JHVEPhoto/iStock Editorial via Getty Images

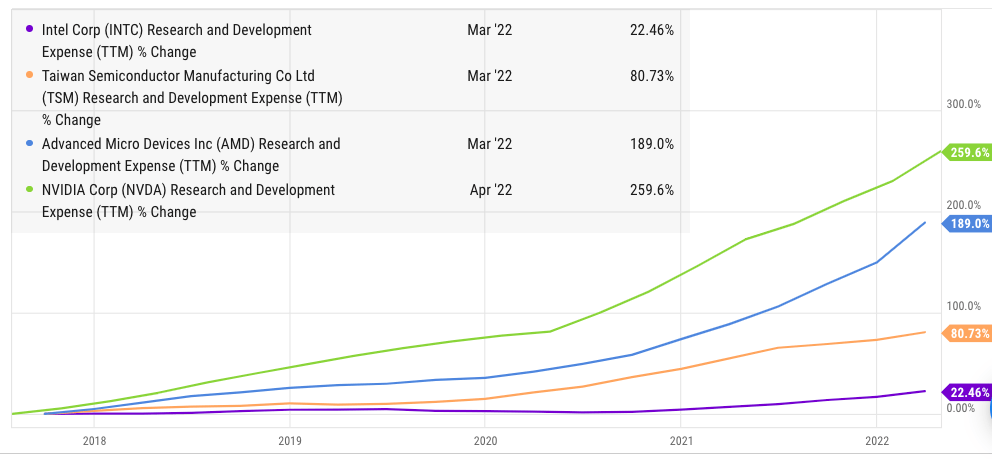

Intel (NASDAQ:INTC) has been playing catch up with its competitors for the last few years. A completely new strategy has been announced by Intel under the new leadership. However, this might be too little too late. In the past five years, there has been a massive change in the research and development department of major chip makers. NVIDIA (NVDA) has shown the biggest jump in R&D bill in the last five years with a growth of 260%. AMD (AMD) has reported close to 190% increase and TSMC (TSM) has reported 80% growth in R&D bill in the same period. On the other hand, Intel’s research budget grew by a mere 22.5%.

There is a lot of discussion on the new product lineup and how they can alter the market share in a particular segment. This has sometimes helped Intel stock over the short term by giving a more bullish sentiment towards the company. But long term investors should look at the bigger trend within the R&D department to gauge the ability of these companies to deliver sustainable growth. A single hit product might not help Intel in building durable momentum because of the rapid changes within the semiconductor industry.

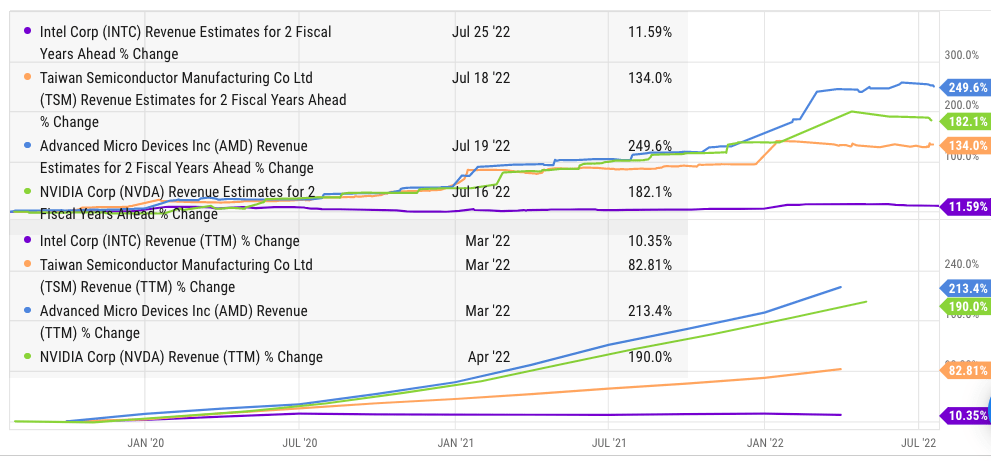

Higher revenue growth within AMD, NVIDIA, and TSMC will allow them to further increase the investment in R&D. This will hurt the ability of Intel to close the technological gap with the competitors. Despite the low stock price, investors should look at options other than Intel to make a long-term bet.

