Floaters can help keep a portfolio from sinking by providing additional income each time the Fed hikes interest rates.

Gabriele Maltinti/iStock via Getty Images

In late May, we highlighted the WisdomTree Floating Rate Treasury ETF (NYSEARCA:USFR) as a tool investors could utilize in order to diversify their cash holdings, avoid falling net asset values, or NAVs, in short duration bond funds and also benefit from rising rates. So far this strategy has worked as the change in NAV is negligible (down 5 basis points from the price at publication) and far better than some of the short-duration bond funds while monthly distributions continue to trend higher on the back of the Fed’s interest rate increases as the portfolio’s holdings resetting to higher rates. The trade has a total return of 41 basis points which does not sound that impressive until you realize that the S&P 500 is down 12.28%, or 1,228 basis points! It turns out that this was a pretty good place to stash one’s cash!

We think that the U.S. Federal Reserve will remain vigilant moving forward, and that higher rates are here to stay… at least for the next 12-18 months. This is why we think that investors need to continue to watch this fund for potential inclusion in their portfolios in order to hedge against higher rates, and inflation to an extent.

Fund Structure

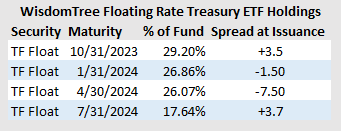

As we explained in our previous article, the holdings of the WisdomTree Floating Rate Treasury ETF do not fluctuate too much, as the U.S. Treasury issues a new floater each quarter which is included in this fund. Since our last article, one floater was removed and was replaced with a newly issued floater – the July 31, 2024 issuance. The current holdings of the WisdomTree Floating Rate Treasury ETF are included in the table below:

Floater spreads at issuance are once again positive. (WisdomTree, Bloomberg, Author)

As readers will notice, the January and March of 2024 floaters were issued at a negative spread. However, we would point out that the new floater was issued at a positive spread and that its spread is actually 0.80 greater than the July 31, 2023 issuance that rolled out of the index, and thus the fund. While this is not a huge deal because the ETF has to adjust the portfolio regularly and will transact at different spreads over the period that these floaters are included in the ETF, we think it is worth pointing out because the trend of negative spreads at issuance has been broken and this does add to performance.

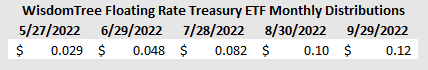

With the wind at their back, floaters are trending higher and the weekly resets on these holdings are helping to drive interest income higher. Below is a table showing the monthly distributions starting in May when we first highlighted the opportunity for readers:

So far floaters have been a winner, with monthly distributions growing to $0.12 per unit per month. (WisdomTree, Bloomberg, Author)

The yield on the WisdomTree Floating Rate Treasury ETF has acted just as we expected and as of today’s distribution pays out just over 4x more than it did back on May 27th. The 12-month indicated yield is now a respectable 2.86%, or in the neighborhood of a 2-month Treasury Bill. The kicker is that the yield will continue to move higher here and we believe that the units should continue to see a relatively stable NAV. The same cannot be said about that 2-month Treasury Bill.

Closing Thoughts

We continue to believe that investors should utilize floating rate instruments or funds for their cash holdings as they are another tool that can assist when managing cash or short-term needs. There is little reason to use short-duration bond funds holding maturities of 1-3 years when the Fed is aggressively raising interest rates and one is trying to preserve cash and buying power. Also, it must be noted that some of those funds are showing lower yields because they are locked into lower coupons on bonds that are trading underwater. This is not the case with floaters, which trade relatively close to par as their rates reset to market rates which pulls the floater price back to par (or pretty close to it). In this market, which would you rather own?

With the Fed poised to continue raising rates aggressively at each meeting through the end of the year, we think that the WisdomTree Floating Rate Treasury ETF is a powerful tool for retail investors to utilize to help shield their portfolios from asset price volatility while also creating a hedge within their portfolio that benefits from Fed rate hikes and can help minimize some of the losses moving forward.

Pairing this ETF with some money market funds looks like a decent bet for maintaining buying power with cash as well as generating additional monthly income each time the Fed does raise rates. If one requires more yield, there are corporate floaters available, but we would stress that readers do their homework to understand the securities included in those funds to understand the credit risks and how they might perform if credit markets were to weaken.

Be the first to comment