FG Trade

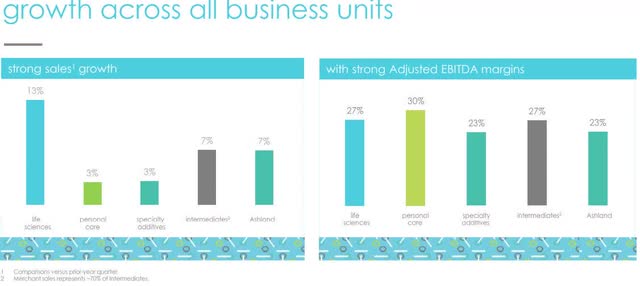

Ashland Inc. (NYSE:ASH), which provides additives and specialty ingredients around the world, delivered a solid fiscal fourth quarter, with all its segments contributing to the results, led by Life Sciences, which generated 13 percent revenue growth in the reporting period.

Among the positive contributors to the performance of the company in the reporting period among its several segments were improved product mix, pricing power, record number of product launches and wider margin. Negative catalysts were currency headwinds, supply constraints and higher energy costs.

Take note that these various catalysts were spread across different geographies and segments of the company, meaning there were different impacts on the performance of the units of the company under different circumstances.

In this article, we’ll look at its latest earnings report, break down some of its performance among the different segments, and take a look at how the next year or so looks.

Recent numbers

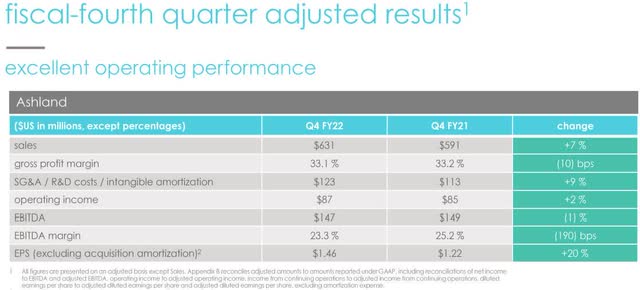

Revenue in the fiscal fourth quarter was $631 million, an increase of $40 million, or 7 percent year-over-year, beating slightly by $723k.

Full-year revenue was almost $2.4 billion, up 13 percent from full-year 2021.

Net income was $57 million, or $1.04 per share. EPS in the reporting period was $80 million, or $1.46 per share, up 20 percent from the same reporting period last year.

Adjusted EBITDA in the quarter was $147 million, down 1 percent from $149 million in Q4 2021. EBITDA margin was 23.3 percent, a drop from the 25.2 percent in EBITDA margin for the fourth fiscal quarter of last year.

Gross profit margin was 33.1 percent, a little down from the 33.2 percent in the first quarter of 2021.

Free cash flow in the reporting period was $93 million, down from the same quarter last year primarily from higher input costs and raw material inflation.

Cash and liquidity as of the end of the quarter stood at $1.3 billion. Net debt at the end of the fourth fiscal quarter was $624 million.

Guidance for fiscal 2023 are for revenue to come in at a range of $2.5 billion to $2.7 billion. Adjusted EBITDA is projected to be from about $600 million to $650 million.

Those numbers are predicated upon the fact there is no way of knowing the degree of the headwinds the company faces over the next year. Assuming things remain close to where they are today at the macro level, those numbers should be close to how it plays out.

If the company executes at or near those levels, it’s going to do very well under the significant headwinds it currently faces, including economic, currency and geopolitical.

Breaking down the segments

All the segments of ASH did well in the fourth fiscal quarter, and we’ll give a quick breakdown of each on in this section of the article.

Life Sciences

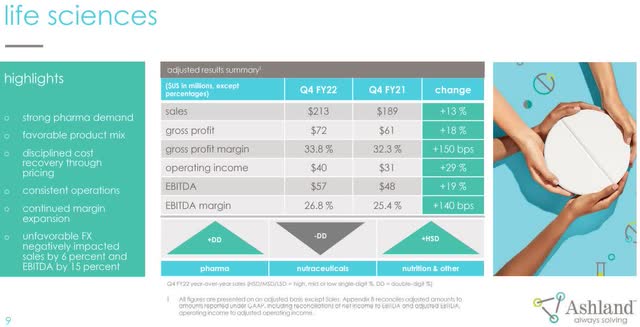

Based upon revenue, Life Sciences led all of Ashland’s segments, with sales of $213 million in the reporting period, up $24 million, or 13 percent year-over-year. The segment was led by strong demand in the pharma industry.

Gross profit in the quarter was $72 million, up $11 million or 18 percent over Q4 of 2021. Gross profit margin was 33.8 percent, up 150 bps from the 32.3 percent from the fourth fiscal quarter of the same reporting period last year.

EBITDA was $57 million, up 19 percent from the $48 million in EBITDA year-over-year. EBITDA margin in Life Sciences was 26.8 percent, an increase of 140 bps of 25.4 percent last year in the same quarter.

Catalysts for the positive performance there were a favorable product mix, solid pharma demand, no significant disruptions at its plants, pricing power, and widening of margin.

