Karel Bock/iStock via Getty Images

For those of us that have been investing in shipping companies for at least two years, Eagle Bulk Shipping (NASDAQ:EGLE) is one of the companies that are always in our shortlist. The company has a specific set of advantages that provide it with increased resiliency against market downturns and allow it to face the future with a good degree of optimism. Today, I’m revisiting the company in an attempt to highlight these advantages in anticipation of their Q3 2022 earnings release scheduled for November 4th.

Exclusively focused in the midsize vessel segment

As I have written many times in the past, larger vessels are associated with higher volatility. The BCI, which follows the freight rates of Capesizes, is particularly prone to changes in steel output (see China) and in the global economic prospects, in general. On the contrary, one of the less volatile vessel segments are the Supramaxes / Ultramaxes. These usually have a carrying capacity ranging from 50k to 70k DWT and one of their key advantages is that they can dock in almost every port, without the need of loading / unloading equipment. From a purely economic standpoint, their smaller size makes their deployment less prone to commodity price fluctuations. For a more detailed discussion of the advantages of this vessel type, please refer to my previous article about the company, “Eagle Bulk Shipping: The Eagle will continue to fly“.

The company currently owns a fleet of 53 vessels, all of them belonging to the Supramax / Ultramax segment. The latest addition to the company’s fleet was the purchase of a 2015-built Ultramax for $27.5 million, which is expected to be delivered in this quarter. The average fleet age is 9.5 years, which is affected by the 17 young vessels that the company purchased during the last 6 years.

Modern fleet means larger savings

From the total 53 vessels, 48 are scrubber fitted, which means they can operate on high sulfur oil and still comply with current environmental regulations. Speaking of environmental regulations, starting from next year, they will become stricter, as an extra tonne of CO2 emitted will result in a EUR 100 tax when operating in EU waters. In addition, as the high sulfur / low sulfur oil price differential is significant, scrubber fitted vessels will mean higher profit margins for shipping companies. Currently, this price differential stands at $225 to $321 per tonne. While not at record high levels, this figure is still quite material for most shipping companies.

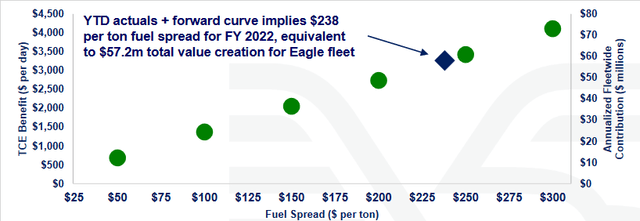

Eagle Bulk Shipping fleet scrubber benefit (Eagle Bulk Shipping October 2022 Investor Presentation)

For Eagle Bulk Shipping, at the current oil spread of $238 per tonne, the total benefit will be $57.2 million, or a TCE benefit of more than $3k per day. Just to give you some perspective, for the second quarter of 2022, the company paid its shareholders a total of $28.5 million in common share dividends. In other words, with the inputs used above, each year the company saves around two times its current quarterly dividend from the use of scrubber fitted vessels.

Eagle Bulk Shipping’s attractive and transparent dividend policy

Although I’m not a purely income investor, I like companies with significant dividend yields. Do you know what I like more? Companies with significant dividend yields and a transparent dividend policy. Knowing what to expect from your ownership is a huge plus for me, and that’s what Eagle Bulk Shipping does, since last October. According to their dividend policy, they will pay out at least 30% of their net income to common shareholders. Based on the fact that with 72% of the days chartered, the company has a TCE rate of $29k per day, and with CapEx remaining stable, we’re heading into a similar, yet I believe slightly reduced, dividend per share. However, even a dividend per share of $1.8 will stand for a forward annual dividend yield of 14%, which is brilliant.

