Spencer Platt

Investment Thesis

Pinterest (NYSE:PINS) is a leading global social media platform with a mission to ‘bring everyone the inspiration to create a life they love’. Its platform is used by ‘Pinners’ to discover ideas and be inspired, whether that’s looking for your next favorite outfit or deciding how you want to remodel your kitchen.

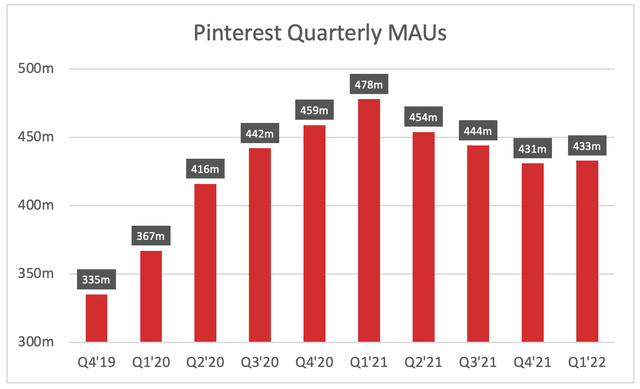

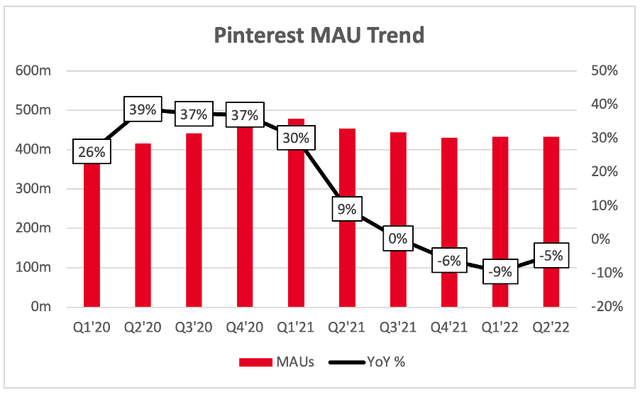

It’s been a difficult year for Pinterest shareholders, with the stock down 65% from its 52-week high & 75% from its all-time high back in early 2021. This has been driven by a combination of factors, but the primary concern from Wall Street was Pinterest’s apparent haemorrhaging of MAUs (monthly active users). Social media companies need users in order to monetize, and Pinterest has always been in the ‘growth stock’ bucket, so when a growth company starts to go in the opposite direction… well, that’s a recipe for investing disaster. Yet investors need to take this data with a pinch of salt. MAUs shot up during the pandemic as people were stuck inside, and often used the lockdowns as a chance to do some home remodeling – so, they went on Pinterest! But when the world opened up again in 2021, this spike in MAUs started to unwind.

As a long-suffering Pinterest shareholder, what is my investment thesis for this company?

Perhaps surprisingly, it doesn’t rely too much on user growth (although it would help, and user losses are a bad sign). I believe that Pinterest is a highly monetizable, shoppable platform, and that it has the potential to grow ARPU to the levels of Meta (META) and beyond. Advertisements are normally a distraction on any other social media platform, but on Pinterest adverts can actually be complimentary to the user experience – if I’m looking to redecorate my living room, and see an inspiring design on Pinterest, it would be a bonus if I could purchase all the items there and then.

But do these latest results help validate this thesis, or are Pinterest shareholders in for more pain?

Earnings Overview

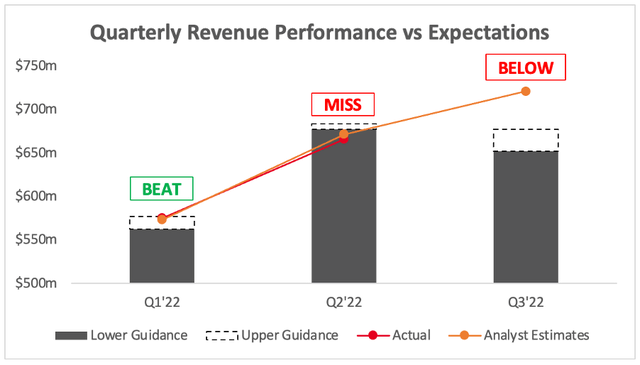

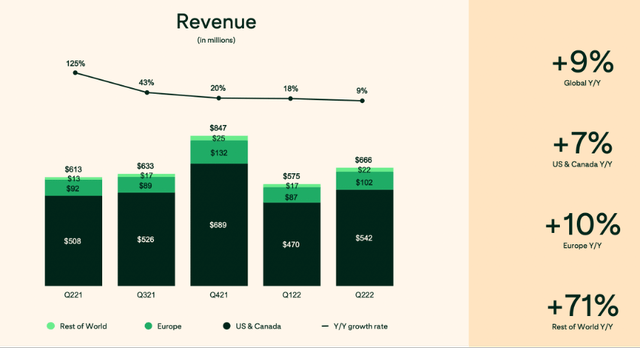

On the face of it, these were not brilliant results for Pinterest. Revenue of $666m represented growth of 9% YoY, coming in below management’s guidance of 11% YoY & also below analysts’ estimates of $671m. Guidance for Q3’22 also came in way below analysts’ estimates, with ‘mid-single digits YoY growth’ implying revenues of $652-$677m for the quarter, whereas analysts were expecting revenue of $721m – so, a pretty horrendous guidance miss.

Investing.com / Pinterest / Excel

However, as I write this, Pinterest shares are up ~20% in pre-market. As a rule of thumb, when shares rally on poor results, it can imply that pretty much all the negativity is currently baked into the share price.

Despite this miss, there are some positives that could be responsible for the share price pop. Firstly, there are signs that the MAU decline has certainly stabilized, hitting a recent low of 431m MAUs in Q4’21, followed by two consecutive quarters of 433m – good news! The YoY trend is also changing direction, with the -5% YoY decline in Q2 being the first quarterly improvement in MAU YoY growth since Q2’20.

Perhaps the most important thing to highlight here is CFO Todd Morgenfeld’s comments during the earnings call on the biggest contributors to the 5% YoY decline.

These year-over-year declines were most pronounced for our web users, which dropped approximately 30% year-over-year, while our global mobile app users remain far more resilient, growing 8% year-over-year.

It’s worth noting that in the US and Canada, our mobile app users were flat sequentially, which was a particularly positive signal during our seasonally weakest quarter of the year for engagement. It’s important to note that our global mobile app users represent well over 80% of our revenue and our impressions. So resilience with mobile app users is an important signal for financial performance and capacity.

This is something often missed by Pinterest investors. MAUs have been falling, but the decline is predominantly coming from web-based users, whereas mobile app users are generally more resilient & also contribute to the majority of revenue. This resilience is demonstrated by the fact that mobile app MAUs grew 8% YoY; a very positive sign!

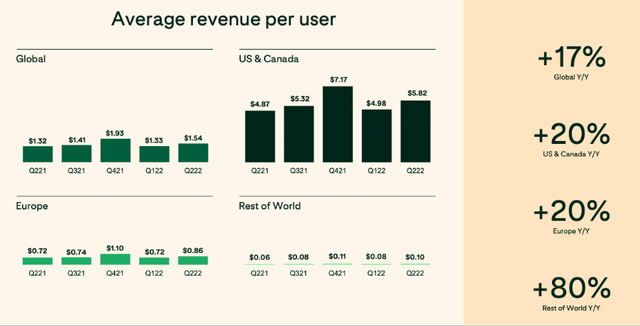

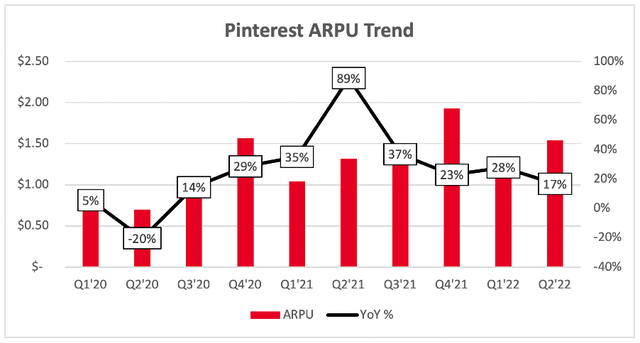

Another positive is Pinterest’s ARPU, which continues to grow at a rapid pace. This explains why Pinterest has still been consistently growing revenues despite losing MAUs, as it is able to extract more and more value from its Pinners.

Pinterest Q2’22 Results Presentation

The 80% YoY growth rate in RoW ARPU is especially promising. It may only be coming off a small base, but RoW users made up over half of all MAUs in the quarter – so if Pinterest can continue to grow that ARPU at a rapid rate, then RoW could become a very meaningful driver of revenue growth.

