sefa ozel

Introduction: A Reckoning Is Coming In The Digital Advertising Space

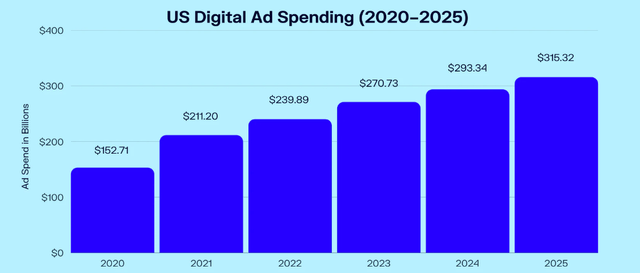

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) is the 800-pound gorilla in the digital advertising market, which benefitted significantly in the immediate aftermath of the COVID-19 pandemic (in the era of free money – zero interest rate environment [ZIRP]). In the US alone, digital ad spending jumped up from $152.7B in 2020 to $211.2B last year. And this year, US digital ad spending is projected to reach $240B and keep growing at a brisk pace for many more years to come.

US Digital Advertising Spend (Oberlo)

While these market estimates have not shifted lower (yet), the shift in tone from digital advertising bellwethers like Meta Platforms (META), Roku (ROKU), and Alphabet has set off alarm bells ringing on the state of global economies and the near-term outlook for the digital advertising market. With central banks across the globe implementing quantitative tightening (interest rate hikes + liquidity withdrawal) programs to reign in multi-decade high inflation [caused by supply chain problems], asset valuations are deflating across the board, and an economic recession is looking likelier by the day.

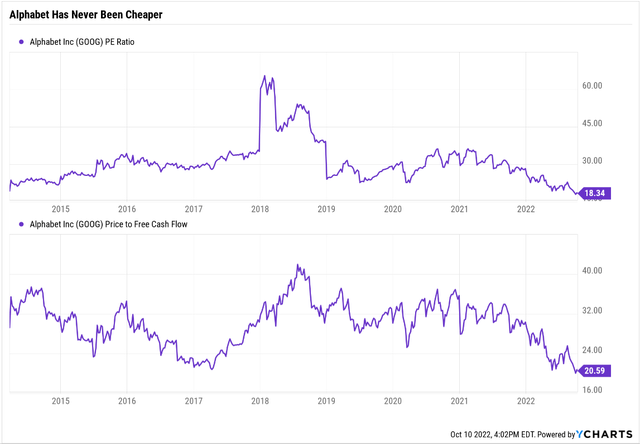

In response to an impending slowdown, businesses will cut back on ad dollars, which will hurt the likes of Alphabet. Despite the ad giant adopting several cost-cutting measures to boost profitability, the stock is sliding lower as trading multiples contract to all-time lows. While rising interest rates do necessitate this valuation adjustment, the next leg is likely to be driven by fundamental reasons.

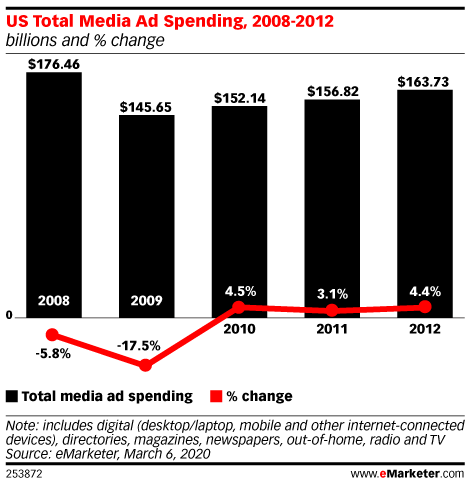

During the Great Financial Crisis of 2007-09, the advertising market shrunk by ~25%; however, low penetration levels allowed digital advertising companies to grow through this period. This time around, digital advertising makes up the majority (~60-65%) of the total advertising pie. Hence, a contraction in ad spending is set to inflict pain on digital advertising companies.

eMarketer

Alphabet is one of the strongest companies on this planet, and its monopolistic dominance in ‘Search’ is undeniable. While Alphabet will continue to rake in billions of dollars in revenue (and free cash flow) over coming years, a 15-20% contraction in advertising dollars will lead to much weaker operating results from Alphabet, which is not immune from the poor macroeconomic environment and the broad digital advertising markets.

