JJ Gouin/iStock via Getty Images

(This article was co-produced with Hoya Capital Real Estate.)

Last Thursday, November 10, the latest CPI report was released. Here is one brief excerpt from the BLS summary.

The all items index increased 7.7 percent for the 12 months ending October, this was the smallest 12-month increase since the period ending January 2022.

No sooner had the report dropped than the stock market went on a tear, with the S&P index soaring some 6.52% over the next 2 trading sessions, and the Nasdaq easily besting even that, with a 2-day gain of 9.37%.

As a recent retiree, I took advantage of the opportunity to raise a significant amount of cash in my personal portfolio. As of market close on Friday, November 11, my overall cash position in all accounts sat at some 22.4%. In my investment account, from which come the funds to cover my current living expenses, I raised this all the way to 38.55%. In the ETF Reliable Retirement Portfolio, which in many ways mirrors my personal portfolio, I brought the cash level to 10%. One slight difference between this model portfolio and my personal portfolio is that I generally keep the model portfolio close to 100% invested, so the raise to 10% cash is a departure from my normal practice.

It may be the case that I am a little early in doing so. As I write this the afternoon of Monday, November 14, the S&P index closed the day’s session at 3,957.25. Some pundits have predicted that a strong year-end rally could take us to the 4,150 range or perhaps even a little higher. So, I may end up leaving a little money on the table, even if I am right in the big picture.

But that’s OK with me. You see, early last week, even before the release of the CPI report, I spent a fair amount of time reading current outlooks from investment professionals whom I respect. And the conclusion I personally come to is that the market may have gotten a little ahead of itself. Let me do my best to explain why.

Why I Believe We May Be In the 5th Inning

In the title of the article, and again in the heading of this section, I chose to use a baseball metaphor that I believe has applicability.

While I believe most readers understand the metaphor, let me briefly explain for those who may not. In baseball, barring a tie, the game lasts 9 innings. As such, the 5th inning represents approximately the midpoint of the game. At that time, there is so much about the outcome that is unknown. For example, even if one team has a lead, the quality of its relief pitching may be poor. As a result, the remaining 4 innings may prove to be a real adventure.

Back in August, I wrote an article entitled ‘The World Of 4,818 Faces An Uncertain Future’.

By “the world of 4,818,” I am referring to the confluence of circumstances that culminated with the S&P 500 reaching its all-time high of 4,818 during the trading session of January 4, 2022. Interestingly, my recent reading more or less expanded on, or crystallized, the same themes I wrote about in that article. Let’s now get into some of these uncertainties, one by one.

FACTOR 1: Current Market Declines Mainly Reflect Rising Interest Rates and Monetary Tightening

Here’s the first concept to consider. While it is the case that, until late last week, we found ourselves in a bear market in the S&P 500 index, an argument is made that this simply reflects a higher discount rate.

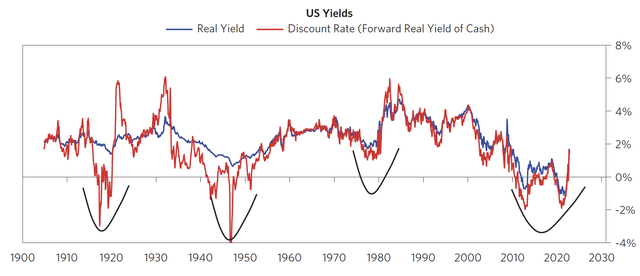

Take a look at the following graphic.

U.S. Interest Rate Yields (Bridgewater Associates, LP)

As featured in my “world of 4,818” article, for several years we had what some refer to as a “Goldilocks” environment. Following the Global Financial Crisis of 2009, in addition to lowering short-term interest rates to zero the Fed engaged in what is known as quantitative easing (QE). Even through the COVID pandemic, with its associated massive stimulus, the Fed left monetary stimulus in place through the entirety of 2021, contending that such inflation would be “transitory” in nature. It was not until February 18, 2022 that the Fed approved a 1/4 percent interest rate hike.

As displayed in the graphic above, this effectively led to a discount rate of more or less zero. Not at all surprisingly, the price of all sorts of risk assets soared.

Now, however, risk assets such as equities have to compete against cash and short-term assets yielding in the ballpark (pun intended) of 3%. As such, prices of risk assets must decline to a level at which investors are willing to forego the risk-free rate on cash and purchase such assets.

FACTOR 2: From Globalization to De-Globalization

Again, in my “world of 4,818” article, I featured recent epochal changes on the world scene. In Ukraine, the largest ground war is being fought since World War II. Commentators suggest that this was inspired by Vladimir Putin’s world view of a Russia that assumes its rightful place in the world, as leader of a Eurasian empire that stands in opposition to the “decadent” west.

Meanwhile, China, under Xi Jinping, appears to be bent on reversing what Chinese refer to as the “Century of Humiliation“. Just today, Joe Biden and Xi Jinping met face-to-face for the first time to discuss, among other things, the highest level of tension between the U.S. and China over Taiwan in modern history.

In short, the “friendly” (at least on the surface) environment of globalization that led to lowered prices and greater growth for rich and poor countries alike has been replaced with de-globalization. This is both inflationary and suppressive of growth, and it doesn’t appear the environment will be reversing to the way it was anytime soon.

FACTOR 3: Recession and Declining Corporate Profit Margins

As featured in a recent article from CNBC, corporate profits, at least so far, have been surprisingly robust. One of the undercurrents of the current inflationary environment that has generated some level of consternation, and even controversy, is that many companies appear to have been successful in passing along higher costs to consumers in the form of higher prices.

However, it is not at all clear that this can continue to be the case. Almost all analysis I have read posits that we are facing at least some level of recession. Almost certainly, this will be accompanied by a decline in corporate profits.

In addition, I referenced the increase in interest rates as factor 1 above. Corporations will be affected by this as well, adding to their cost profile and therefore lowering profits. A recent report from Elliott Management goes so far as to suggest that this factor could lead to a surprising number of bankruptcies.

Already, there seems to be some evidence that companies are recognizing this. You may have read that Meta recently laid off some 11,000 employees. A report that surprised me even more came this morning, when the New York Times reported that Amazon is planning to lay off some 10,000 employees in corporate and technology jobs, citing anonymous sources with knowledge of the matter.

A CNN article highlighting that report offered this additional detail.

Last month, Amazon founder Jeff Bezos tweeted about the possibility of a looming recession, writing, “the probabilities in this economy tell you to batten down the hatches.” In an interview with CNN’s Chloe Melas on Saturday, Bezos said that advice was meant for business owners and consumers alike. “Take some risk off the table,” he said. “Just a little bit of risk reduction could make the difference.” (Bold mine)

FACTOR 4: Decline and Even Collapse of Housing Prices

Since homes are a much larger source of household wealth, this 4th factor could lead to a far greater loss of wealth for U.S. households than losses in the stock or bond markets.

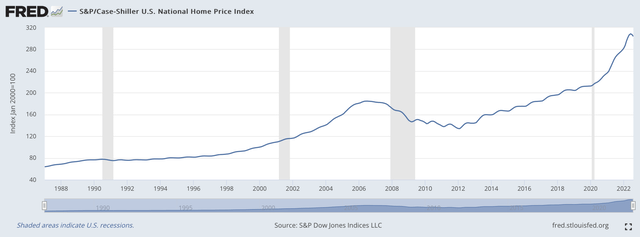

Take a look at the below graphic featuring the Case-Shiller U.S. National Home Price Index.

S&P/Case-Shiller U.S. National Home Price Index (St. Louis Fed (FRED))

During the 3-year period from July, 2019 – July, 2022, this index shot up by 45.3%. Combine that with mortgage rates that have more than doubled during that period and you have the fastest and largest rise in home unaffordability in history. The same report from Elliott Management referenced above observes that they think it highly likely that home prices retrace part or all of that boom surge.

