Funtay/iStock via Getty Images

Investment Thesis

ConocoPhillips (NYSE:COP) is a fully unhedged exploration and production oil and liquefied natural gas development company. Thus, with oil and gas prices roaring higher, ConocoPhillips is a full beneficiary of this pricing environment.

I lay out a bullish case for why ConocoPhillips may increase its shareholder capital return program to $9 billion in 2022, implying a 7% shareholder yield.

Why ConocoPhillips? Why Now?

ConocoPhillips is an exploration and production company, with assets spanning 14 countries. It holds a diverse low-cost supply of both resource-rich unconventional plays in North America, as well as, conventional plays in North America, Europe, and Asia.

Furthermore, importantly, it also has liquefied natural gas developments. For investors, the opportunity is now simple. Investors who wish to participate in elevated oil and gas prices, but do not want to invest in a seemingly ”risky” junior production company, ConocoPhillips is a happy medium.

Given its massive reach, it’s well-positioned to participate in higher oil and gas prices, but not likely to become a donut if energy markets suddenly turn south faster than analysts expect.

Now, let’s discuss its cash flow potential for 2022.

Free Cash Flows in Focus

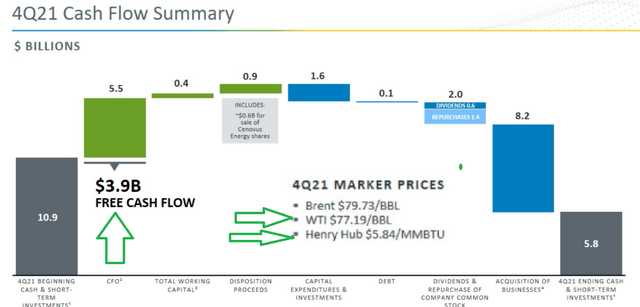

ConocoPhillips investor presentation

As you can see above, for Q4 2021, ConocoPhillips’ free cash flow reached $3.9 billion. This was reported during a period when the WTI was approximately $77.19, while the Henry Hub was around $5.84.

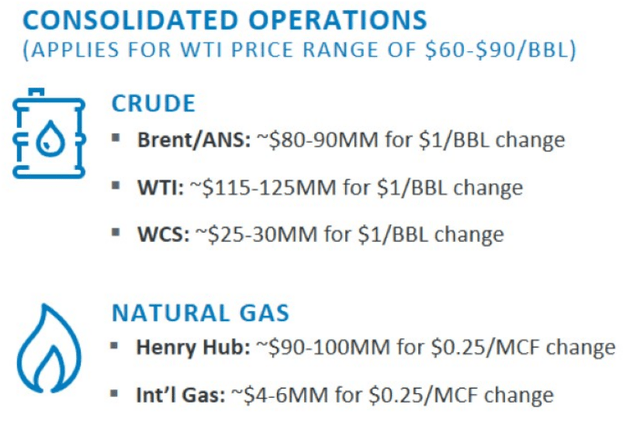

ConocoPhillips investor presentation

However, since the end of Q4 2021, WTI is higher by approximately $20 to $25 WTI. This means that just on the crude side of the business, ConocoPhillips is looking to report a further $2.4 billion of cash flows from operations.

Meanwhile, on the natural gas side, the average prices for the Henry Hub were around flat compared with Q4 2021. That being said, we are now already into Q2 2022, and it appears that prices for Q2 2022 may be around $7.5 for the quarter, although this is early and the situation is very fluid.

That being said, at around $7.5 on the Henry Hub, this translates into a further $300 million on the Henry Hub alone.

Thus, altogether, it’s not inconceivable that ConocoPhillips’ free cash flow for Q2 2022 could reach higher than $6.5 billion during Q2 2022.

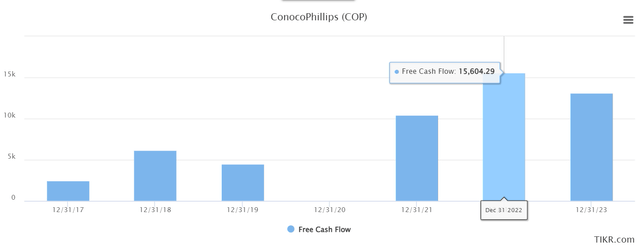

Consequently, this altogether appears to substantiate analysts’ present expectations that ConocoPhillips’ free cash flow in 2022 could reach $15.6 billion.

