Funtap

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on November 1st, 2022.

SRH Total Return Fund (NYSE:STEW) was the former Boulder Growth & Income Fund (BIF). The name change took place when the long-time Stewart Horejsi manager retired from the fund. He had been leading the fund since January 2002. Though the fund has a long history, going back to its inception in 1972, according to CEFConnect.

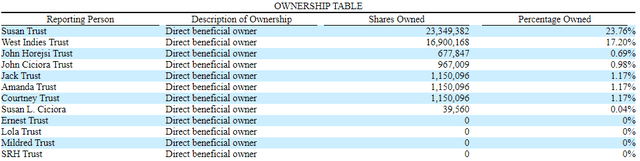

Worth noting is that the Horejsi family still controls a significant portion of the fund, even if Stewart Horejsi isn’t the manager anymore. This is through a number of trusts representing ~46% of the outstanding shares.

Horejsi Ownership (13D Filing)

(b) PTC is presently the sole trustee of the Ernest Trust, Lola Trust, Susan Trust, West Indies Trust, Mildred Trust, SRH Trust, John Horejsi Trust, John Ciciora Trust, Jack Trust, Amanda Trust and Courtney Trust (together, the “Horejsi Trusts”) and may be deemed to control the Horejsi Trusts.

(c) By virtue of the relationships reported in this statement, the West Indies Trust (i.e., the sole owner of PTC ) may be deemed to be the indirect beneficial owner of the 45,344,694 Shares indirectly beneficially held by PTC (which includes the Shares directly beneficially held by each of the Horejsi Trusts), or approximately 46.14% of the Outstanding Shares.

With the retirement of Stewart Horejsi as the manager, it left Joel Looney and Jacob Hemmer to manage the fund for the day-to-day operations. These managers have been involved with STEW for several years now. The name change was to better reflect the fund’s goal of total return.

However, no investment policy or objectives on the fund changed. Which has basically left this fund to be managed the exact same. That puts it in the situation of a new name but the same old fund.

If you disliked BIF before, you’ll still dislike STEW now and vice versa. Essentially, it comes down to a way to play Berkshire Hathaway (BRK.A)(BRK.B) at a discount and produce a quarterly distribution. As we know, BRK doesn’t make any dividend payments, making this one way to generate an “income” stream from the holding.

The Basics

- 1-Year Z-score: -0.50

- Discount: 16.79%

- Distribution Yield: 3.89%

- Expense Ratio: 1.57%

- Leverage: 13.39%

- Managed Assets: $1.666.5 billion

- Structure: Perpetual

STEW’s investment objective is “total return.” To achieve this objective, the fund “utilizes a bottom-up, value-driven investment process to identify securities of good quality businesses trading below estimated intrinsic value.”

With that being said, they invest about 40% in BRK and have had a significant weighting in both class A and B shares for years. Of course, they don’t try to deny this either. Their website notes this to shareholders right away.

The Fund’s management feels that it is important that stockholders be aware that the Fund is highly concentrated in a small number of positions. Concentrating investments in a fewer number of securities may involve a degree of risk that is greater than a fund which has less concentrated investments spread out over a greater number of securities. In particular, the Fund is highly concentrated in Berkshire Hathaway Inc., which, in addition to other business risks, is dependent on Warren Buffett for major investment decisions and all major capital allocation decisions. If Mr. Buffett were no longer able to fulfill his responsibilities to Berkshire Hathaway Inc., the effect on the value of the Fund’s position in Berkshire Hathaway Inc. could be materially negative.

The other names in the portfolio might utilize the approach that they go on to describe even further. They will invest in both equity and fixed-income but regularly overweight equity positions. They will also utilize writing calls to provide a bit more capital gains in the form of premiums to the portfolio.

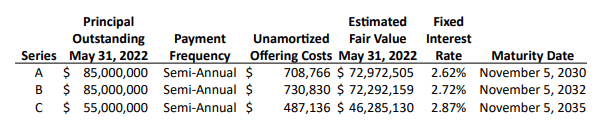

The fund utilizes a moderate amount of leverage on top of this approach. These are fixed-rate senior notes. Therefore, they are protected against higher interest rate costs that some other CEFs are dealing with now. So while a year ago, this financing was more expensive, as interest rates exploded higher, this has become cheap financing now.

STEW Borrowings (SRH Total Return Fund)

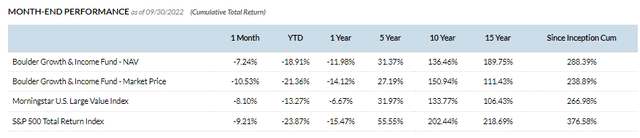

Performance – Attractive Discount

The portfolio results have mostly underperformed over the long-term relative to what they include as comparisons. Those comparisons include the Morningstar U.S. Large Value Index and the S&P 500 Total Return Index. On a short-term basis, including the YTD and 1-year periods, STEW has outperformed these benchmarks.

STEW Annualized Returns (SRH Total Return Fund)

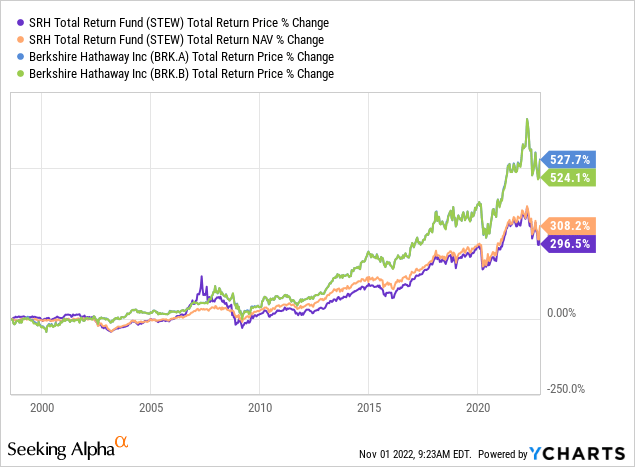

Looking at a comparison between STEW and BRK.A and BRK.B is also interesting. We see a significant underperformance over the longer term. One of the reasons for this is because of those distributions the fund is paying out. As an investment that pays out income, that is less capital they have to compound off of and keep investing. One of the big reasons BRK doesn’t pay a dividend at all is keeping the cash and looking for places to put that capital to work.

Ycharts

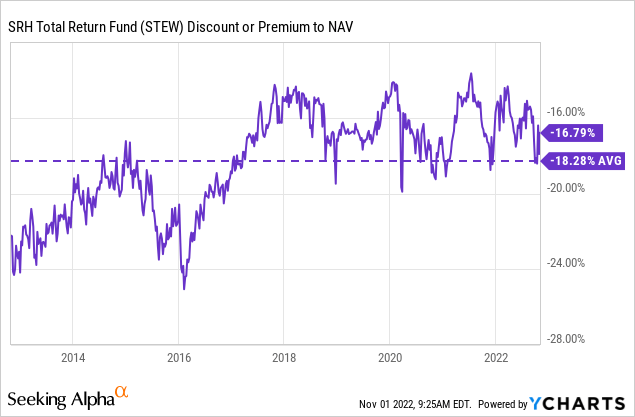

With that, it doesn’t make STEW a bad investment, but it is certainly for a different type of investor. What also makes STEW more of a tempting offer is the significant discount the fund is trading at. The fund has regularly traded at a deep discount. In fact, the current discount is at an even shallower trading level than the last decade has averaged.

Ycharts

One thing they do to try to reduce the fund’s discount is repurchasing shares. When buying shares at a discount to NAV, it is accretive. They regularly repurchased their shares beginning in 2017. For the most part, it is no surprise that we see the fund’s discount start to narrow around that time.

The Fund repurchased and retired 469,255 shares of its Common Stock during the period. The shares were repurchased at an average price of $13.34. Since the Fund’s Board of Directors (“Board”) reinstated the share repurchase program in August 2017, the Fund has repurchased and retired 8,763,699 shares at an average price of $10.25 per share.

Distribution – Not Attractive Enough

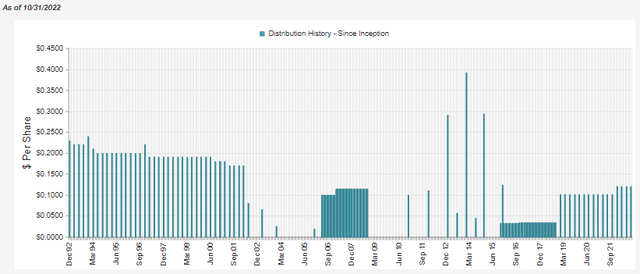

Share repurchases can be beneficial to shareholders, but most investors holding CEFs are interested in the payouts. They want them high and consistent. Neither of those two things is what STEW offers. Although they’ve been a bit more consistent, they also tried becoming more attractive in 2015-2017 by going with a monthly payout.

That monthly payout was then dropped in favor again of a quarterly payout. Monthly or quarterly doesn’t really drive my investing decision, but I know a lot of investors prefer monthly distributions or dividends. So, as we can clearly see over the years, consistency and predictability really aren’t there. Though I’d assume they are comfortable at this time with continuing their quarterly payout.

STEW Distribution History (CEFConnect)

I bought the fund during the time it was paying a monthly distribution. I felt that it would be more attractive to investors. It also showed that they were potentially looking for ways to reduce that discount. However, they quickly abandoned that strategy. The share repurchase is still a benefit, though.