Importance of R&D department

In the rapidly changing tech ecosystem, it is very important to maintain a healthy R&D investment. This allows companies to launch cutting-edge products and also gain a brand premium from customers. Almost all tech companies try to max out their R&D investment while maintaining good margins. The rapid revenue growth in AMD, NVIDIA, and TSMC in the last five years has allowed these companies to increase investment in their R&D department. On the other hand, the stagnant revenue base of Intel has led to a very low increase in R&D investment.

Ycharts

Figure 1: Increase in R&D investment in AMD, NVIDIA, TSMC, and Intel in the last five years.

We can clearly see from the above chart that Intel is trailing other competitors in terms of an increase in R&D investment. This will likely have a long-term impact on the ability of Intel to deliver attractive products which can beat the competition.

Bang for the buck

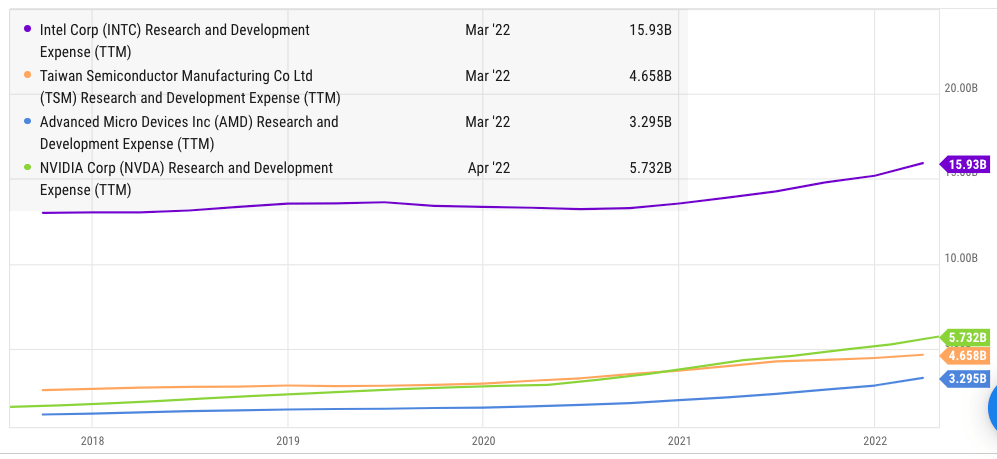

It should be noted that Intel still spends more on R&D compared to other competitors. Intel’s R&D expense on a trailing twelve-month basis stood at $16 billion. AMD spent $3.3 billion, NVIDIA spent $5.7 billion and TSMC spent $4.7 billion on R&D. This shows that Intel’s R&D expense is more than the combined R&D expense of these three competitors.

Ycharts

Figure 2: R&D expense of AMD, NVIDIA, TSMC, and Intel on ttm basis.

However, the biggest difference is in getting a bang for the buck. Intel has been plagued by delays after delays over the last few years. Even recently, there has been a further delay in the next-gen Saphire Rapids processor.

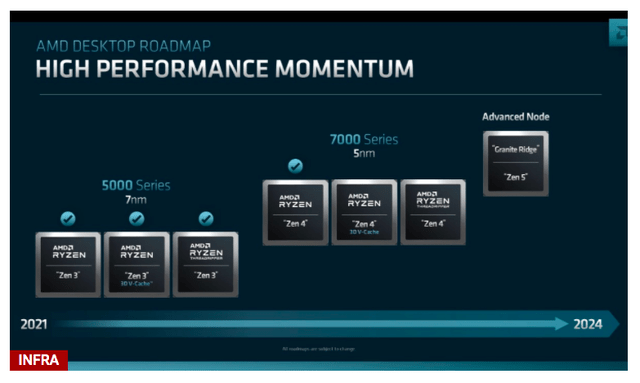

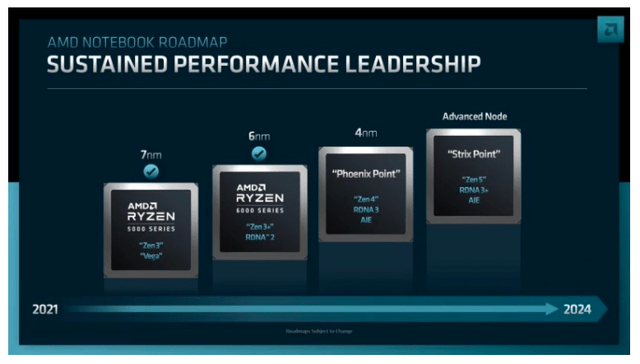

Figure 3: AMD’s roadmap for next-gen chips.

Figure 4: AMD’s roadmap for Notebook segment.

AMD has announced a very ambitious roadmap in the recent analyst day presentation. If AMD can stick with the roadmap it has announced, it will be in great shape to meet future competition from Intel. The rapid growth in R&D budget by AMD, NVIDIA, and TSMC will certainly help them in maintaining a strong product launch momentum in the next few quarters.

Delays, Delays, Delays

The delays in the roadmap of Intel have eroded investor confidence significantly. By this time, Intel is almost synonymous with delays. It would be better if the management gave a more general roadmap timeline instead of pushing launch dates from early to mid to late calendar year. Meteor Lake is also believed to be delayed to the end of 2023 from mid-2023 launch date announced earlier. While the new management has stepped on the gas in terms of capital investment, it has not resolved the basic issue of delays.

A lot of analysts have mentioned the superiority of the next-gen products of Intel compared to its competitors. However, none of this is important if the company does not keep to its roadmap. Wall Street might eventually ignore all future product roadmaps and focus on the delivered products of Intel.

AMD, NVIDIA, and TSMC have shown strong revenue growth in the past few years. This has allowed them to ramp up their R&D investment. All of them have also forecasted a strong revenue growth trend in the next few years. This will certainly lead to a faster increase in their R&D investment in the near term.

On the other hand, Intel’s management has already announced low single-digit revenue growth forecast for the next three years as the company undergoes a major transformation. This will limit the ability of Intel to increase its own R&D investment. It must be noted that intel has already announced massive capital expenses for building new plants in USA and Europe. This can further limit the ability of the management to divert resources to R&D department.

Ycharts

Figure 5: Past revenue growth and future estimates of AMD, NVIDIA, TSMC and Intel.

If the current trends hold, we could see AMD, NVIDIA and TSMC reach an annual R&D expense rate of over $10 billion by 2025. It is unlikely that Intel will be able to increase spending on this department in the near term due to lower revenue growth. This will be a game changer within the semiconductor industry. It can also cause a further increase in the technological gap between Intel and its competitors which would be another headwind for Intel stock.

Impact on Intel stock

The fortunes within the semiconductor race can change quickly. Many investors want to invest in Intel due to its attractive stock price and betting on the turnaround. One or two hit products by Intel can certainly help the company reduce the decline in market share in key segments. However, the ability of Intel’s competitors to massively increase their R&D budget will be one of the biggest challenges faced by Intel. AMD, NVIDIA and TSMC have already proved that they can launch good products with a relatively modest R&D expense. Future increase in their R&D budget will probably increase the technological gap with Intel.

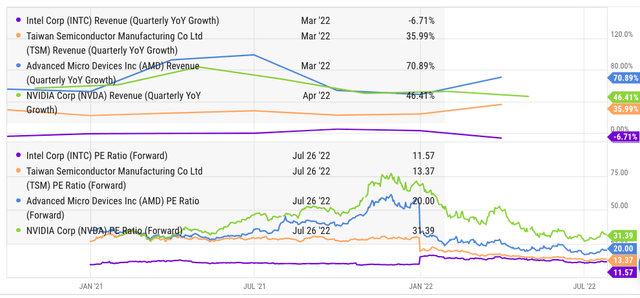

Figure 4: Forward PE ratio and revenue growth of AMD, NVIDIA, TSMC and Intel.

Intel stock is not very cheap when we look at the forward PE ratio metric. TSMC stock is slight ahead of Intel in terms of forward PE ratio while AMD is trading at a 60% premium. Intel’s recent Alder Lake chips have received good reviews. It is possible that Intel is able to launch a couple of hit products in the near term. However, the long-term trend in revenue and R&D expense growth between Intel and its competitor does not favor Intel.

Investor Takeaway

Intel is facing headwinds due to significant changes in the competitive landscape. The R&D expense of Intel’s competitors has increased massively over the past five years. The future revenue growth estimates of AMD, NVIDIA and TSMC are also good. This will lead to a further increase in their R&D expense. Intel’s competitors have shown that they can deliver a better bang for the buck in terms of their research expenses.

Intel stock is not very cheap compared to other competitors when we look at the revenue growth trends and forward pe ratio metric. The rapid growth in R&D investment by Intel’s competitors will allow their management to launch new products at a faster rate and build a strong lead over Intel. Investors with a long-term horizon should carefully look at the changing picture within the R&D metric of Intel and its competitors.

Be the first to comment