Weakness Is Temporary, Moat Is Permanent

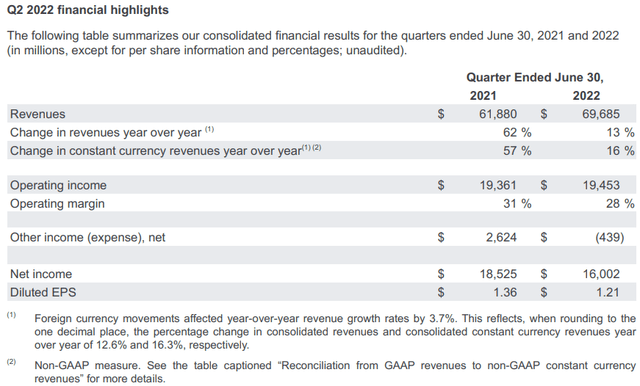

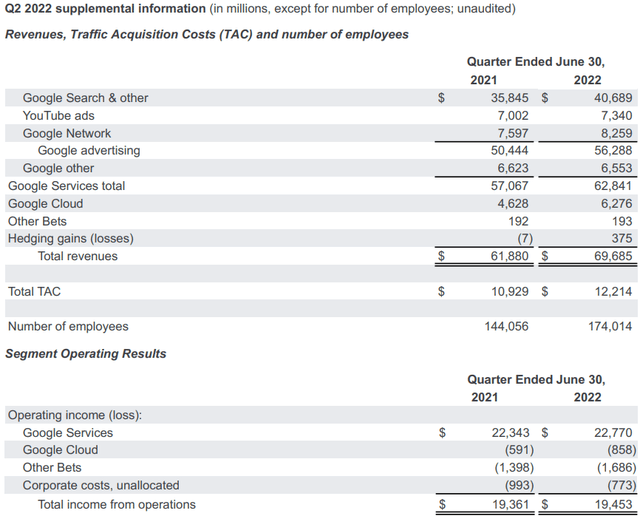

History tells us that businesses (large, medium, and small) are very likely to cut back on advertising spending during recessionary periods, and Alphabet’s Q2 results showed early signs of a drastic slowdown in digital advertising. In addition to a drastic slowdown in revenue growth rates, Alphabet is also experiencing a moderation in operating margins. In recessionary periods, advertising rates tend to go down, and Alphabet’s margin profile may worsen in the coming quarters.

Alphabet Q2 Earnings Release Alphabet Q2 Earnings Release

As the digital advertising giant grapples with a tough macro environment, Alphabet’s management team has implemented several cost-cutting measures, with the latest one being the shutdown of Stadia – a consumer gaming service. In recent weeks, Alphabet’s CEO, Sundar Pichai, has been sounding the alarm about the economy and increasing competition (from TikTok). Looking at Alphabet’s cost-cutting measures, I think he is dead serious about pushing for a 20% improvement in operating efficiency to ride through this downturn. We are still only in “Hiring Freeze” mode, but I wouldn’t be surprised to see some layoffs in 2023. Alphabet experienced hypergrowth during the pandemic (and right after the pandemic) and went on a hiring spree. However, the music has stopped, and Alphabet may need to lean down (like Meta Platforms, where restructuring is rumored to be in the offing).

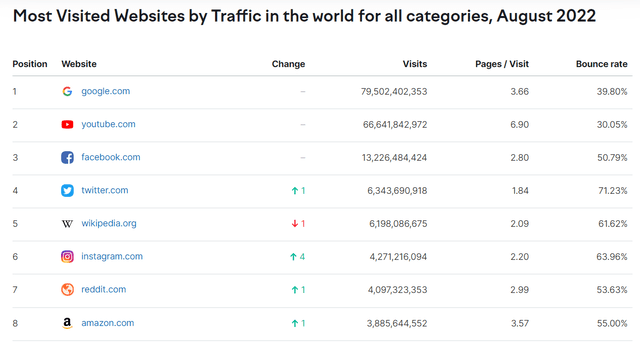

Pain is coming, and Alphabet is not immune to the changing macroeconomic environment. However, on the other side of this recession, Alphabet will continue to dominate the digital advertising market due to its incredible business moats. As of August 2022, Alphabet’s Search and YouTube assets are the most visited websites in the world, and these eyeballs are going nowhere. They were here before the recession, they will be here during a recession, and they will be here after the recession.

Alphabet’s core business is advertising; however, it also happens to be a cloud hyperscaler, productivity software provider, and much more. While it is tough to quantify the monetization potential of immensely valuable offerings like Google Maps, I strongly believe that Alphabet could quite easily spin up an additional multi-billion dollar revenue stream via Maps, and the addition of immersive views is probably a step in this direction. My point here is that Alphabet has tons of future growth left in the tank.

