Marcio Silva

Following a better-than-expected CPI report on November 10, the S&P 500 Index (SP500) surged 5.5%, registering its largest one-day gain since 2020. Even more impressive, the rally extended into the next trading session, with the SP500 finishing up another 0.9% to close just a few points under the 4,000 level mark. Equity market bears are struggling to understand the reasons behind this forceful rebound in the S&P 500. At the time of writing, new analyses published after the rebound appear to remain overwhelmingly bearish.

While some argue that inflation is still way too high and that the Federal Reserve will again remind market participants that further monetary tightening is necessary, others claim that this is just another round of short covering. After all, there is little evidence to suggest that the worst is over for the U.S. economy, and surely there is no reason to think this is anything more than just a bear market rally. Right?

The problem with these arguments lies in the assumption that some evidence of a healthy economy, or at least the absence of major economic risks, must precede bull markets.

Bull Markets Are Born In Chaos

Historical observations of equity market cycles suggest that more often than not, the early beginnings of a bull market were accompanied by economic uncertainties, earnings downgrades, and pessimistic sentiment. Conversely, bull market peaks were often accompanied by healthy economic outlooks, strong corporate earnings, and overwhelmingly bullish sentiment. This counterintuitive nature of financial markets is why investing is so challenging for the majority, even for professional fund managers.

What is unsettling and uncomfortable for investors often turns out to be the correct thing to do when it comes to financial markets. In fact, there are trading strategies that are based simply on taking the opposite side of what the majority of investors are positioning for, especially when those positions become heavily skewed. Such trading strategies are appropriately named “contrarian strategies”.

Interestingly, if we base our investment decisions using this principle of doing what is uncomfortable, then the most uncomfortable thing to do right now must be to hold onto gains in anticipation of even larger gains. Or worse, to start buying now if we missed the bottom in October. Doing so feels like a gut-wrenching violation of our innate mental programming to preserve gains and avoid risks. Indeed, many cognitive biases and heuristics that have been carefully studied and documented in the field of behavioural finance prove how these biases constantly work against investors.

Don’t get me wrong, I am certainly not recommending that investors should simply do what feels the most uncomfortable for them or be blindly contrarian. Instead, we simply propose that investors be more aware of the cognitive biases that could prevent them from investing objectively. A simple way to block out cognitive biases as much as possible is to adopt an evidence-based approach to investing. And history offers some of the most valuable evidence and lessons for success.

The Odds Favour The Bulls, Not The Bears

There are simple reasons why it is much more advantageous to be a bull than a bear.

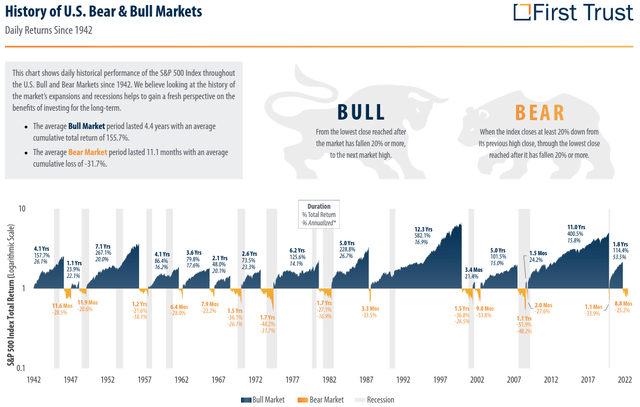

Firstly, the S&P 500 spends a large majority of its time in a bull market. According to a study by Hartford Funds, over the last 92 years of market history, the S&P 500 Index has been on the rise around 78% of the time. That means if there are no real reasons to believe that equity markets will be starkly different from the past 92 years, then long-only investors (perma-bulls) already have the odds stacked heavily in their favour versus the bears. Below is a chart showing this bullish bias of equity markets.

Secondly, bear markets tend to be much more volatile while bull markets have enjoyed extended periods of low volatility with equity prices rising steadily over time. The most commonly cited explanation for this characteristic of equity markets is risk aversion. Simply put, investors tend to be more patient when prices are rising but make a dash for the exit when prices fall. Thus, it is not only challenging to get a good price when selling because markets move really fast, but it is also crucial to be an early seller. An extremely challenging task compared to the buy-and-forget investor. We suspect this requirement to be fast is why many investors eventually evolve into day traders.

Lastly, bulls are incentivised to stay invested in the market, while bears are incentivised to stay out of the market. For a bull, it is necessary to buy and own shares in order to profit from subsequent increases in price. In contrast, precision in market timing is crucial for a bear due to the reasons we have discussed above. With the market rising 78% of the time, shorting a stock means you did better be sure you are catching the 22% window when prices fall. Because timing is so crucial for bears, they are incentivised to stay out of the market until the time is perfect to short. Even if a bear doesn’t take short positions, but merely tries to time market bottoms to go long thereafter, she is still incentivised to wait for the market to bottom. The principle behind compounding returns over time works exclusively for the bulls.

So What Is Next For The S&P 500?

I hope I have made a convincing argument for readers to be a bull rather than a bear. It may feel extremely challenging to be a bull at this time, especially given that inflation is still high, the Fed is still hiking rates, and almost every CEO is hinting at a recession ahead. Worse, the S&P 500 has already gained 11.6% from the October 12 low (14.4% if measured from the intraday low).

For the bulls, the game plan is simple: Hold and keep buying. If we are right that this is the beginning of a bull market, then we can expect to enjoy strong returns for years to come. If we are wrong and the market makes a new low, we just keep buying. Keep allocating a portion of your income each month into stocks. Bear markets don’t last long anyways.

For the bears, the best they can probably hope for is that this is 2009 all over again and they can expect to make a juicy 30%+ gain. If they are wrong, however, they might have to wait several years (possibly even a decade) for the next bear market. Best of luck to the bears, because they will need it.

But please, just don’t be a perma-bear.

Be the first to comment