TIKR.com

Now, to be fair, the only thing that matters here is what the outlook for 2023 looks like. Because trying to figure out the free cash flow that ConocoPhillips will make during H2 2022 is practically irrelevant. The market is always forward-looking and having a view on the sustainability of elevated oil and gas prices is where the alpha can be attained here.

With that in mind, before we go further and discuss COP’s valuation, allow me to put the following dynamic in the spotlight.

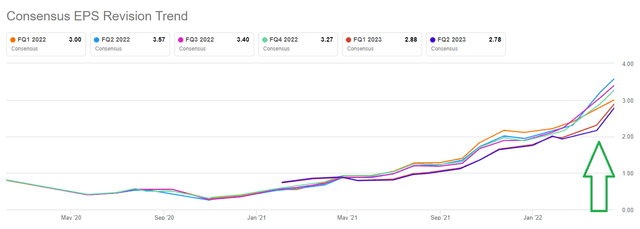

Seeking Alpha’s analyst consensus estimates

As you can see above, analysts have been very busy upwards revising their EPS estimates for ConocoPhillips. Why is this important?

Because it shows that analysts have been playing catch-up with the market. The market for oil and gas stocks has been soaring high for a while and analysts are only now starting to take a slightly less-dim view of this sector’s prospects.

While it may be difficult to spot from the graph above, it shows that analysts are expecting oil and gas to fizzle out as we progress out of 2022 and into 2023. This is a bumper year, that’s the thesis.

And while I generally agree with that insight, where I disagree is that 2023 will ”fizzle out”. Why? Because getting significantly more oil supply online is actually more difficult than it seems.

When it comes to oil and gas, the big needle movers, producing countries, have been underinvesting for years in their infrastructure. After all, it’s just been a multi-year bear market. Many big oil suppliers are producing under their quotas because they haven’t been investing in the required infrastructure.

It’s not a case of just turning on the spigot, and everything will be ok. You have to survey the area, find the oil, get the equipment up and running, hire people, and drill for the oil, this all takes time.

COP Stock Valuation – Attractively Priced

Before discussing its valuation, let’s spend a moment on ConocoPhillips’ balance sheet. At the end of Q4 2021, ConocoPhillips carried approximately $20 billion of gross debt.

On the other hand, the business is clearly going through a period of robust cash flows. Right now, ConocoPhillips is targeting bringing its gross debt profile to $15 billion by 2026.

For a business that’s bringing in more than $16 billion of free cash flow this year, this appears to be a very achievable target. Perhaps even a conservative target.

That means that there’s going to be a strong capital return program for shareholders. Presently, ConocoPhillips has announced its intention to return to shareholders $8 billion worth of capital. This accounts for approximately 6.1% yield back to shareholders via dividends and buybacks.

Now, I suspect that given that oil and gas prices are so high, investors are likely to see ConocoPhillips upwards revising its capital return program by a further 12% to somewhere near $9 billion. This implies that at present prices, the shareholder return of capital here would be approximately 7%.

Getting a 7% return of capital and paying less than 8x this year’s free cash flows is a nice and reasonably safe investment proposition.

The Bottom Line

I believe that one of the worst ways to invest in the market is to price anchor. Investors notoriously price anchor when share prices are high, and they expect that prices will retrace to former highs.

And they price anchor when prices have been low for a prolonged period of time. And they believe that just because the share price has moved higher, it’s overdue for a ”pullback”.

That’s often not the case. And hanging around waiting for a pullback is often a faulty investment strategy. Either the thesis makes sense or it doesn’t. Quibbling over pennies on the dollar is pointless.

As for me, while I’m very much bullish on oil and gas, I prefer to invest in smaller market cap companies. Because if the pitch is right, these can truly outperform the market. Whatever you decide, good luck and happy investing.

Be the first to comment