dani3315

Market volatility can be painful, especially if one holds a basket of non-dividend paying growth stocks that are underwater. That’s why it pays to have portfolio stabilizers such as utilities that can withstand all-weather market environments. These names generally have far lower volatility than the market average, all while providing income to boot.

This brings me to the dividend aristocrat, Atmos Energy (NYSE:ATO), which has outperformed the market on both one-year and year-to-date bases. In this article, I highlight what makes ATO a good ‘all weather’ stock to own, so let’s get started.

Why ATO?

Atmos Energy is the largest fully regulated, natural gas-only distributor in the U.S. It’s headquartered in Dallas, Texas and serves over 3 million customers in 1,400+ communities across 8 states. It manages a proprietary pipeline and storage assets, including one of the largest intrastate natural gas pipelines in Texas. Atmos is member of the S&P 500 (SPY) and generated $3.8 billion in revenue over the trailing 12 months.

ATO’s pure-play focus on natural gas makes it well-positioned in a lower carbon future, as natural gas is far cleaner than coal, and should serve as an essential fuel source that complements the growth in renewable energy. This is supported by estimates from the US EIA, which projects that natural gas will remain the most consumed energy source in 2050.

ATO also has good diversification by customer type, with around 55% of its customer base being residential, 31% commercial & industrial, and the remaining 14% being comprised of transportation and wholesale customers. Moreover, Atmos operates in regions with favorable regulatory frameworks, and over 90% of its capital expenditures are generally recovered within 6 months. This quick payback period means less risk to its operating model.

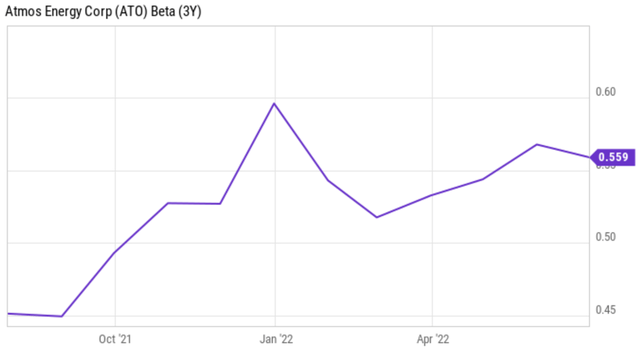

The steady nature of ATO’s business model has translated to lower volatility in its stock price. As shown below, ATO carries a 3-year in the 0.45 to 0.6 range, sitting well below the 1.0 market average.

ATO Beta (YCharts)

ATO continued to demonstrate healthy growth, with consolidated operating income growing by $3.3 million YoY to $385 million. Excluding one-time tax effects, adjusted operating income grew by a stronger $46.6 million YoY, driven by positive rate outcomes and customer growth in its key markets.

Looking forward, I see reasons to be optimistic, as ATO has strong prospects for growth that should flow to the bottom line. Moreover, its focus on natural gas makes it relatively immune to residential solar panels. These factors were reflected by Morningstar in its recent analyst report:

Atmos has a clear near-term growth trajectory. We estimate its annual capital investments will grow from $2.5 billion in fiscal 2022 to over $3 billion by 2026. This should nearly double Atmos’ rate base and support our annual earnings growth outlook at the high end of management’s 6%-8% target.

We expect earnings growth to trail rate base growth as we forecast the company will issue over $2.5 billion of common equity to maintain a strong balance sheet. Long term, we think growth will slow in part due to policymaking that aims to reduce fossil fuel use. Renewable energy and electrification continue to grow as gas substitutes. Unlike some of its peers, Atmos will not benefit from home electrification as it serves only natural gas customers.

Meanwhile, ATO maintains a strong A- rated balance sheet with a long-term debt to capital ratio of 47%. It also maintains strong liquidity, with $3.5 billion of available capital comprised of cash on hand and capacity on its revolving credit facilities. This lends support to its 2.4% dividend yield, which is well covered by a 49% payout ratio, 37 years of consecutive growth, and an 8.7% 5-year CAGR.

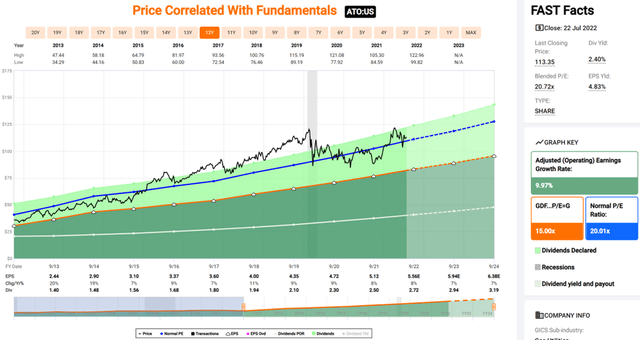

Admittedly, ATO isn’t cheap at the current price of $113, with a forward PE of 20.5, sitting slightly above its normal PE of 20.0 over the past decade. As such, value investors may want to put this on their watch list, as inflation and interest rate fears may help to drive the price down.

ATO Valuation (FAST Graphs)

Investor Takeaway

Atmos Energy is a well-positioned, diversified, and growing natural gas utility with a strong balance sheet. It should continue to benefit from the long-term growth in demand for natural gas, as well as the recent favorable rate outcomes in its key markets. While it isn’t cheap at the current price, I believe ATO has long-term upside potential for patient long-term investors. However, value investors may want to wait for a better entry point.

Be the first to comment