Here’s one additional piece of information to consider. In an article I wrote some time back, I referenced a note from Zoltan Pozsar, Investment Strategist at Credit Suisse, that intimated that the Fed would be comfortable with some level of decline in the housing market, as this would have the effect of deflating U.S. household balance sheets and, in turn, helping to control inflation.

FACTOR 5: Cryptocurrency, Derivatives, And Other Wild Cards

I won’t dwell too much on this one, but here are two brief observations to consider.

First, in the U.K., newly-elected Prime Minister Liz Truss was forced to resign her office after only 45 days in office. One of the biggest reasons for this was that a “growth plan” full of unfunded tax cuts caused a panic among bondholders. In turn, and due to use of derivatives, the U.K defined-benefit pension plan ran out of cash to meet margin calls, sending bond prices into a “death spiral.”

Secondly, and just last week, FTX, one of the biggest and most powerful players in the cryptocurrency industry, collapsed with stunning speed. While we are still early into this story, and the full ramifications are not yet known, some industry insiders have said the company’s downfall had triggered a “Lehman moment,” referring to the 2008 collapse of the investment bank that sent shockwaves around the world.

Think of these as wild cards. One of the side effects of the excessive monetary stimulus of the past few years is that all sorts of assets have been bid up, including some that are extremely speculative.

Playing The Remaining Innings

All of the above naturally leads to a question. If, using my metaphor, we are in the 5th inning of the game, how should I position myself for the remaining innings? I don’t claim to have all the answers, but here is how this retiree is planning to play it.

Keep A Healthy Cash Reserve – As I mentioned above, cash and short-term assets are currently generating a return of roughly 3%. While it is true that this return will likely trail inflation to a certain degree, it gives you what some have called optionality. In other words, the ability to keep your options open, watch how things develop and have funds available if and as opportunities present themselves.

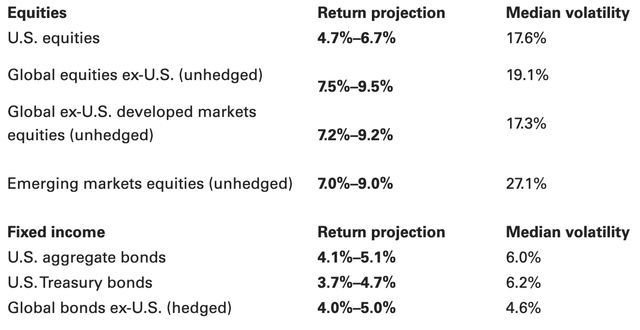

Stay Diversified, Including Bonds – Rather than writing a ton of words in this section, how about I share a picture instead? Take a look at this, from a November, 2022 market perspectives update from Vanguard.

Asset Class Return Outlooks – As of November, 2022 (Vanguard Research)

As can be seen, Vanguard suggests that global equities, both developed and emerging, may offer greater potential for return than U.S. equities, with only slightly higher volatility. Further, given the sharp drop in bond prices thus far in 2022, bonds actually offer the potential for positive real returns for the first time in years.

Consider Deploying That Cash At Predefined Price Points – One of the things I have been doing in my personal portfolio is setting good-till-canceled limit buy orders on total-market U.S. and foreign ETFs, at multiple predefined price levels and with a larger number of shares as the levels get lower.

As just one example, I have limit buy orders starting at roughly 5% below current prices on SPDR S&P 500 Trust ETF (NYSEARCA:SPY) and continuing down to a level that would approximate roughly 3,450 on the index, about 14% below where we sit at present.

For me, this takes emotion out of the equation. I do the best I can to make a rational decision based on my outlook, and then live with it. What, though, if I am wrong and the market continues to the upside. Here, particularly as a retiree, I bear something known as the marginal utility of wealth in mind. Essentially, this concept asks the question: “Even if I generate excess gain by assuming excess risk, will it make a meaningful difference in my lifestyle?” The flip side, of course, is that such risk can also generate excess loss, with a negative effect on one’s lifestyle.

I hope this article at least offers a perspective to think about. Please, take a minute to share a comment below. I’d love to hear your view on what I have shared.

Be the first to comment