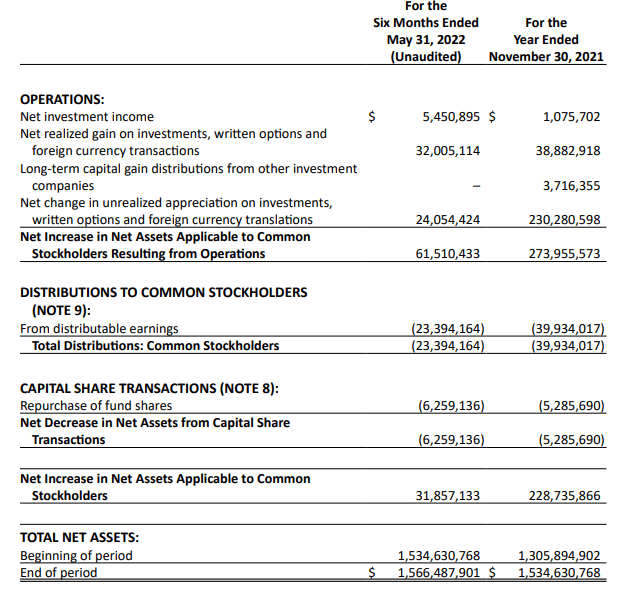

With a significant allocation in BRK, their distribution coverage will largely come from capital gains. However, net investment income coverage isn’t zero as they also invest in other names that do pay out quite healthy dividends. We even see that NII has jumped quite considerably in the latest report. That brought the NII coverage up to 23.3%.

STEW Semi-Annual Report (SRH Total Return Fund)

This is also a sizeable change from the six months that ended a year ago in 2021, where NII came to $2,621,833. This could hint that at least a bit of change is going on under the surface, even if the largest holdings are staying relatively unchanged. That being said, with a turnover of just 3% for the last six months and 6% in the last two years – these changes are slow.

With capital gains required for such a significant portion during a bear market, the coverage could be harder to come by. Since the fund’s payout is relatively small at ~3.25% on a NAV basis, there wouldn’t seem to be a risk at this time. Their written options also contributed around $1.2 million in gains for the last report. Not enough to cover the payout, of course, but every little bit helps.

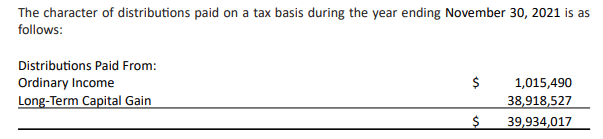

For tax purposes in the previous year, the majority was made up of long-term capital gains.

STEW Tax Classifications (SRH Total Return Fund)

STEW’s Portfolio

I mentioned above the low turnover of the portfolio, which has meant their portfolio has stayed relatively static.

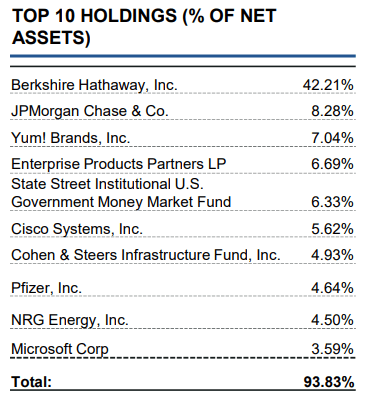

STEW Top Ten Holdings (SRH Total Return Fund)

If we look at my previous article, it showed that BRK was a combined 31.83%. So the weighting generally swings between 30 and 40%. This depends on the amount of cash the portfolio is holding and the weightings relative to the other names in the portfolio.

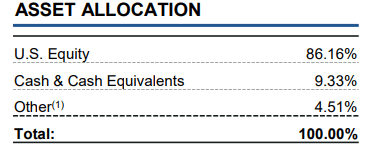

In that previous article, I also included the November 30th, 2020, positioning. At that time, we saw a significant 20.1% weighting in cash and short-term investments. Today, we see that State Street Institutional U.S. Government Money Market Fund is 6.33%.

At the same time, they appear to have another cash position elsewhere as the total cash & cash equivalents come out to 9.33%. Which means they are still holding a fairly substantial allocation to cash. It would come in as its second-largest exposure behind Berkshire.

STEW Asset Allocation (SRH Total Return Fund)

Over the years, they’ve continued to hold a weighting in the popular Cohen & Steers Infrastructure Fund (UTF). A position that they noted as increasing in the latest semi-annual report, too. That’s certainly a position that could have helped contribute to higher NII generation on the fund.

The Fund’s full positions in Heineken Holding NV (OTCQX:HKHHF)(HEIO) and Ventas Inc. (VTR) were sold. During the period, the Fund purchased additional shares of eBay Inc. (EBAY), Intel Corp (INTC), and Cohen and Steers Infrastructure Fund (UTF).

After Mr. Horejsi stepped down on April 1st, 2022, I was curious to see if the allocation to BRK A and B would be changed. On November 2021, they held 1028 shares of BRK.A and 485,000 BRK.B. The latest N-PORT showing the holdings at the end of August 2022 gives us the same number of shares held in each class of BRK.

Conclusion

The long-term primary manager has stepped down, and the fund has changed its name. However, nothing else in the fund has seemed to change, at least not substantially. With a big jump in NII, under the surface, some changes could be taking place. One worth noting is a reduced but still substantial weighting to cash, and even bumping up their weighting in UTF could have helped out the income generation of the fund.

At the end of the day, this is still substantially identical to how the fund was run previously. This could be a solid choice if you want a discounted approach to investing in BRK and provide some distributions along the way. If not, then this fund is unlikely to appeal to you.

Be the first to comment