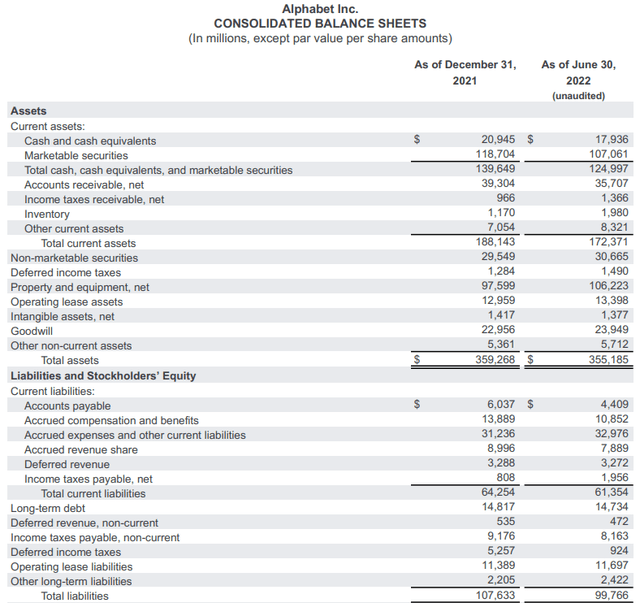

Nobody knows how deep the economic recession will be or how long it will last, but Alphabet’s cash cushion of ~$125B (against long-term debt of just ~$15B) is very reassuring. In my view, Alphabet is well-capitalized to get through this crisis and strengthen its market positioning during this tumultuous period [with smart acquisitions like Mandiant].

We have already seen that Alphabet has never been cheaper based on trading multiples; however, let us now examine its absolute valuation.

Alphabet’s Fair Value And Projected Returns

An economic recession is on the horizon, and we could very well see further multiple contraction in Alphabet. Honestly, I do not know where the bottom is, and I refuse to play the guessing game. The eventual bottom will depend on how deep the recession turns out to be, and we will only see it in hindsight.

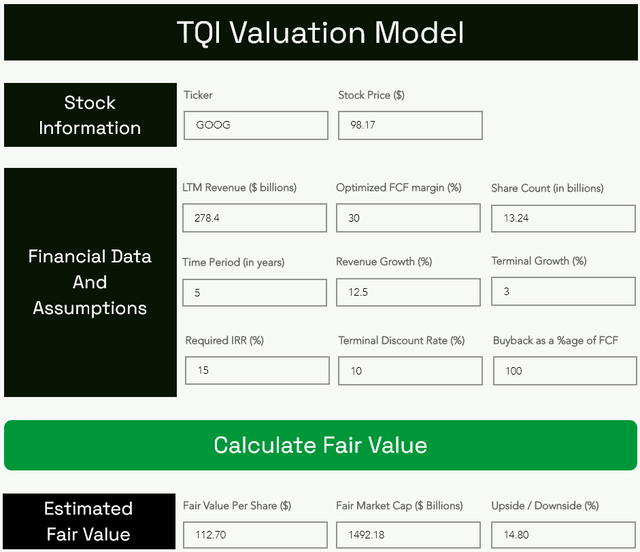

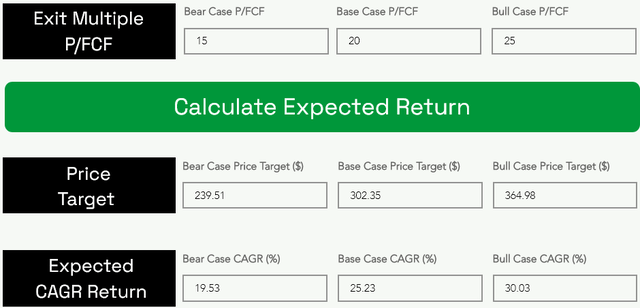

To determine the fair value and expected return of Alphabet, we will use TQI’s Valuation model with the following assumptions:

As you can see, Alphabet is worth $112.7 per share ($1.5T in market cap), i.e., it is currently undervalued by ~15%. But what about expected returns?

Considering Alphabet’s revenue growth (10-15% per year) and margin profile (operating margin 30-35%, FCF margin 25-30%), an exit P/FCF multiple of ~20x (inverse of long-term average interest rates of 5%) is very reasonable.

Assuming a P/FCF multiple of ~20x in 2027, Alphabet is projected to generate a CAGR return of 25.2%, which is far greater than my investment hurdle rate of 15% (and S&P500’s long-term CAGR of ~12%). Hence, Alphabet is a strong buy at the current level for long-term investors.

