ProfessionalStudioImages/E+ via Getty Images

It’s always great to get some upside from a company that you bought stock into. What makes it even better is when this upside occurs in a very short time after the stock was initially purchased. However, it can also be tricky to know whether to hold on after the fact or to sell some or all of your position in order to lock in gains. This might be one of the questions that some investors in LKQ Corporation (NASDAQ:LKQ) are kicking around after shares of the company have, over the past two months, risen quite nicely compared to the broader market. If anything, this type of question has probably become even more relevant given the firm’s mixed performance for its most recent quarter and considering what’s going on in the vehicle market. But given how shares are priced today, it does appear that further upside could be on the table. And because of that, I have decided to keep my ‘buy’ rating on the firm for now.

A look at recent events

On May 22nd of this year, I published an article about LKQ Corporation that worked upon the company in a favorable light. This came after it became clear that revenue with the company was slated to continue rising this year but also as profitability was starting to suffer some. Ultimately, I based my decision on how cheap shares were, both on an absolute basis and relative to similar businesses. And at that time, I reiterated my ‘buy’ rating on the business, saying that it still represented an attractive opportunity. Since then, this play has worked out nicely. Shares of the firm are up by 13.7% compared to the 4.8% return generated by the S&P 500 over the same timeframe.

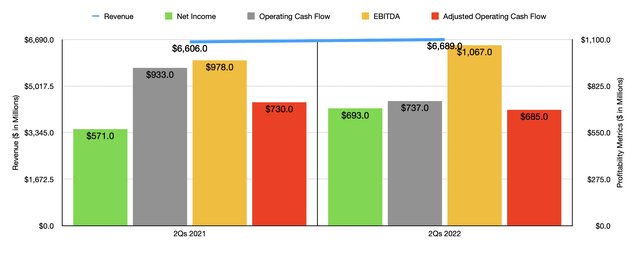

It’s very important to note that this strong performance compared to the broader market did not come from strong fundamental performance across the board. In some ways, the company actually saw some weakening in the second quarter of its 2022 fiscal year, which is the only quarter that we now have data for that we didn’t as of the last article I wrote about the business. Take, as an example, revenue. During the quarter, sales came in at $3.34 billion. That’s 2.7% lower than the $3.44 billion generated the same time one year earlier. This was driven by three main factors. One of them was a hit caused by foreign currency fluctuations to the tune of 5.6%, while the second was a 1% decrease caused by certain asset divestitures. The third was a modest decrease caused by changes in commodity prices that hit the ‘other revenue’ category to the tune of 2.9%. Actual organic revenue associated with parts and services managed to rise by 3.8% year over year. Even with this weak quarter, total revenue for the first half of the year came in strong at $6.69 billion. That represents an increase of 1.3% compared to the $6.61 billion generated just one year earlier.

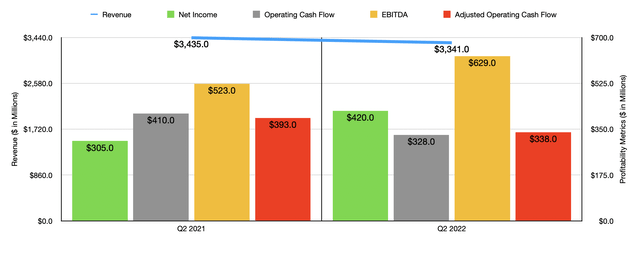

Although revenue for the company was weak in the latest quarter, profitability was somewhat mixed. Net income came in strong at $420 million. That’s 37.7% higher than the $305 million generated just one year earlier. It is worth noting, however, that this improvement was not because of operational concerns. Instead, it was because of a $154 million swing in games associated with the disposal of businesses. Actual margins for the company did decline year over year, with gross margin falling from 41.2% of sales to 40.9%, while selling, general, and administrative costs increased from 26.2% of sales to 26.8%. Even so, a gain is still a gain and, for the first half of the year as a whole, net income of $693 million beats out the $571 million achieved at the same time one year earlier.

There are, of course, other profitability metrics that we should pay attention to. One of these is operating cash flow. During the latest quarter, this came in at $328 million. That’s down from the $410 million generated just one year earlier. Even if we adjust for changes in working capital, the metric would have fallen from $393 million to $338 million. Meanwhile, EBITDA for the company managed to increase some, climbing from $523 million to $629 million. Although performance has been mixed, management did say that the company experienced significant inflationary pressures, supply chain disruptions, and volatile commodity and currency markets in the latest quarter. This seems to be a new trend for the business, as can be seen when looking at data covering the full half of 2021. Of course, this has not stopped the company from continuing to put the cash that it does generate to work. In the latest quarter, for instance, the company bought back 8.1 million shares for a combined $404 million. That brings total share repurchases for the first six months of the year to 10.8 million shares for $548 million.

When it comes to the 2022 fiscal year as a whole, management still expects revenue to climb by between 4.5% and 6.5%. This matches prior guidance released by the company. Earnings per share, meanwhile, should come in at between $4.09 and $4.29. Despite the troubles the firm has experienced in this space, this still represents an improvement over the prior expected range of between $3.57 and $3.87. Given the company’s current share count, this should translate to net income of roughly $1.18 billion. The company is also holding its guidance for operating cash flow steady at roughly $1.3 billion, while EBITDA should come in at around $1.74 billion.

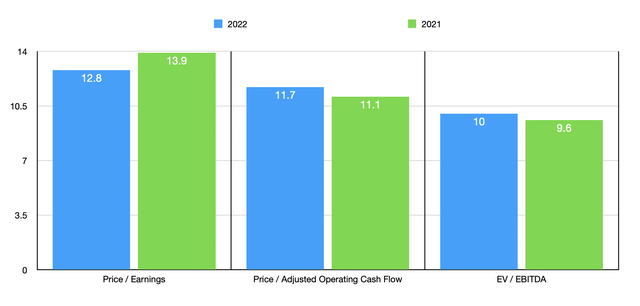

Based on these data points, shares of the company still look quite cheap. On a forward basis, the firm is trading at a price-to-earnings multiple of 12.8. This is down from the 13.9 reading that we get if we rely on 2021 results. The price to adjusted operating cash flow multiple should be 11.7. That’s actually up from the 11.1 reading that we get if we use 2021 figures. Meanwhile, the EV to EBITDA multiple should climb from 9.6 to 10. To put the pricing of the firm into perspective, I decided to compare it to the same four firms that I compared it to in my last article. On a price-to-earnings basis, these companies ranged from a low of 19.2 to a high of 22.3. The price to operating cash flow multiple of these firms was between 12.7 and 16. And the EV to EBITDA multiples should be between 13.5 and 15.8. In all three scenarios, LKQ Corporation was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| LKQ Corporation | 12.8 | 11.7 | 10.0 |

| Genuine Parts Co (GPC) | 19.8 | 13.9 | 13.5 |

| O’Reilly Automotive (ORLY) | 22.3 | 15.5 | 15.8 |

| AutoZone (AZO) | 19.2 | 12.7 | 13.8 |

| Advance Auto Parts (AAP) | 21.7 | 16.0 | 14.1 |

Takeaway

Based on all the data I’m seeing right now, LKQ Corporation continues to impress me. Although fundamentals have been somewhat mixed and I expect this trend to continue, shares are cheap on both an absolute basis and relative to similar firms. Absent some major change in guidance from management, I do think that the outlook for shareholders is positive. Yes, the easy money has likely been made. But so far, it does look as though further upside might be on the table. And because of this, I cannot help but to retain my ‘buy’ rating on the company for now.

Be the first to comment