AlexLMX

Welcome to the Vanadium miners news.

October saw generally flat vanadium prices and some suggestions that VRFBs are “starting to take-off,” especially in China.

Vanadium uses

Vanadium is traditionally used to harden steel. Chinese rebar standards are requiring more vanadium. Also Vanadium Flow Batteries [VRFBs] are becoming increasingly popular especially for commercial energy storage, most notably in China. Vanadium Pentoxide [V2O5] is used in VRFBs and Ferrovanadium [FeV] is used in the steel industry.

Vanadium spot price history

Europe Vanadium Pentoxide [V2O5] Flake 98% 1 year chart – Price = USD 7.30/lb (China price not given)

Vanadiumprice.com![Europe Vanadium Pentoxide [V2O5] Flake 98% 1 year chart](https://static.seekingalpha.com/uploads/2022/10/26/37628986-16668370111612904.png)

China and Europe Ferrovanadium [FeV] 80% prices – China = USD 37.00/kg, Europe = USD 30.75/kg

Vanadium demand versus supply

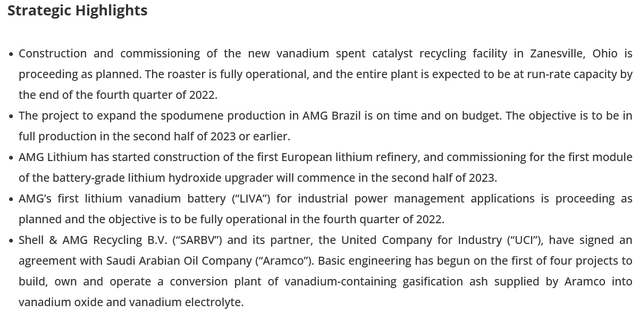

An April 2021 Wood Mackenzie report stated (emphasis added):

Global energy storage deployment surged a remarkable 62% in 2020, with 5 GW/9 GWh of new capacity added. This brought the total energy storage market to more than 27 GWh. Furthermore, we expect the global (energy storage) market to grow 27-fold by 2030.

Woodmac forecasts high growth ahead for solar, wind and energy storage

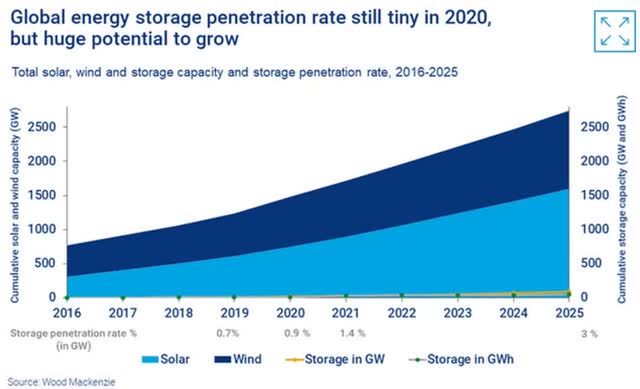

Global VRFB forecast growth by region 2022-2031

In 2017 Robert Friedland stated: “We think there’s a revolution coming in vanadium redox flow batteries….”

Vanadium market news

On October 3 Stockhead reported:

Three reasons why vanadium redox flow battery technology has NOT hit the mainstream…yet. Vanadium redox flow batteries have shown plenty of promise over the past few years and delivered very little, however, big developments in China plus a perceived shortage of battery metals may be the spark this battery technology needs to lift off……Vanadium is an expensive metal and significantly drives up the cost of a VRFB system compared with other battery types. If the uptake of VRFBs increases dramatically, so does the price of vanadium pentoxide (V205) – the material used in the electrolyte solutions…….As it stands, China is leading the charge in the vanadium redox flow battery space where a hot bed of activity is taking place…….Shanghai Electric Energy Storage Technology Co revealed up to now, the company had 3GWh of orders for vanadium batteries……there is no doubt we are seeing a substantial increase in real projects utilizing vanadium in 2022 along with many new entrants. “There is also competition emerging from iron flow batteries and we are watching how that plays out carefully

Note: From a LinkedIn quote in the above article: “VRFB’s starting to take-off as predicted. 3GWh of vanadium battery orders is huge.“

On October 14 InvestorIntel reported:

Critical mineral Vanadium finds new interest in grid energy storage battery applications…..Global production in 2020, according to Statista, was about 105,000 tonnes. China accounted for 70,000 tonnes or two-thirds of global production. Russia was next at just over 19,500 tonnes, followed by South Africa at 8,584, and Brazil at 7,582……A few years ago China passed requirements for rebar to use vanadium but the advent of COVID and the current malaise of the Chinese construction/real estate business has not seen the potential increase in demand that the industry widely expected…….Recently there has been renewed interest in the large potential capacity of the vanadium redox battery, also known as the vanadium flow battery (VFB), for grid energy storage.

On October 22 PV Magazine Australia reported:

European vanadium flow battery company to specialize product for Australian microgrid market. Australian outfit BESS Research is teaming up with CellCube, owned by Austria’s Enerox, to target Australian commercial and industrial projects for the potential use of vanadium redox flow batteries.

Vanadium miner news

Vanadium producers

Glencore [LSX:GLEN] [HK:805] (OTC:OTCPK:GLCNF)

Glencore is a large vanadium producer, but vanadium production represents only a small portion of their revenue.

No vanadium related news for the month.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

AMG Vanadium is a leading provider of products and services for the metals, manufacturing, refinery and petrochemical industries. AMG Vanadium produces ferrovanadium and related ferroalloys from spent refinery catalysts using a proprietary pyrometallurgical process.

No news for the month.

You can view the latest investor presentation here and a recent Trend investing article here.

AMG Q2, 2022 results announcement

Bushveld Minerals Limited [LN- AIM:BMN] (OTC:BSHVF)

Bushveld is a diversified AIM-listed resources company with a portfolio of vanadium, tin and coal assets in Southern Africa and Madagascar.

On October 10, Bushveld Minerals announced: “Mustang announcement: VRFB-H investment update.”

On October 25, Bushveld Minerals announced: “Q3 2022 and 9M 2022 Operational Update.” Highlights include:

Group highlights

- “Production of 2,657 mtV for 9M 2022 (9M 2021: 2,629 mtV).

- Production of 1,016 mtV for Q3 2022 (Q2 2022: 668 mtV) supported by Kiln 3 improved performance.

- Weighted average production cash cost (C1)[1] of US$28.9/kgV for 9M 2022 (9M 2021: US$25.80/kgV).

- Weighted average production cash cost (C1) of US$29.3/kgV for Q3 2022 (Q2 2022: US$31.0/kgV.).”

2022 Group guidance

- “Production guidance of 3,900 mtV – 4,100 mtV maintained.

- (C1) Production cash cost guidance at each asset is maintained.

- On track to achieve an annualized steady state production run rate of 5,000 mtVp.a. – 5,400 mtVp.a. by the end of 2022.”

You can view the latest investor presentation here.

Largo Inc. [TSX:LGO] [GR:LR81] (LGORF)(NASDAQ:LGO)

Largo Inc. is a pure-play vanadium pentoxide producer from their Maracás Menchen mine in Brazil as well as a producer of VRFBs.

On October 17, Largo Inc. announced: “Largo announces third quarter 2022 production and sales results highlighted by record high purity vanadium production; completes battery stack manufacturing for its 6.1 MWh VCHARGE VRFB Deployment in Spain.” Highlights include:

- “V2O5 production of 2,906 tonnes (6.4 million lbs1) vs. 3,260 tonnes produced in Q3 2021; Lower quarterly production due to a planned kiln and cooler refractory refurbishment and a change of mining contractor, but was in line with the Company’s revised production guidance.

- Record high purity V2O5 equivalent production of 962 tonnes, representing 33% of the Company’s Q3 2022 production.

- V2O5 equivalent sales of 2,796 tonnes (inclusive of 351 tonnes of purchased material) vs. 2,685 tonnes sold in Q3 2021; Completed first high purity V2O3 sale in Europe in Q3 2022.

- ……High purity vanadium demand has increased following ongoing recovery from 2020 COVID-19 impacts, which was partially offset by a softening of steel demand in Q3 2022.

- The Company advanced construction of its ilmenite concentration plant, including receiving all required metallic flotation structures and building of desliming, flotation, filtration, warehouse and pipe rack structures; Expects commissioning completed in Q2 2023.

- Largo Clean Energy (“LCE”) progressed with the delivery of its Enel Green Power España (“EGPE”) VCHARGE vanadium redox flow battery (“VRFB”), including the manufacturing of all high-power battery stacks required for the system; The Company has begun shipping battery stacks and electrolyte to the deployment site in Mallorca, Spain.

- Largo Physical Vanadium Corp. (“LPV”) commenced trading on the TSX Venture Exchange on September 27, 2022 under the symbol “VAND” and launched a new website www.lpvanadium.com.

- Published inaugural Climate Report aligned with the Taskforce on Climate-Related Financial Disclosures (TCFD), providing additional transparency on the Company’s approach to climate change.”

You can view the latest investor presentation here.

Energy Fuels Inc. [TSX:EFR] (UUUU)

Energy Fuels state they are “the No. 1 uranium producer in the U.S. with a market-leading portfolio,” as well as being a small vanadium producer.

No news for the month.

Ferro-Alloy Resources [LON:FAR]

FAR is developing the giant Balasausqandiq vanadium deposit in Kyzylordinskaya Oblast of southern Kazakhstan. FAR state: “The ore at this site has a significantly higher grade than all other primary vanadium extraction sites, which allows for much lower processing costs.”

No significant news for the month.

Western Uranium & Vanadium Corp. (OTCQX:WSTRF)

Western Uranium & Vanadium Corp. own the Sunday Mine Complex which is an advanced stage mine property consisting of five interconnected underground mines in Colorado, USA.

No news for the month.

Investors can read the latest company presentation here.

Vanadium developers

Neometals [ASX:NMT] (OTCPK:RDRUY) (OTCPK:RRSSF)

Neometals 100% own the Barrambie Titanium Vanadium Iron Project in Western Australia. Barrambie’s Eastern Band is one of the highest grade hard rock titanium deposits globally.

On October 24, Neometals announced: “Vanadium recovery project environmental permit granted.” Highlights include:

- “The Vanadium Recovery Project in Pori, Finland has been granted an Environmental Permit by the Regional State Administrative Agency for Southern Finland.

- Permit authorises, subject to conditions, construction and operation of a vanadium recovery plant to produce supply constrained vanadium pentoxide in Europe.

- Nordic investment bank Aventum Partners appointed to lead debt process.

- Formal agreements being advanced with SSAB for additional feedstock and Betolar for key by-product offtake.”

You can view the latest investor presentation here.

Australian Vanadium [ASX:AVL] [GR:JT71] (OTCQB:ATVVF)

Australian Vanadium is an emerging vanadium producer focused on their Australian Vanadium Project in Western Australia. VSUN Energy was launched by AVL in 2016 to target the energy storage market for vanadium redox flow batteries [VRFBs].

On October 5, Australian Vanadium announced: “AVL commences trading on USA OTCQB Market.”

On October 17, Australian Vanadium announced:

Experienced Project Development and Operations Executive appointed as CEO. Experienced business leader, vanadium and lithium project development and operations executive Graham Arvidson appointed as Chief Executive Officer…

On October 24, Australian Vanadium announced: “Vanadium resource development drill program completed.” Highlights include:

- “7,283 metres of Reverse Circulation drilling completed at the Australian Vanadium Project during September and October 2022…

- Updated Mineral Resource Estimate scheduled for early 2023 which will be used in updated Mine Schedule targeting highest possible V2O5 recovery in concentrate early in the mine life.

- Recent work programs[1] identified: Vanadium concentrate grades of up to 1.51% V2O5, confirming near surface opportunities for improving vanadium concentrate grades and recoveries. Iron grades in fresh magnetic concentrate of up to 61.0% Fe identified in beneficiation of historical core samples in southern ore blocks, demonstrating potential to improve value of AVL’s FeTi coproduct grade.

- Verification of vanadium concentrate grades greater than 1.39% V2O5 used in AVL’s Bankable Feasibility Study[2] in the early years of production can contribute positively to project economics.”

Catalysts include:

- Early 2023 – Updated Mineral Resource Estimate due.

- 2023 – Possible further off-take and/or JV partner announcements.

You can view the latest investor presentation here, or read a Trend Investing CEO interview here.

Technology Metals Australia [ASX:TMT]

The Company’s primary exploration focus is on the 100% owned Gabanintha Vanadium Project located 40km south east of Meekatharra in the mid-west region of Western Australia. Technology Metals Australia is studying (“Integration Study”) to combine the high grade, high quality Yarrabubba deposit with the Gabanintha Vanadium Deposit to form the Murchison Technology Metals Project (MTMP).

On October 10, Technology Metals Australia announced: “MoU executed with India’s Tata Steel.” Highlights include:

- “Memorandum of Understanding ((MoU)) executed with Tata Steel Limited, one of the world’s largest steel manufacturing companies.

- The MoU establishes a framework for discussions regarding offtake of vanadium pentoxide and other downstream vanadium products.

- The parties will investigate downstream technical collaboration with scope for joint development of ferrovanadium production facilities in Western Australia and India.

- Discussions will also include potential investment by Tata Steel into Technology Metals Australia and / or the Murchison Technology Metals Project.”

On October 17, Technology Metals Australia announced: “Quarterly activities report for the three months ended 30 September 2022.” Highlights include:

- “Integration Study increases project life to 25 years; Yarrabubba to be mined towards start of project.

- Maiden Ilmenite Ore Reserve estimated for Yarrabubba.

- Targeting a Development Decision by the end of 2022.

- TMT committed to vanadium electrolyte research aimed at producing electrolyte in Australia.

- Implementation activities progressing to schedule.”

You can view the latest investor presentation here.

TNG Ltd [ASX:TNG] [GR:HJI] (OTCPK:TNGZF)

TNG is an Australian resources company focused on the evaluation and development of its Mount Peake Vanadium-Titanium-Iron project. The Mount Peake Project is located 235km north-northwest of Alice Springs in the Northern Territory of Australia. TNG Ltd is well advanced with a massive $4.7b NPV8%, but relies on titanium and iron with a lower grade vanadium by-product.

On September 30, TNG Ltd. announced: “TNG identifies potential lower-cost water source to support Mount Peake development…”

On October 20, TNG Ltd. announced:

Mount Peake Project – capital expenditure update…In September 2021, TNG made the strategic decision to move to a single, consolidated and integrated mining and processing operation for the Mount Peake Project, with all processing operations to be co-located at the Mount Peake Mine Site rather than being split across two separate sites (see ASX announcement of 30 September 2021)…… current indications are that capital expenditure (both for the Company’s own pre-production expenditure and for any equipment and plant provided by third parties under “Build-Own-Operate” arrangements) is likely to be significantly higher than estimated in 2019…

You can view the latest investor presentations here.

Vanadium Resources Limited [ASX:VR8] [GR:TR3]

Vanadium Resources is a junior exploration company established with the purpose of exploring and developing gold zinc, lead, copper and other mineral opportunities. Vanadium Resources owns 74% of a globally significant vanadium project, the Steelpoortdrift [SPD] Project, in Gauteng Province, South Africa.

On October 4, Vanadium Resources announced: “VR8 updates mineral resource and ore reserve for the Steelpoortdrift Vanadium Project.” Highlights include:

- “Vanadium Resources (“ASX:VR8”) has completed the updated Mineral Resource and Ore Reserve estimate for the Steelpoortdrift (“SPD”) Project following the completion of a Definitive Feasibility Study (“DFS”) that resulted in a re-interpretation of the geology, an enhanced block model, Life of Mine (“LoM”) plan and revised Mineral Resource and Ore Reserve statements.

- The Mineral Resources now amount to 680Mt (2.7% increase) averaging 0.70% vanadium pentoxide (“V2O5”) at a cut-off grade of 0.45% V2O5. The Measured Mineral Resources increased by 58% to 145Mt averaging 0.72% V2O5.

- The Ore Reserves total 76.86Mt at an average grade of 0.72% V2O5 with 30.23Mt of Proved Ore Reserves at an average grade of 0.70% V2O5 and 46.62Mt of Probable Ore Reserves at an average grade of 0.72% V2O5.

- Geological Model identified potential target areas for future infill drilling down dip from current Resource to further expand deposit.“

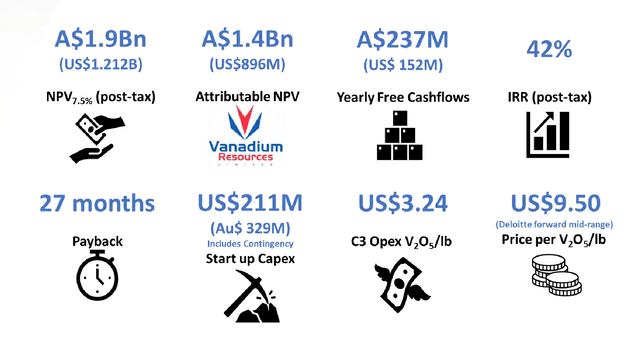

On October 4, Vanadium Resources announced: “DFS delivers a$1.9bn NPV confirming world class Steelpoortdrift Vanadium Project.”

DFS highlights

You can view the latest investor presentation here.

King River Resources [ASX:KRR] (formerly King River Copper)

King River holds 785 square kilometers of mineral leases covering a unique geological feature in the Eastern Kimberley of Western Australia, called the Speewah Dome. The company state on their website: “The focus of King River Copper Limited is the exploration for Gold, Silver and Copper.” However their deposits also contain vanadium.

On October 25, King River Resources announced:

Quarterly activities report 30 September 2022… King River holds 100% interest in the large Speewah Vanadium-Titanium-Iron deposit located in the Kimberley of Western Australia (Figure 3). Speewah is Australia’s largest vanadium-in-magnetite deposit based on tonnes and V2O5content (Figure 3).The deposit comprises a Measured, Indicated and Inferred Mineral Resource of 4,712 million tonnes at 0.3% V2O5, 3.3% TiO2and 14.7% Fe (reported at a 0.23% V2O5 cut-off grade….).…Testwork is ongoing trialling mixed salts, optimization of the salt dosage, and the precipitation of V2O5 product by the ammonium metavanadate (AMV) process…..“

You can view the latest investor presentation here.

VanadiumCorp Resource Inc. [TSXV:VRB][GR:NWN] (OTCPK:VRBFF)

VanadiumCorp Resources Inc. 100% owns the Lac Dore Vanadium-Iron-Titanium project in Quebec Canada. The Company also has royalties on the Raglan Nickel-PGM mine. The Company is looking to take a vertically integrated approach and is also developing leading process technologies ‘VanadiumCorp-Electrochem Processing Technology’ and “Electrochem globally patented Electrowinning” technology.

On October 4, VanadiumCorp Resources Inc. announced:

VanadiumCorp announces commencement of Lac Dore metallurgical bulk sampling…With the bulk samples, the Company plans to promptly execute a multifaceted testing program on its Lac Dore deposit. Large grinding and novel mineral separation tests will be performed in Q4 2022 and Q1 2023. An estimated 5 tonnes or more of high-quality concentrates from the bulk samples will feed new hydrometallurgical tests in January 2023…

You can view the latest investor presentation here.

Richmond Vanadium Technologies Pty Ltd (“RVT”) ASX IPO planned for late 2022 – Spin-off from Horizon Mining [ASX:HRZ]

RVT now owns 100% of the Richmond Vanadium Project. It has a global Mineral Resource of 1.8Bt @ 0.36% Vanadium Pentoxide (V2O5).

On October 24, Richmond Vanadium Technologies Pty Ltd announced: “Richmond Vanadium IPO to raise up to $35m now open.” Highlights include:

- “IPO to raise between $25 million and $35 million opened on 24 October 2022.

- Funds raised will primarily be used for the Bankable Feasibility Study at the Company’s wholly owned Richmond Vanadium Project in North Queensland.

- Richmond Vanadium Project contains a world-class clean green focused vanadium deposit which hosts a Mineral Resource of 1.8Bt @ 0.36% for 6.7Mt V2O5 and Ore Reserve of 459Mt @ 0.49% for 2.25Mt V2O5 (compliant with the JORC 2012 Code).

- Key attributes of Richmond Vanadium Project include: Large scalable project. Fully oxidized free-dig resource. Lower carbon footprint than other vanadium deposits due to easy mining and processing. Tested metallurgy with proven technology (completed process flowsheet). Stable mining jurisdiction with access to infrastructure. Co-ordinated project status awarded by Queensland Government. Vanadium listed by Australian and US Governments as a Critical Mineral. Aligned with Australian Vanadium Redox Flow Battery manufacturer.

- Subject to any variation to the proposed timetable, the priority offer to eligible Horizon Minerals (ASX: HRZ) Shareholders is expected to close on 7 November 2022 and the balance of the IPO is expected to close on 14 November 2022.”

Phenom Resources Corp. [TSXV:PHNM] (OTCQX:PHNMF) (formerly First Vanadium Corp.)

The Carlin Gold-Vanadium Property hosts one of North America’s largest richest primary vanadium deposits, located in Nevada. Its West Jerome project targets a large scale high grade copper and zinc deposit in Arizona. Carlin has a Historic Inferred Resource 28Mt at 0.525% V2O5 (2010 SRK).

No significant news for the month.

Investors can read the latest company presentation here.

Graphite miners with potential vanadium projects

- Syrah Resources [ASX:SYR] (OTC:OTCPK:SYAAF) (OTC:SRHYY)

- NextSource Materials [TSX:NEXT]

- DNI Metals [TSXV:DNI] [GR:DG7N](OTC:DMNKF)

Other listed vanadium juniors

- BlackRock Metals (Private)

- Gladiator Resources [ASX:GLA]

- Golden Deeps [ASX:GED]

- Intermin Resources [ASX:IRC]

- Maxtech Ventures [CSE:MVT]

- New Energy Minerals [ASX: NXE] (formerly Mustang Resources)

- Pursuit Minerals [ASX:PUR]

- QEM Limited [ASX:QEM]

- Sabre Resources [ASX:SBR]

- Strategic Resources [TSXV:SR] (OTCPK:SCCFF)

- Trigon Metals Inc. [TSXV:TM] (OTC:PNTZF)

- Voyager Metals Inc. [TSXV:VONE][GR:9VR1] (OTC:VDMRF) (formerly Vanadium One Iron Corp.)

- Venus Metals [ASX:VMC]

- Victory Metals [TSXV:VMX]

VRFB Companies

- Protean Energy [ASX:POW] [GR:SHE1]

- Enerox GmbH (90% Bushveld/10% Cellcube Energy Storage Systems)

- Invinity Energy Systems (LSE:IES) (IVVGF) (OTCQX:IESVF)

Conclusion

October saw slightly higher V2O5 prices and flat ferrovanadium prices.

Highlights for the month include:

- China is leading the charge in the vanadium redox flow battery space. Shanghai Electric Energy Storage Technology Co revealed up to now, the company had 3GWh of orders for vanadium batteries. VRFB’s starting to take-off as predicted. 3GWh of vanadium battery orders is huge.

- Critical mineral Vanadium finds new interest in grid energy storage battery applications.

- Bushveld Minerals maintains 2022 guidance (3,900 mtV – 4,100 mtV) and is on track to achieve an annualized steady state production run rate of 5,000 mtVp.a. – 5,400 mtVp.a. by the end of 2022.

- Largo Inc. V2O5 production of 2,906 tonnes was lower than the 3,260 tonnes produced in Q3 2021, due to refurbishments.

- Neometals Vanadium recovery project environmental permit granted.

- Australian Vanadium appoints a new CEO and is on track for an updated Mineral Resource estimate in early 2023.

- Technology Metals Australia MoU executed with India’s Tata Steel for discussions regarding offtake of vanadium pentoxide and other downstream vanadium products.

- Vanadium Resources DFS delivers a post-tax NPV7.5% of A$1.9bn, confirming world class Steelpoortdrift Vanadium Project.

- King River Resources V2O5 test work is ongoing trialing mixed salts.

- VanadiumCorp announces commencement of Lac Dore metallurgical bulk sampling.

- Richmond Vanadium IPO to raise up to $35m now open.

As usual all comments are welcome.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

![China and Europe Ferrovanadium [FeV] 80% prices](https://static.seekingalpha.com/uploads/2022/10/26/37628986-16668370985436604.png)

Be the first to comment