stefanamer/iStock via Getty Images

Renalytix (NASDAQ:RNLX) released its full-year results this week and sales are growing well but the bottom line is worse than ever.

My most recent piece on the company was in July (Renalytix: The Investment Case Is Shot.)

Full-year Results Highlight Progress and Challenges

The company recently released its full-year results.

I think these contained both positive and negative news. The sales momentum is positive albeit from a very small base, while the company is also reshaping to try and become more viable in the long term. But meanwhile it continues to burn cash at a rate I see as unsustainable.

Revenues grew 99% to $2.9m. That is still small beer but at least the movement is in the right direction. There has been continued momentum into the first quarter of the current year:

“Operational progress continued into the first quarter of fiscal 2023 with over 1,200 tests performed. More than 80% of these were billable, yielding about $1.0 million revenue for the quarter. These are record amounts for us in quarterly testing volumes and revenue.”

That is positive and suggests this year’s revenue growth is in line to top that from last year. Still, it is pretty small beer given how much the company has been investing to expand and deepen its sales reach.

Fixing Renalytix’s Cost Base

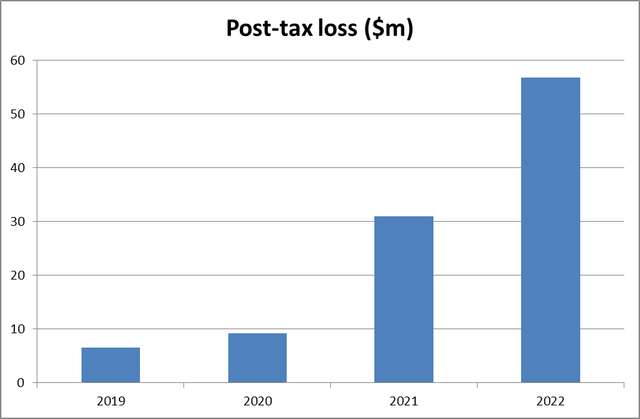

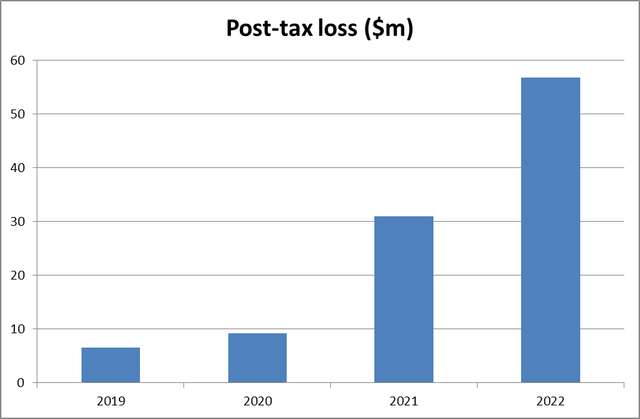

The main problem with the results is not the topline but the horrendous bottom line. Post tax loss ballooned 83% to $56.7m. That means that over the past four years, the company’s post-tax losses come to $103.6m.

author using data from company reports

Chart compiled by author using data from company reports

That reflects a number of elements but what I see as the key one is the company’s sales strategy to date. That means its commercial coverage now includes 28 private insurance and network providers, Medicare payment through the individual claims review (ICR) process and 33 state Medicaid programmes. That is a solid basis for future sales growth. The company has also focussed its efforts geographically and took steps earlier this year to cut costs which might make its return on investment in sales more efficient down the line.

But how much will the cost base improve? In the outlook commentary in its full-year results, the company did not provide any real guidance on revenues or income for the present year. The cost-cutting programme which kicked in towards the end of last year is reportedly reducing annualized spend by over $12 million. That still strikes me as relatively minor stuff, representing as it does less than half of the additional loss the company reported last year compared to the already heavily lossmaking prior year.

I think more cost cutting is necessary and the company said in its results that it is reviewing cost-savings opportunities. However, sales remain pretty small. So can it really cut costs by the sorts of levels needed without significantly denting its sales prospects?

I have my doubts about that. What goes in Renalytix’s favour is that as the initial adopters get to grips with the system and clinical evidence in its favour mounts up, repeat business should increase substantially and recruiting new customers should take less resource. Still, I see the sales productivity as the core challenge for the company and its determinant of success in the medium term.

The Balance Sheet may Need to be Strengthened

Renalytix has already taken steps to strengthen its balance sheet, with a $30 million gross equity and convertible note financing boost in March.

