bizoo_n

Introduction

The American oil producer VAALCO Energy (NYSE:EGY) announced the approval of the Plan of Development for Discovery on Block P in Equatorial Guinea on September 26, 2022.

[T]he Government of Equatorial Guinea has approved the Venus – Block P Plan of Development (“POD”). VAALCO has an 80% participation interest in the project and is the operator. Upon the execution of final documents, VAALCO will proceed directly to project execution which targets first oil in 2026 and adds 23.1 million barrels of oil of 2P CPR gross reserves, and 18.5 MMBO of 2P CPR Working Interest (“WI”) reserves (16.2 MMBO net 2P reserves).

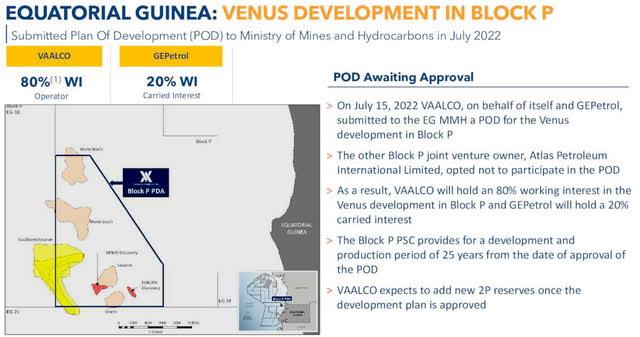

VAALCO has a 45.9% WI in Block P Offshore Equatorial Guinea after the Ministry of Mines and Hydrocarbons approved the new amendment to the PSC.

However, VAALCO will hold an 80% WI in the Venus development in Block P, and Guinea Ecuatorial de Petroleós GEPetrol has a 20% carried working interest; as the result of EGY’s joint venture owner, Atlas Petroleum International, opting not to participate in the POD.

The Block P PSC implies a development and production period of 25 years from the date of approval of the POD.

CEO, George Maxwell, said in the last conference call:

Once the development plan is approved, we will hold an 80% working interest as a result of our joint venture owner opting not to participate. We look forward to receiving the approval soon so that we can continue to move forward with our discovery at Block P, which is expected to add meaningful 2P reserves upon approval of the POD and provide another strong operational asset to the portfolio. As we work through the approval process, we’ll provide more details about potential timing, capital cost, reserves and production estimates. We are committed to profitably exploiting the resource potential of all our assets and are pleased with our progress at Equatorial Guinea.

1.1 – A bit of history

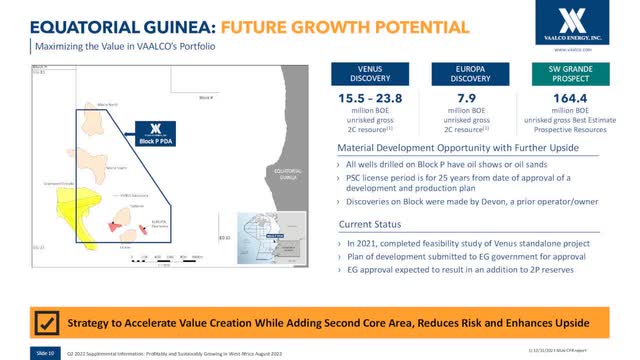

EGY Equatorial Guinea Map (VAALCO Energy)

The Venus Production and Development Area is located in the Block P exploration area shown on the map above. It concerns one of the two discoveries made in the block years ago.

Block P covers a total area of 1,253 square kilometers in the Rio Muni Basin.

The Venus discovery was made in September 2005 by Devon Energy (DVN). The semi-submersible Global Santa Fe rig “Aleutian Key” encountered about 45 meters in net oil pay in upper cretaceous sands at a depth of 2,160 meters.

The sand reservoirs in the Venus Field in Block P have been identified and verified as the same type as these other Rio Muni discoveries. These fields have proven reserves of around 500 million barrels of oil.

The reserves of the Venus field are estimated to contain between 15.5 million and 23.8 million gross recoverable barrels of oil.

EGY Venus Development (VAALCO Energy Presentation)

Block P comprises several exploration prospects.

- The Marte/Saturno prospect

- The SW Grande prospect

- The Venus discovery

- The Europa discovery contains about 7.9 million gross recoverable barrels of oil

Guinea Ecuatorial de Petroleós (GEPetrol) acquired Devon’s assets in the block in 2008 and became the operator.

On November 2, 2012, VAALCO Energy purchased the 31% interest owned by Petronas Carigali for $10 million.

Note: The Venus discovery is located approximately 50 km south of Block P are the Hess (HES) Ceiba and Okume fields.

Based on the data from Atlas Petroleum International Limited, the sand reservoirs in the Venus field have been identified and verified as the same type as these other Rio Muni discoveries. These fields show proven reserves of around 500 million barrels of oil. In comparison, the reserves of the Venus field have been estimated by VAALCO as between 15.5 million and 23.8 million gross recoverable barrels of oil.

1.2 What comes with the Plan of Development for discovery

1.2.1 – VAALCO is adding substantial 2P CPR WI reserves

Adds 18.5 MMBO of 2P CPR WI reserves as of September 2022, which includes 9.1 MMBO of WI proved undeveloped reserves (“PUDs”).

Furthermore, exploration upside with Saturno and Southwest Grande prospects are adding to the attractiveness of the block.

1.2.2 – VAALCO is now able to proceed with the development of the Venus discovery

The company plans to spud its first development well in early 2024 and intends to spud an additional development and a water injection well in 2025/2026. Also, VAALCO will acquire, convert and install production facilities over the next three years.

1.2.3 – How much will it cost?

VAALCO indicates that the preliminary project cost of drilling two development wells, an injection well, and a related production facility is approximately $310 million gross, or roughly $13.40 per barrel of 2P gross reserves.

1.2.4 – Time schedule and production

VAALCO expects the first oil production from Block P in mid to late 2026. Based on results from the initial discovery well and reservoir modeling, production from the field is to reach approximately 15K Bop/d (or 12K Bop/d net) upon completion of the two development wells and the injector well is more than what is produced in Gabon.

George Maxwell, VAALCO’s Chief Executive Officer, said in the press release:

With approval of the POD, and upon execution of final documents, we are very excited to proceed with our plans to operate, develop and begin producing from our discovery at Block P in Equatorial Guinea over the next few years. We have a strong and highly economic plan of development in place and are looking forward to working with our carried partner GEPetrol and the Equatorial Guinea government in efficiently developing this exciting discovery.

1.3 – Investment Thesis

VAALCO Energy’s expansion during the past several years has been robust.

The first phase of this evolutionary process began about two years ago with the development of the Etame block in Gabon with aggressive exploration campaigns, which paid off when oil prices turned highly bullish.

I have been reticent in the past to push for a long-term investment in EGY because I believe management was not doing what it should. But after witnessing how much has been done, I started to recognize the merits attached to long-term investment. Also, EGY is now paying a dividend, which is another incentive long term.

One negative remains until now. EGY lacks diversity and relies on one single producing asset in Gabon. As I have explained earlier, the company can double its oil production and reduce its dependency on Gabon. However, the situation is about to change with the approval of the Plan of Development for Discovery on Block P in Equatorial Guinea.

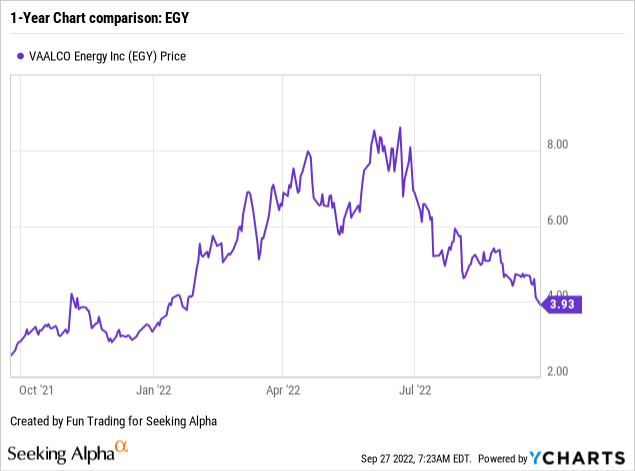

Sadly, the stock has retraced significantly since July with the oil prices decline and the merger announcement with TransGlobe that I covered in my article here. I said:

Thus, it is difficult to see why VAALCO Energy owned less than 60% of the merger company? I think it was one of the reasons why EGY sold off when the news was announced. The stock price may drop even further if oil prices continue to decrease.

Finally, in terms of synergies, I see only a minimal effect going forward due to the assets’ location and the company’s expertise. EGY is an offshore E&P producer, whereas TGA specializes in onshore assets.

EGY is now below $4, and I believe it is time to accumulate again.

Technical Analysis And Commentary

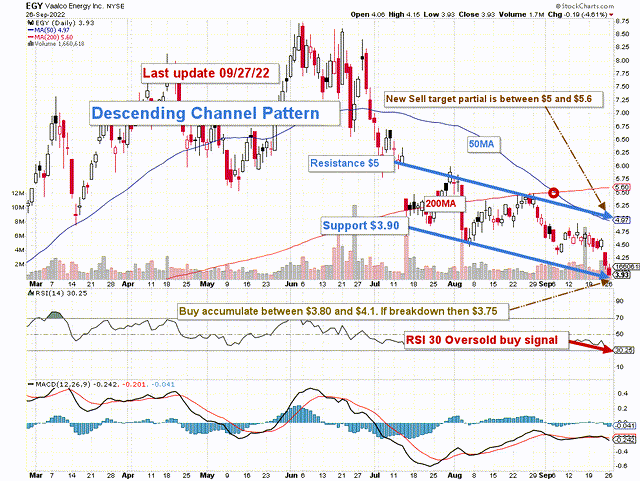

EGY TA Chart Short Term (Fun Trading)

Note: The chart has been adjusted for dividends.

EGY forms a descending channel pattern with resistance at $5.00 and support at $3.90.

The channel formation can be of two types: bullish and bearish. Generally, a descending channel is a bearish trend reversal chart pattern. When the movement is downward, which is the case here, it is considered bearish.

The short-term trading strategy is to trade LIFO for about 30%-40% of your position. I have decreased the short-term part because of the increasing volatility attached to the oil sector and the nature of the pattern.

Oil prices may have found some support just below $80 and may help EGY hold support at least for a while. However, the risk of a painful recession could push oil prices even lower.

I suggest selling at above $5 to $5.60 and buying below $4 with potential lower support at $3.75. Trading LIFO is highly recommended.

Watch oil prices like a hawk.

Note: The LIFO method is prohibited under International Financial Reporting Standards (IFRS), though it is permitted in the United States by Generally Accepted Accounting Principles (GAAP). Therefore, only US traders can apply this method. Those who cannot trade LIFO can use an alternative by setting two different accounts for the same stocks, one for the long term and one for short-term trading.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below to vote of support. Thanks.

Be the first to comment