Japanese Yen Talking Points

USD/JPY rises for the second day following the kneejerk reaction to the US Personal Consumption Expenditure (PCE) Price Index, and the exchange rate may continue to retrace the decline from the monthly high (151.94) as the Federal Reserve is expected to maintain its existing approach in combating inflation.

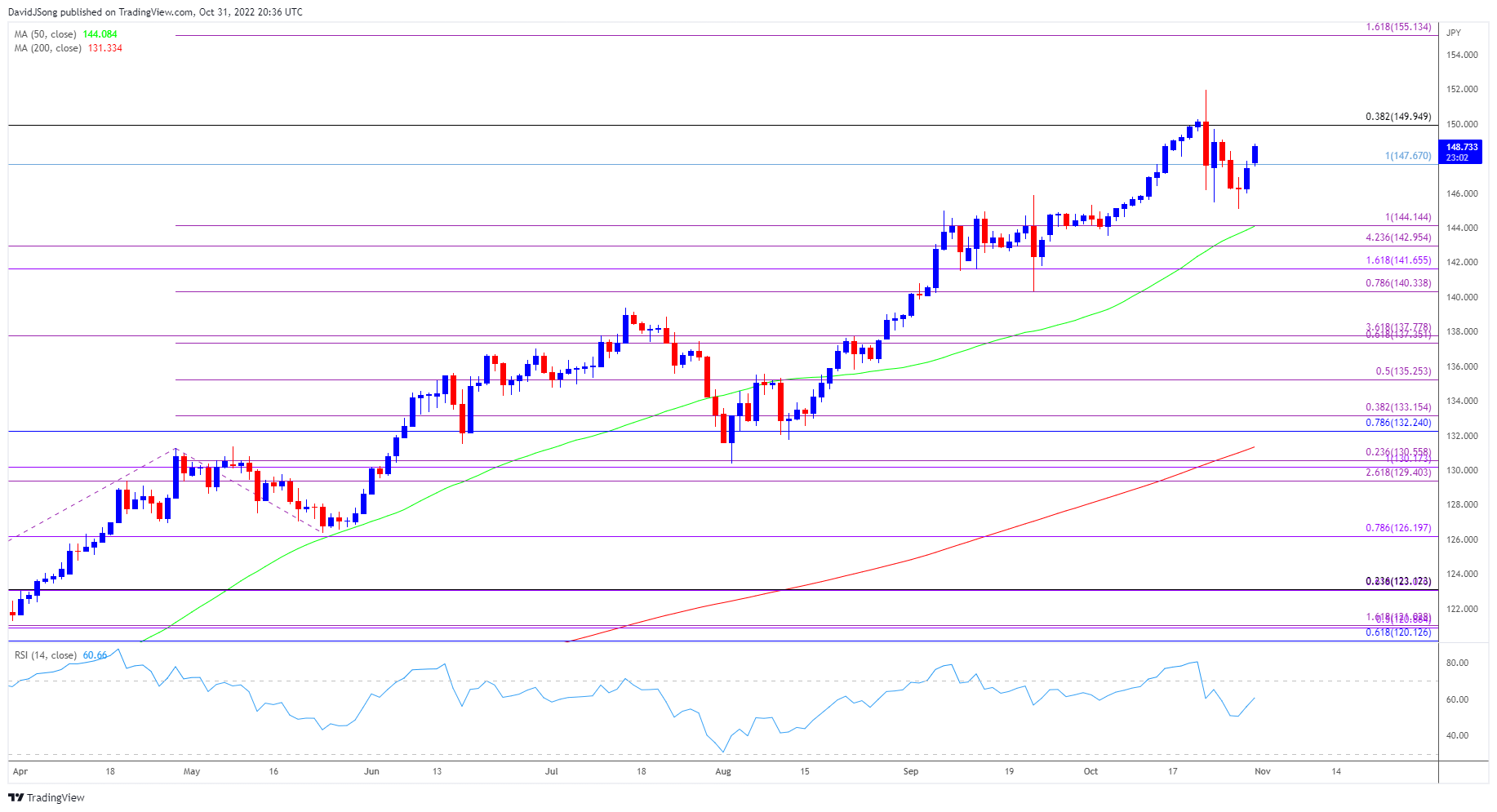

USD/JPY Reverses Ahead of 50-Day SMA with Fed Rate Decision on Tap

USD/JPY appears to be tracking the recent rebound in US Treasury yields as it initiates a series of higher highs and lows, and the exchange rate may continue to track the positive slope in the 50-Day SMA (144.08) as it reverses ahead of the moving average.

As a result, USD/JPY may attempt to test the July 1990 high (152.25) as the Federal Open Market Committee (FOMC) is anticipated to implement another 75bp rate hike, and the central bank may continue to strike a hawkish forward guidance as the ongoing rise in the core US PCE points to sticky inflation.

At the same time, the FOMC may show a greater willingness to pursue a highly restrictive policy as the most recent Non-Farm Payrolls (NFP) report reflects a resilient labor market, and the diverging paths between the Fed and Bank of Japan (BoJ) is likely to keep USD/JPY afloat as Governor Haruhiko Kuroda and Co. sticks to the Quantitative and Qualitative Easing (QQE) with Yield-Curve Control (YCC).

In turn, USD/JPY may continue to retrace the decline from the monthly high (151.94) as it tracks the rise in US yields, while the tilt in retail sentiment looks poised to persist as traders have been net-short the pair for most of the year.

The IG Client Sentiment (IGCS) report shows 31.89% of traders are currently net-long USD/JPY, with the ratio of traders short to long standing at 2.14 to 1.

The number of traders net-long is 19.17% higher than yesterday and 49.35% higher from last week, while the number of traders net-short is 5.42% higher than yesterday and 18.58% lower from last week. The jump in net-long interest has helped to alleviate the crowding behavior as only 22.42% of traders were net-long USD/JPY last week, while decline in net-short position comes as the exchange rate initiates a series of higher highs and lows.

With that said, another 75bp Fed rate hike paired with a hawkish forward guidance may prop up USD/JPY, and the exchange rate may continue to retrace the decline from the monthly high (151.94) as it reverses ahead of the 50-Day SMA (144.08).

Introduction to Technical Analysis

Market Sentiment

Recommended by David Song

USD/JPY Rate Daily Chart

Source: Trading View

- USD/JPY initiates a series of higher highs and lows as it reverses ahead of the monthly low (143.53), and the exchange rate may continue to track the positive slope in the 50-Day SMA (144.08) as it holds above the moving average.

- At the same time, a move above 70 in the Relative Strength Index (RSI) is likely to be accompanied by a further advance in USD/JPY like the price action from earlier this month, with the move back above the August 1998 high (147.67) bringing the 150.00 (38.2% retracement) handle on the radar.

- A break above the October high (151.94) may lead to a test of the July 1990 high (152.25), with the next area of interest coming in around 155.10 (161.8% expansion).

Trading Strategies and Risk Management

Becoming a Better Trader

Recommended by David Song

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment