artJazz

Introduction

My thesis is that Brookfield Renewable (NYSE:BEP) (NYSE:BEPC) is well positioned for global growth in solar and wind electricity generation demand. Some of the increased demand will come from electric vehicles and BEP is making early investments as this landscape should be completely different by 2050.

The Numbers

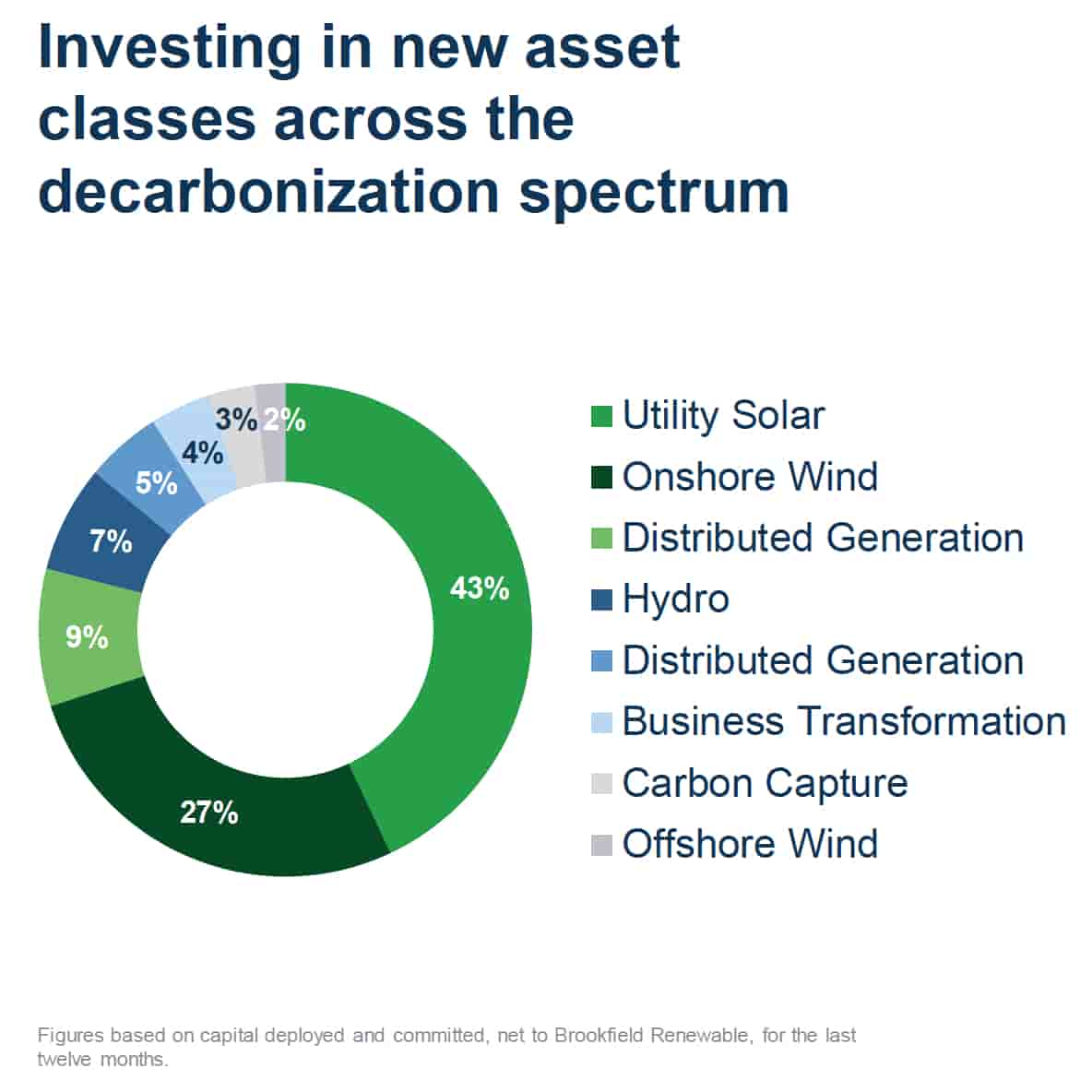

BEP has a long history of investing in hydro-power but much of their past has been stasis with respect to solar. Over the last 5 years, they have been shifting to solar and wind as the economics for these sources have improved and demand has increased. The 2022 investor day presentation shows that utility solar has made up 43% of investments from the trailing twelve months (“TTM”) while onshore wind has been responsible for 27%, leaving little for their more traditional projects like hydro:

BEP TTM Investments (BEP 2022 Investor Day)

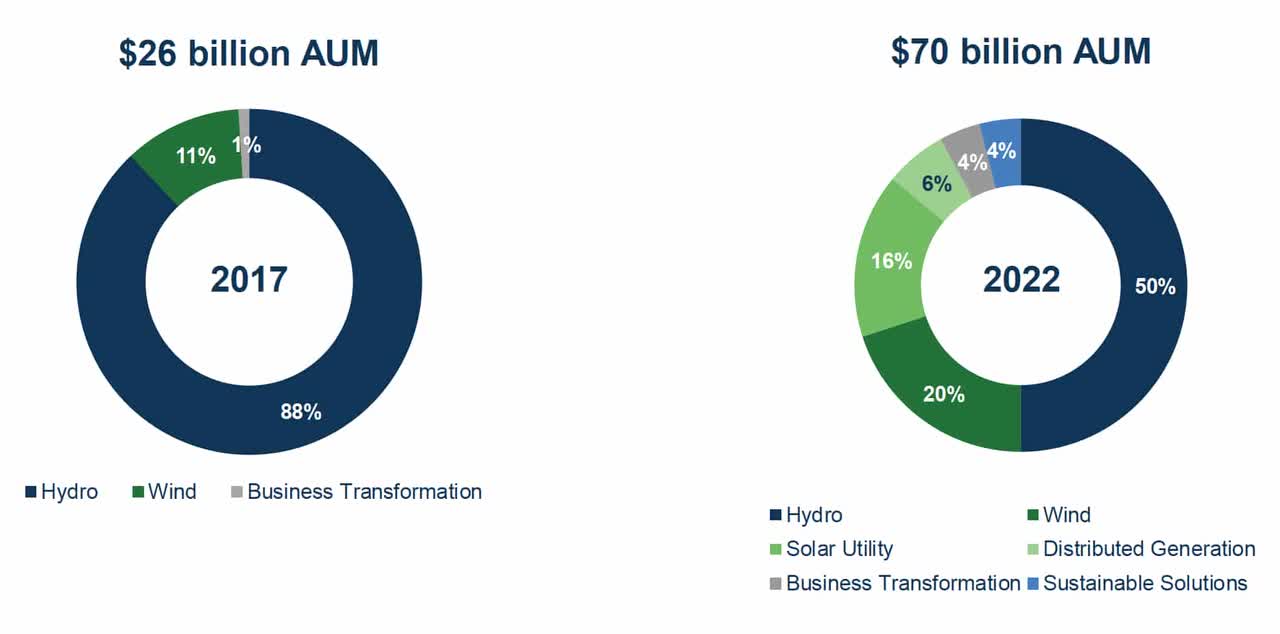

These investments are changing their composition of their overall assets. Only 11% of their $26 billion in assets under management (“AUM”) were wind back in 2017 and solar wasn’t even shown. By 2022, 20% of their $70 billion AUM was wind and 16% was solar utility:

BEP Solar And Wind (BEP 2022 Investor Day)

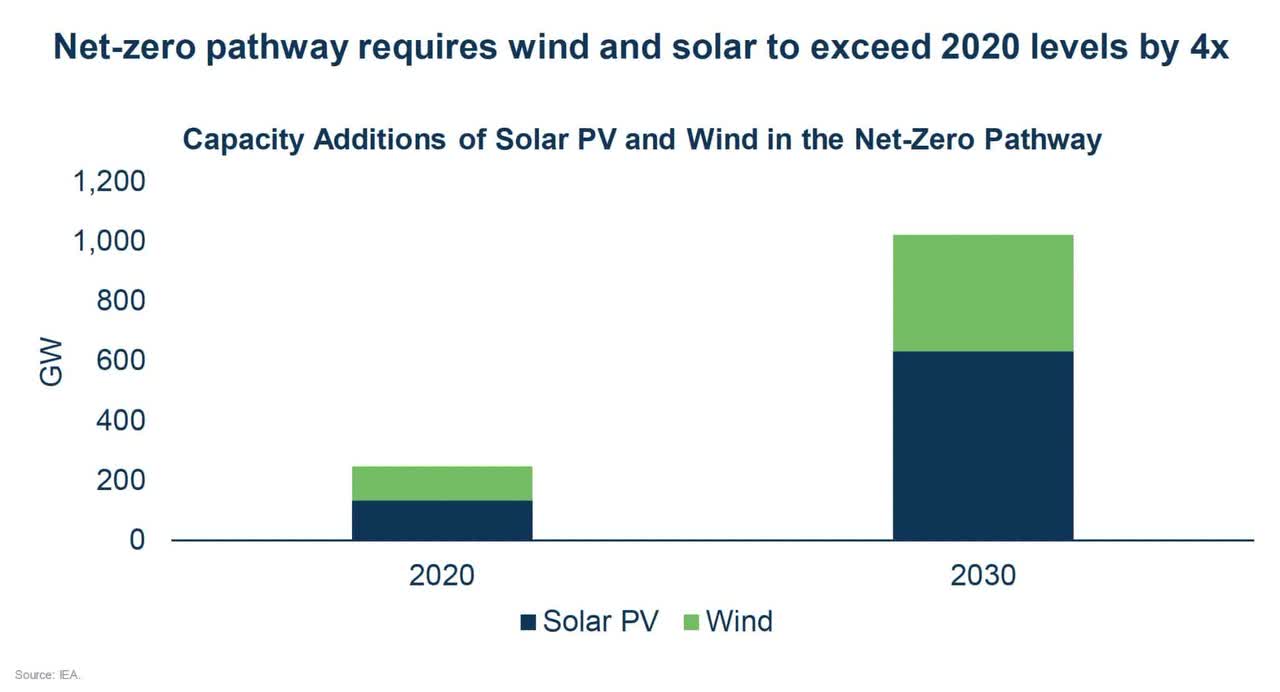

BEP’s 2022 investor day presentation points out that the net zero pathway means solar PV and wind will have to increase rapidly with respect to global electricity generation:

Solar And Wind Increases (BEP 2022 Investor Day)

The 2022 investor day video shows Renewable Chief Investment Officer Jehangir Vevaina explaining the slide above:

Renewables are in the very early stages of their growth trajectory. We expect the next decade is going to see tremendous growth with capacity additions of over a thousand gigawatts. This is over 4X the current deployment. And this will only increase over the next 30 Years to achieve Net Zero. As storage further develops, renewables could be as much as ninety percent of the grid from 30% today.

