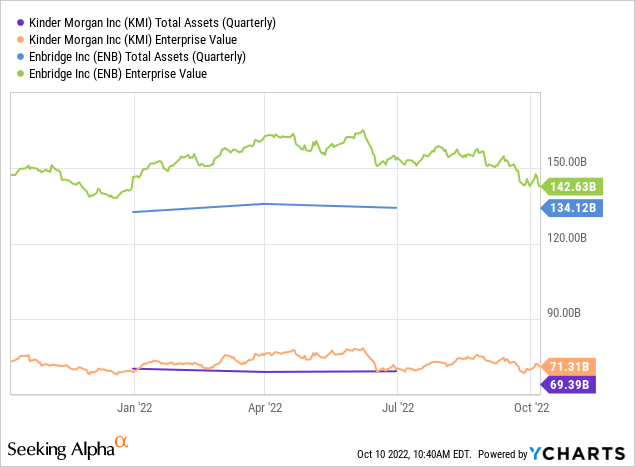

With assets worth $134 billion (GAAP book value) and an enterprise value of $143 billion, Enbridge is roughly twice as large as Kinder Morgan, even though KMI also belongs to the leading North American energy infrastructure players. Notably, the EV/asset ratio stands at marginally above 1 for both companies. Since GAAP asset value likely understates the true value of these pipelines and other assets considerably, due to current replacement costs being way higher than the (depreciated) cost to build them in the past, one could argue that both companies trade below fair value.

Which Is The Higher-Quality Company?

Both companies own important assets that are needed to move energy products to American and foreign consumers. But I do believe that Enbridge has several advantages over Kinder Morgan. First, it is more diversified, due to being active in the US and Canada, while its renewable assets, e.g. in Europe, add another non-correlated income stream.

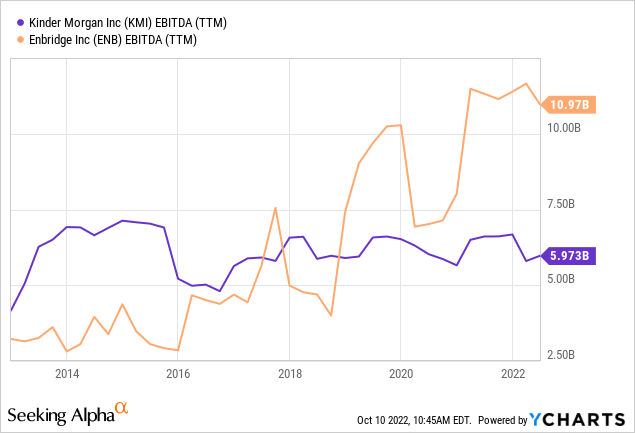

Enbridge also has a way better growth performance:

There was some cyclicality in the EBITDA results of both companies on a short-term basis. But for Enbridge, the underlying growth trend was very strong over the last decade — EBITDA more than tripled in that time frame. Kinder Morgan, on the other hand, has not shown a lot of EBITDA growth in that time frame, clearly underperforming Enbridge in that regard.

Last but not least, Enbridge also looks advantaged when it comes to management quality and capital allocation. While Kinder Morgan ran into problems some years ago due to being overleveraged and due to paying out too much in dividends, Enbridge has always been working with a more sustainable model that balanced dividends and capital spending so the company wasn’t as reliant on equity issuance as KMI was in the past.

Enbridge’s better management is also showcased by the fact that Enbridge has performed better when it comes to fulfilling the company’s own longer-term guidance. Enbridge has a history of beating and raising its own cash flow guidance throughout a fiscal year, and it’s been able to deliver on longer-term guidance when it comes to its dividend growth. Kinder Morgan, on the other hand, had to cut its dividend a couple of years ago despite promising significant dividend growth. More recently, it had to deliver a dividend growth rate that was lower compared to what management was guiding for — the company originally announced it would pay out $1.25 per share by now, yet that has not happened. With Enbridge, investors thus can feel more confident that management will meet or beat its own goals, whereas KMI has a bit of a checkered history when it comes to delivering on longer-term goals. It should be noted, however, that KMI’s management sees unforeseen one-time issues at fault for its underperformance versus its own goals, thus one can argue whether this really is the company’s fault or not.