Pinterest Q2’22 Results Presentation

Times They Are A-Changin’

In a recent article, I focused on the announcement that Pinterest Co-Founder Ben Silbermann would be stepping back from his role of CEO & transitioning to the newly created role of Board Executive Chairman. His replacement, Bill Ready, is an ecommerce specialist who boasts CEO roles at both Venmo and PayPal (PYPL) on his CV, with his most recent role being the President of Commerce at Google (GOOGL).

I think that he is the perfect CEO to lead Pinterest’s transition from social media to a social commerce company, & I am excited to see what he will bring to the business – but I’m not the only one.

Elliot Management, one of the world’s largest activist funds, recently took a substantial stake in Pinterest which led it to become the company’s largest investor. On 1st August 2022, they released the following statement outlining their rationale for this investment:

Pinterest is a highly strategic business with significant potential for growth, and our conviction in the value-creation opportunity at Pinterest today has led us to become the Company’s largest investor. As the market-leading platform at the intersection of social media, search and commerce, Pinterest occupies a unique position in the advertising and shopping ecosystems, and CEO Bill Ready is the right leader to oversee Pinterest’s next phase of growth. We commend Ben Silbermann and the Board on the leadership transition, and we look forward to continuing our collaborative work with Ben, Bill and the Board as they drive toward realizing Pinterest’s full potential.

This is another promising sign, and further validation of investors’ optimism surrounding Bill Ready’s leadership & the potential of the Pinterest platform.

Also, not that I’d want to play into any sort of speculation, but The Wall Street Journal reported on 26th July that Elliot Management had also taken a stake in PayPal. Pinterest investors will remember the share price spiking back in October following rumors of a takeover from PayPal, so now there is a question about whether or not Elliot Management will be playing matchmaker between these two businesses?

As a Pinterest shareholder, I hope not, since I feel like the business has more than enough potential as a standalone company – but after a difficult 18 months, I would not be completely averse to a substantial premium on its current share price.

Valuation

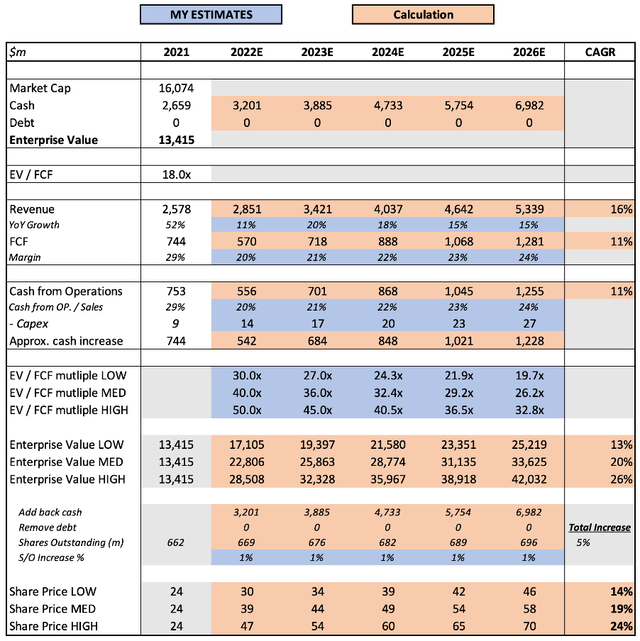

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Pinterest is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

All my assumptions for this model can be found in my previous article. I have only updated the enterprise value details in line with these latest results & the implied market capitalization, and I have also updated by 2022 YoY growth forecast from 15% to 11%, driven by the muted outlook for Q3 & I assume beyond.

Put all that together, and I can see Pinterest shares achieving a 19% CAGR through to 2026 in my mid-range scenario.

Investment Thesis: On Track, With Fewer Yellow Flags

In truth, my investment thesis was never really busted, even as Pinterest went through a difficult 2021. MAU growth was never the basis of my thesis, but losing 47m MAUs from Q1’21 to Q4’21 was undoubtedly a yellow (if not a red) flag, despite the decline being driven by the unusual impact of lockdowns & then an easing of restrictions. The fact that MAUs are now steadying is a great sign for this business.

My thesis has remained on track, however, because ARPU has been consistently growing. I invest in Pinterest because I believe that it is the most monetisable social media platform out there, and the growing ARPU is validating this thesis quarter after quarter.

The new CEO should only help to further Pinterest’s social commerce ventures, and I for one cannot wait to see what he brings to the table. In short, my thesis remains on track, and I truly believe this quarter could be the start of a new era for Pinterest.

Be the first to comment