PytyCzech

Over the past month global equities and bonds have swooned. One trend that bucked the trend until recently was the uranium sector.

Trading View

With some major positive news today, it appears that the uranium sector may be in the process of decoupling from broader markets.

I will illustrate how these developments should benefit the Global X Uranium ETF (NYSEARCA:URA).

Germany To Extend Nuclear Plants

One of the most steadfast opponents to nuclear energy has been the Green Party in Germany. Despite a brewing energy crisis in Europe, Germany refused to budge from their anti-nuclear stance. This is important as German opinions on the matter greatly influence the EU as a whole. Their negative slant was seen as a major overhang for the expansion of nuclear energy throughout the European continent.

Today, that stance appears to have been reversed as Germany announced that it plans to extend the lifespan of two nuclear plants.

Economy Minister Robert Habeck said that Germany expects to extend the lifespan of two of its last nuclear power plants Isar 2 and Neckarwestheim beyond their planned phase-out as declines.

“The operators will now make all the preparations needed for the southern German nuclear power plants to produce electricity in winter and beyond the end of the year, naturally in compliance with safety regulations,” Habeck said.

Germany is following in the footsteps of nuclear power plant extensions in California and Illinois. This is tremendously bullish news from a sentiment perspective.

France Nuclear Construction Plans

The second new development is that France has drafted new legislation to streamline the construction of new nuclear plants.

France is aiming to start construction a new type of reactor, EPR2, by 2027.

“The goal is for the procedural part and authorizations to last less than five years and for construction work on the first EPR2 (reactor) to start before the end of the presidential term, before May 2027,” the ministry official told reporters.

France is planning to invest $50 billion to build six new reactors that should be completed by 2035-6. The new legislation is aimed at reducing the bureaucratic process to permit the construction of the new reactors.

The demand from six new reactors is not what is important. After all there are ~450 reactors worldwide. What is important is that a major European nation is taking steps to invest in nuclear energy. We have moved past the point of simply pontificating about how to solve the energy crisis in Europe. We have now moved to the practical stage where a steady stream of positive announcements should be expected. Germany and France are the leaders of Europe and you can expect Holland and Belgium to follow their lead towards investing in nuclear energy.

Cameco M&A

The final piece of good news for the uranium sector was that industry leader Cameco (CCJ) filed a $1.5 billion shelf offering.

The offering is rather broad and vague in its intention. However, the most likely scenario is that Cameco is planning to raise money for M&A purposes.

“The securities may be offered in consideration for the acquisition of other businesses, assets or securities by the company or a subsidiary of the company. The consideration for any such acquisition may consist of any of the securities separately, a combination of securities or any combination of, among other things, securities, cash and assumption of liabilities.”

Of course any M&A activity would boost the underlying stocks in the URA ETF.

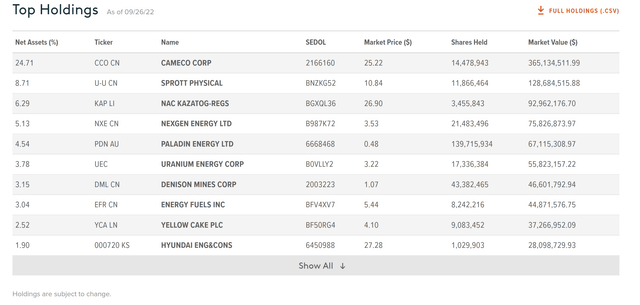

Global X URA ETF Factsheet

I think that there are a couple of potential acquisition targets within the top ten holdings of the URA ETF.

The other possibility is that Cameco is looking to purchase physical pounds in the spot market joining Sprott (OTCPK:SRUUF) and Yellow Cake (OTCQX:YLLXF). If Cameco joined the ranks and started buying physical uranium this could really ignite the spot and contract price of uranium.

Conclusion

In a week where doom and gloom has permeated all major markets, uranium stocks were up today. From a practical perspective, uranium stocks should not be correlated with other stocks. However, we all know that hedge funds and other money managers are forced to sell what they can. This in turn drags down industries where the news has been positive.

I sense that today was an inflection point in terms of sentiment towards nuclear energy. The Global X Uranium ETF should be a prime beneficiary.

Be the first to comment