ENB Versus KMI: Income And Valuation

At current prices, Kinder Morgan offers a dividend yield of 6.5%. Enbridge, meanwhile, offers a dividend yield of 7.3% today. From a yield perspective, Enbridge thus looks stronger, as its income potential is around 10% higher than that of Kinder Morgan on a relative basis.

Enbridge also has a better dividend growth track record. It has raised its dividend reliably for many years, although it should be noted that US-based investors have to stomach some volatility in ENB’s payout as dividends are declared in CAD, which can lead to some fluctuation once translated into USD due to forex movements.

Over the last five years, Enbridge has raised its dividend by a compelling 9% a year. Kinder Morgan has an even higher dividend growth rate in that time frame, although from a much lower basis following its steep dividend cut a couple of years ago. Since KMI is growing its EBITDA and cash flow at a pretty low pace, it seems very likely that its dividend growth will slow down over time.

When it comes to valuation, neither company looks expensive. As shown above, both companies trade close to GAAP asset value, while the underlying or fair value of their assets is way higher than what is reflected on their balance sheets.

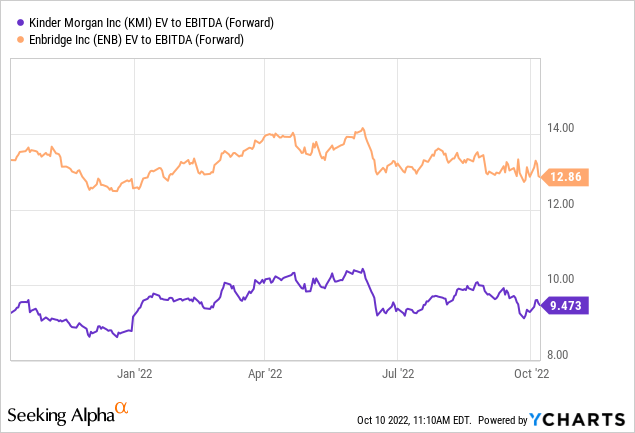

Looking at each company’s enterprise value to EBITDA multiple, we see the following:

Enbridge is more expensive, at close to 13x EBITDA, while KMI trades at only 9.5x EBITDA. That being said, Enbridge’s valuation isn’t high in absolute terms, either. Due to Enbridge’s better growth, higher dividend yield, and stronger management its premium versus Kinder Morgan seems justified, I believe.

We can also look at the distributable cash flow multiples of the two companies. Kinder Morgan is forecasting DCF of $4.7 billion for the current year, which translates into an 8.3x DCF multiple, for a DCF yield of around 12%. Enbridge, meanwhile, is forecasting distributable cash flow per share of CAD$5.35 for the current year, which translates into US$3.90. At current prices, Enbridge is thus valued at 9.4x this year’s expected cash flow. That’s a valuation that is around 10% higher than that of Kinder Morgan, but I believe that this small premium is more than justified based on Enbridge’s way better track record when it comes to growing EBITDA and cash flow over time.

Takeaway

Neither of these infrastructure giants looks like a bad pick at current prices. Both offer a high income yield that should be resilient even during a recession. Both should benefit from the fact that their pipelines become more valuable and harder to replace over time, while both also should benefit from inflation via CPI-linked contracts and since their debt is being inflated away.

That being said, Enbridge is the higher-quality company, with a management team that is executing better and with a stronger growth track record. It also offers a higher dividend yield.

Some may prefer KMI for its lower valuation at current prices, but I believe the premium valuation for Enbridge will be more than justified in the long run, which is why I see ENB as the more appealing pick today.

Be the first to comment