tomch/iStock Unreleased via Getty Images

Introduction

The Norwegian-based Equinor ASA (EQNR) reported its third-quarter 2021 results on October 27, 2021.

3Q21 Snapshot

The company reported a third-quarter 2021 adjusted income per share of $0.85 per share, which beat analysts’ expectations.

Source: Presentation

It was a solid quarter with a significant rise in revenues. The strong quarterly results were due to higher commodity prices reaching a record this quarter and ramping up operations at the Johan Sverdrup oil field.

The Johan Sverdrup field is a technological triumph and a milestone for the Norwegian oil industry, supplying the world with energy, and creating value for society. It’s now in Phase 1 of production, at unprecented low cost and high quality.

- 720,000 boe/d, estimated daily production in Phase 2, after 2022

- up to 30% of NCS oil up to 30% of total oil production from the Norwegian Continental Shelf at plateau.

- 80-90% less carbon Emissions compared to a standard development employing gas turbines.

Equinor generated a new record of $6.122 billion in free cash flow this quarter. However, the threat of a new virus mutation called Omicron affected the stock, but the market is now turning bullish again after it downgraded the threat to the economy.

On the debt front, the company is also making some significant progress reducing its net debt ratio from 24.6% to 16.4%.

Feeling confident again with the increase in commodity prices and a nascent recovery, Equinor’s Board of Directors proposed a quarterly dividend of $0.18 per share, representing an increase of 20% QoQ.

Furthermore, on July 28, 2021, Equinor began executing the first tranche of around $300 million of the $600 million share buyback program for 2021, announced 15 June 2021.

The integrated company is primarily an oil and gas producer with a robust crude oil segment, as we can see below:

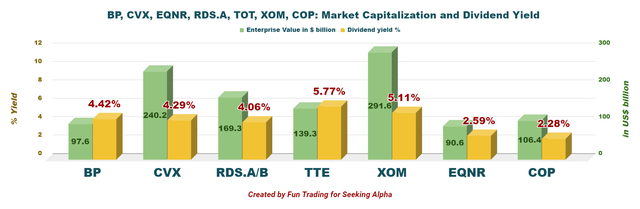

Equinor is one of the smallest in terms of market cap amongst its peers and pays a low dividend with a withholding tax of 25%, limiting its attractiveness for dividend-oriented investors.

CFO Ulrica Fearn said in the conference call:

Today, we present our strongest financial results since 2012. Clearly, these results benefit from higher prices, particularly European gas prices but they also reflect our ability to capture those prices through our solid operational performance with high production efficiency, our flexible gas capabilities, which gives us potential to optimize volumes and our continued focus on costs.

Balance Sheet And Production 3Q21: The Raw Numbers

| Equinor | 3Q20 | 4Q20 | 1Q21 | 2Q21 | 3Q21 |

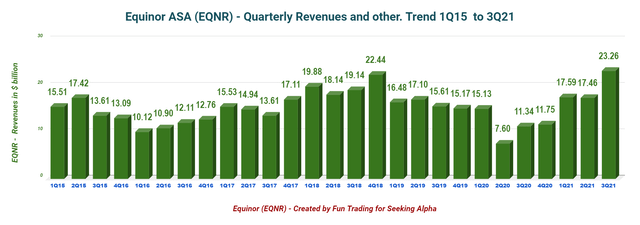

| Revenues in $ billion | 11.25 | 11.88 | 16.13 | 17.38 | 23.11 |

| Total Revenues and others in $ billion | 11.34 | 11.75 | 17.59 | 17.46 | 23.26 |

| Net Income in $ million | -2,127 | -2,421 | 1,851 | 1,938 | 1,406 |

| EBITDA $ billion | 2.921 | 2.404 | 7.622 | 7.320 | 11.37 |

| EPS diluted in $/share | -0.65 | -0.75 | 0.57 | 0.60 | 0.43 |

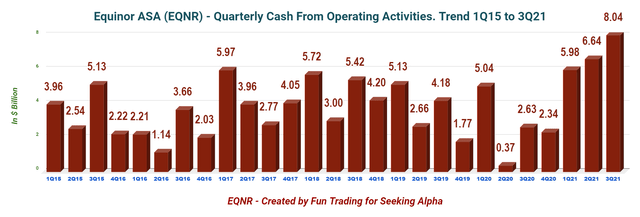

| Cash from operating activities in $ billion | 2.63 | 2.34 | 5.98 | 6.64 | 8.04 |