However, more may be needed. At the end of June, cash on hand was $41.3m. Cash outflow in the year was $23.8m depite the finance raise. Without it, last year’s cash burn would have exceeded the cash on hand at the start of this financial year.

Cash outflow should improve this year due to the combination of growing sales and tightening expenditure. But it is still likely to be substantial and I expect the company will need to boost its balance sheet in the coming 18 months or so. That brings a risk of dilution to existing shareholders.

Valuation May not be as Cheap as It Looks

The market reacted positively to the results, sending the Renalytix share price up 20% on the day of release. That still leaves them worth just a tenth of what they were a year ago, though.

A lot needs to go right for Renalytix to succeed, primarily dramatic sales growth and sufficient financing. Both look possible to me though are far from assured. So despite its low price and massive fall, the current Renalytix share price may not be a bargain. I see the shares as a punt not an investment that can be valued with any level of confidence. Accordingly, I continue toRenalytix (RNLX) released its full-year results this week and sales are growing well but the bottom line is worse than ever.

My most recent piece on the company was in July (Renalytix: The Investment Case Is Shot

Full-year Results Highlight Progress and Challenges

The company recently released its full-year results.

I think these contained both positive and negative news. The sales momentum is positive albeit from a very small base, while the company is also reshaping to try and become more viable in the long term. But meanwhile it continues to burn cash at a rate I see as unsustainable.

Revenues grew 99% to $2.9m. That is still small beer but at least the movement is in the right direction. There has been continued momentum into the first quarter of the current year:

“Operational progress continued into the first quarter of fiscal 2023 with over 1,200 tests performed. More than 80% of these were billable, yielding about $1.0 million revenue for the quarter. These are record amounts for us in quarterly testing volumes and revenue.”

That is positive and suggests this year’s revenue growth is in line to top that from last year. Still, it is pretty small beer given how much the company has been investing to expand and deepen its sales reach.

Fixing Renalytix’s Cost Base

The main problem with the results is not the topline but the horrendous bottom line. Post tax loss ballooned 83% to $56.7m. That means that over the past four years, the company’s post-tax losses come to $103.6m.

author using data from company reports

Chart compiled by author using data from company reports

That reflects a number of elements but what I see as the key one is the company’s sales strategy to date. That means its commercial coverage now includes 28 private insurance and network providers, Medicare payment through the individual claims review (ICR) process and 33 state Medicaid programmes. That is a solid basis for future sales growth. The company has also focussed its efforts geographically and took steps earlier this year to cut costs which might make its return on investment in sales more efficient down the line.

But how much will the cost base improve? In the outlook commentary in its full-year results, the company did not provide any real guidance on revenues or income for the present year. The cost-cutting programme which kicked in towards the end of last year is reportedly reducing annualized spend by over $12 million. That still strikes me as relatively minor stuff, representing as it does less than half of the additional loss the company reported last year compared to the already heavily lossmaking prior year.

I think more cost cutting is necessary and the company said in its results that it is reviewing cost-savings opportunities. However, sales remain pretty small. So can it really cut costs by the sorts of levels needed without significantly denting its sales prospects?

I have my doubts about that. What goes in Renalytix’s favour is that as the initial adopters get to grips with the system and clinical evidence in its favour mounts up, repeat business should increase substantially and recruiting new customers should take less resource. Still, I see the sales productivity as the core challenge for the company and its determinant of success in the medium term.

The Balance Sheet may Need to be Strengthened

Renalytix has already taken steps to strengthen its balance sheet, with a $30 million gross equity and convertible note financing boost in March.

However, more may be needed. At the end of June, cash on hand was $41.3m. Cash outflow in the year was $23.8m despite the finance raise. Without it, last year’s cash burn would have exceeded the cash on hand at the start of this financial year.

Cash outflow should improve this year due to the combination of growing sales and tightening expenditure. But it is still likely to be substantial and I expect the company will need to boost its balance sheet in the coming 18 months or so. That brings a risk of dilution to existing shareholders.

Valuation May not be as Cheap as It Looks

The market reacted positively to the results, sending the Renalytix share price up 20% on the day of release. That still leaves them worth just a tenth of what they were a year ago, though.

A lot needs to go right for Renalytix to succeed, primarily dramatic sales growth and sufficient financing. Both look possible to me though are far from assured. So despite its low price and massive fall, the current Renalytix share price may not be a bargain. I see the shares as a punt not an investment that can be valued with any level of confidence. Accordingly, I continue to rate them as a strong sell.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment