designer491

My opinion is it is best not to go long or average down on Edgio, Inc (NASDAQ:EGIO) Yes, the big drop from $5.55 to $2.69 is tempting for bottom-fishing experts. Unfortunately, Seeking Alpha Quant has a hold rating for EGIO. We should heed this prudent AI-infused advice. Let us remain neutral on EGIO. My takeaway is that this stock is still under the influence of gravity. I opine the $5.55 52-week high euphoria back in April is not going to get revived before 2022 is over.

The seven Wall Street analysts who gave a strong buy to EGIO have an average price target of $6.29. I opine that their optimism is not going to materialize within the next 12 months. I opine EGIO is not a buy because it is still a falling knife. Edgio’s stock price nosedived after April. It lingered way below the $6.29 average price target of Wall Street analysts.

The announced initial deal was an all-stock $300 million deal. It was NOT an all-stock deal. Mr. Rayburn’s July explanation is that the Edgecast acquisition only cost $120 million. Read Rayburn’s article, which said Apollo also gave $30 million cash to Limelight in addition to the 72 million Edgio shares that Yahoo received. Rayburn also explained that Apollo gave another $35 million to Limelight in exchange for 8 million shares of Edgio.

My Takeaway

I opine EGIO is unlikely to breach the $5 barrier this year. The Q3 F2022 earnings beat and raised guidance for the full F2022 were not enough to push the stock above $4. Rayburn’s article was not enough to push the stock up to $4.

I opine the hyped combo revenue of Limelight and Edgecast is not going to hit $500 million this year or in 2023. The raised guidance said FY2022 revenue would only be $380 to $390 million. Mr. Rayburn said the deal was closed last June and yet Edgio did not have any confidence to give a more optimistic guidance.

I opine the $65 million cash should have inspired the bulls to keep EGIO above $3.50 for the past few months. The $65 million cash payment from Apollo is very important. The Q2 2022 balance sheet of Edgio revealed it only has $55.2 million in cash. I opine A takeover deal where the buyer gets paid in cash by the seller is a very intriguing scenario.

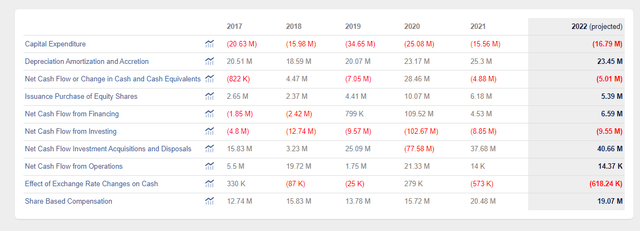

The $65 million cash infusion is certainly a boon. It could help us overlook Edgio’s net operating cash flows of $14k for 2022.

Motek Moyen’s Author Account @ Macroaxis.com

It is speculative on my part but Apollo giving $65 million in cash means Limelight executives/shareholders wanted something more in their takeover of Edgecast. We are not privy to the real details of this deal. Nobody can disprove my subjective analysis.

Technical Indicators Are Still Bearish

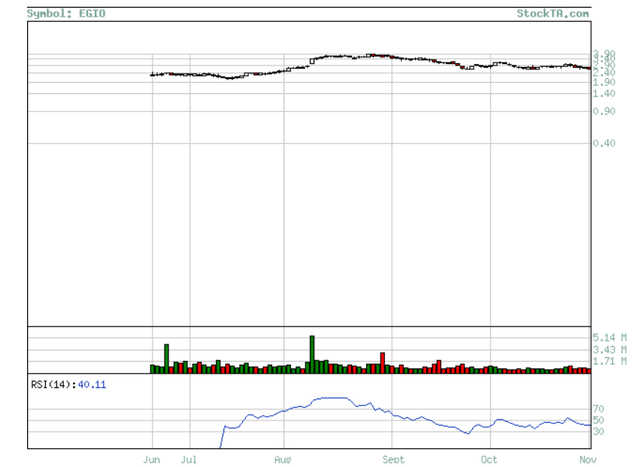

Do not go long or average down on EGIO. Its Exponential Moving averages are still bearish. There is no bullish reversal EMA trade alert. The Simple Moving Averages of EGIO are also bearish. Please heed the chart below.

The Relative Strength Index indicator is also an easy gauge of market emotion. The RSI indicator is still bearish on Edgio. EGIO’s RSI score is 40.11. It is in bearish territory, but not yet below the oversold RSI score of 30.

Is It Efficient?

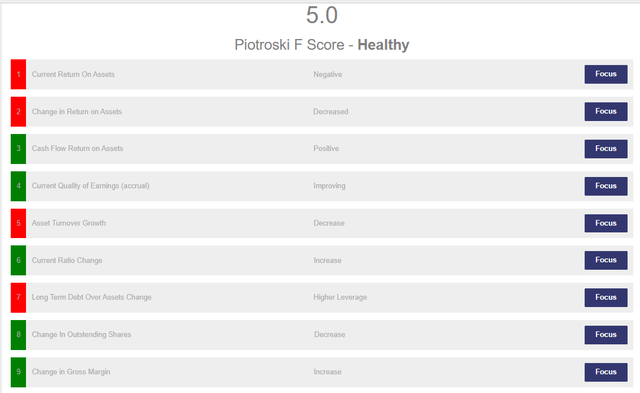

The Piotroski F-score is my most important metric when evaluating stocks. I checked my author account at Macroaxis. Edgio’s F-score is 5. Edgio is still considered an efficient company. I hope that the takeover of Edgecast will eventually raise the F-score to 6 or higher.

Motek Moyen’s Author Account at Macroaxis.com

Let us hope that the $65 million cash from Apollo shows up on the Q3 balance sheet of Edgio Inc. This cash from Apollo can certainly address that -$28.28 million leveraged free cash flow of Edgio.

My Verdict

Everything I publish here in Seeking Alpha is my opinion. If you disagree with my views do not insult me on the comments section. Subjective statements should not be taken 100% correct. Use your own critical thinking.

It is best to respect bearish technical indicators. We should heed what the Seeking Alpha Quant AI algorithm is saying. EGIO is a hold as per Quant AI. You pay for this quant feature.

I opine Inorganic growth through an acquisition only fattens up the top line. The acquisition of Edgecast only raised the revenue potential. It doesn’t automatically fix the persisting net losses of Edgio. The $65 million cash payment to Limelight was a very intriguing incentive. The March official statement was that it was an all-stock transaction.

I opine you can hold on to your Edgio Inc. It is still a midget among Content Delivery Network platform giants. It could grow big enough that industry leaders might eventually buy it.

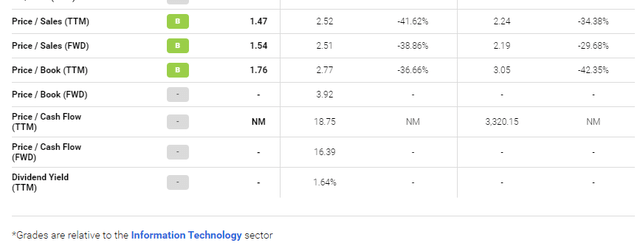

If you think that a TTM P/S ratio of 1.47x is good enough for a midget but growing CDN company, then go ahead, go long or average up on EGIO. You can justify to yourself that the 1.47x P/S is indeed -41.62% lower than the Information Technology sector’s average P/S of 2.52x.

I cannot dismiss that there’s a long-term tailwind from Edgio’s web/app security solutions. Bundling CDN services with mobile/web security subscription services is a winning strategy. The screenshot below is prima facie evidence that Edgio offers cybersecurity solutions.

The global cybersecurity business was valued at $139.11 billion in 2021. It is expected to be worth $155.83 billion this year. This particular industry exhibits a 13.4% CAGR. In comparison, the Content Delivery Network industry has an estimated 2022 market size of $19.6 billion and a 20% CAGR. Going forward, Edgio’s management should focus more on growing its cybersecurity products and less on CDN. Bundling is good, but some vigilant customers do not like entrusting their CDN and app security to just one company.

Be the first to comment