AleksandarGeorgiev

Introduction

Herbalife (NYSE:HLF) posted strong financial and operating results for Q2 2022, but shares continue to decline -53% YTD. Despite the decrease in revenue as a result of a weakening consumer, the company showed a trend towards improving growth rates and maintaining business profitability, which, in my personal opinion, is a positive signal. I believe that now investors continue to have doubts about the company’s prospects and the possibility of achieving the announced guidance, however, if the financial statements in the next periods turn out to be at the level of expectations, this should lead to a revaluation of the share price.

Survey of Q2 results

On August 2, 2022, the company released its financial results for the 2nd quarter of 2022. The results were strong, better than expected in terms of revenue and EPS, in line with the company’s guidance. I would like to emphasize that, according to the statements of management, the company plans to show revenue growth in the 4th quarter. Also, on the positive side, the company is able to increase the price of products for the end consumer due to the increase in prices for input costs and freight.

According to the Q2 earning report, “the Company took incremental pricing actions in most markets in late Q2“

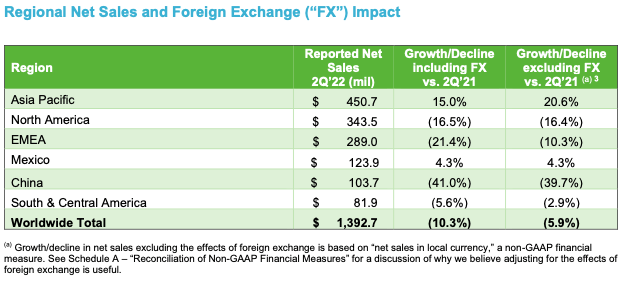

The company’s revenue decreased by 10.3% YoY, but the company expects a recovery in the 4th quarter of 2022. We see the largest drop in China, where revenue fell by 39.7% due to covid lockdown. I believe that against the backdrop of the easing of covid restrictions in China, we will see a recovery in revenue in the next periods in my personal opinion.

Company’s official site

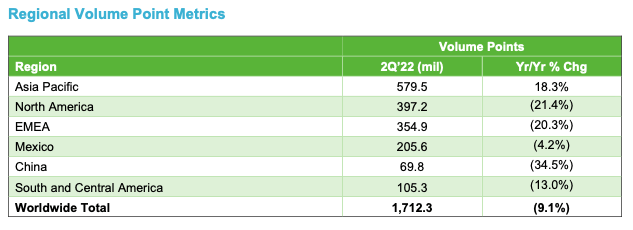

Volumes declined 9.1% YoY as the company increased prices for its core products. It is important to understand that we will see the main effect of price growth in Q3 and Q4 2022, which should support the pace of revenue growth and increase in profitability.

Company’s official site

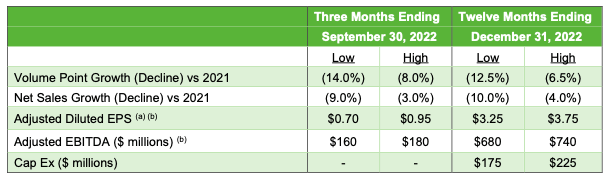

In addition, the company’s management confirmed guidance for 2022, which, in my personal opinion, is a positive signal for investors. In my personal opinion, consumers of the company’s products are less sensitive to prices than in other sectors of the economy, so the company is able to both maintain revenue growth rates in future periods (Q4 22E and 2023-26E) and the level of profitability of the core business. In addition, the company will continue to show positive net income in line with the published guidance.

