August Karlsson/iStock via Getty Images

Our Partnership Principles

We will communicate with you regularly and in a straightforward manner. We will not sugarcoat or exaggerate the truth. We will never promise what we cannot deliver. We will continue to keep a substantial percentage of our net worth invested along your side, as have many of our family members and friends. Rest assured that our interests are aligned with yours. We will strive to manage your capital to maximize long-term results and will gladly accept “bumpier” short-term results to achieve them. We will look at risk before return and will ignore high-risk opportunities regardless of potential payoffs.

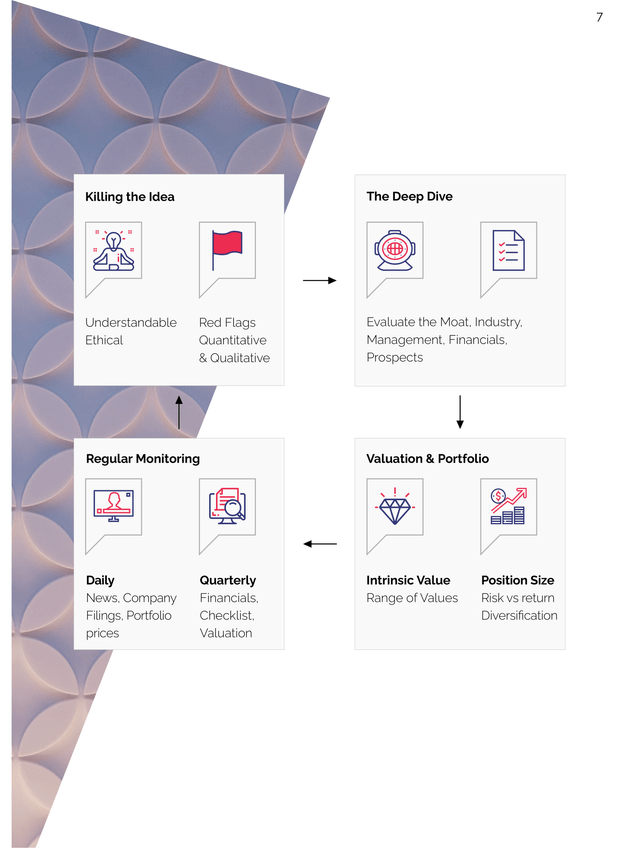

Our Strategy

We invest globally in great businesses that have durable economic moats, favorable customer economics, consistent financial results, high and stable returns on capital, strong cash flow generation, and attractive capital redeployment opportunities.

We do that by buying securities of great companies with able and shareholder- oriented managements, a conservative capital structure, and a strong track record of rational capital allocation.

We pay reasonable prices for these securities, giving us a margin of safety on our investment, and we place significant amounts of our capital into such rare opportunities and continue to own such companies as long as these conditions are satisfied.

We are patient and disciplined. We don’t view ourselves as investing in little pieces of paper that trade in markets. Behind every stock there is a real business and we, the shareholders, collectively own that business. This mental framework drives our decision-making process. Many in the investment field call us value investors, we call ourselves businesspeople.

Most of the time, the successful execution of our strategy requires us to act against the crowd. Or, in the words of Warren Buffett: “Be fearful when others are greedy. Be greedy when others are fearful.” Our edge over other market participants is in having a much longer investment horizon, better temperament, and the investment discipline to stay the course, especially in down and volatile markets.

Our Performance – General Commentary

“All else being equal, invest in the company with the fewest color photographs in the annual report.” Peter Lynch

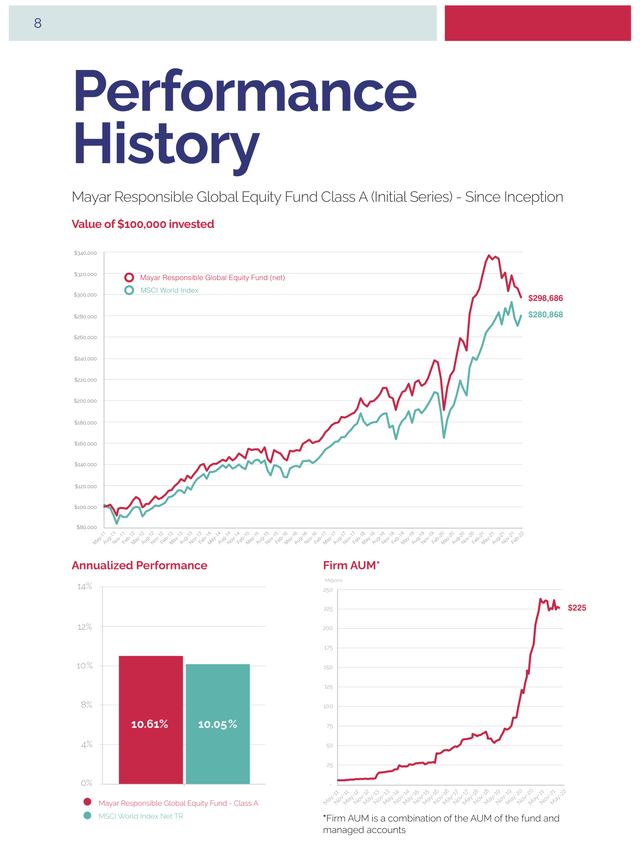

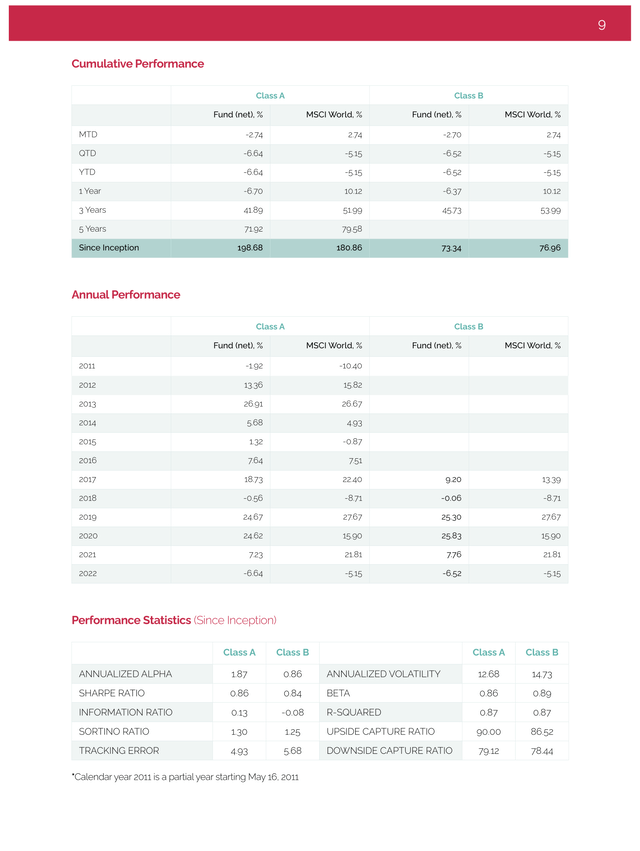

For the three months ending March 31, 2021, Mayar Fund (Class A) was down 6.6% net of all expenses and fees, while the MSCI World Index decline by 5.2% in the same period. Since its inception in May 2011, Mayar Fund has seen a 198.7% increase versus a 180.9% increase for the MSCI. That corresponds to a 10.6% annualized rate of return for Mayar Fund, compared to 10.1% for the MSCI.

It might seem absurdly obvious that when you buy a share of stock you become a partial owner of the company, and yet I find that most investors, even experienced ones, don’t really think or act as owners.

That might be one of the most important ideas to adopt as an equity investor. I was lucky to be exposed to it very early in my career through the writings of Peter Lynch and Warren Buffett. In addition to its big impact on how I analyzed the attractiveness of investments, the awareness of this fact also had a deep philosophical effect on how I viewed my responsibility as a shareholder. As a business owner, I felt morally responsible for the actions of my businesses. That belief became the basis of Mayar Capital’s Ethical Business-owner Approach™.

That ethical view of company behavior is now popularly known as Environmental, Social and Governance Investing, or ESG, for short.

To me, it seems obvious that the environmental and social factors are part of a company’s ethical behavior, regardless of whether or not the business owner assigned any importance to a wider definition of stakeholders. Furthermore, I would argue that the company’s self-interest and its impact on the environment and society do actually converge over the long term.

Governance, on the other hand, is of supreme importance to the self-interest of shareholders, both in the short- and in the long-run. As owners of an equity security that, unlike a bond, carries no contractually mandated payouts, good governance alone can ensure that the returns of the business go to all the shareholders instead of enriching only the management or a controlling shareholder. History is riddled with examples of great businesses that became bad investments due to bad governance.

Large helpings of cake

Unfortunately, the behavior of some actors in the investment industry has lately drawn some criticism to the issue of ESG investing. In typical Wall Street and London City fashion, the finance industry started with what was a fundamentally sensible idea and took it to its most absurd extreme.

Consultants, rating agencies and other “helpers” jumped on the bandwagon to try to get a slice of the hottest trending cake in years, offering a plethora of very profitable services (profitable to them, that is). Fund managers, concerned about their own careers, and cheered on by conformist institutional allocators, embraced the box ticking exercise and delegated — or abdicated — responsibility to these helpers, instead of using their own judgement, as they do when selecting investments. Helpers, virtually overnight, gained the supreme power to decide on what was good and what was bad. They wasted no time in flexing their new muscles to gain ever-higher profit margins for their own companies.

Many cynical companies greenwashed their behavior to appear to be doing better and gain more points from these ESG helpers but without actually changing their behavior for the better. Those developments have driven many people to start questioning the validity of responsible investing in principle.

Is ESG investing good?

The first criticism is what appears to be a lack of consistency (or logic) in many ESG ratings. The same company can have widely differing scores at different rating agencies. In other cases, companies in “obviously bad” industries can get a decent ESG score. Many observers of these apparent anomalies argue that ESG ratings are inconsistent, lack objectivity, and therefore cannot be trusted. I agree with this observation but disagree about the conclusion.

I would argue that analyzing the ESG impact of a company is inherently just as subjective as analyzing the attractiveness of an investment in the company. We should expect differences of opinion and get used to that, just as we are used to having well-informed analysts widely disagree about the prospects and quality of a company.

The second criticism of ESG investing is directed at investment managers. Isn’t the manager’s job to maximize investment returns for their clients, they ask? And if so, shouldn’t the managers override any factor that doesn’t directly contribute to that goal? The classic justification given by proponents of ESG is that ESG factors help to increase returns and/or reduce risk and so, voila! Both ESG and investment return goals are achieved simultaneously.

I personally disagree with this defense. In my opinion, an efficient market — and the stock market is efficient over the long run—would not consistently misprice companies with good behavior, thereby giving them consistently higher risk-adjusted returns.

Instead, I would argue that any client investing with the ESG investment manager, will naturally do so while knowing that they will limit their investment universe to companies with good ESG credentials. It is therefore no different from a US-focused fund manager passing on an attractive investment in an Italian company because their fund’s mandate restricts them to investments in US companies only.

The burden here, however, is on both parties. Investment managers need to inform their clients of how they view ESG, while clients need to comprehend what these ESG restrictions mean to their portfolios. That means that often in practice, clients are the ones demanding the ESG restrictions and not the other way around (dealing with middlemen such as pension trustees is more complex, but I won’t got into that here).

The third criticism is more macro-based. Critics argue that if everyone applied ESG restrictions in their investing, we could end up with a situation that is worse for society in the short term. This scenario was especially prevalent after the Russian invasion of Ukraine. The lack of investment in oil and gas over the previous few years, supposedly driven by ESG pressures, has made the West more dependent on Russian oil and gas. I sympathize with this argument, which appears the most valid of the three criticisms of ESG investment restrictions.

My response here is twofold. First, I would argue that — when done properly — investing in oil and gas in countries that have rule of law and high regulatory standards can be consistent with ESG.

Limiting supply can only help the environment if significantly higher prices cause lower demand, but the reality is that energy demand takes many years or even decades to adjust. Higher prices in the short term will have a very limited effect on demand.

Therefore, if someone is going to burn that liter of gasoline anyways, I would rather it came out of a barrel of oil from a country that demands a reduced environmental impact, and where the proceeds won’t go towards padding the bank accounts of oligarchs or corrupt officials.

Further, because the contribution to climate change is not confined within political borders, it doesn’t matter from the environmental point of view whether the barrel of oil came from Russia or Texas, or whether it was consumed in India or Paris. All that matters is how much was burned; not how much was produced.

Second, even though I’ve been a vocal proponent of ethical/ESG investing for years, I don’t believe that all investors will, in fact, embrace it. To use the example of the oil and gas sector once again, I believe that where the opportunity to make money is sufficiently attractive, plenty of capital will be available to fund it.

In my view, the lack of investment in the oil and gas capacity over the past few years was driven largely by low oil prices and returns on investment, not by investors optimizing for ESG. We see the same thing happen in every oil cycle, hence the saying “the cure for low oil prices is low oil prices.” A long period of low oil prices, driven by an over-supply, drives under-investment, creating a period of under-supply and high prices, which encourages investment in new supplies, which eventually causes prices to decline, rinse and repeat.

Finally, many cases of ethical investing, such as the oil and gas example mentioned above, are, in my opinion, grey areas. Nonetheless, as responsible investors and business owners, we must simply strive to do our best. Inevitably, we’ll make mistakes in assessing the ethical behavior of companies, as we do in assessing their investment potential. We cannot expect to be right all the time. Over time, we try to learn from our mistakes and sharpen our judgement.

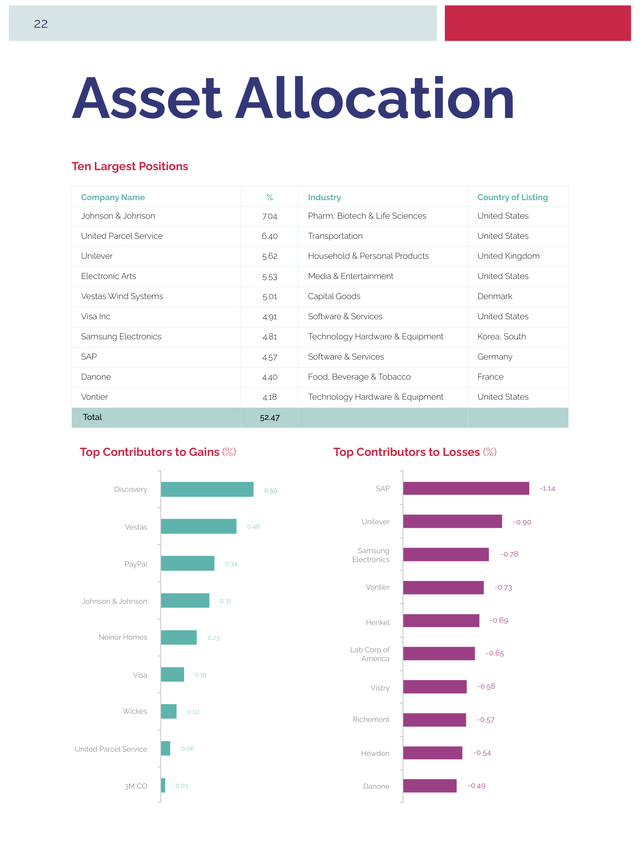

Our Portfolio

This quarter, we bought shares in PayPal (PYPL), the payments platform. PayPal has been one of the more high-profile victims of the market’s brutal ruthlessness over the past few months, and the stock fell by over two thirds between its peak in July to the beginning of March this year. As we progressed PayPal through the Mayar Checklist Process, we identified a business with a leadership position in a structurally growing market.

The company benefits from certain network effects, and faces several competitive threats at the same time. As the business profited from the move to online retail during the pandemic, as well as from the stimulus cheques handed out in the US, the stock price soared to absurd levels. As so often happens, however, the market had overcorrected by February and this quarter was offering prospective shareholders prices that assumed essentially zero growth in the business. When life gives you irrational sellers, make lemonade!

Likewise, we bought shares in Wickes this quarter. Wickes is a retail-focused home improvement/DIY UK chain that spun out of Travis Perkins (OTCPK:TVPKF) in April last year. The company’s inauspicious first year as a public company saw the stock steadily falling by about a third between the time of its IPO in May 2021 to the beginning of March. Its small size — under GBP 500m in market capitalization — has led to sustained selling by investors more predisposed to owning larger companies like its former parent. Meanwhile, due to its comparative lack of research coverage — although increasing now — the firm has failed to attract new interest. These factors, however, do not change the value of the business and so fortunately for us — and for you! — we picked up some shares in the company at an attractive valuation. Further, we are excited by Wickes’ ongoing store uplift program that’s boosting per-store sales by up to 25%.

We also bought back into 3M (MMM) as the stock reached attractive levels. We’d sold our shares in 3M last year when the price exceeded our estimated fair value, and as better opportunities to invest in presented themselves at the time. Nonetheless, we’ve always liked this business with its diversified revenues, its R&D leadership and its stable margins.