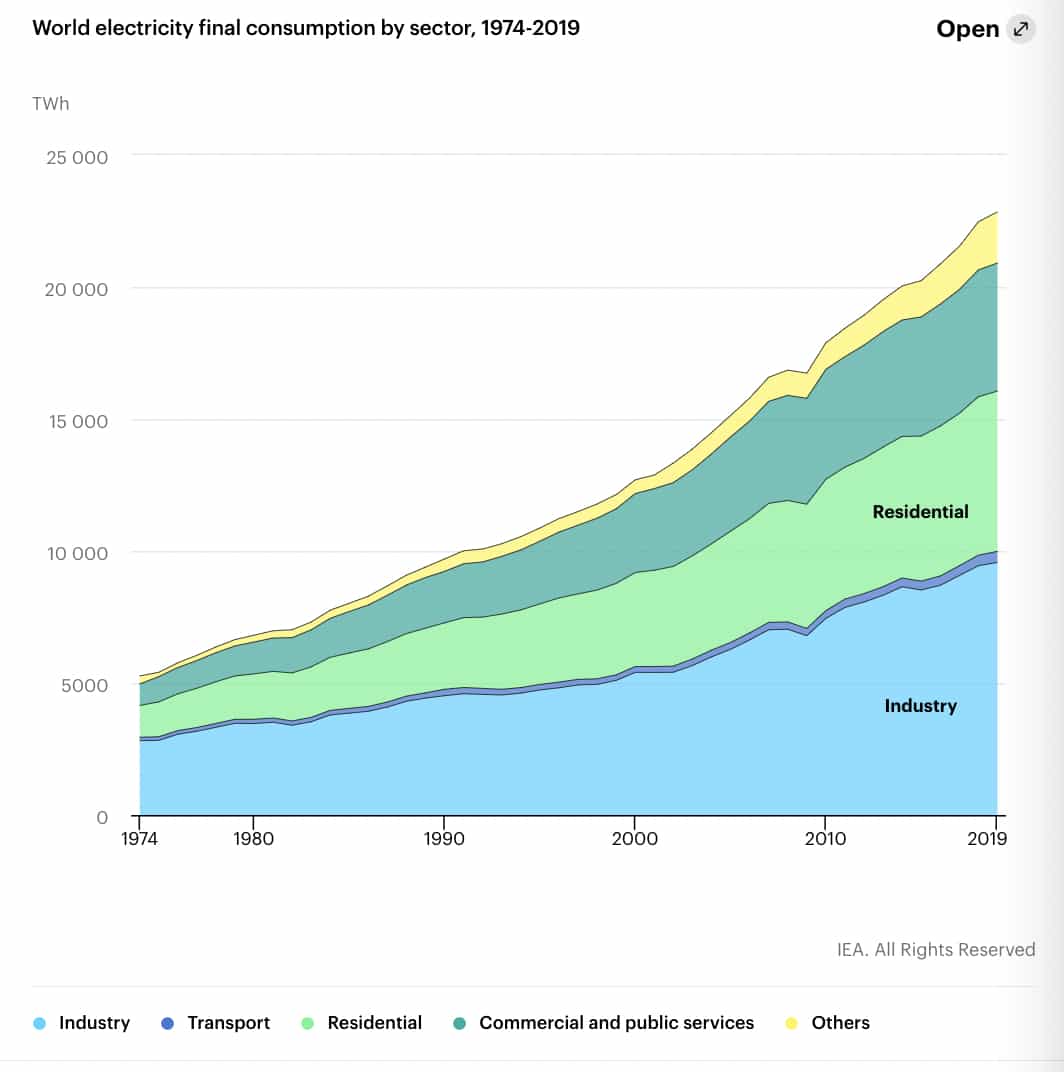

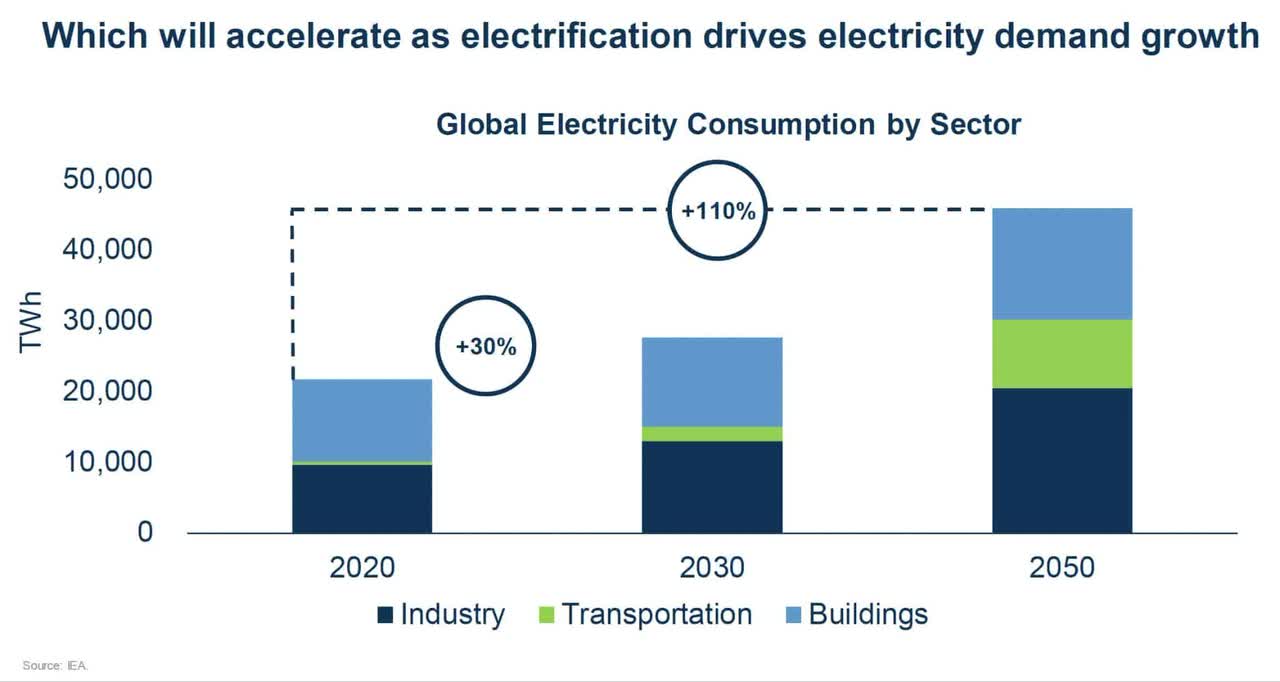

Electric vehicles are one of the reasons solar PV and wind generation will have to increase. Electric vehicles haven’t been a big part of transportation historically and we see from the IEA that transportation’s portion of electricity consumption has been negligible over the years:

Electricity Consumption (IEA)

BEP’s 2022 investor day presentation shows that the world is changing such that transportation will be a large part of electricity consumption by 2050:

Transportation Consumption (BEP 2022 investor day)

Renewable Chief Investment Officer Vevaina notes that electrification will be key for transportation in the decades ahead:

Today demand for power is growing for the first time in 30 years and we think this is only going to accelerate due to electrification which will be key to decarbonizing businesses. Over the next few decades, We believe many production processes will be replaced with electrification. We expect to see this in the C&I segment which is the commercial industrial segment, the residential segment and of course the transportation – the quickly growing transportation segment. And this takes place through technologies like electric cars and buses – heat pumps and buildings and electric furnaces for steel. Renewables, given their low-cost position and zero carbon emission profile are very well positioned for that growth.

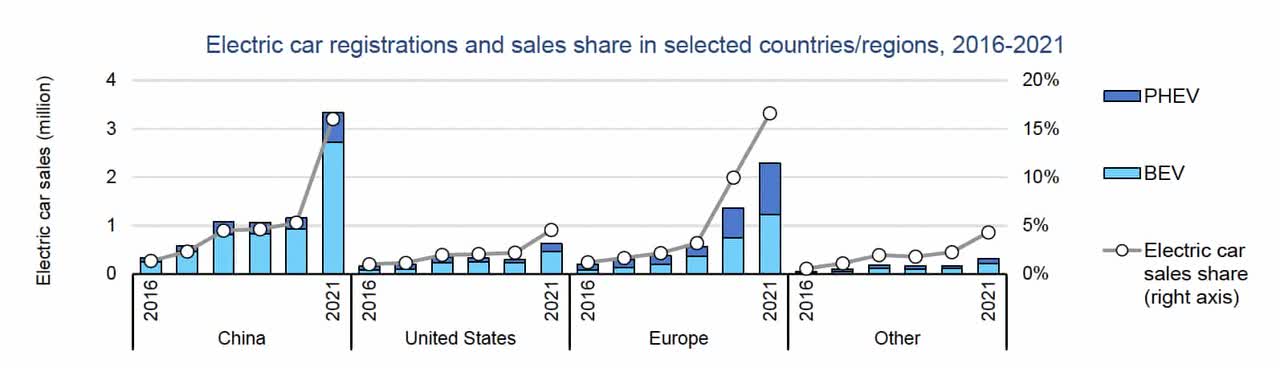

It’s important to be directionally correct about the massive demand growth for electricity from the transportation segment above. Looking at recent numbers, we appear to be well on our way to seismic changes. Global electric vehicle sales more than doubled from 2020 to 2021. Global sales of battery electric vehicles (“BEVs”) have climbed from 1.5 million in 2019 to 2 million in 2020 to 4.7 million in 2021 per the IEA Global EV Outlook 2022 report. Meanwhile, global sales of plug-in hybrid electric vehicles (“PHEVs”) have gone from 580 thousand in 2019 to 980 thousand in 2020 to 1.9 million in 2021. The IEA shows that most of the increase has been in China where we saw sales of 2.7 million BEVs and 600 thousand PHEVs in 2021. Note that many of the BEVs in China are mini-cars such that a graph showing miles driven would be different from what we see below in terms of sales:

Electric Car Sales (IEA Global EV Outlook 2022 report)

Not shown in the graph above are the 1Q22 numbers and the IEA says China’s 1Q22 sales were more than double the 1Q21 numbers. 1Q22 sales in the U.S. were 60% higher than 1Q21 while 1Q22 sales in Europe were 25% higher than 1Q21.

The Innovator’s Dilemma book by Clayton Christensen talks about new technologies gaining traction in the lower end of the market. The IEA Global EV Outlook 2022 report shows that this is kind of what is happening in China where sales of electric two and three-wheelers are substantial:

In China, electric cars are typically smaller than in other markets. This, alongside lower development and manufacturing costs, has contributed to decreasing the price gap with conventional cars. In 2021, the sales-weighted median price of EVs in China was only 10% more than that of conventional offerings, compared with 45-50% on average in other major markets. China accounts for 95% of new registrations of electric two- and three-wheeler vehicles and 90% of new electric bus and truck registrations worldwide. Electric two and three-wheeler vehicles now account for half of China’s sales. The speed of charging infrastructure roll-out in China is faster than in most other regions.

