Dragon Claws/iStock via Getty Images

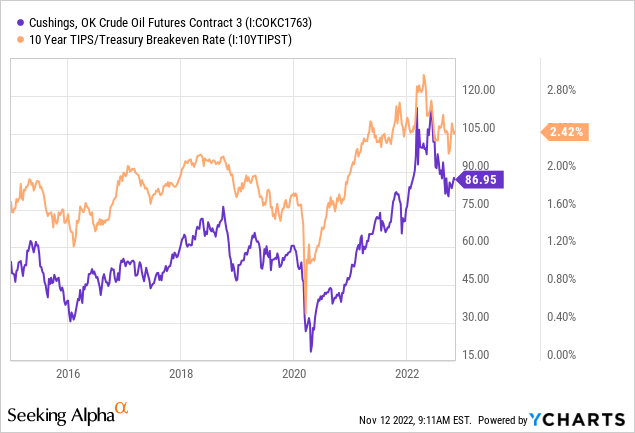

Crude oil is the most critical commodity impacting markets today. The price of oil drives transportation and energy costs. Higher energy costs increase not only fuel’s “price at not only the pump” but also virtually all goods due to transport costs. As such, the long-term inflation outlook closely tracks the immediate price of crude oil. In reality, crude oil may have a more significant impact on inflation than the Federal Reserve’s changes in short-term borrowing rates since the correlation between oil and the inflation outlook is so strong. See below:

The bond market’s implied 10-year average inflation rate is 2.4%, while crude oil is at ~$87. When crude oil was around $110, the expected long-term inflation rate was closer to 3%, well above the Fed’s 2% target. Of course, the expected inflation rate was well-below target levels for many years before 2021, when crude oil was below $75.

The strong relationship between oil and expected inflation indicates that more rate hikes are likely if oil rebounds and vice versa. The price of crude oil generally fluctuates with economic demand, so eventually, higher interest rates are likely to lower the demand for crude oil (through indirect means). In the US, there has not yet been a decline in the demand for crude oil and petroleum products. Although there was a slight decline in “products supplied” this spring, when fuel prices were high, it quickly reversed when oil declined.

Of course, many other factors impacting crude oil supply and demand are outside the Federal Reserve or any US entity’s control. One major factor that has weighed on oil has been China’s heavy-handed and seemingly unending COVID lockdowns. These restrictions have lowered China’s consumption of oil products and other commodities. Recently, China announced plans to end its lockdowns, leading to sharp rallies for commodities. Of course, China has ended and quickly restarted lockdowns before and may do so again. Since lockdowns have caused the country significant economic damage, I believe the change may be permanent – increasing China’s fuel consumption.

The potential end to China’s restrictions comes just as the United States ends the record release of its Strategic Petroleum Reserve and distillate inventories reach extreme lows. Further, US, and potentially global, oil production may be set to decline as drilling activity slows and OPEC+ pursue cuts. On top of that, the US dollar is showing solid signs of peaking, potentially exacerbating a price rally for crude oil as it falls. With this in mind, I believe there is ample evidence to suggest the price of crude oil could rise dramatically over the coming months. Investors and speculators may benefit from this opportunity through the crude oil futures ETF (NYSEARCA:USO).

US Oil Inventories Set To Collapse

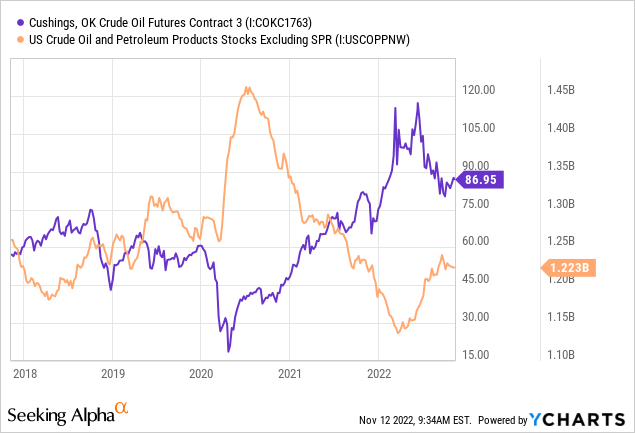

The price of crude oil is strongly associated with commercial inventory levels. These exclude storage in the government’s SPR supply. Since crude oil is usually quickly turned into refined products after it is released from inventory, artificial changes in the supply can create short-term gluts, mainly because refining capacity is limited. Since spring, crude oil prices have moderated while total commercial oil (and product) inventories have risen sharply. See below:

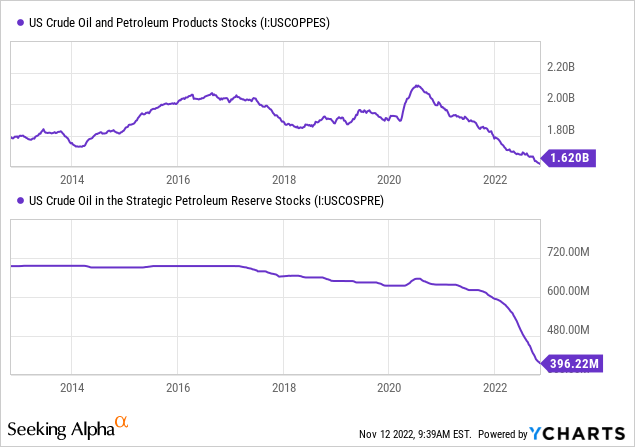

Crude oil inventories did not rise due to a significant increase in production. In fact, there has been virtually no output growth over the past six months. The increase in commercial inventories is entirely due to the sharp decline in SPR stocks, which has created a temporary glut in the oil market – exacerbated by a lack of refining capacity. Total oil and petroleum product inventories have declined to relatively extreme historical lows as the SPR falls to a ~50-year low. See below:

This week, the Biden Administration released its last batch of oil from the SPR reserve, ending one of the most significant artificial increases in commercial fuel supplies. Some of this oil will not reach the market until late November to December after the last extension, but the bulk of the release is effectively over. There is some speculation that the administration will decide to continue the release for some time due to low production levels; however, I greatly doubt this would last due to limited remaining SPR supplies. In reality, SPR oil supplies are meant for crises of dire need and not a means to stop a rise in the oil price, so continued withdrawals seem unwise in light of the global geopolitical situation with Russia (and others).

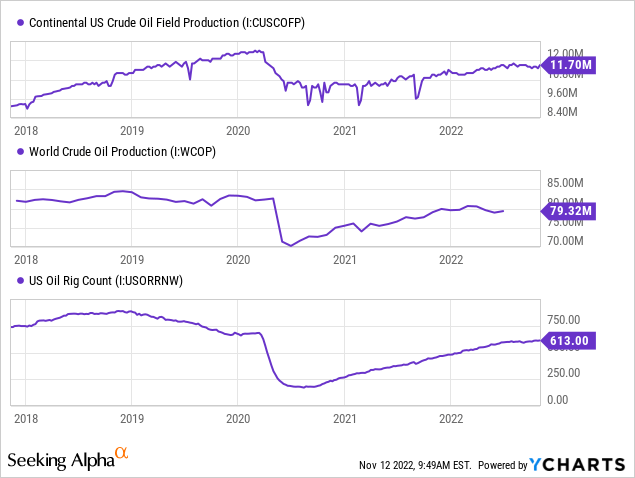

US and global oil production remain below 2019 peak levels while demand, at least in the US, is roughly as high as ever. International production levels are low for various reasons, including issues with OPEC’s output (likely labor and materials shortages) and the situation with Russia and Ukraine. These factors have led to sharp increases in US exports of oil and petroleum products, particularly distillates – leading to growing US diesel shortages. More recently, US output growth has stagnated amid a plateau in the US rig count. See below:

The US rig count indicates future production growth via drilling activity. The count is slightly below 2020 levels which were already significantly below the 2014-2016 “shale boom” levels. Notably, oil wells experience significant declines in production during their first years of output. The US saw significant drilling growth during the 2010s, causing well productivity to rise. However, as those wells age, oil output per well is now falling considerably, meaning significant new drilling will be needed to maintain a flat output level.

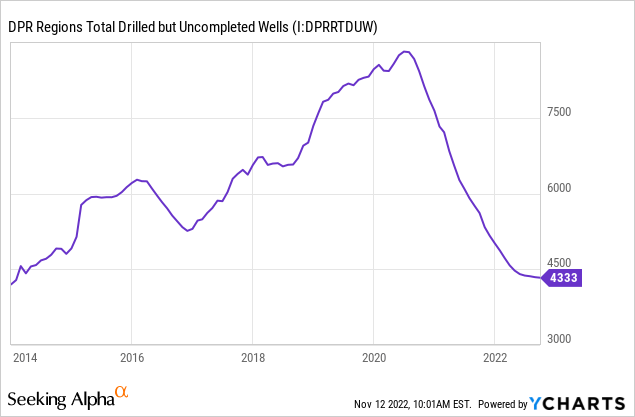

Since 2020, Oil producers have had challenges expanding output due to sizeable skilled labor and parts shortages and financial needs to reduce CapEx after years of losses. To grow production, many oil producers have utilized “drilled-but-uncompleted” wells already drilled before 2020. As you can see below, the supply of these “DUC” wells has run low:

In the future, oil producers will need to raise drilling activity (rig count) more dramatically to grow or even maintain production levels. Given low CapEx spending targets on behalf of most oil producers, it seems very unlikely this will occur. Persistent labor shortages and dramatically increased capital financing costs also act as headwinds to drilling expansion. Of course, the Biden administration is also opposed to “new drilling” (although there is always some new drilling), signaling regulatory headwinds in production expansion.

The oil market is often caught up in political and emotional turbulence that can cloud rational analysis. Based on the critical data, it appears very likely that the US and global oil shortage will grow over the coming months due to this confluence of factors. At this point, a significant global recession is likely the only major factor that could stop or slow an oil shortage. While numerous negative economic signals exist, US oil consumption remains near record levels. As such, I believe oil demand will only decline after prices rise significantly.

Falling US Dollar May Exacerbate Oil Rally

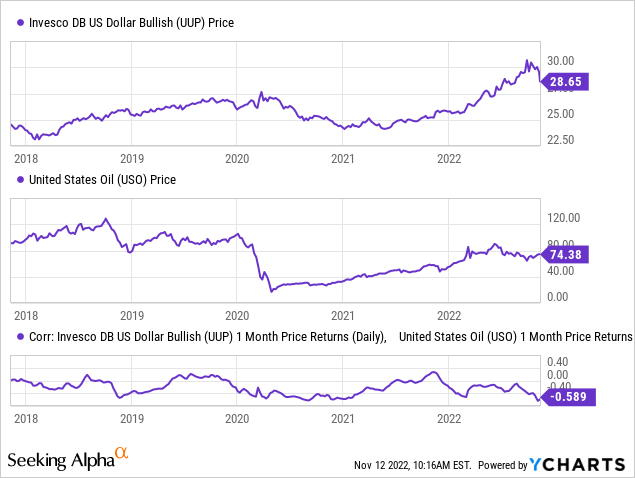

The price of crude oil fell since spring primarily due to the SPR release, which (artificially) ended the acute oil shortage. Secondarily, the relative value of the US dollar compared to most foreign currencies rose tremendously. While oil is generally priced in US dollars throughout the world, the rising dollar likely had a negative price impact since it increased foreign fuel costs (in foreign currencies). Indeed, there is a relatively strong negative correlation between the oil futures ETF (USO) and the US dollar index ETF (UUP). See below:

The US dollar sharply declined in recent days following FX intervention from Japan, followed by the low US CPI (indicating fewer rate hikes) and news signaling the reopening of China’s economy. The US dollar lost nearly 6% of its value last week, an extremely large decline for the FX market. The most extreme shift was the sharp ~8% decline in the USD-JPY exchange rate, potentially signaling the end of the Japanese Yen’s immense depreciation.

The US dollar strengthened in 2022 as the Federal Reserve was more hawkish than its foreign counterparts, creating a large dollar shortage as investors and banks preferred it for its higher yield. With the US CPI moderating and foreign inflation indices worsening, the trend seems likely to reverse, potentially creating a rush away from the US dollar as the Fed becomes less hawkish. In my opinion, it is not necessarily likely that US inflation has peaked, nor that the Fed will stop rising interest rates due to the potential upcoming rise in crude oil and fuel prices. That said, such a change will roughly impact all countries equally, creating no significant currency impact. With that in mind, I believe the US dollar may plummet against other currencies as the Fed becomes less hawkish than its foreign peers.

The massive decline in the US dollar we saw last week may indicate a very sudden and large reversal for the dollar. If the tides change, many trillions of US dollars in overseas banks could repatriate quickly. If the US dollar exchange rate falls, then most commodities, including oil, should rise at a more rapid pace – particularly if US exports rise higher as the dollar falls. I believe this factor is less critical for oil than the broader production shortfall, but it may compound potential gains in USO.

Last Chance To Jump On USO?

I’ve generally taken a bullish long-term view on oil over the past year and have looked for value opportunities in the sector when prices declined earlier this year. Today, crude oil and USO have begun to reverse higher. Given the numerous bullish catalysts facing oil, I believe this trend will continue and accelerate through year-end as commercial inventories fall without SPR supplies or new production growth.

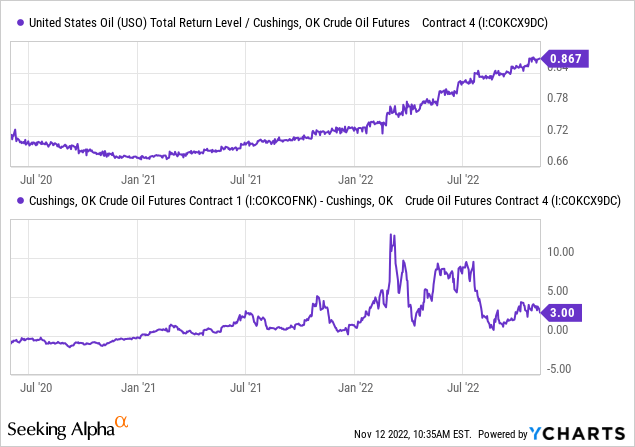

Today, USO is a great way to benefit from the potential rise in crude oil due to the oil market’s persistent backwardation. USO owns an array of near-term oil futures contracts and, historically, pays more for new contracts (as its holdings expire) due to “contango” in the crude futures market. Contango is more common when high storage levels increase storage costs priced into the oil futures curve. Despite temporary help from SPR supplies, the crude oil futures market remains in “backwardation” when futures contracts are cheaper the further they expire. This can be measured by taking the price difference between near-term and longer-term oil contracts. As you can see below, USO generally outperforms the oil futures price when backwardation is larger:

The concept of “roll yield,” or the opposite, “time decay,” can confuse investors but is somewhat important regarding ETFs like USO. To simplify, when the oil market is in a persistent glut (high inventories), USO will tend to underperform the oil price, leading to a decay in its value. Conversely, when oil is in a shortage (low inventories – such as today), USO will tend to outperform the spot price of oil consistently. In today’s situation, oil’s spot price is ~12% discounted a year out, giving USO an effective 12% “roll yield” added return. I expect this yield may rise over the coming months if the end of SPR withdrawals exacerbates the shortage as I expect.

Overall, I believe the fundamental oil situation, the dollar’s technical position, and the USO’s future mechanics make the fund a very attractive short-term opportunity. Indeed, given the potentially growing oil shortage and possible fall in the dollar, I would not be surprised to see crude oil make a new all-time high by next year ($140+). USO’s chief risk is a significant decline in economic demand for oil; however, I believe it is more likely that oil demand will slide following another large price rally that hampers central banks’ ability to moderate inflation.

Be the first to comment