Tibrina Hobson/Getty Images Entertainment

DoorDash (NYSE:DASH) grew massively during the pandemic due to consumers being stuck at home and cash rich from continuous stimulus checks. This caused the total number of users and revenue to increase at sky-high rates and become a favorite stock among many investors. However, with a recession most likely coming soon, DoorDash’s pricing model may be too expensive for many users to handle. This could cause the company’s top line to be harmed by lower service fees, commissions, and DashPass subscriptions. With all of this in mind, as well as the current price the stock is trading at, investors should reconsider the company’s future before buying the stock.

The Pandemic Caused Inflated Demand For DoorDash

During the COVID-19 pandemic, consumers were stuck at home and were much more likely to order from DoorDash instead of going to a restaurant. This caused the number of DoorDash users to double, increasing to 20 million total users in 2020. This caused skyrocketing revenue as the company collected more service fees and commissions from merchants. From 2019-2020, the company increased its revenue from $885 million to $2.89 billion. DoorDash was also able to become the clear winner in the food delivery industry in terms of market share, now sitting at 57%.

Although the service adds many fees to the original subtotal, users of DoorDash were willing to accept the higher costs due to being cash rich from multiple stimulus checks. The average consumer in the United States received about $3500 from the pandemic stimulus checks. Since these checks were sent out to consumers who were under certain income levels, it caused many consumers to have much more money than normal. Since consumers had more money to spend, they didn’t mind paying for the extra fees DoorDash adds to orders.

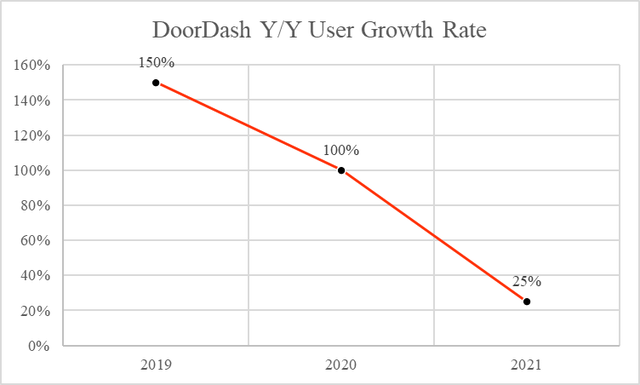

Now that the pandemic is over and consumers are no longer receiving stimulus checks, DoorDash is not adding as many users as it has in previous periods. From 2020-2021, DoorDash added about 5 million new users, which equates to a 25% growth rate. While this is still impressive, this is the lowest growth rate the company has experienced in the previous few years. This is the first sign of the possible pain the company will face in the future.

DoorDash Y/Y User Growth Rate (eMarketer – Chart by Author)

The Company’s Pricing Model May Be Too Expensive For Some Consumers To Handle

Now that consumers are no longer cash rich and a recession is likely on the way, consumers are going to start cutting expenses. This will likely lead to many customers of DoorDash driving to a restaurant themselves instead of paying the extremely high fees to use the service. The main ways DoorDash generates revenue is by taking commission from merchants and charging consumers a service fee. The commission rate for DoorDash orders ranges from 15%-30%. This leads merchants on DoorDash to raise prices because restaurants normally have low margins and cannot take a double-digit percentage hit to revenue. Therefore, consumers who buy food through DoorDash are actually paying much more than if they were to go to the store themselves. On top of this, the service fee DoorDash charges currently sits at 15% and must be a minimum of $3 per order. The company also charges a delivery fee, as well as additional fees depending on certain areas and orders. All of these fees combine with higher base prices to cause the service to become very expensive for the average consumer when money is tight.

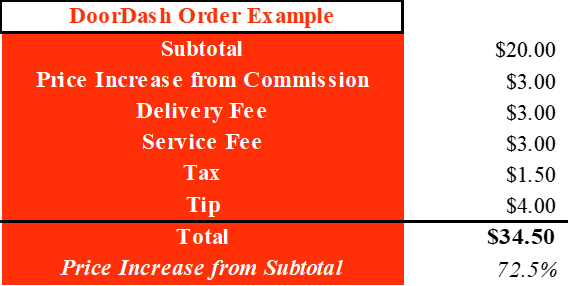

Let’s take an example of an order that would normally cost $20 at a restaurant. If DoorDash takes the lowest commission possible of 15%, this would cause the merchant to increase the price of the food to roughly $23. By adding an average delivery fee of $3, a 15% service fee of $3, sales tax, and a 20% tip, the total price of the food increases to $34.50. This represents a price increase of 72.5% from the normal price of the food if the consumer drove to the store themselves. With this example, the consumer would likely choose not to order on DoorDash to save the money during a recession.

$20 DoorDash Example

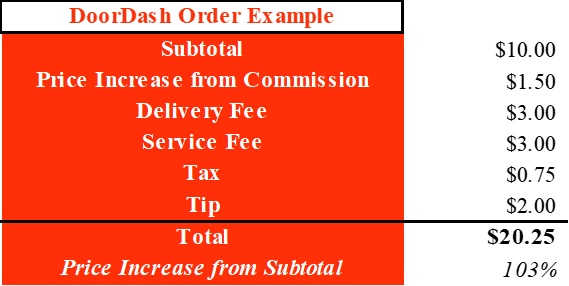

These fees also get exponentially worse as the original subtotal of an order decreases. Since the minimum service fee for a DoorDash order is $3, the price increase from the subtotal of smaller orders will be dramatically larger. To compare to the previous example, let’s take an order that would originally cost $10 at the store. By adding the same costs from before at the same commission rate, tax rate, and tip rate, the final price increases to $20.25. This means the final price of the DoorDash order has increased by over double. With more consumers looking to cheaper options like fast food during a recession, many consumers will not be willing to incur the extra fees anymore. This will deeply hurt DoorDash’s top line in the following periods as the company sees less orders overall.

$10 DoorDash Example

Lower Demand For DoorDash Could Lead To Lower DashPass Subscriptions

DashPass is a subscription service that allows customers of DoorDash to have free delivery and lower service fees on orders of at least $12. DashPass has grown rapidly over the past 3 years, increasing its number of subscribers from 800,000 to over 5 million. With the subscription being priced at $9.99 per month, DashPass generates lots of revenue for the company. However, a decrease in demand for DoorDash’s services could lead to less people starting new subscriptions and even cancelling current subscriptions.

Since DashPass subscribers still have to face the issue of higher prices from merchant commissions, many may still stop using DoorDash and cancel their subscription. With inflation on the rise, the 15%-30% commission rate DoorDash users incur will increase exponentially. For example, if a merchant increases its price at the store by $1, it could mean the DoorDash price will have to increase by $1.50 or even more. As inflation continues to soar, DashPass users will have to continue to incur even higher prices than normal. This could possibly cause subscribers to cancel, as well as drive less consumers to begin new subscriptions.

Valuation

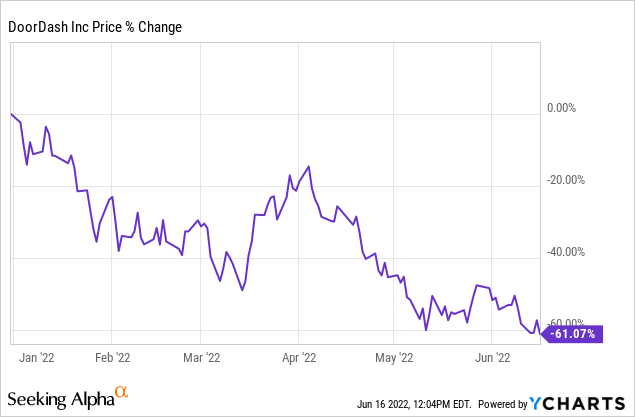

DoorDash’s stock is down over 60% since the beginning of 2022, leading many investors to want to jump into the stock. However, the possibility of an upcoming recession may cause the company to underperform and have lowered fundamentals. Furthermore, the stock may still be overvalued.

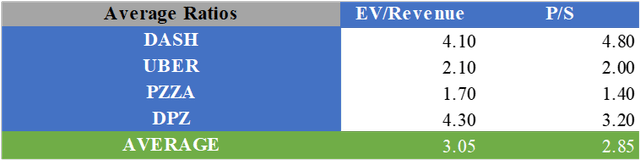

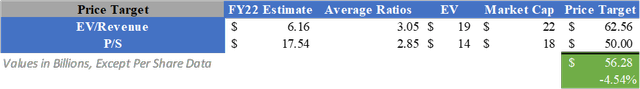

By multiplying consensus analyst estimates for FY22 by the average valuation multiples of EV/Revenue and P/S of DoorDash and other comparable companies, a fair value of $56.28 can be calculated. This means the stock is slightly overvalued and can continue to drop by 4.54%. It is important to note that the revenue estimates for DoorDash may still likely be high as analysts start to bake in the effects of a recession.

Risks To Bearish Thesis

The biggest risk to this bearish thesis is if inflation does not last as long as expected or a recession does not occur. However, with inflation coming in at a 40-year high of 8.6%, the probability of a soft landing from the Fed is becoming increasingly less likely. With inflation continuing to rise, the Fed will likely have to take more aggressive actions than expected. With interest rates rising faster than expected, it becomes more likely a recession will come and consumers will start cutting expenses, including DoorDash.

What Does This Mean For Investors?

DoorDash has become a favorite stock among many investors due to its massive growth in previous periods. However, the service saw highly inflated demand during the pandemic, as consumers were stuck at home and cash rich from stimulus checks. With the pandemic’s effects fading and cash becoming much tighter from inflation and a possible recession, the enormous fees DoorDash adds to subtotals may become too much for many consumers to handle. This will likely lead to many consumers opting not to order from DoorDash and possibly cancel their DashPass, causing the company’s top line to see harm. Due to all of these factors and the idea that the stock will likely continue to drop, I will apply a Sell rating to DoorDash at this time.

Be the first to comment