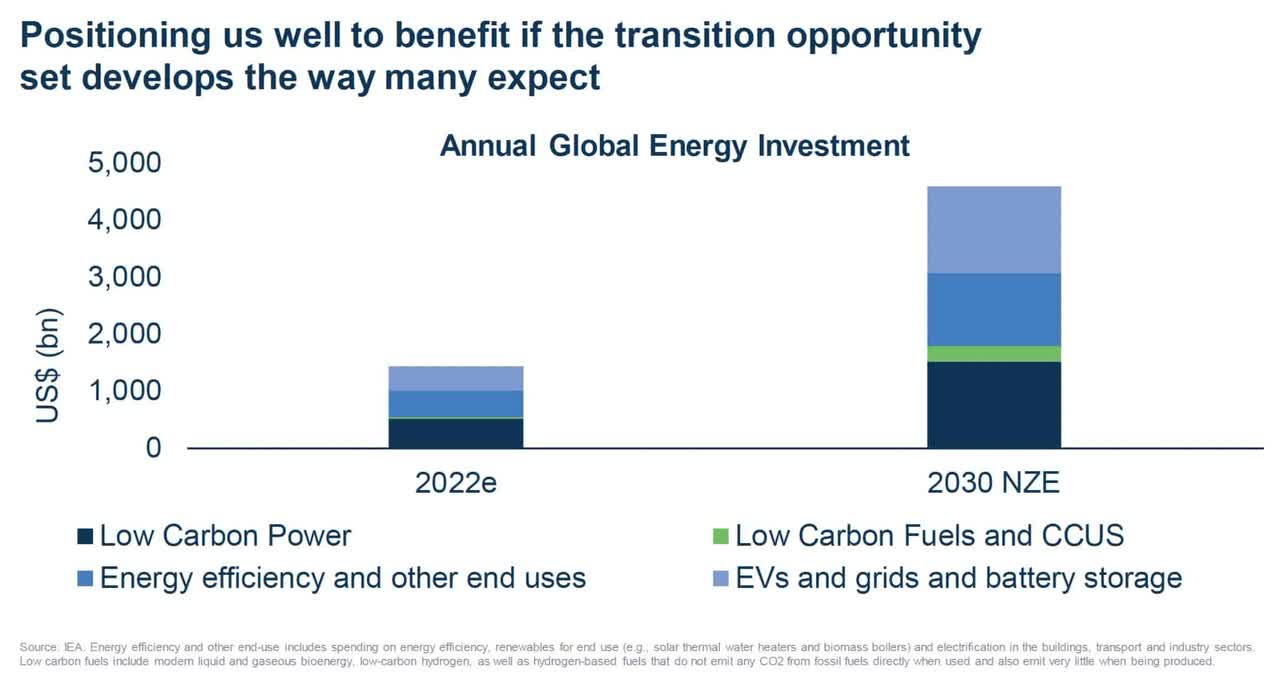

In the U.S. it is kind of the opposite where luxury BEV brands like Tesla are penetrating the high end of the auto market. The key for BEVs will be for them to be appealing to middle-of-the-road car buyers and I believe this will be the case soon. BEP Transition Chief Investment Officer Natalie Adomait shows the staggering dollar amounts involved under the net zero emissions (“NZE”) scenario:

BEP Transition (BEP 2022 Investor Day)

Closing Thoughts

Debt is a big concern in today’s environment where interest rates keep going up. CEO Connor Teskey addresses debt in his 2Q22 letter:

Our balance sheet is in excellent shape, with an average debt duration across our portfolio of 13 years and very limited floating rate debt, almost all of which is in Brazil and Colombia, where we have the benefit of full inflation escalation in our contracts.

The 2Q22 supplement highlights some strong points of the balance sheet as well:

Maintained a robust balance sheet with close to $4 billion of available liquidity, no material near-term maturities and virtually no floating rate exposure.

Slide 9 of the investor day presentation shows that BEP has a 17% total return from 1999 to 2021. Forward-looking investors should keep this in mind when thinking about slide 82 where CEO Teskey says they are focused on 12-15% total returns moving forward. Given BEP’s track record and the way we’re seeing changes in demand for electricity consumption, I think BEP has a great opportunity to have continued success in the long run.

Be the first to comment