The Buying Opportunity Could Get Even Better

After a corrective move in 2022, Alphabet’s stock is sitting ~35% off its all-time highs and recently made a new 52-week low. Here’s an excerpt from my previous research note on the company:

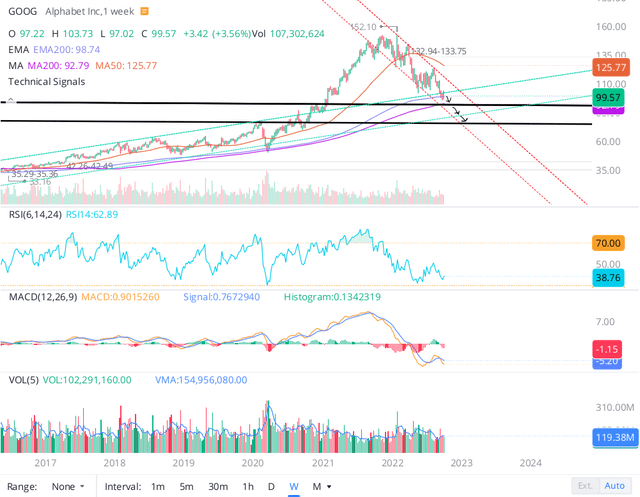

Recently, Alphabet has been forming a base in the $105-115 zone. After the Q2 report, Alphabet’s stock is bouncing ~5%; however, the stock remains firmly entrenched in its downward wedge pattern. At current levels, Alphabet is trading in a no-trade zone. If the stock can rally past the $120-$135 resistance zone, it could hit new highs over the coming months. On the contrary, if it fails to break past $115-120 in the near-term, Alphabet could easily test a long-term support trendline and 200DMA at ~$90-95 (and a break of this support could send the stock to a pre-COVID high of $75 (unlikely, but possible)).

Source: Google Q2 Earnings Miss: Why Mr. Market’s Glass-Half-Full Approach Makes Sense

The recent breakdown of June lows is a cause for concern, and the $90-95 support zone for Alphabet’s stock is very likely to be tested in the coming weeks. As we have discussed in the past, a failure to hold there would take us down to pre-pandemic levels [$70-75].

While Alphabet is getting close to oversold on the 14-day RSI heading into Q3 results on 25th October 2022, a weak quarterly report or guidance could trigger another leg lower in this counter. Hence, I think the buying opportunity may get better in the upcoming weeks.

Risks

- Alphabet’s monopolistic dominance in the advertising market is constantly under the regulatory microscope. As you may know, Alphabet is no stranger to multi-billion dollar fines, and privacy concerns remain persistent.

- The regulatory risk of an enforced breakup of its advertising ecosystem is always lingering and enough to keep its trading multiples depressed for long periods of time.

- Alphabet is heavily reliant on its core advertising business, and despite investing billions of dollars, none of its various ventures (cloud, gaming, and “Other Bets”) have become profitable to date.

- Alphabet is a global conglomerate, and currency fluctuations are hurting its finances. While higher interest rates in the US will make up for some of these losses, Alphabet’s results may remain under pressure due to an emerging de-globalization trend.

Final Thoughts

Alphabet is an absolute juggernaut in the digital advertising space; however, it is not immune from the macroeconomic environment. As the advertising market contracts, Alphabet’s financial performance will deteriorate too. Hence, Alphabet is entering a tumultuous period. To its credit, Alphabet is flush with cash, and eyeballs continue to crowd its core digital assets – Search and YouTube. And Google Cloud continues to grow rapidly. A recession will come and go, Alphabet is not going anywhere.

While Alphabet’s stock may see some more pain in the near term, the stock has never been cheaper in its entire trading history. From current levels, Alphabet has a downside risk of ~25-30% in the near to medium term and an upside of ~200% for the next five years. Therefore, Alphabet is an asymmetric contrarian bet for bold, long-term investors. Due to considerable near-term downside risk, I will be using a DCA plan to spread my purchases over the next 3-6 months.

If you are worried about a deep recession [another 30-50% drop in Alphabet], using an options-based hedging strategy could be a fine idea. At TQI, we implement such strategies to manage our risk proactively. For Alphabet, I like this strat: Buy 100 shares at $98, Buy 1 Jun-23 $100 Put at $11, Sell 1 Jun-23 $70 Put at $2.5, and Sell 1 Jun-23 $115 Call at $6.5. The combined position will require an outlay of $10K, the downside will be limited to $70 per share (downside protection against a ~30% drop in stock price), and the upside will be limited to +15% (nice return for an 8-month investment).

Key Takeaway: I rate Alphabet a ‘Strong Buy’ at $98

As always, thank you for reading, and happy investing. Please feel free to share any questions, concerns, or thoughts in the comments section below.

Be the first to comment