Lexus dealership showroom. Toyota Motor Corp.’s luxury franchise.

chameleonseye

The first Lexus RX 300 that debuted in 1998 was a phenomenal model in the sense that it was the industry’s first luxury SUV to ride on a car platform. RX was an engineering coup by the Toyota Motor Corp. (NYSE:TM) that was greeted warmly by consumers, inaugurating an entirely new category, of which RX remains the leader to this day.

2023 Lexus RX (Toyota Motor)

Just peruse a typical shopping mall parking lot or that of a health club or high-end grocery and you’ll see an ocean of similarly shaped mid-sized BMW, Cadillac, Audi and Asian-branded SUVs, which have largely displaced the mid-sized Cadillac and Mercedes sedans as the most common passenger luxury cars on the road.

Caution ahead

In light of today’s budding automotive trend toward battery-electric vehicles (BEV), Toyota is exercising caution not to tinker too much with the formula that has bestowed RX leadership as the model enters its fifth generation. RX remains Lexus’s top seller among its various models.

(By contrast, General Motors Co.’s Cadillac luxury brand has declared it will be the first GM brand to sell BEV models exclusively by 2030, starting with Lyriq this year.)

F Sport turbo engine option (Toyota Motor)

The 2023 RX will be available with four powertrain options: The base model features a 2.5-liter turbo generating 275 hp and 317 pound-feet of torque with a fuel efficiency rating that will be slightly higher than the outgoing V6; a gas-electric hybrid with 246 hp and all-wheel-drive delivering superior fuel efficiency; and a second F Sport gas-electric hybrid with more horsepower and torque that is tuned for performance rather than fuel efficiency.

A fourth powertrain option is coming as well. The fourth, available after the first three go on sale, is a plug-in hybrid. Plug-in hybrids are targeted toward consumers who tend to travel shorter distances but also want some all-electric availability – as well as the convenience of a gasoline engine for longer distances.

Battery luxury

Lexus’ RZ 450e for 2023 will be the brand’s first BEV, built on the same platform as Toyota’s bz4X BEV that debuted this year. The 65.6-kWh battery is the same, though the RZ will include a dual-motor setup that increases horsepower and standard all-wheel-drive and delivering about 225 miles of range.

2023 Lexus RZ BEV (Toyota Motor)

Presumably, the imported Lexus RZ 450e will be sold in relatively small numbers – as is the case with its cousin, Toyota bZ4X. The automaker needs these models to prove to the world that it is in the electric car business, despite what its critics in the environmental activism community say.

|

Toyota is deliberately adopting an incremental approach to full electrification based on the belief that consumers won’t be switching from internal combustion engine technology in large numbers for some time due to a number of factors. If consumers prove to be more enthusiastic for BEVs than they appear to be at the moment, Toyota can ramp up production; otherwise it will continue to push a combination of gas-electric hybrids, plug-in hybrids and conventional ICE models as BEV demand grows stronger.

An important wild card in the demand calculus for BEVs is the role of federal incentives. The latest so-called Inflation Reduction Act (IRA) appears to be a mixed bag: The $7,500 tax credit on BEVs is extended, though with several qualifiers, including the mineral composition of the battery and whether the minerals are derived from local sources. The 200,000 limit on the number of vehicles per manufacturer that can qualify for the incentive is lifted, while several other limits on the price of the vehicle and the income of the buyer are imposed. How much these new rules will stimulate BEV sales is anything but clear.

Efficiency rules

The U.S. Environmental Protection Agency (EPA) is working on new fuel-efficiency standards for 2027 and beyond that could force automakers to sell a certain number of emission-free vehicles – BEVs – in order to comply with the law, since CO2 emissions have become a proxy for fuel efficiency. General Motors Co. (GM) – which has placed its bet on an all-BEV future sooner rather than later – is collaborating with its one-time nemesis, the Environmental Defense Fund non-governmental organization – to lobby the EPA for a 50% BEV sales mandate by 2035. California already has passed a law prohibiting the sale of ICE models after 2035.

Whether new mandates will take on the force of law – and how practical they may be stimulating BEV sales – remains an open question that depends on the willingness of the consuming public to abandon a personal transportation system that today is tied largely to fossil fuels and gasoline filling stations. Politics could be a factor as well, since future administrations have the power to modify current regulations. Toyota in effect is betting that the outcome is not yet a foregone conclusion, and the automaker aims to be ready and to optimize returns to shareholders in the event that BEVs become a mainstream consumer choice a decade from now – or three decades from now.

The next generation RX should be seen in this light, a model that will likely prove to be a strong seller for the next five years or so – and which Toyota can claim to be more fuel efficient than the model it replaces. Beyond the four powertrain choices, RX for 2023 comes with a softer, gentler exterior design that departs from the spindle grille and angular Darth Vader look of the previous generation, as well as a raft of new features. Among the features is a new infotainment system that omits a touch pad which proved unpopular and delivers standard wireless Apple Car Play and Android Auto that mirror an owners’ smartphone apps.

Down, not out

Toyota’s vehicle production has suffered due to the shortage of semiconductor chips and other supply chain hang-ups. Early in the pandemic the automaker was able to cope; lately it has suffered along with the rest of the global industry and will continue to do so until macroeconomic headwinds subside.

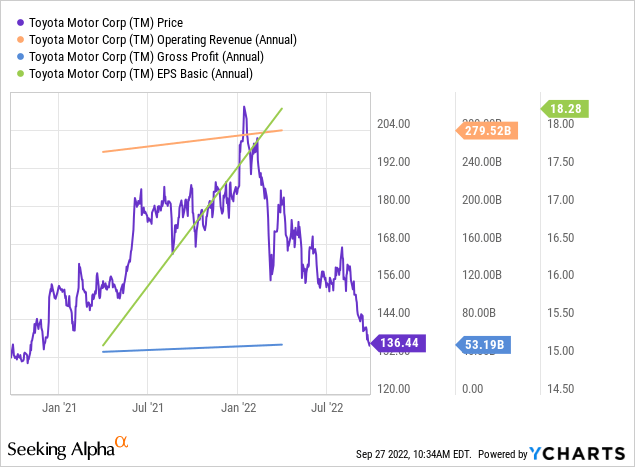

TM shares have been clobbered since the beginning of the year, down from a peak of $213 or so a share to its current level in the mid-$130s – a drop of about 36%, making an attractive entry point for those who understand the company’s intrinsic value and agree with its approach to electrification. The current yield of about 1.8% is adequate. Toyota’s financial strength is such that a recession-induced dividend cut or suspension is unlikely.

For the long-term investor, TM remains the automotive equity of choice and the one that likely will deliver the most return among its peers when the cyclical recovery begins.

Be the first to comment