kynny/iStock via Getty Images

Introduction

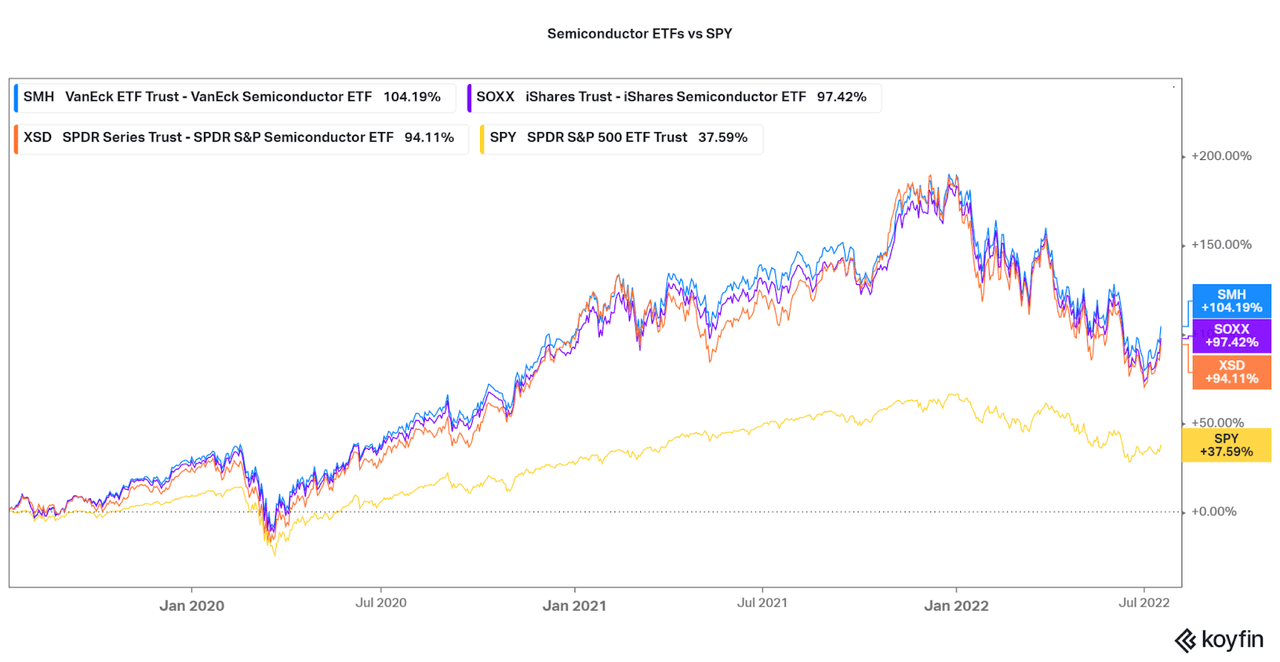

Using an ETF such as the VanEck Vectors Semiconductor ETF (NASDAQ:SMH) is a safe way for part-time individual investors to gain exposure to this incredibly important industry. I personally believe that SMH is the best ETF compared to the iShares Semi (SOXX) and SPDR Semi (XSD) due to a favorable expense ratio and exposure to ADRs of foreign leaders Taiwan Semi (TSM) and ASML (ASML). Although, there is little difference between the collection (as shown in the chart below), and this article can apply to any industry ETF. I hope to provide insight on how to take advantage of this rapidly growing sector by looking at supply fundamentals.

Koyfin

For passive investors, it may be difficult to understand the fundamental performance of the industry without performing extensive research on the multiple top holdings. Instead, look to the foundation of the industry in the manufacture and sale of raw silicon wafers. This will help to maintain the right expectations, even as the market may seem to expect otherwise. Enter Sumco (OTCPK:SUOPY), one of the world’s major silicon wafer suppliers. This article will showcase how to read Sumco’s financials to determine the health of the semiconductor industry. Why Sumco? Well, I will let the Japan Times set the narrative:

Sumco Corp., a key supplier of silicon wafers for the semiconductor industry, said it has already sold out its production capacity through 2026, a sign shortages in the industry may not abate for years.

The Japanese company, one of a handful to provide the specialized silicon slabs that chipmakers use to create their designs, has orders to cover all output of its 300 mm wafers for the next five years, it said after reporting earnings on Wednesday.

It is not taking such long-term orders for 150 mm and 200 mm wafers, but demand is likely to keep surpassing supply for years to come, the company said. The price of wafers rose by 10% in 2021 over the previous year and Sumco expects to see increases continue until at least 2024.

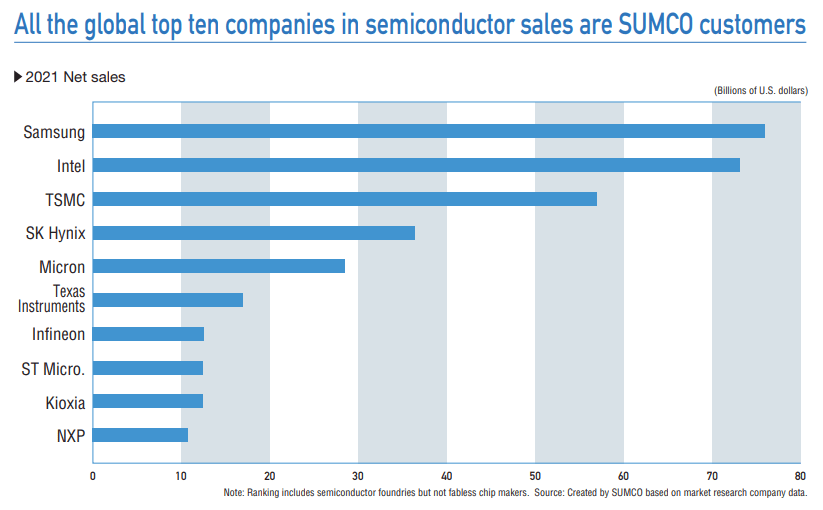

That’s right, Sumco has sold out their production capacity until 2026 thanks to long-term contracts with clients. Who are these clients? Well, they include all top ten foundries in the world: Samsung (OTCPK:SSNLF), Intel (INTC), TSMC, SK Hynix, Micron (MU), Texas Instruments (TXN), Infineon (OTCQX:IFNNY), ST Micro (STM), Kioxia, NXP (NXPI), and more. Notice something? Most of these companies are in the top 10 holdings of semi industry ETFs as well. Considering Sumco is backed up until 2026, I would say the industry is quite healthy at the moment. However, as I will discuss next, investor sentiment may be the issue at heart.

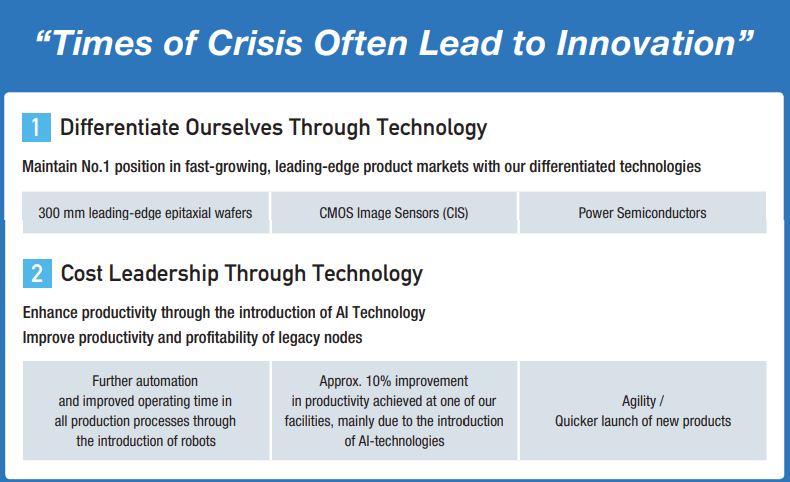

Sumco Sumco

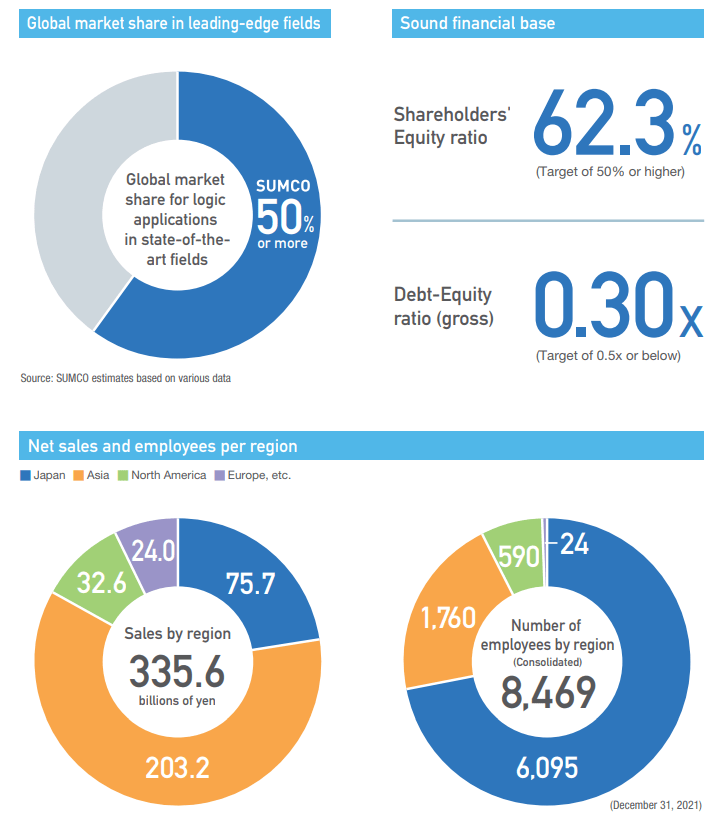

Other reasons why Sumco is a great indicator of industry success is their exposure to the latest technological advancements, rather than cheaper commodity chips. In fact, Sumco is the leader in advanced chips for applications in computing, CMOS (imaging for cameras, etc.), and even power semis (solar panels). Sumco is extremely focused on supplying the leading semis, but this works to our advantage. Thankfully, Sumco’s leadership has produced an extremely favorable financial situation thanks to high revenue growth, improved profitability, and a healthy balance sheet. Also, as sales are geographically diversified, as shown below, there is little financial risk to worry about that may cloud our entire industry outlook analysis. As the Japan Credit Rating Agency puts it:

The semiconductor market remains favorable against a background of changes in social environment and expansion of demand base. Supply and demand for wafers has also been on a tight trend, and it is highly likely that these conditions will continue for the time being. In making its decision to expand its facilities, it is considered that the Company has concluded long-term agreements with large customers for longer periods than in the past, which will continuously improve its ability to generate cash flow.

As the semiconductor market is expected to expand over the long term, the Company is more likely to be able to maintain a strong presence in the industry, while fulfilling its responsibility to supply wafers. JCR also believes that the Company will be able to maintain a sound financial position even as it makes large-scale growth investments through public offering.

Sumco

How to Determine Outlook

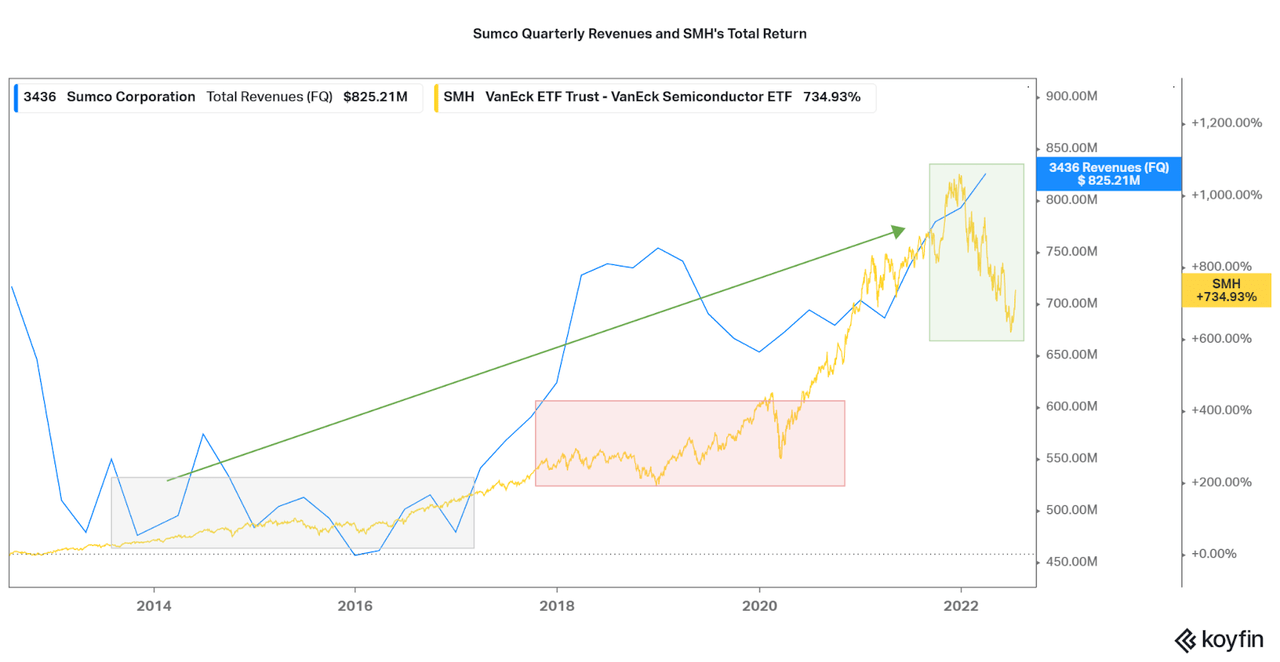

To understand the future, we must understand the past. While historical performance is no indicator of future performance, I will begin by looking backwards to find patterns that we can follow. By comparing Sumco’s quarterly revenues and SMH’s total return over the past 10 years, I noticed three major patterns.

-

First, a period of consolidation from 2013 to 2017 where both Sumco and SMH see mild growth, shown in gray.

-

Second, a period of overexuberance followed by a significant decline. Interestingly, the worst total return performance was seen as Sumco reached a peak in revenues.

-

Third, the current extreme volatility event as SMH has fallen 25%+ while Sumco has yet to find a peak in revenues.

Tying together all three patterns is strong underlying organic growth (green arrow). Both Sumco and SMH have risen steadily over the past 10 years, spurred on by digitization across every aspect of our society. In the past, periods of consolidation were brought on by holding patterns in demand, as evident with flat revenue growth. Then, quick bullish cycles in the semi industry lead to significant outperformance for a year or so. I would recommend being aware of these patterns, as investors can take advantage and maneuver their holdings accordingly. The first takeaway would be to be aware of overoptimism and trim your holdings in a semi industry ETF as Sumco reaches a peak in revenues. Then, when industry sentiment creates a disconnect between revenue performance and valuation, begin adding back to your position.

Koyfin

This brings us to 2022, where semi industry valuations have fallen to decade low levels off the back of incredible performance in 2020 and 2021. While Sumco has yet to reach a peak in revenues (meaning they are still selling wafers), investors across the industry remain bearish on growth. SMH has fallen 27% from the peak in late 2021, while the cycle in 2018/2019 only saw a decline of ~24%. Also to note is that the trough in SMH share price occurs shortly after the peak in revenues, usually less than a year. This is why I believe that SMH’s current trading level offers another similar opportunity to 2019.

Also, when considering Sumco’s current sales are expected to remain strong, and that production is sold out until at least 2026, investors have to consider the possibility that the current discrepancy is a timely entry point. In the table below, I summarize future results from two other times when revenues were disconnected in a similar fashion (2011 and 2018-2019). As you can see, there may be some valuation, but investors are likely to see significant gains within just a few months to years. If you like to attempt timing the market, perhaps now is the time to begin adding shares. Then, if a consolidation period forms (like 2013-17), investors are able to accumulate more shares at a low price and benefit from the next bullish move.

|

Period |

Sumco Revenue Drop (quarterly, peak to trough) |

SMH Price Drop (%, peak to trough) |

SMH 6 Month Return (%, from trough) |

SMH 1 Year Return (%, from trough) |

SMH 3 Year Return (%, from trough) |

|

2011 |

50 |

21 |

25 |

15 |

75 |

|

2018-19 |

14 |

24 |

29 |

72 |

270 |

|

2020-present |

– |

27 |

– |

– |

– |

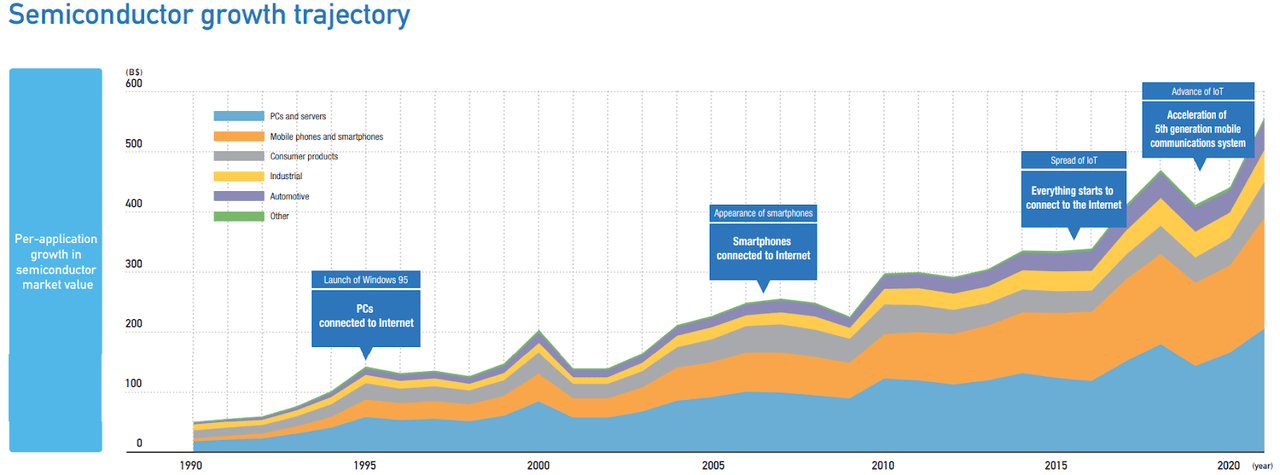

Secular Trends for Passive Investors

Timing the market too risky for you? Sumco also offers data on the secular rise of semiconductors thanks to both market analysis and company sales data. The most important chart to base an investment case is the historical growth of the semiconductor market. As shown in the chart below, a tremendous upward trend can be seen starting from the 90s, with only temporary, and mild, cyclicality disrupting the flow. Due to the increase in available applications for semiconductors thanks to cloud services, advanced vehicles, automation, and renewable energy, it is unlikely that this secular trend will unwind.