Company’s presentations

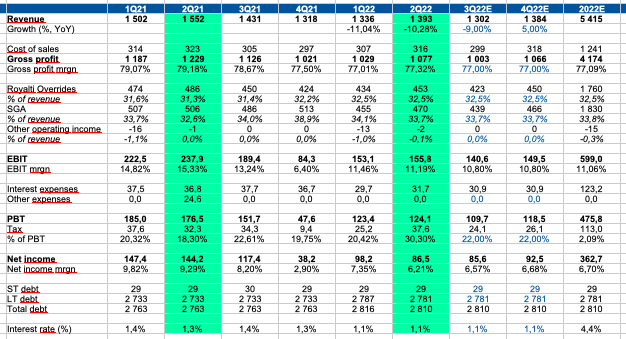

Quarterly projections:

Personal calculations

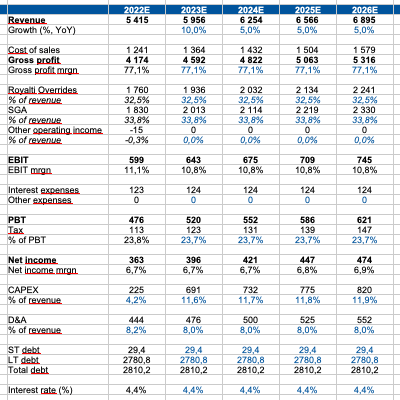

Yearly projections:

Personal calculations

Valuation

I believe that I can use the DCF model to value a company because:

1) Based on historical data and statements from management, I can make assumptions about future cash flows

2) The business model of the company allows you to make assumptions about future costs and profitability

Main assumptions:

WACC: 9.3%

TGR: 3%

Gross profit margin: I assume a stable gross margin based on historical data and management statements, as the company is able to increase the price of its products in line with inflation.

Revenue growth: in line with current trends and company guidance, I am looking at low sing digit growth in the next periods and high single digit growth in 2023 based on the low base effect in 2022.

SGA (% of revenue): the company has demonstrated that it is able to effectively control costs and maintain a stable level of profitability, so I am laying flat dynamics for the following periods in accordance with historical data.

CAPEX: In 2022, I assume CAPEX in accordance with the guidance of the company, then I assume the historical % of revenue.

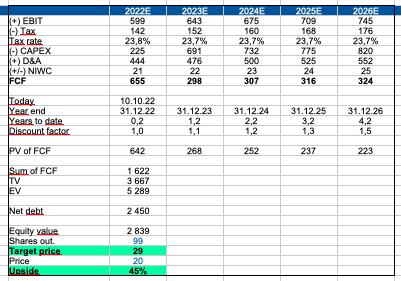

DCF model:

Personal calculations

Thus, according to my DCF model, the fair price of the share is $29, upside potential 45%.

Drivers

Macro: macro normalization, lower inflation and a recovery in real incomes could support the weakening consumer, which should support revenue and margin growth.

Moreover, based on current revenue growth trends and management announcements, I predict that the company will be able to post positive revenue growth in Q4.

First, we see that the pace of revenue decline continues to slow down, -11% in Q1 and -10% in Q2. Also, in the 4th quarter we will see a lower base of last year.

COVID: The easing of COVID restrictions in China will support revenue in the coming quarters. In addition, in my personal opinion, the effect of pent-up demand in Q2 2022 should provide additional support.

In accordance with the company’s financial statements, we see that revenue in China in Q2 decreased by 40% (7.5% of total revenue) as a result of the introduction of COVID restrictions. I believe that a recovery in demand in China could support the pace of revenue recovery.

Cost control: efficient work of management on cost management and price growth will help to maintain profitability at historical levels.

Risks

Macro: rising interest rates and inflation could put pressure on the consumer, which is negative for revenue growth, as it may be difficult for the company to continue to pass on high inflation to the end consumer.

Margin: rising input cost and freight costs may put pressure on margins in the coming periods.

COVID: new COVID restrictions in China may have a negative impact on revenue in China

Conclusion

The company posted strong results for Q2 2022. Despite high inflation, rising interest rates and declining real incomes, in my personal opinion, the company is able to increase the price of its products and maintain profitability. I believe that the company is trading below fair value, upside potential 45%. In my opinion, the market is not fully appreciating the company’s positive guidance for 2022 right now. At the moment, I believe that it is worth waiting for the financial and operational reports for the 3rd quarter of 2022. If the company is able to report at the level of market expectations, in my personal opinion, this will lead to a reassessment of the company’s prospects by investors and provide us with an attractive entry point for opening a position.

Be the first to comment