| Capital Expenditure in $ billion | 1.72 | 2.50 | 2.15 | 1.75 | 1.92 |

| Free Cash Flow in $ million | 0.909 | -0.161 | 3.83 | 4.90 | 6.12 |

| Total cash $ billion | 18.41 | 17.62 | 19.91 | 25.06 | 28.85 |

| Long-term debt (+liabilities) in $ billion | 37.47 | 38.12 | 34.91 | 35.48 | 30.80 |

| Dividend per share in $ per share | 0.11 | 0.12 | 0.15 | 0.18 | 0.18 |

| Shares outstanding (diluted) in billion | 3.257 | 3.257 | 3.256 | 3.257 | 3.255 |

| Oil Production | 3Q20 | 4Q20 | 1Q21 | 2Q21 | 3Q21 |

| Oil Equivalent Production in K Boepd | 1,994 | 2,043 | 2,168 | 1,997 | 1,994 |

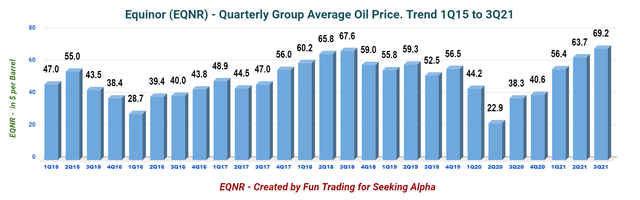

| Group average oil price ($/b) | 38.3 | 40.6 | 56.4 | 63.7 | 69.2 |

Courtesy: Company 2021 Filing

Financials: Revenues, Free Cash Flow, Debt, And Production

1 – Revenues and others were $23.26 billion in 3Q21

EQNR reported third-quarter 2021 on October 27, 2021. Revenues and others were $23.264 billion, up from $11.339 billion the same quarter a year ago and up 33.2% sequentially (please look at the graph above).

Net income was a loss of $1,406 million, or $0.43 per diluted share, up from a loss of $0.65 per diluted share in the same quarter last year.

After-tax, the adjusted earnings were $2,777 million in the third quarter, up from $271 million in the same period in 2020.

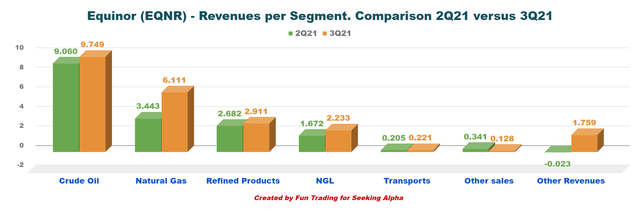

Higher prices for liquids boosted the earnings this quarter. Details per segment are presented below:

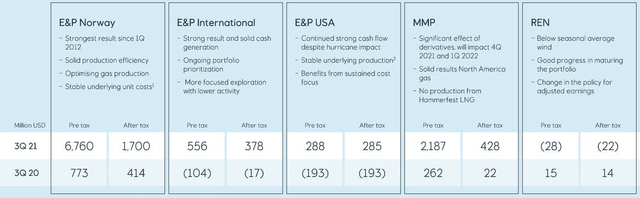

Source: Presentation (extract)

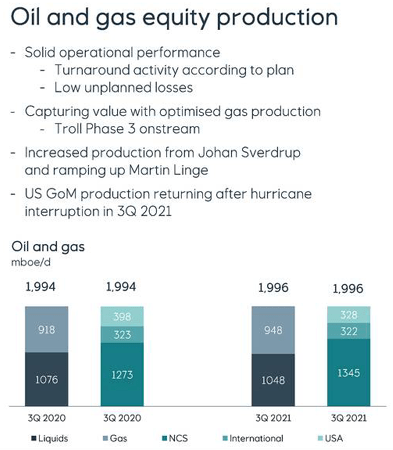

- Exploration & Production Norway (E&P Norway): The adjusted earnings were $6,760 million, up from a profit of $773 million last year. This year’s increase was due to a rise in production and liquid prices. The company’s average daily liquids and gas production increased 6% year over year to 1,345K Boepd due to ramping up operations at the Johan Sverdrup oil field and positive contributions from the new field Martin Linge.

