pengpeng/iStock Unreleased via Getty Images

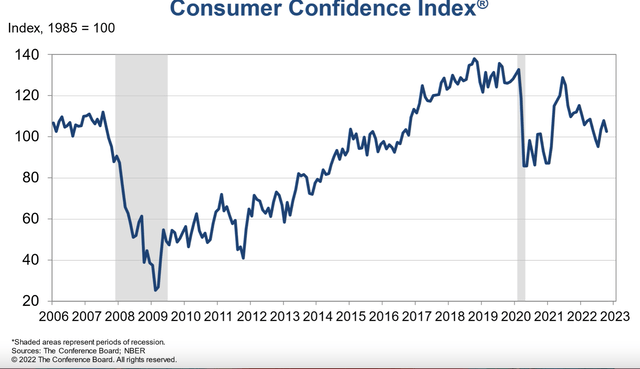

Consumer discretionary stocks haven’t exactly had their best year in 2022. The price-to-earnings (P/E) ratio for the sector is 13.2x, which is way below that for the S&P 500 (SP500) at 20.8x. This isn’t a surprise, though. Runaway inflation, rising interest rates, and an uncertain economy have taken their toll on consumers’ wallets and even more so on consumer confidence. The U.S. Conference Board Consumer Confidence Index had fallen by 11.5% in October from the end of last year.

For the medium-to-long-term investor, however, this could be a good time to buy otherwise healthy companies while they are undervalued. This brings me to the owner of well-known brands like Wrangler and Lee, Kontoor Brands, Inc. (NYSE:KTB). It’s hard to miss that its P/E ratio is even lower than that for the consumer discretionary sector at 10x. This could, of course, be because the stock’s genuinely undervalued right now, or its fundamentals might be weak, which are keeping investors at a healthy distance from it. Which of the two is it? And what does it mean for the stock’s future? This analysis unpacks the KTB story.

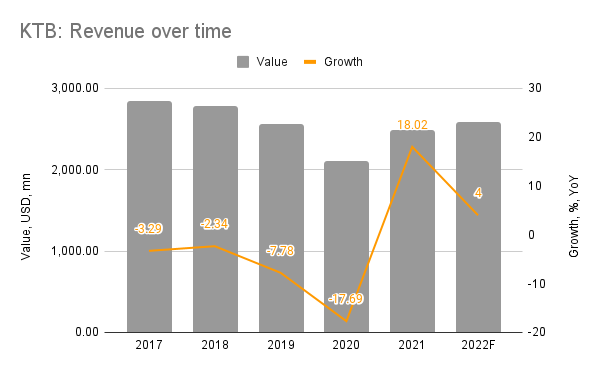

Weak revenues

The company’s revenue picture over the years isn’t pretty. In the five years of 2017-2021, it has seen exactly one year of revenue growth – 2021. And this too was because of a low base in 2020 as a result of the pandemic. Compared to 2019, its revenue was down by 2.9%, indicating continued weakness. However, just because a company has failed to perform in the past doesn’t mean it won’t in the future either. And indeed, KTB’s revenues for the first nine months of 2022 have risen by 6% as the first two quarters of the year showed positive growth, making up for sales contraction in the third quarter, which it says is on account of COVID-19-related restrictions in China and inventory rebalancing by US retailers.

However, going by the company’s projections of a 4% revenue growth in 2022, which is below what we’ve seen for the first nine months of the year, indicates it is penciling in another quarter of a ~1% drop in revenues for the final quarter of the year. KTB sees macroeconomic pressures, especially inflation, to continue weighing on sales. This is also indicative of the conditions that might affect revenue in 2023.

Kontoor Brands, Seeking Alpha, Author’s Estimates

The U.S., which is its biggest market with a ~75% share in revenue, is expected to slow down further. The IMF predicts that growth in the U.S. will slow down from 1.6% in 2022 to 1% in 2023. The blow might be softened by the forecast decline in inflation and following from there the pace of rate hikes can slow down too, which could buoy consumer sentiment to some extent. Besides this, the Chinese economy is also expected to pick up, which might have a positive though relatively limited impact considering its relatively small share in the revenue. Overall, though, some drag could persist though.

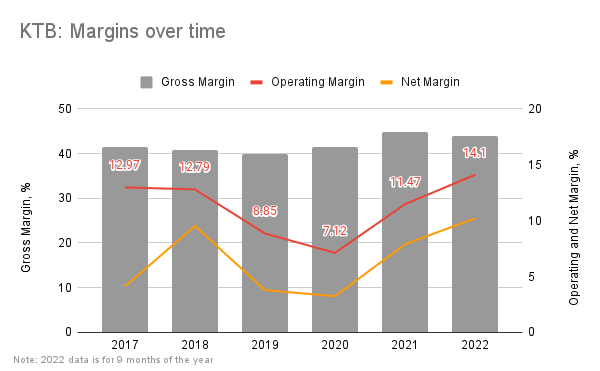

Strong margins

It’s notable, however, that despite disappointing revenue trends, Kontoor Brands has not just managed to clock net profits but also grow them at a CAGR of almost 11% over the last five years. Its net margin commensurately jumped from 4.1% in 2017 to 7.9% in 2021 and was an even higher 10.1% for the nine months of 2022. At 14.1% its operating margin for the nine months of 2022 is also better than it has been in years. In fact, its TTM EBIT margin is also much higher than that of the consumer discretionary sector at 8.1%.

Kontoor Brands, Seeking Alpha, Author’s Estimates

While the company’s gross margins have been slightly impacted by inflationary pressures on “input costs, inventory provisions, elevated ocean freight rates, and foreign currency,” it also notes where it has been able to manage its cost better. It mentions “strategic pricing, channel and product mix, as well as moderating transitory cost such as air freight” in this regard. The cost of revenues hasn’t declined in the latest quarter as much as revenues have, which explains the decline in gross margin, but operating costs declined sharply by 14% resulting in a healthy operating margin. To my mind, this reflects well on the company’s ability to manage itself even during challenging circumstances like the ones we are seeing presently.

Manageable debt

Healthy margins are particularly helpful right now considering KTB’s elevated debt to equity at 3.96x. If it was loss-making or had been so far a few years, this number would be a definite red flag because it could bring at least the sustainability of its capital structure into question. However, besides earnings, its interest coverage ratio is also strong at 10x as per the latest report and its current ratio too is at a comfortable 2.1x.

What the market multiples say

Based on its key financials, it’s clear that the weakest aspect of the business is its sales. Interestingly enough, though, its price-to-sales (P/S) at 0.9x is a little higher than that for the consumer discretionary sector. Its price-to-earnings (P/E) at 10x is lower by comparison, with that for the sector at 13.2x as noted earlier. On average, some upside is indicated for the stock, especially considering that it pays a dividend. Its dividend yield isn’t bad at all either, at 4.5% TTM.

What next?

At the same time, the risks to Kontoor Brands’ stock are amply clear. We are not out of the woods by a long shot as far as macroeconomic concerns are concerned. If inflation doesn’t decline consistently, if the COVID-19 drag returns or even if there’s any other cause for stock market uncertainty, this is exactly the kind of stock that is likely to get impacted. I like how Kontoor Brands has managed itself at this time, and, in good times, it would be a Buy for me. But right now, there are other alternatives that are faster-growing and safer options to buy. I’d Hold Kontoor Brands, Inc. for now.

Be the first to comment