trainman111/iStock via Getty Images

When times are tough, sometimes the best way to invest is to buy into larger companies that are stable and that have simple and sturdy business models. One such business model is the packaging industry, and a particular player in this space that is noteworthy is Packaging Corporation of America (NYSE:PKG). Despite extreme volatility from the broader market and concerns over inflation and rising interest rates aimed at combating that inflation, shares of Packaging Corporation of America have held up comparatively well. No doubt, this can be attributed to the recent strong performance reported by the business. It also helps that shares of the company look fairly cheap on a relative basis and are attractively priced on an absolute basis. Absent some major change in the company’s fundamental condition or a severe worsening in the broader market, I fully suspect that this enterprise will continue to outperform the market for the foreseeable future. As such, I’ve decided to retain my ‘buy’ rating on its stock at this time.

Keep it simple

Few companies are as operationally simple as Packaging Corporation of America. In a prior article, I detailed exactly how the company functions. Because of that, I will refer you to that piece instead of rehashing information I already covered. But in short, it’s worth noting that this business is currently the third-largest producer of containerboard products, as well as a leading producer of uncoated freesheet paper, throughout North America. Last year, the company produced 4.89 million tons of containerboard, resulting in 65.7 billion square feet of corrugated product shipments. This compares to the 4.25 million tons and 59.4 billion square feet worth of shipments reported just two years earlier. Due to the attractive operating history of the company, combined with how shares were priced, I had ultimately rated the business, in that article, a ‘buy’. Since then, shares have performed more or less as I would have anticipated. Even though the stock is down by 5.4%, investors should view that as a win considering that the broader market is down by 17.1% over the same window of time.

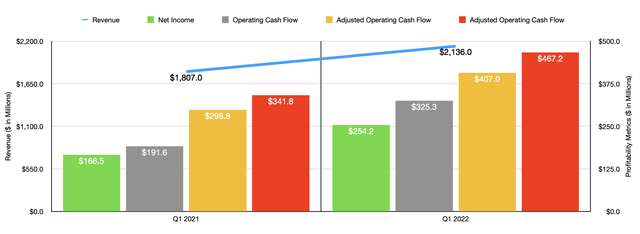

While looking at historical performance is important, it’s also worth noting that what is even more important is how the company continues to perform. And since my last article on the company, management has succeeded in delivering. Revenue in the first quarter of 2022, for instance, came in strong at $2.14 billion. That’s 18.2% above the $1.81 billion reported just one year earlier. This came at a time, according to management, when containerboard production throughout North America had risen by just 2% year over year. What’s more, industry-wide inventories in the first quarter of 2022 totaled 2.7 million tons, an increase of 17.5% compared to the same time one year earlier. UFS paper, a product the company produces some of, saw shipments drop by 1% year over year.

During this same window time, Packaging Corporation of America benefited significantly, with packaging revenue up 21% year over year. Of the roughly $341 million increase in revenue year over year associated with this set of operations, $73 million was attributed to higher shipment volume while higher prices and favorable product mix added $268 million for the business. Unfortunately, this was offset to some degree by an $11 million decrease in paper sales, with a $19 million additional contribution coming from higher prices and product mix more than offset by a $30 million reduction from lower volume.

The increase in volume produced by the company’s packaging operations, combined especially with the higher prices the company achieved, were instrumental in pushing profitability up. Net income in the latest quarter was $254.2 million. That’s 52.7% higher than the $166.5 million reported for the first quarter of 2021. In an asset-intensive industry that is notorious for mediocre margins, any sort of improvement in pricing can really help the firm’s bottom line. Other profitability metrics have followed this same trajectory. Operating cash flow of $325.3 million dwarfed the $191.6 million reported one year earlier. If we adjust for changes in working capital, operating cash flow would have risen even further, climbing from $298.8 million in the first quarter of 2021 to $407 million the same time this year. Meanwhile, EBITDA for the company also improved, climbing 36.7% from $341.8 million to $467.2 million.

From what I can see, management has not provided any real guidance for the current fiscal year. In some ways, this might be for the better. After all, it’s unclear that current industry conditions will represent the new norm. It is highly probable, in fact, that weakness will eventually come around the corner in the form of lower prices and/or as a result of reduced demand. Instead of trying to value the company based on projected results, I would prefer to use the more conservative figures reported for the company’s 2021 fiscal year. Even if we do see a weakening in the broader market, the results experienced in 2021 were not so radically different from the pre-pandemic years that I could see a justification for an even more conservative assessment.

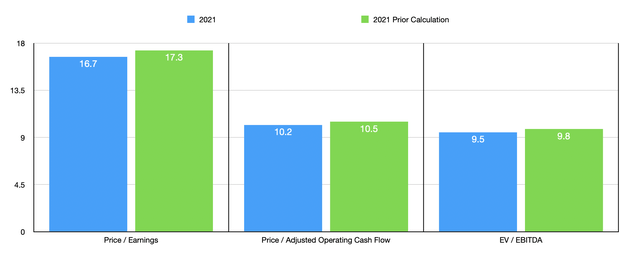

Using the 2021 results, I calculated that the company is trading at a price-to-earnings multiple of 16.7. That’s slightly lower than the 17.3 that I calculated when I last wrote about the firm. The price to adjusted operating cash flow multiple of 10.2 is lower than the 10.5 in my last piece. And finally, the EV to EBITDA multiple has dropped from 9.8 to 9.5. All during this time, the net leverage ratio of the company has remained flat at 1.07. To put the pricing of the company into perspective, I decided to compare it to the same five firms that I compared it to in my last article. On a price-to-earnings basis, these companies ranged from a low of 14.4 to a high of 33.9. In this case, two of the three companies were cheaper than Packaging Corporation of America. Using the price to operating cash flow approach, the range was from 5.5 to 34.1 while the EV to EBITDA approach yielded a range of 6.7 to 41.5. In both of these cases, only one of the five companies was cheaper than our prospect.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Packaging Corporation of America | 16.7 | 10.2 | 9.5 |

| Sonoco Products Company (SON) | 33.9 | 34.1 | 41.5 |

| WestRock Company (WRK) | 14.4 | 5.5 | 6.7 |

| Graphic Packaging Holding Company (GPK) | 24.3 | 11.0 | 12.2 |

| Sealed Air Corp. (SEE) | 16.1 | 12.9 | 10.9 |

| Amcor plc (AMCR) | 20.0 | 13.2 | 12.6 |

Takeaway

Based on the data provided, shares of Packaging Corporation of America look to be quite attractive to me at this time. While I wouldn’t call the company a deep value prospect, I would definitely call it a value opportunity. If results from the first quarter of this year are any indication, shares are even much cheaper on a forward basis. But I would prefer to be more conservative and use the 2021 figures. Doing this, we can see that the company has gotten cheaper compared to my last article. On top of that, shares are cheap relative to similar players. Due to all of this, I have decided to keep my ‘buy’ rating on the firm, indicating to you that I feel it will continue to outperform the market for the foreseeable future.

Be the first to comment