We also added to our existing holdings in Howdens, Vestas (OTCPK:VWDRY) and Vontier (VNT), and trimmed UPS (UPS) and Discovery (WBD). Meanwhile, we fully exited our investment in the UK homebuilder Redrow (OTCPK:RDWWF) to raise some funds to invest in Wickes and manage the size of our exposure to UK housing.

Finally, we’ll be adding two new sections to our quarterly reports. Both will be written by our research team. The first, titled “Business Summaries,” will give you a one-page dive into one of our long-term holdings. These summaries will help you gain a deeper knowledge of the businesses you own. The second section, “Business Updates,” will provide annual operating updates for our holdings and will be published in the Q1 quarterly letter.

The Fund and The Company

Mayar Capital ended the quarter with $225m in Assets Under Management (AUM). Several of our SMA clients have chosen to switch their investment to the Fund, so we expect Fund assets to increase to approximately $170 million once the transfer is complete. This will give the Fund additional scale, which will benefit all its investors.

Additionally, we’ve now added you all to the Apex web portal, Apex Connect. This online portal will allow you to view performance, access your investment balance and see reports, all in one place. You should have already received your login information, but please let us know if you haven’t received yours or if you need any help in accessing the portal.

What’s more, we’re also about to launch a new, more user-friendly platform for all of the Fund’s forms. This will make it easier for you to subscribe, redeem or top-up your investment in the Fund, or to update your personal information. Our investor relations team will be in touch with you soon with more details.

We welcomed three new members to the Mayar Capital team this quarter.

Marina joined Mayar Capital in January 2022. Prior to this Marina worked as Practice/ Office Manager in the legal sector for 7 years working for De Pinna Notaries — the largest firm of Scrivener Notaries in the UK — for over 4 years undertaking a major business transformation project whilst managing all business operations functions, and then at Lawrence Stephens Solicitors covering multiple practice areas during a time of exponential growth during the pandemic.

Marina has extensive experience managing all aspects of office management and business operations including HR, IT, Finance, Facilities Management, Compliance, Strategy Development and Process Improvement. Prior to this Marina spent 16 years as an Office & Accounts Manager within the Media industry. Working for an international Graphic Design Agency with a diverse global corporate client base covering multiple industries, she provided a global rollout of projects from concept to production.

Marina took over from Sophie Forsyth as our Office Manager and HR, after Sophie left us to pursue an exciting new opportunity with her family’s business. I wish her the best of luck in this fresh and stimulating challenge.

Huzaifa Khalil joined Mayar Capital as an Investment Operations Analyst in February, after working in a similar role at a FinTech company. He earned a bachelor’s degree in Chemical Engineering in 2021 and is a member both of the Chartered Institute for Securities & Investment and the CFA Institute, with plans to pursue a professional certification. Huzaifa Khalil took over from Kamea Mayes who left to take up a new role elsewhere. I wish her all the best in this new chapter of her career.

Last, but by no means least, Felix Cruze joined Mayar Capital as an analyst, transitioning from an internship role here that started last year. Before joining Mayar, Felix worked in Consulting, Private Equity, and International Trade. He holds a BSc (Hons.) in Business, Economics and Social Sciences from the WU Wien, and gained his MSc Finance and Economics with distinction from the LSE.

Thank you for your continued support and trust.

Best regards,

Abdulaziz A. Alnaim, CFA, Managing Director

Business Summaries

Johnson & Johnson (JNJ)

J&J is currently our largest position and a long-standing holding. The majority of the group’s sales comes from its collection of pharmaceutical franchises, but a large majority (~45%) comes from its collection of medical device businesses and its consumer brands.

Here’s how JNJ make and spend a dollar of revenues: As of 2021, about 55 cents of that dollar comes from its pharmaceutical sales – sales of drugs to pharmacies and distributors – while 30 cents come from the sale of medical devices, such as surgery equipment and orthopaedics. The rest of that dollar in sales comes from sales of JNJ’s consumer brands such as Listerine mouthwash, Nicorette nicotine tablets and Neutrogena cosmetics.

To make that dollar, however, JNJ typically spends about 25 cents to make the products themselves and another 27 cents on marketing and general administrative functions. This leaves JNJ with about 48 cents on the dollar in profit.

The pharmaceutical industry is a research intensive one and investments in R&D – along with typical capital expenditures into manufacturing – take their own share of revenues. JNJ spends about 16 cents in R&D for every dollar of product sold, along with another 4 cents in investments into property, plant and equipment. Taking all this together, Johnson & Johnson pockets roughly 25-30 cents of cash profit per dollar sold of its pharmaceutical, medical device, and consumer products; all, of course, before interest and taxes.

The economics differ slightly by business segment, and this is worth noting: JNJ’s pharmaceutical business has on average contributed about 52% of group sales over the last half decade but has contributed to two thirds of the operating profit. Compared with this, the Medical Devices business made an average operating margin of 30% in the 5 years before COVID, with the Consumer business making margins just over 10%.

Aside from the high degree of margin stability the group has exhibited over the last two decades, the business also runs efficiently on its capital base, with returns on invested capital – treating R&D spend as a capitalised expense – of a commendable 20% to 25%. This stability, high ability to produce returns on capital invested in the business, and its decent cash conversion profile, make this a high-quality business.

Healthcare businesses of course come with plenty of risks – and we have seen JNJ pay some hefty fines in previous years for product liability issues; and the pharmaceutical business faces some near-term headwinds as a couple of its most important patents roll off and leave them open to cheap generic manufacturers. However, longer-term, JNJ’s history of innovation, its institutional memory and knowledge base should ensure its ability to top up its pipeline of pharmaceutical franchises well into the future.

Business Updates

Our technology businesses enjoyed a strong year of operating performance – from Google (GOOG, GOOGL) to Dropbox (DBX), through payment companies Visa (V) and Mastercard (MA), to gaming behemoth Electronic Arts (EA), enterprise software giant SAP (SAP) and semiconductor and consumer electronics business Samsung (OTCPK:SSNLF).

Google saw revenue growth of over 40% in the year, with operating profits growing above 90%; YouTube ended the year with higher viewership than Netflix – without the content costs. With its dominant position in online advertising, we continue to monitor regulatory risks for this business.

Dropbox, one of our newer holdings, continues to progress as expected. Paying users grew by 30% with the acquisition of DocSend adding value to the customer value proposition.

Visa and Mastercard have both been beneficiaries of the move away from cash over the course of the pandemic with the consequence that forward- looking opportunities for further penetration of card payments are lower than a couple of years ago. Moreover, cross-border payments – which were badly impacted by lockdowns – strongly recovered in 2021 and for both businesses are at or near to pre-COVID levels.

Electronic Arts is also developing as we would expect. The business enjoyed strong engagement last year with players of EA games spending 20% more time than even during 2020, helped by the delayed sales of the PS5 console. A potentially important development is the ongoing negotiation between EA and FIFA regarding the licensing of the FIFA brand for the EA football game. Strongly worded public statements have been slung from both parties as part of the negotiation process, but this could certainly be an opportunity for EA.

SAP, the German software company, continues its transition from a licensing-based business model to a Cloud subscription- based model. This is an attractive structural shift as the cloud business – aside from being more predictable – has greater lifetime value per customer. The cloud business now stands at 34%, up from just 14% five years previously.

Samsung Electronics posted revenue growth of 18% for the year with DRAM prices increasing in the first half of the year, before pulling back in the second half, although management have commented that these will firm up again. The business generated strong operating leverage, enjoying a strong incremental margin of 37% for the year. We continue to monitor capital additions to the industry – TSMC as an example has indicated it will hike capital expenditures from USD 30 billion in 2021 to USD 40-44 billion in 2022.

Labcorp has similarly been boosted by strong sales from COVID, which hoisted revenues in its Diagnostics segment up significantly for the year. However, this looks as though it is past its peak now – but sales are still almost 50% higher than pre- COVID levels. We continue to monitor the step downs in the COVID testing business and associated decremental margin impacts thereof.

Johnson & Johnson’s pharmaceutical business saw very strong growth of 17% for the year, driven predictably by a largely not-for- profit Coronavirus vaccine programme. Excluding this, sales were up 3% along with low single digit growth in the consumer and medical devices business. Management of Johnson & Johnson also announced the spin-off of the consumer division in the year, which looks due to completion in spring to autumn 2023.

Inflation was a persistent theme over 2021 for our consumer goods holdings, including Unilever (UL), Danone (OTCQX:DANOY)and Henkel (OTCPK:HENKY). Supply chain difficulties as the global economy opens back up has increased input prices – both material and transportation costs – and these businesses have not yet passed on these cost increases, though we know from history that this can take time.

Henkel’s consumer businesses in the laundry and beauty categories exhibited anaemic growth for the year, with price increases outstripped by inflation, and with volumes flat to down in part due to lower soap sales versus 2020, and with a stop-start dynamic in the professional hair salons category. The adhesives business, however, had a very strong year, with double digit volume growth spread over a variety of customer segments.

In addition to the general inflation theme, Unilever made headlines at the beginning of the new year with rumours that it was considering buying GSK’s consumer brand portfolio, followed by a formal offer of GBP 50 billion for the business. After an almost unanimously negative reaction from the market, CEO Alan Jope commented later that ‘we do not intend to pursue major acquisitions in the foreseeable future’.

Danone’s turnaround continues, despite cost inflation of 8% last year. Its planned 20% reduction in stock-keeping units (SKUs) was completed in the year and coincided with a EUR 800 million share buyback programme. However, the highly profitable Chinese baby formula business had a mixed year, with grey- market imports of formula through the informal ‘Daigou’ sales channel decreasing as cross-border travel collapsed; more positively, management commentary at the end of the year suggests that this dynamic is slowing down.

On the other end of the consumer spectrum is Richemont (OTCPK:CFRHF), the luxury goods business and owner of the Cartier brand. The business predictably suffered in 2020 due to wide-reaching lockdowns. However, we have seen a strong bounce-back this year and the business is back to its pre-pandemic growth trajectory. There has also been recent negotiation of Richemont turning its Yoox Net-a-Porter business into an industry-owned venture, with the possibility of Farfetch (FTCH) taking a stake; we await further developments on this issue.

Vistry (OTCPK:BVHMF), the UK Homebuilder, continues to see strong growth in its highly profitable Partnerships business which acts as a turnkey home builder for UK housing authorities. The business also benefitted from strong house price growth in 2021, although a mix shift towards more affordable housing mitigated some of these effects. The cladding remediation issue continues to cast a shadow over the sector, with many housebuilders taking large provisions to pay for remedial works to buildings as well as bracing for a housing developer tax. Positively, however, Vistry’s building projects tend to be less focused on the mid-rise sector on which these extra costs are targeted.

Meanwhile in Spain, Neinor Homes (OTCPK:NNRHF) delivered new housing at a sustainable run rate, with the nascent build to rent business developing in line with expectations. AEDAS and Metrovacesa (OTC:MRVCF), two competitors of Neinor, entered the build to rent sector recently, too, highlighting the attractiveness of the sector though we will monitor the new capital entering this business.

Howden (OTCPK:HWDJF), the UK-based joinery and kitchen fitting business, enjoyed a strong 2021 trade, with revenues up 15% over the past two years. The depot count continues to increase as we expect, including a modest expansion in France and entry into Ireland.

Higher chemical prices boosted Brenntag’s (OTCPK:BNTGF) revenues to almost 20% higher than 2019 levels, despite volumes being lower than 2019. This pricing dynamic helped Brenntag convert a greater portion of its gross profits into operating profit over the year, although cash conversion was somewhat hamstrung by higher inventory costs, again due to chemical prices. The ‘Project Brenntag’ efficiency programme continues and has boosted operating profits by EUR 120 million, and we should see benefits come through more visibly as volumes begin to grow to beyond 2019 levels.

While also struggling with heightened transportation costs in 2021, Vestas (OTCPK:VWDRY) is poised to benefit from a European refocusing on energy independence in light of Russia’s invasion of Ukraine. While a wind farm can be built in months, other forms of non- hydrocarbon energy such as nuclear reactors can take years to construct. It is no wonder, then, that the UK government as one example has dramatically reduced the red tape associated with approvals for new wind parks. Vestas’ high-margin aftermarket servicing business continued to develop during the year.

UPS has been a beneficiary of the pandemic-related shift to e-commerce. Revenues increased 15% in the year, with strong leverage in the business boosting operating profit by al- most 67%. Management is focusing on a ‘Better not Bigger’ strategy for the business and divested the UPS Freight business early in the year. Mean- while, the company is expected to increase distributions to shareholders in 2022, from both dividends and share buybacks.

Vontier, the point of sale terminal and software supplier to gas stations across America (and Danaher spin-off) continues to perform as expected. The group closed a notable acquisition of DRB Systems in the year. DRB Systems is a provider of point of sale and business software solutions to the car wash industry and therefore has a similar but EV-agnostic profile to Vontier. Given the pedigree of Vontier, we expect integration of this business to be strong and prove the Vontier Business System (named after the famed value-creating Danaher Business System) and value driver for Vontier’s shareholders.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment