peepo

The iShares MSCI World ETF (NYSEARCA:URTH) is the typical benchmark for the world market, but because of the prominence of its markets, the US dominates the ETF, which means that really the URTH ETF is mostly just a bet on large cap US stocks. We are not overweight US stocks right now since their anticipation of economic recovery has run ahead a lot of other markets, and the PE of US markets are pretty high relative to other developed markets. While you dodge emerging markets which have growing risks in the current environment, we’d think investors would prefer a narrower bet.

The URTH Breakdown

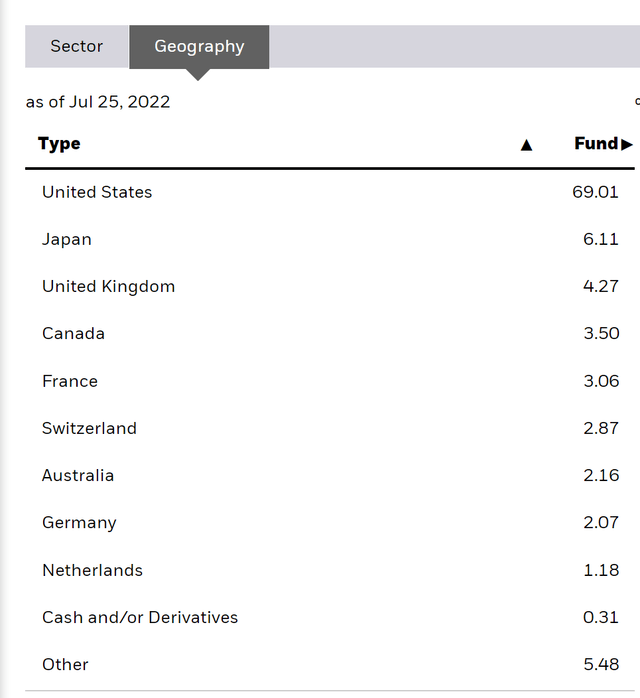

URTH is mostly just a bet on the US:

Geographic Breakdown (iShares.com)

Other markets like Japan and the UK are a little bit featured, but mostly we are talking about a value weighted bet on the US markets, which means primarily on mega-cap US stocks like Apple (AAPL) and Amazon (AMZN). Apple alone is 5% of the whole URTH ETF, and Microsoft (MSFT) is 3.5%.

The fortunes of tech are going to be important for the direction of URTH, where MSFT and Amazon’s recent reports started betraying some signs of reversals in the goods and tech markets. Indeed, MSFT has some headcount exposure with its enterprise offerings, and with unemployment spiraling being a concern in the economy, despite yesterday’s rebound, these high multiple and growth assumed companies could see some serious retreats. While bullish sentiment takes the pain off investors for some tough previous months, it shouldn’t be taken as a definite sign of economic direction.

The US Premium

In general, a value weighted bet right now in an environment that isn’t of stable and muted growth is riskier as it skews towards these tech names. While there is secular growth in the tech end-markets, we are nearing the end of a cycle and the general multiple for the S&P is so much higher than other markets where expectations might be a lot more conservative. Currently, European markets trade at a PE just below 14x while the S&P is at 19x. With economic concerns being real, you want the margin of safety provided by a more conservative market. Japan is another conservative stock market that has some more respectable tech exposures near the top of its markets, and the discount between them and the US is even higher where Japan trades at 13x. With the Fed indicating that they’re liable to take their foot off the rate pedal if things calm down with inflation, further FX devaluation seems unlikely of these foreign currencies for US investors. Moreover, with these countries potentially following in the rate increases, US investors might see those foreign FCFEs convert better back into dollars than they have until now.

Conclusions

A strengthened dollar has helped combat some of the imported inflation, but the inflation is still substantially cost-push on supply side issues. With demand destruction on that basis pairing with higher rates and the growth in leverage over the last two years, unemployment spiraling and falling incomes remains a risk. The big tech stocks have great economics but are not immune. With higher valuations across US markets, investors might want to choose this moment to go contrarian and look for their exposures that offer similar risk at a lower price. While URTH dodges emerging markets, that have currencies dependent on commodities in many cases and debt denominated in dollars, difficult environments reward selectivity.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment