Sonja Filitz

After a couple tough years, Pilgrim’s Pride (NASDAQ:PPC) has been posting impressive quarterly results in 2022. The continued decrease in their share price has led to a reasonably significant undervaluation of the firm.

However, multiple market disruptions combined with historically mediocre business fundamentals cast doubts over the long-term viability of the company. Therefore, an in-depth examination of the viability of Pilgrim’s Pride is necessary to determine whether or not sufficient shareholder value exists to warrant creating a position on the stock.

Company Background

Pilgrim’s Pride Corporation is the second largest poultry producer in the US and UK. Approximately 70% of their product sales consist of fresh meats such as chicken, pork and turkey. Pilgrim’s has the capacity to process approximately 36 million birds per week during normal, uninterrupted operations. This translates to almost 4.3 billion kilograms of live chicken annually.

Primarily, Pilgrim’s aims to market their fresh poultry and meat products through contracts with chain restaurants such as Chick-fil-A and McDonald’s, as well as through wholesale agreements with the likes of Kroger and Costco in the US.

Recent acquisitions of Kerry Consumer Foods (now renamed to “Pilgrim’s Food Masters” and Tulip Limited (a pork producer based in Warwick, UK) have grown the size and international reach of the company culminating in total revenues eclipsing $14.7B in 2021.

Recent economic headwinds in the form of rising feed prices and a lack of economic moat leading to poor control over prices and margins on their products have placed the company in a difficult situation and led to the large drop experienced in share price. This has led the stock into the realm of consideration for investors looking for a good company at a good price.

Economic Moat – In Depth Analysis

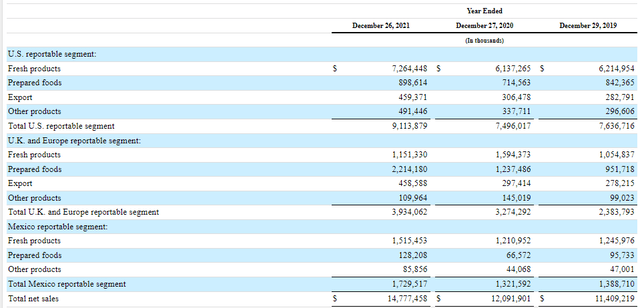

In the US and Mexico, 79.7% and 87.6% respectively of their sales consisted of fresh products such as main cuts of chicken or pork along with whole chickens and turkey. In the UK and Europe (particularly the Republic of Ireland), fresh product sales only accounted for 29.3% in 2021, due to the significantly different market exposure Pilgrim’s has in this region.

Nonetheless, this means approximately 70% of their entire revenue stream comes from homogenous, commodity-style meat products.

The issue with primarily selling unprocessed cuts of meat and poultry is that it is almost impossible to differentiate their product offerings from their competitors.

Pilgrim’s does have a good spread of product offerings within the unprocessed segment, such as offering organic cuts under their “Just Bare” branding or premium poultry using the “Gold’n Plump” moniker. However, the problem is that the primary driver which affects consumers in the selection of which product to buy is price. Therefore, it is fair to assume that if Pilgrim’s were to start charging a premium for their unprocessed meats and poultry (in comparison to their competitors in each respective segment of the market), volumes would drop significantly.

However, it must be acknowledged that the 2021 acquisition of Kerry Consumer Foods allowed Pilgrim’s to expand significantly into the European and UK marketplace with the majority of their product portfolio (56%) consisting of value-added and prepared meats and poultry products.

The extent to which Pilgrims can establish their brands in the European prepared foods marketplace thanks to the Kerry Consumer Foods acquisition will significantly impact the growth of revenues and profits going forwards. From 2019-2021, Pilgrim’s was able to increase their revenues in the prepared foods marketplace in Europe by 131% (from $951M to $2.2B).

Whether or not such a growth rate is sustainable is difficult to say, however, it is clear that according to European consumer tastes, pre-prepared proteins is a rapidly growing market.

Unfortunately, the relatively small proportion of net sales derived from the UK and Europe (only 20.2% of their total) means Pilgrim’s net global sales still relies too heavily on unprocessed fresh produce sales for my liking.

While the Kerry Foods acquisition did provide Pilgrim’s with many famous UK prepared meal brands such as “Fridge Raiders” and “Denny”, their generally undifferentiated product offerings make it difficult to assign any real value to the intangible assets the company holds.

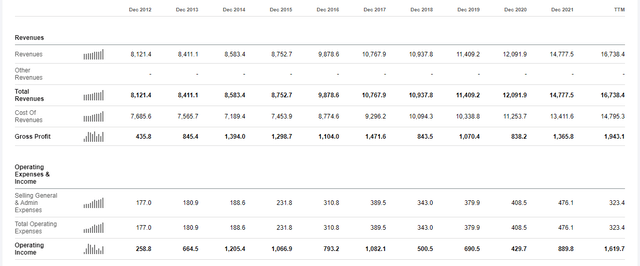

The other issue that faces Pilgrim’s pride is that in my opinion, the company has failed to demonstrate any real form of production cost advantage against their competitors. Their 5-year operating margin is just 5.03% while their gross profit margin for the same average period is 9.49%.

In comparison, one of Pilgrim’s closest public competitors Industrias Bachoco, S.A.B. de C.V. (IBA) holds a 5-year average operating margin of 7.26% and gross margin of 16.73%. While this difference of only 2.23% in operating margins seems small, Industrias Bachoco only had total revenues in 2021 of $3.9B, while Pilgrim’s achieved over $14.7B.

Naturally, one would expect Pilgrim’s to be able to achieve much greater economies of scale and thus increase their operating margins particularly in comparison to a firm less than 1/3 their size. Furthermore, because of the 2021 spike in market prices for corn and soybeans (the two primary feeds used by Pilgrim’s accounting for 52.9% and 41.0% of feed costs respectively), operating margins fell in 2021 to just 1.47%.

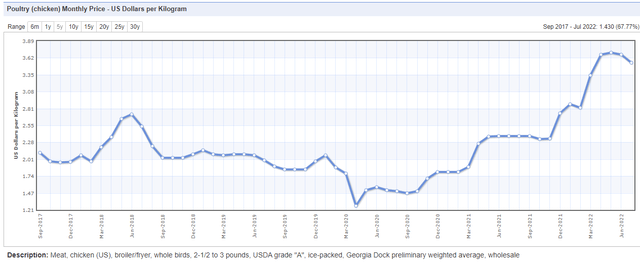

Trading Economics |

Trading Economics |

In my opinion, this highlights the relative inefficiency with which Pilgrim’s operates its businesses. Furthermore, the acquisition in 2017 of the loss-making UK pork producer Tulip from Danish Crown seems to have brought down the efficiency of Pilgrim’s operations, with the average operating margins between 2013-2017 being 10.6%. A whole 5.03% above their most recent values.

Regarding the purchase of Tulip, the management team has historically illustrated that they possess the skills required to turn around companies which were struggling before being purchased by Pilgrim’s. Considering the return to profitability experienced by Moy Park after being acquired by Pilgrim’s in 2017, the possibility of Tulip being returned to financial form by Pilgrim’s is an entirely plausible scenario, and one which could unlock significant value to shareholders in the future.

Nonetheless, the relatively weak intangible assets held by Pilgrim’s and their inability to create an effective cost advantage (which should be visible through elevated operating or gross profit margins) demonstrates that Pilgrim’s Pride has failed to establish any form of tangible economic moat for their operations. This leaves their profitability and value generation potential vulnerable to the cyclical market in which they operate.

Double Trouble Competition

In August 2022, the Department of Justice (DOJ) ruled in favor of Cargill and Continental Grain’s $4.5B acquisition of what was America’s third largest poultry producer Sanderson Farms. Continental Grain already owned Wayne Farms, America’s sixth largest chicken processor. The move created a private company roughly equal in size to Pilgrim’s Pride in processing capacity. However, a key difference is that with the help of Cargill, the new conglomerate is incredibly vertically integrated all the way from producing feed to creating finished, value-added goods.

This creates a situation where significant manipulation can occur within the market on feed costs which would impact other producers such as Pilgrim’s Pride or Tyson Foods, Inc. (TSN)

Such consolidation of firms within the chicken industry is expected by Joe Maxwell (president of the Farm Action advocacy group who were consulted by the DOJ regarding the merger) to further increase the costs of poultry farming. In his view, such control over the entire process by one company allows for “corruption, collusion and price-gouging”.

It will be crucial to monitor the prices of corn and soy-based feeds in the US over the coming years to see how this merger will impact other producers like Pilgrim’s Pride.

Financial Situation

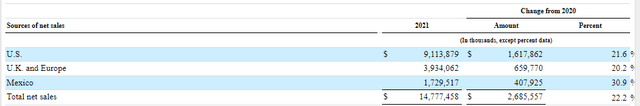

While Pilgrim’s pride may not have the economic moat one may desire, it is undeniable that financially they are in a relatively strong position. Operating revenues have increased 22% from 2020 to just over $14.7B in 2021.

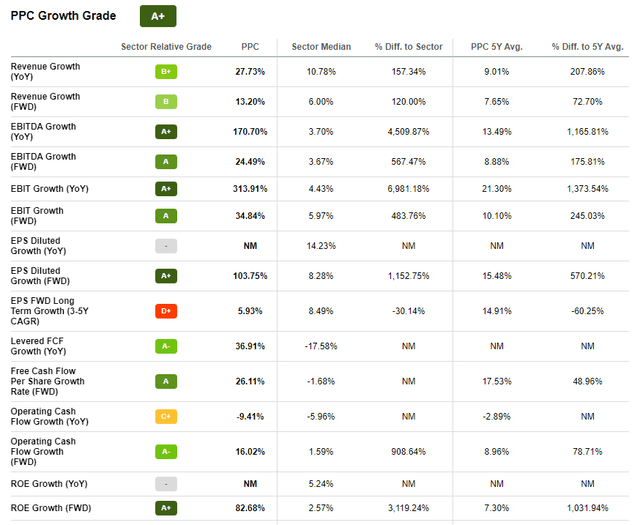

While this increase can largely be attributed to the rapid inflationary environment, it must also be noted that chicken prices have increased dramatically since 2020 which have fueled revenues and profits. When combined with an EBIT growth YOY of 313.91%, it is no surprise that Seeking Alpha’s Growth metrics have assigned Pilgrim’s with an A+ rating. I agree with this rating in the company’s current state.

It must be said that I do not expect these astronomical growth rates to continue into the future. Seeking Alpha’s growth metrics suggest a FWD Revenue Growth of 13.39% which I believe to be reliable guideline for the coming 2023 fiscal year.

Historically, they have seen YOY average growth rates of approximately 2-3%, and I fully expect that after the inflationary environment we are in calms down, and supply for chickens matches demand, 2024 growth rates will return approximately to these historical norms.

Profitability wise Pilgrim’s has historically been relatively unimpressive. In 2021, after netting their highest gross profits ever of $1.36B, skyrocketing COGS (a 94% increase from 2020) of $1.15B leave the company with an unimpressive operating income of $211m in 2021. However, the past twelve months have shown a remarkable change in momentum for the company. Operating incomes for the TTM have jumped to $1.6B.

Furthermore, their Selling General & Admin Expenses for the same TTM have decreased by $153m (compared to 2020) totaling only $323m. This suggests that Pilgrim’s has taken full advantage of the aforementioned rise in chicken prices while managing to keep feed costs low. Considering Pilgrim’s operates on a days payables schedule of around 28 days, the TTM values should be relatively reliable as no huge expenditures are being omitted.

The huge EBIT growth combined with much better managed operations allowed Pilgrim’s to smash FY2022 Q2 EPS estimates of around $1.14 by $0.38 posting Non-GAAP EPS of $1.58. Equally impressive has been their TTM ROIC which has been a fantastic 17.2%.

Nonetheless, these truly outstanding financial achievements must be considered with a cautious outlook on future potential, especially given that the main driver for this growth (poultry commodity prices) have begun to see a gentle roll-off.

Valuation

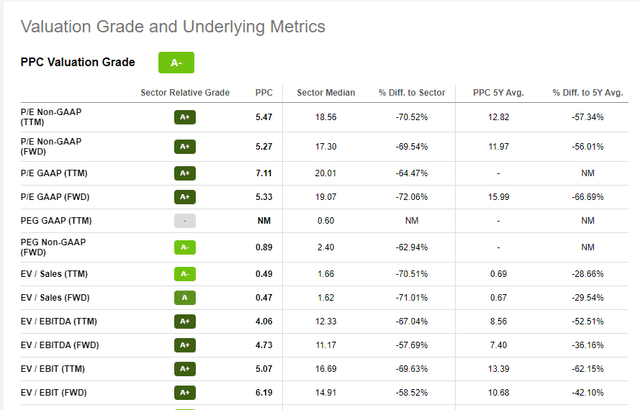

Seeking Alpha’s quant system has assigned an A- Valuation rating for Pilgrim’s Pride, which I am largely inclined to agree with. Their FWD P/E Non-GAAP of 5.23 is outstandingly low, especially considering a sector median of 17.30 and a 5Y average of 11.97. This is supported by a FWD EV/EBITDA of just 4.76 compared to a historical 5Y average of 7.4 and a sector median of 11.2.

I believe these metrics illustrate that Pilgrim’s is trading at prices below its current intrinsic market value.

In the short term (6-9 months) I do believe the stock price should experience a resurgence to better match the monster year Pilgrim’s has had in 2022. However, in the long-term (2-4 years) their lack of economic moat and pricing power casts doubts in my mind over their ability to generate meaningful profits without succumbing to the cyclical nature of the consumer staples market.

If we look stock price chart for the past five years, it’s clear that their share prices generally follow the consumption patterns (and thus market demand) of poultry. Most chicken is consumed from the early spring until the later summer, with demand and sales dropping-off in the wintertime.

Therefore, I believe if one was to buy shares, it would be better to wait another month or two to see a tangible increase in prices rather than jumping in prematurely and trying to catch the falling knife.

Summary

Pilgrim’s Pride has had an underwhelming couple of years leading-up to 2022. However, solid business fundamentals and surging poultry prices have allowed the company to have an incredibly profitable and growth oriented 2022. In my opinion, share prices are yet to reflect the value generated by the firm.

In the long-term, I still have doubts over how effectively they can ensure shareholder returns and profitability given their nonexistent economic moat. However, as a short-term investment, I believe Pilgrim’s Pride may be a good pick indeed, especially if the share price drops another 2-4 dollars.

For the time being, I will be observing the firm and waiting for the Q3 results to roll in on October 27 (expected).

Be the first to comment