Sumco

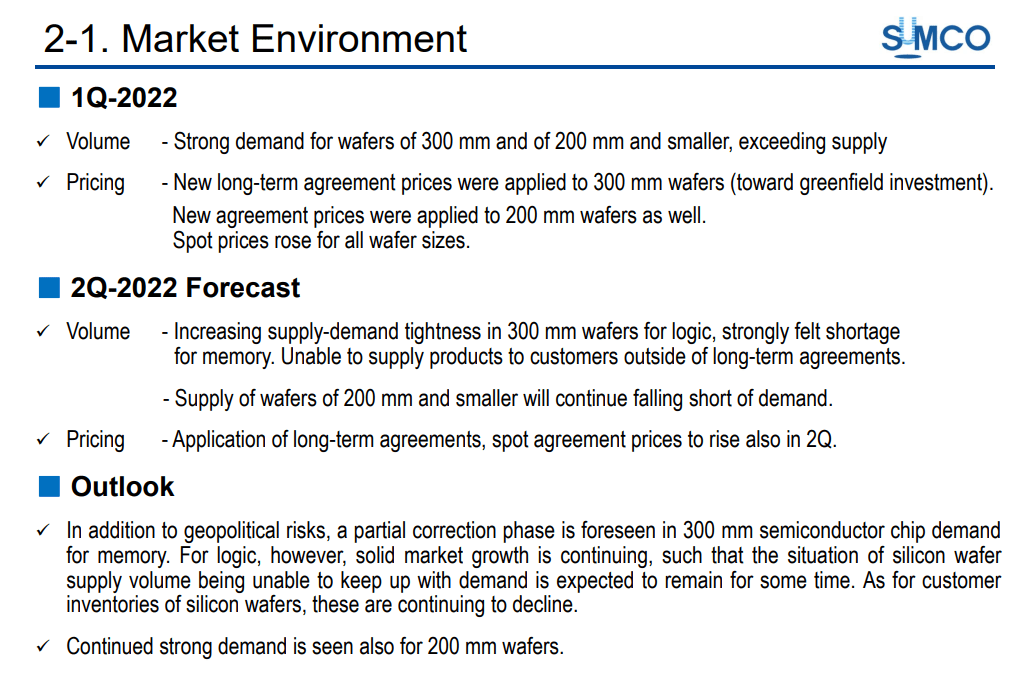

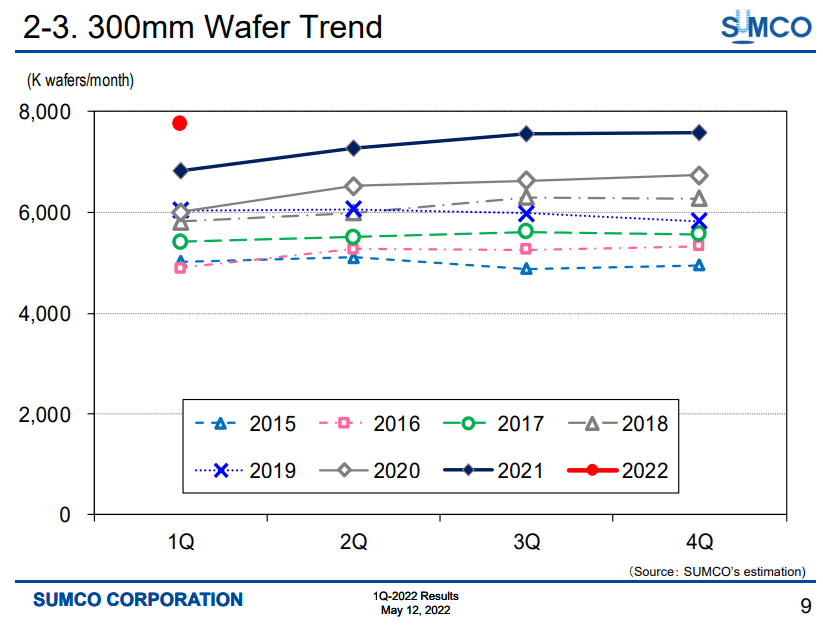

Other data points presented by management include direct wafer sales trends. As Sumco has tight relationships with the major foundries of the world, the company will be the first to announce any issues that might emerge for the industry. However, as shown in the growth of advanced 300 mm wafer sales, especially in the most recent quarter, there is no slowdown as yet. As long as Sumco continues to supply advanced wafers, the semi industry will be able to advance. I would recommend perusing each earnings presentation as the company offers many slides worth of cogent data and outlook expectations.

Sumco Sumco

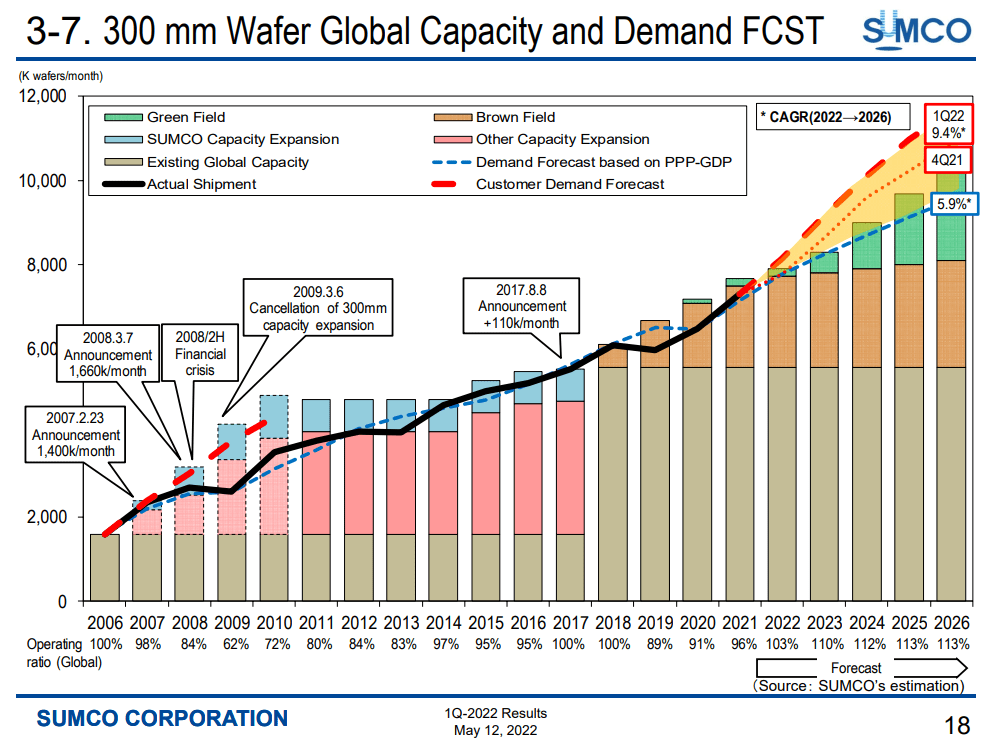

To end, I will quickly discuss Sumco’s operational outlook. As discussed, sales are contracted until 2026, but the company is also investing rapidly to expand production. Due to a strong Q1 of 2022, the company has also raised their customer demand forecasts for the next five years. In 2021, the company planned for $2.0 billion in investments for the future, and the company raised over a billion USD through a public offering at the end of the year. These funds are going towards a joint venture in Taiwan, the leading country for semi production. This is a positive sign of the times as other companies including Entegris (ENTG) and Japanese conglomerates such as Mitsubishi, Mitsui, and Hitachi invest in the region, as reported by Nikkei Asia.

Taiwan, meanwhile, is receiving fresh investment from numerous chip material makers. Formosa Sumco Technology, a joint venture between Taiwan’s leading petrochemical group Formosa Plastics and Sumco, the world’s second-largest wafer material maker, is building a NT$28.26bn ($1bn) plant in the Taiwanese city of Yunlin that will begin production in 2024. Mitsubishi Chemical, Mitsui Chemicals and Hitachi Chemicals are also expanding their manufacturing presence in Taiwan.

Sumco

Conclusion

While investors certainly spend hours and hours researching individual holdings in semiconductor ETFs like SMH, I find a simpler measure of the industry is by looking at wafer manufacturer Sumco. Passive investors can take periodic looks at the company’s provided outlook and estimations for solace about the rapidly growing industry. This helps to block out noise and worry, especially as the ETF falls over 25% from recent highs. At the same time, this decline is a pattern, and savvy investors would have trimmed during times of overenthusiasm. However, data suggests that the bottom may be in soon, and that significant returns are also in store. I will certainly be keeping an eye on how things progress, and will update readers as the need arises.

Thanks for reading.

Be the first to comment