Personal Care

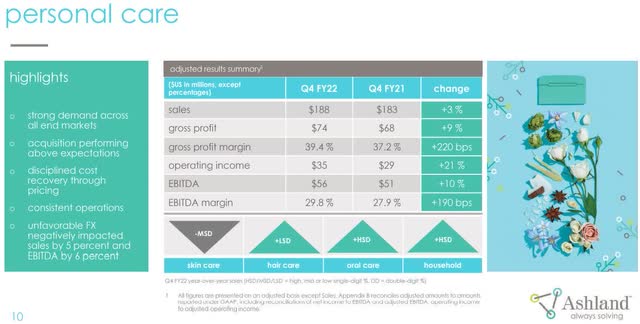

Even though revenue in Personal Care was up a modest 3 percent to $188 million in the quarter, management noted that there was significant organic demand at all its end markets, and its acquisition of the microbial protection was doing better than company expectations.

Adjusted EBITDA was up 10 percent to $56 million, and adjusted EBITDA margin increased to almost 30 percent. The boost in adjusted EBITDA in Personal Care led the company in that category for the quarter.

Gross profit was $74 million, up 9 percent from the $68 million of gross profit in Q4 2021. Gross profit margin in the quarter was 39.4 percent, up 220 bps from last year’s 37.2 percent in the same reporting period.

Along with an increase in demand across all its end markets and its acquisition outperforming, other catalysts were pricing power and no meaningful operational delays.

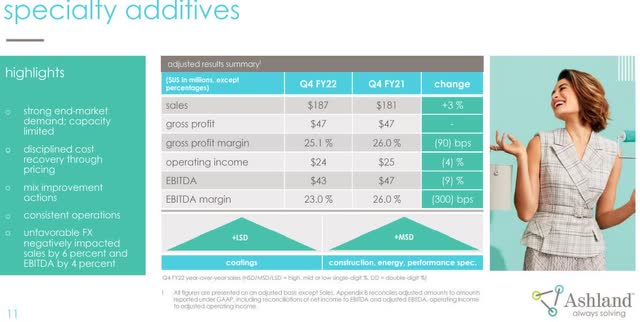

Specialty Additives

Specialty Additives probably struggled to gain traction in the quarter more than the other segments because of capacity restraints and FX effects that limited total sales potential.

As for capacity restraints, that was higher operating and energy costs at its European cellulosic manufacturing facilities; that’s likely to continue in 2023.

In the reporting period revenue came in at $187 million, up 3 percent year-over-year, with adjusted EBITDA falling by 9 percent to $43 million. Adjusted EBITDA margin dropped to 23 percent because of the aforementioned increase in operating costs.

Gross profit in Specialty Additives fell 90 bps to 25.1 percent, against the 26 percent in the same quarter last year.

Intermediates

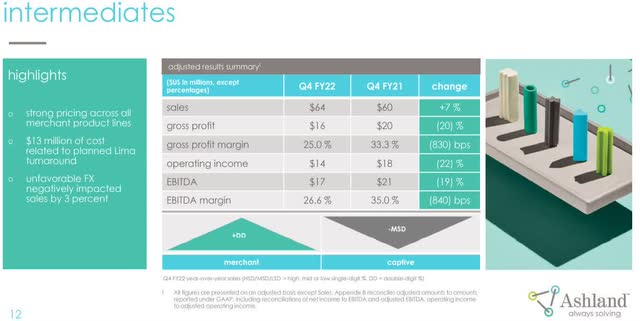

Outside of Life Sciences, Intermediates had the best quarter as measured by revenue and adjusted EBITDA. The segment had record sales of $64 million, up 7 percent from the $60 million in revenue from the same quarter of 2021, which was attributed to improved product mix and pricing power.

The $13 million in spend on its Lima, Ohio facility during the fourth fiscal quarter resulted in EBITDA of $17 million in the quarter, down $4 million, or 19 percent from the fourth fiscal quarter of 2021. EBITDA margin in the reporting period plunged to $26.6 percent, down 840 bps from the 35 percent of EBITDA margin produced in the fourth fiscal quarter of 2021.

This is likely to be a one-off anomaly and should show improvement in the next quarter.

Conclusion

Based upon the good but constrained results in the quarter, ASH looks like it’s going to face similar headwinds going forward, and if they don’t get worse in any meaningful way, the company should perform at a similar level as it did in the fourth fiscal quarter, based upon percentage of growth in its various metrics and its different segments.

I like the idea that the company introduced a record number of new products that have a lot of upside growth potential. It appears to me, at least in the first half of calendar 2023, that the strong U.S. dollar is going to be an ongoing headwind for the company, and until that changes, it’s going to deflate otherwise solid results.

And with an abundance of liquidity and the company still throwing off a lot of cash flow, there is more than enough cushion to endure a prolonged period of slow economic growth, while at the same time investing in growth projects and initiatives.

I don’t see anything that will be extraordinary in the performance of ASH going forward, but I do believe it’s a solid, safe play that also pays out a modest dividend. It’s not as easy to find companies like this under current market conditions as it may seem.

For that reason, I believe ASH is worth taking a close look at as a defensive play that has the potential for incremental long-term growth while generating some income for shareholders.

Be the first to comment