Well-laddered amortization schedule

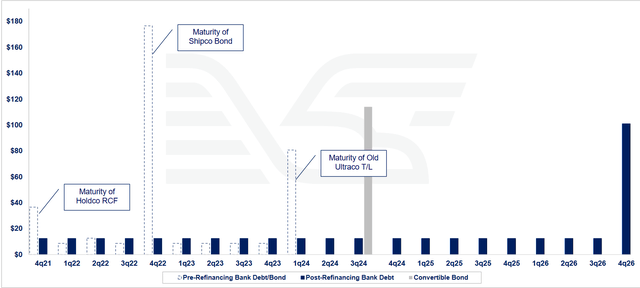

EGLE’s debt amortization schedule (Eagle Bulk Shipping January 2022 Investor Presentation)

The recent debt refinancing agreement created a much better debt amortization profile, while debt servicing cost got down to 3.6% from more than 7%. This is particularly important, given the general rise in the cost of debt. The cash debt amortization per vessel is at $2.6k per ship. From a different angle, we could argue that the scrubbers benefit is actually providing the company with free capital, based on the $3k effect in the TCE. This has enabled the company to be able to modernize its fleet, pay down debt while at the same time provide a hefty dividend to its shareholders.

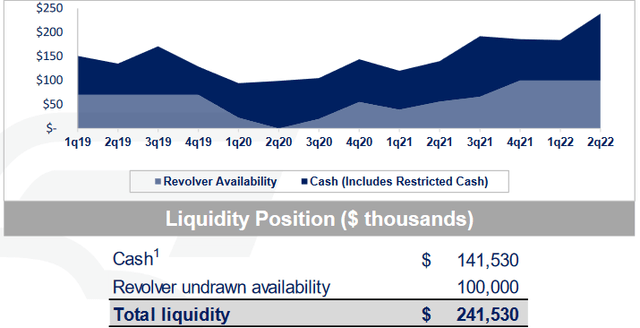

EGLE’s liquidity and remaining revolving credit facility (Eagle Bulk Shipping October 2022 Investor Presentation)

Potential risks

Unfortunately, high potential returns nearly always come together with some risks. I have identified two potential risks for Eagle Bulk Shipping:

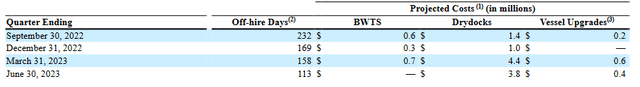

1. Increased CapEx in 2023: While the company has scheduled $1.3 million of CapEx in the last quarter of this year, the first two quarters have significantly higher figures. For Q1 2023, the company anticipates total CapEx of $5.7 million and for Q2 2023 total CapEx of $4.2 million. For the next two quarters of 2023, the company has planned CapEx of $4.6 and $5 million, respectively, as it is found in their investor presentation. The majority of these costs have to do with drydocking expenditures. These figures bring us to a total 2023 CapEx figure of $19.5 million, compared to $13.3 million spent (or planned) in 2022. However, off-hire days are anticipated to be significantly lower than 2022.

EGLE’s Capital Expenditures until Q2 2023 (Eagle Bulk Shipping Q2 2022 10 – Q)

2. Weakening freight rates in the short term: While in the medium term it is anticipated that freight rates will recover from their recent slump, in the near term, it is reasonable to expect some further easing. First of all, traditionally, the first quarter of each year is the weakest of all four, and given the recent global economic uncertainties, I think we’re heading for a bad Q1 2023. However, shipping market fundamentals continue to be healthy. There’s a historical low orderbook on Supramax / Ultramax vessels, and as I wrote earlier, this vessel segment is quite resilient to market downturns. Not to mention that still, despite all the turmoil, the BSI is trading higher than its 25-year average. In the short term, though, things could get worse.

Conclusion

For the medium term investor, Eagle Bulk Shipping is a long opportunity. During the troubled times that we’re going through, investors can find consolation in the company’s thick dividend until the market starts recovering next year, from the second quarter and onward. This is based on a very efficient and modern fleet providing the company with lower operation costs, thus, wider profit margins. Meanwhile, the company’s focus in the less volatile vessel segment makes it suitable for investors looking to invest in a high seasonality and cyclicality sector, with the least possible risk. Unfortunately, we’re not in the early summer of 2021, when the shipping tide lifted all boats rapidly. Still, even now, Eagle Bulk Shipping is a solid choice.

Be the first to comment