- E&P International: The adjusted operating profit was $556 million, compared to the year-ago quarter loss of $104 million. Liquids and gas prices boosted upstream activities.

The company’s average daily equity production of liquids and gas decreased to 322K Boepd from 323K Boepd last year. An increase in output from Russian fields helped the segment.

Equinor’s realized price for liquids was $69.2 per barrel during the third quarter of 2021. The price realized increased significantly from the same quarter last year of $38.3.

In the third quarter, the average European invoiced gas price was $12.82 per million Btu for Europe and $3.23 for North America, up from $2.72 and $1.53 the same quarter a year ago. It was a massive improvement here.

CFO Ulrica Fearn said in the conference call:

We are seeing significant moves in the energy markets and particularly in the gas market in Europe. Record prices in the second quarter were beaten in the third quarter and prices have continued to rise in October. This generates higher revenues for Equinor, but also serves as a reminder of the level of volatility in our markets.

Cash from operating activities was a record of $8.04 billion in 3Q21.

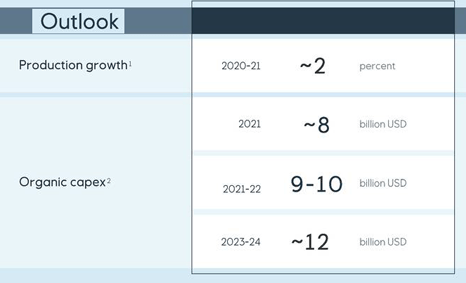

2 – 2021 Guidance and Outlook. The company reaffirmed production growth expectations at 2% for 2021.

Organic CapEx is estimated at an annual average of $9-$10 billion for 2021-2022, increasing to $12 billion in 2023-2024.

Scheduled maintenance activity is estimated to reduce equity production by around 50K Boepd for the entire year of 2021.

For the 2021-2022 period, Equinor expects an average organic CapEx at $9-$10 billion per annum. For the 2023-2024 period, CapEx is expected to increase to $12 billion per annum.

Source: Presentation

CFO Ulrica Fearn said in the conference call:

We are now flexing to produce as much as we can and turning every valve to produce and export more gas to meet European demand. Earlier this autumn, we received permission to produce 2 billion cubic meters of additional natural gas from Troll and Oseberg. And I can also mention that Gina Krog, we have in October decided to redirect gas from normal injection to be able to increase exports over the next 6 months by about 30,000 barrels per day oil equivalent.

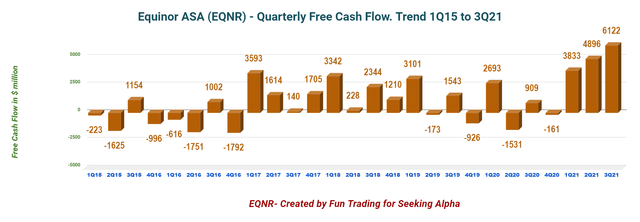

3 – Free Cash Flow was a record of $6,122 million in 3Q21

The company’s free cash flow was a record of $6,122 million in the third quarter of 2021 or a trailing twelve-month free cash flow of $14,690 million.

Note: I use the generic free cash flow, not including divestitures. It is the cash flow from operations minus CapEx. The company has a different way of calculating the free cash flow and indicates $6,725 million in 3Q21.

The annual dividend payment is $2.345 billion, based on $0.72 per share a year.

The dividend yield is now 2.59%. However, U.S. investors receive a net yield of 1.94%, which is relatively low and doesn’t entice long-term investors to keep the stock as a long-term investment.

Also, the company expects a $1.2 billion share buyback starting 2022.

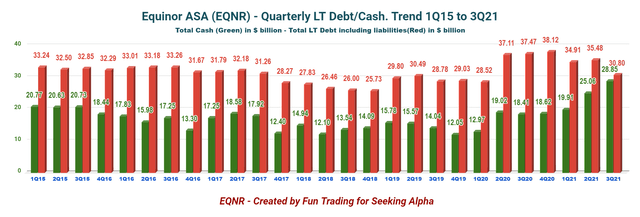

4 – Net Debt is $1.95 billion in 3Q21

Note: The debt indicated above in the graph is the gross interest-bearing debt plus liabilities.

As of September 30, 2021, the total cash was $28,847 million, compared with $18,407 million last year. The total net debt is now $1.95 billion.

The debt-to-equity ratio is relatively high now at 0.83.

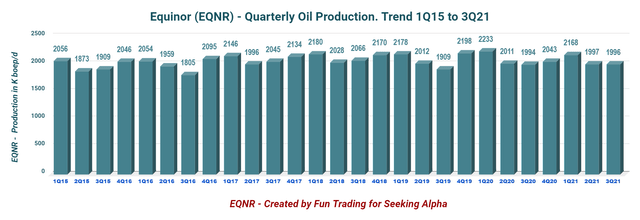

5 – Production Upstream and Investment in Renewables

- The third-quarter production was 1,996K Boepd, up from 1,994K Boepd the same period in 2020 and nearly unchanged sequentially.

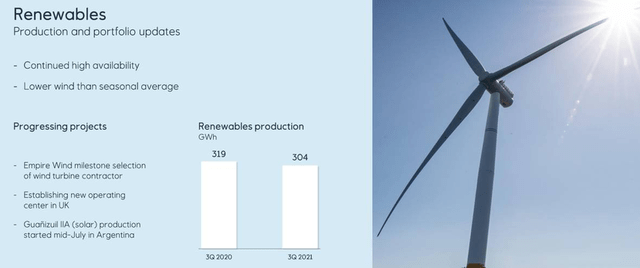

- Equinor share for power generation was down to 304 GWh this quarter, down from 319 GWh last year.

Source: EQNR Presentation (Montage)

Note: Equinor has made six oil discoveries during 2021.

Equinor has made an oil discovery estimated to hold up to 62 million barrels of crude off the coast of Norway, the energy major said on Monday.

The discovery, just north of the Tyrihans field and west of the Kristin development in the Norwegian Sea, was the state-controlled firm’s sixth find in domestic waters this year

Technical Analysis And Commentary

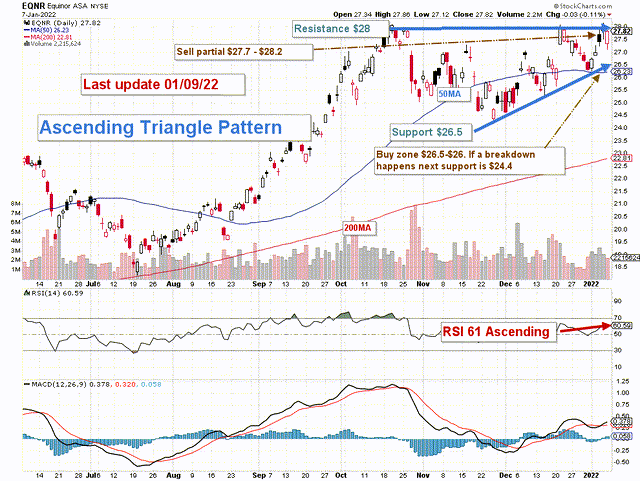

EQNR forms an ascending triangle pattern with resistance at $28 and support at $26.5.

The trading strategy is to sell about 30% or more at or above $28 and accumulate between $26.5 and $26. EQNR is highly correlated to oil prices, and any selling or buying decisions must factor in this critical component.

If oil prices keep trending up, EQNR could eventually cross $28, but it is not very likely at the moment. I believe oil prices are reaching an unsustainable valuation and should be retracing in the next few weeks.

Hence, if oil prices lose momentum and drop at or below $70-$75 per barrel, I see EQNR crossing the pattern support and retesting $24.40, at which point it is safe to buy again.

The best way to profit from your investment in EQNR is to trade LIFO while keeping a long-term position for a potential retest of $30s or higher. I suggest taking some time to understand how it works. Also, options trading could be an alternative to direct trading.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks!

Be the first to comment