bjdlzx

VAALCO Energy (NYSE:EGY) recently reported that the combination with TransGlobe Energy (TGA) completed. This combination puts together two very strong balance sheets. Therefore, financial leverage will not be an issue as there should be plenty of cash to fix many challenges that may arise in the coming months.

But VAALCO is diversifying into a very different business from which it started. There is a risk of frayed people relations as the transition proceeds in an area of the world where personal relationships appear to be important. Therefore, the next six months are likely to prove important as to whether this company moves forward the next few years or at best treads water while fixing acquisition challenges

The Businesses

TransGlobe Energy, the company acquired, is involved in secondary recovery in Egypt. This is actually a very predictable business because the leases have been explored. So, the operator knows where the oil is. It is just a question of getting more oil that is already in place. The upstream risks are reduced but oftentimes the production costs run higher that is typical for upstream.

VAALCO, on the other hand, is interested (until now) in shelf properties which are typically offshore. This business is relatively expensive to begin. But it can be very profitable with the right discoveries. VAALCO has often minimized the offshore risk by looking at previous discoveries that were not commercial for the large operator that found the oil but could be profitable for a smaller operator.

Similar to TransGlobe Energy, VAALCO is also interested in older fields with a history of production that still have profitable amounts to produce even if those amounts are not significant to a larger operator.

Both companies avoid competition with larger operators by finding a niche in the industry that those larger companies are not interested in. Both companies have a profitable history that minimizes upstream risk and financial risk as a result.

The big question is if VAALCO can handle a diversification into a significantly different business in different countries seamlessly.

Current Situation

The combined company has opportunities for growth in several areas. It would appear to be logical for the combined company to expand the Egyptian production at a measured pace while using the cash flow for some of the offshore prospects that may prove to be more profitable if successful.

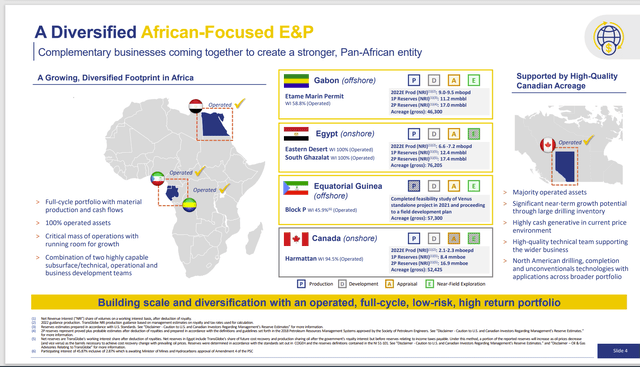

TransGlobe Energy And VAALCO Business Summary (VAALCO Business Combination Presentation August 2022)

VAALCO recently received permission to expand operations with the Venus discovery offshore while TransGlobe Energy has a new contract with Egypt that makes secondary recovery more profitable than it has in the past. Both companies appear to have a very different future ahead than was the case in the past.

In addition, management announced a successful drilling of an offshore well that will be completed in the coming months as well as progress to reducing costs at an established production operation. In addition, management has also elected to drill more wells in the current fiscal year.

Both companies are enjoying the profits that result from robust commodity prices. The result of this is that both companies will likely expand production because paybacks are far faster in the current environment, and those fast paybacks lead to more available cash flow during industry downturns.

Combination Benefits

The combined companies are likely to offer the benefits of predictable secondary recovery combined with the speculative upside potential of a good offshore program. Management has announced a major project approval offshore combined with the successful drilling of the latest well. So, the current fiscal year appears to be one with a lot of offshore progress. That implies a bright cash flow picture into the next few years even if commodity prices decline more than expected.

The risk of any offshore project is that failures can be very expensive. That may cause even the combined company to slowly determine the next strategic move when an offshore proposal fails.

Management announced a solid third-quarter with a decent cash balance and continued debt free balance sheet. The combination with TransGlobe Energy, which has a similar financial philosophy, takes an obvious risk factor of finances off the table. The remaining big risk factor in the transition will be people relationships both with the government of Egypt and with the acquired operations.

Finances

Both companies have debt-free balance sheet along with decent cash balances. This does allow for some hiccups in what is a sizable combination for both companies. Generally, relatively large combinations are riskier than small “bolt-on” acquisitions. The danger for shareholders is that the combined company could “tread water” or worse the first few years until all the acquisition issues are surmounted.

In the case of TransGlobe, the company is too small to have regular oil sales that many of the larger producers in Egypt have. Therefore, the company has to grow production to qualify for regular sales. In the meantime, a strong balance sheet with lots of cash is a necessity because oil sales are irregular.

VAALCO likewise has a strong balance sheet. So, the company can withstand expensive offshore dry holes without much of an issue. However, oftentimes, offshore projects take longer with a smaller company due to cash flow and personnel issues. Any offshore project is far more material to a smaller company, often with multiple year effects.

VAALCO has been conservative about progressing with development which minimizes financial risks to shareholders. The combination with TransGlobe brings a second (badly needed) cash flow source to the table to develop more offshore projects that speed both growth and diversification. That will eventually lead to less dependence upon the success of the next exploration well or development project.

The Future

Both companies have projects underway that should lead to considerable growth in the future. Both companies are also generating a considerable amount of cash in the current environment.

The diversification in the acquisition of TransGlobe is a big jump from the business that VAALCO is currently engaged in. A lot of future progress will come from making a smooth transition of the Egyptian business (and Canadian business) to the new management. Therefore, the next fiscal year will be extremely important to results that lead to more company progress.

Any sign of trouble in the Egyptian business could spell major impairments in the future. That possibility is minimized by the secondary recovery focus of TransGlobe Energy. Not many in the industry have that focus (especially not the major players). That may give the company some leeway during the assimilation process.

So, the next year is likely to be by far the riskiest for the combined company. Mitigating that risk has to be the success of the offshore projects underway. Another well coming online could increase production by as much as half the production of TransGlobe. That would mitigate any potential trouble with the acquisition.

On the other hand, success could bring future growth far in excess of what the market expects in all the areas that the company operates. Even after the acquisition, this is still a relatively small company operating in areas that some would see as riskier than (for example) the United States. Africa has long been a money pit for the oil and gas industry. Only recently have there been a string of successes in certain areas. This company is not for the risk averse.

Be the first to comment